This article was first released to Systematic Income subscribers and free trials on June 12.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the second week of June.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

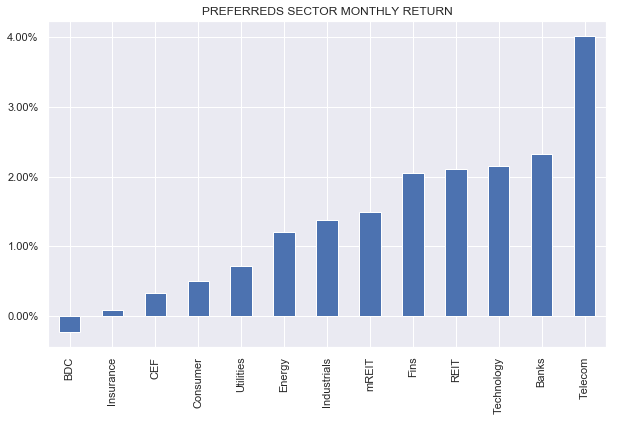

Preferreds were down slightly this week as Treasury yields rose. Month-to-date however, all but one sector are up.

Systematic Income

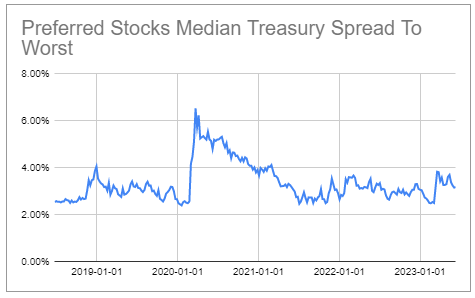

Credit spreads have retraced about half of their widening since the start of the bank tantrum in early March. Arguably, some of the widening is due to the simple fact that spreads looked to be overly tight in March. This suggests that we shouldn’t expect preferreds spreads to tighten much more from current levels, particularly as some stocks in the bank sector specifically may be impaired for an extended period of time.

Systematic Income Preferreds Tool

Market Themes

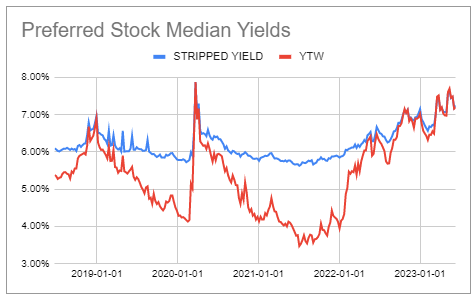

Preferreds yields remain attractive relative to their history, currently trading not far from their COVID level and above the end-2018 Fed “autopilot” tantrum.

Systematic Income Preferreds Tool

As many investors know, however, nearly all preferreds are callable / redeemable by issuers. This tends to happen just at the worst time when interest rates fall and the previously “juicy” yields are called away by issuers only to be refinanced by securities with lower coupons and yields.

There are a couple of ways that investors can mitigate this dynamic. One is to tilt to lower-coupon preferreds which are much less likely to be redeemed. For example, investors can choose between two Public Storage preferreds: PSA.PI and PSA.PO, both of which are trading at roughly similar yields of 5.25% and 5.31% respectively.

The key difference is that PSA.PI has a 4.875% coupon and trades at $23.48 while PSA.PO has a 3.9% coupon and trades at $18.60. No prizes for which security is more likely to be redeemed first if interest rates start to fall. In short, investors who want to mitigate the risk of redemption within the preferred stack of a given issuer should consider lower-coupon / lower-price shares, particularly if they are not giving up any yield to do that.

As a technical sidenote, higher-coupon securities of the same issuer should trade at a slightly higher yield than their lower-coupon counterparts to compensate investors for their greater likelihood of redemption (i.e. a higher price for the embedded call that shareholders are implicitly short). However, because this doesn’t always happen, it creates an opportunity for investors to achieve the same yield while lowering the likelihood of redemption.

Another way to mitigate the chance of redemption is to, well, buy non-callable preferreds. Admittedly, there is not a ton of options here but there are some. A couple of bank preferreds like WFC.PL and BAC.PL with yields at 6.5% and 6.2% respectively are worth a look (some non-callable preferreds are convertible, however, their conversion strikes are often far enough to keep the possibility of conversion minimal). Plus a number of other unusual stocks like OTCQB:SOCGP, OTC:SLMNP and LBRDP with yields of 5.5%, 7.2% and 8% are also worth a look.

Market Commentary

BDC baby bond RWAYZ (Dec-2027 maturity) from BDC RWAY was added to our Baby Bond Tool this week. It’s one of two bonds in the sector at 9%+ yields (OXSQG is the other one which also looks attractive). RWAY debt asset coverage is a healthy 196% and the NAV trend looks fairly decent. The credit facility is quite large relative to the bonds which is a slight fly in the ointment but not a dealbreaker. All in all, a decent option in the sector.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Read the full article here