Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Blackstone Group is preparing to significantly increase its investments across Europe as the private capital group bets economic reforms will revive growth after years of US outperformance.

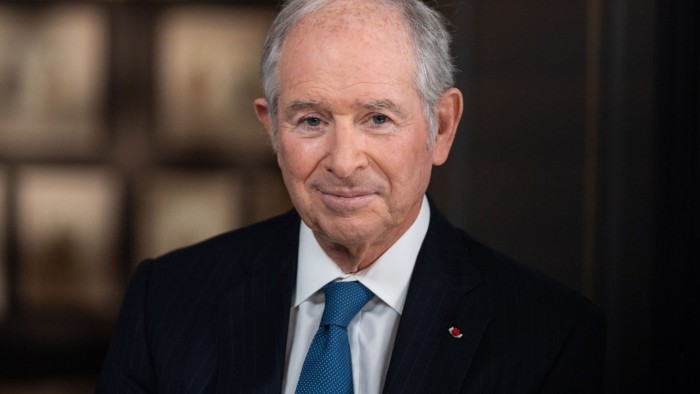

Stephen Schwarzman, co-founder of the $1.2tn-in-assets investment group, told the Financial Times in an interview that Blackstone was planning to invest “at least $500bn” in Europe in the coming decade, as it spots opportunities to become a major lender to companies across the continent and strike large infrastructure and private equity takeovers.

“We are seeing signs of change now in Europe,” said Schwarzman. “European leaders are generally becoming more sensitive to the fact that their growth rates over the past decade have been quite low and it’s not sustainable for them. So they are looking at putting pressure on the European Union regarding deregulation. We think Europe has the prospect of doing better than they had in the past.”

Schwarzman highlighted Germany’s decision under new Chancellor Friedrich Merz to use deficit spending to finance infrastructure and defence investment as a positive change, which could help Europe’s largest market further diversify its automobile-reliant economy.

“Over the next 10 years, we think that we will put at least $500bn of new assets in Europe. Hopefully, things go well and it could be more,” said Schwarzman, who cautioned that “there are no instant miracle cures” for the continent’s economic malaise. “The fact that all the senior people in the different countries across Europe recognise that there is a need for change . . . is positive.”

Schwarzman’s investment target, which was first reported by Bloomberg, marks a significant acceleration for Blackstone, which currently holds about $350bn in assets across Europe after having invested in the region for roughly 25 years. “Doing $500bn [in investments] in 10 years is clearly an acceleration,” he said.

Blackstone’s rivals in the private capital industry are also growing more optimistic about the investment outlook in Europe. Apollo president Jim Zelter said earlier this month it planned to invest as much as $100bn in Germany over the next decade. Private equity group Thoma Bravo, which has found a niche in software, recently opened a European headquarters and has begun to strike large takeovers to take advantage of a valuation gap with US competitors.

Schwarzman spoke to the FT as he and many senior Blackstone leaders celebrated the group’s 25th anniversary in Europe, where it is building a new, expanded London-based regional headquarters in Berkeley Square.

In recent years, Blackstone has struck some of the region’s largest takeovers, including the €54bn privatisation of Italian infrastructure group Atlantia in late 2022 and the €14bn takeover of Norwegian online classifieds group Adevinta the following year.

Schwarzman said Blackstone’s growing excitement for Europe factors in a gap in valuations between European companies and their US-listed peers and falling financing costs. But it mostly hinges on a growing conviction surrounding economic reforms.

“There are valuation differences obviously between the United States and Europe that we find in the private equity and real estate areas, as well as infrastructure. But you need all of those factors,” he said, referring to economic reforms and declining interest rates. “Just cheaper prices isn’t always the right answer.”

Read the full article here