Since the beginning of August, Premier Financial’s (NASDAQ:PFC) price per share has plummeted about 25% and has reached levels touched during the pandemic and banking crisis of early 2023. The release of Q3 2023 failed to provide the hoped-for jolt despite beating estimates:

- Normalized EPS was $0.69, $0.10 above expectations.

- Revenues were $67.32 million, $2.42 million more than expectations.

In my opinion, it is likely that the market is beginning to price in a hard landing scenario, which is why cyclical sectors such as banking are performing poorly in recent weeks. In other words, rather than a Premier Financial-specific problem, the slump has been triggered mostly by the current macroeconomic and geopolitical environment.

NIM sees light at the end of the tunnel

Like many other peers, one of Premier Financial’s main problems is keeping the net interest margin high in an economic environment dominated by high rates in the money market. Customers are no longer satisfied with poor returns on their deposits, and if the bank wants to obtain new liquidity it must necessarily grant financial instruments with a higher interest rate than in the past. Similar discussion applies to the loans granted, which are definitely more profitable than in the past.

The problem is that not all households/companies are willing to borrow at current market rates and this results in an overall negative net interest margin result. In fact, the increase in the cost of liabilities exceeds the increase in the yield on assets.

Compared to a year ago, Premier Financial’s net interest margin has fallen from 3.40% to the current 2.73%, a drop of 67 basis points. For banks with assets from $5 billion to $49 billion, the net interest margin is 3.47%, so far better.

In any case, it should be noted that for the first time in a year there was no deterioration since the Q2 2023 net interest margin was 2.72%. In short, it seems that the bottom has been reached – or almost – and Premier Financial can only climb back up.

Well, we cautioned ourselves not to say we are at the trough yet. We would like to see it for a couple of quarters. But I think your characterization is about right. It’s certainly – if we are not there, we can see it from here.

CEO Gary Small conference call Q3 2023.

Premier Financial Corp. (PFC) Q3 2023 Earnings Call

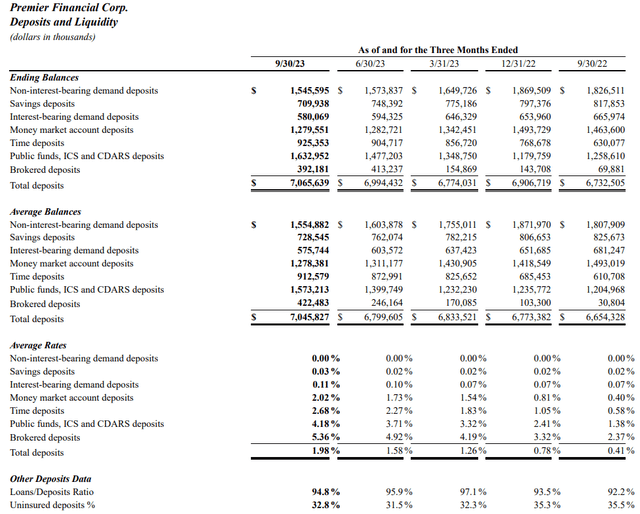

Digging into more detail, everything that has led to an increase in the cost of liabilities is highlighted in this image.

As we can see, non-interest-bearing deposits continue to decline but more slowly than before: we may be near a bottom here as well. Savings deposits fell sharply by $38.45 million, while interest-bearing deposits fell by $14.25 million, much less than in the previous quarter.

These three types of deposits are the most convenient for the bank being at or near zero cost, and while declining, at least they are slowing their descent. In any case, looking at total deposits, there was an increase of $246k, driven mainly by the increase in time deposits and public funds. These two more expensive types of deposits have an average interest rate of 2.68% and 4.18% respectively.

Overall, the average total cost of deposits increased by 40 basis points and reached 1.98%. In contrast, the average yield on loans increased by only 26 basis points and reached 5.12%.

Book value e capital ratios

Seeking Alpha

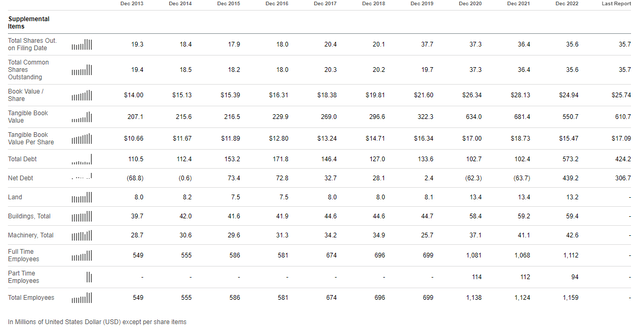

Tangible book value per share in Q3 2023 was $17.09, which is $0.46 lower than in the previous quarter. Making the comparison with 2021, the deterioration increases to $1.64. It is evident that the downward pressure of unrealized losses on AFS securities is oppressing the growth of book value and consequently of the bank itself.

To date, that unrealized loss has increased to $200.30 million, about 18% of equity. The bullish trend in long-term bond yields in recent weeks has exacerbated this issue even more. For Premier Financial, time is its best ally here, since once the bonds mature these unrealized losses will vanish. In any case, some time is needed before this happens since the average maturity of the securities portfolio is 6.5 years. In the next 12 months, the bank expects to receive $66.49 million from these securities.

Premier Financial Corp. (PFC) Q3 2023 Earnings Call

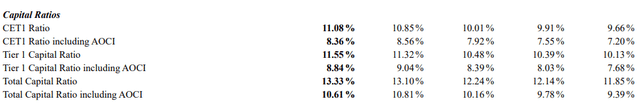

Finally, capital ratios are well above the minimum threshold, but if we also considered unrealized losses, the situation changes. The CET1 ratio and Tier 1 capital ratio would be 272 basis points and 271 basis points lower, respectively. It is difficult to expect that the Fed might continue to raise interest rates leading to an increase in unrealized losses, at any rate we cannot rule it out entirely. What’s more, a deterioration in the financial strength of the U.S. could also fuel the upward trend on long-term bond yields, consequently leading to increased devaluations. In short, it is a situation to be monitored.

Conclusion

Premier Financial beat analysts’ estimates and the net interest margin appears to have bottomed out in the previous quarter. However, investors’ concerns are directed toward the rising cost of deposits and unrealized losses. In fact, based on tangible book value per share, there has been no growth since 2021.

Seeking Alpha

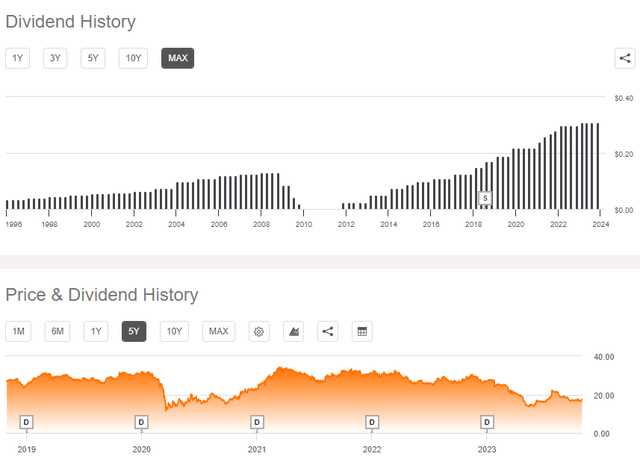

The current dividend yield exceeds 7%, making this bank very attractive to dividend investors. Over the past 10 years only on two occasions has the dividend yield been this high: at the peak of the pandemic and during the banking crisis earlier this year. On the surface, it would seem like a golden opportunity to buy Premier Financial at $17 per share, but watch out for the sustainability of the dividend: it is not guaranteed.

Seeking Alpha

Although the dividend has been growing and steady in recent years, it is not certain that this will be the case in the future. Remember that the macroeconomic environment is no longer favorable for banks and that during the 2008 recession Premier Financial suspended the dividend for a few years.

Read the full article here