Facts do not cease to exist because they are ignored.”― Aldous Huxley.

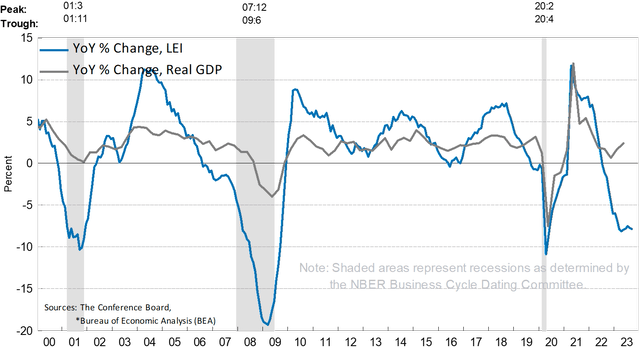

The overall market has ignored traditional signs that a recession is on the horizon for several quarters now. These include a yield curve that has been significantly inverted since the summer of 2022 and 18 months of straight declines in the Leading Economic Indicators. The latter is something that has only occurred during the recessions of 2007 to 2009 and the 1970s. Manufacturing PMI has also been in contractionary territory for 11 straight months as well.

Leading Economic Indicators (The Conference Board)

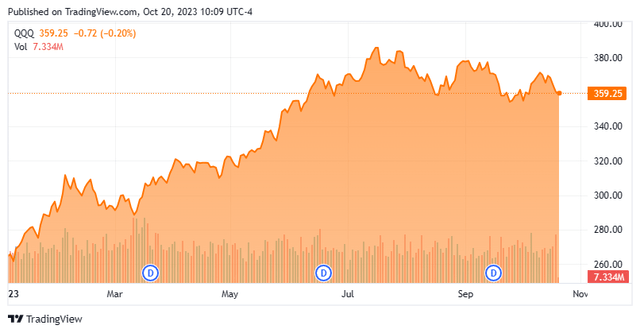

The S&P 500 rose nearly 16% in the first half of this year and Invesco QQQ Trust ETF (QQQ) is still up over 35% for the year even accounting for the last couple of days of decline. However, most of QQQ’s rise and all of the S&P 500’s rise in the first half of this year was due to the “Magnificent Seven.” The breadth of the market’s advance this year has been extremely narrow and outside the NASDAQ among the major indices, an investor would have been significantly better off being 100% in short-term treasuries since the Federal Reserve started to lift rates (525bps and counting now) in March of 2023.

Seeking Alpha

However, the market has started to backtrack since the beginning of August. This coincided with some setbacks on the inflation front. The June CPI got down to three percent from a peak high of 9.1% in June of 2022. By the time the third quarter ended, the CPI was at 3.7%, a rise of 70 bps. Similarly, the yield in the 10-year Treasury (US10Y) gained 74 bps during the third quarter.

The 10-year Treasury touched the five percent level Friday morning for the first time since 2007, and mortgage rates have now hit their highest levels of this century as well. In addition, additional signs are emerging that equities might be turning over.

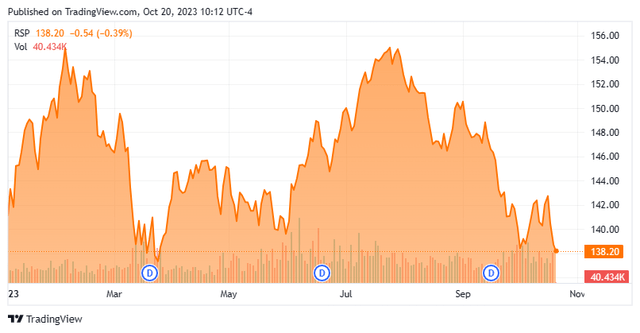

Seeking Alpha

Let’s take the Invesco S&P 500® Equal Weight ETF (RSP), which represents the S&P 500 giving each component the same weight. As can be seen above, returns just became negative for 2023. The small cap Russell 2000 also is down some three percent for the year now and sports a total loss in the high teens since Chairman Powell began to implement the most aggressive monetary policy since the days of Paul Volcker some 19 months ago.

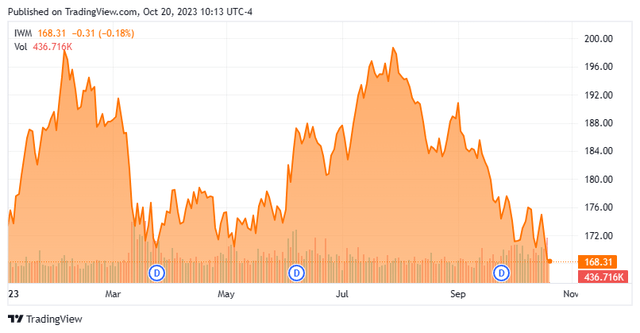

Seeking Alpha

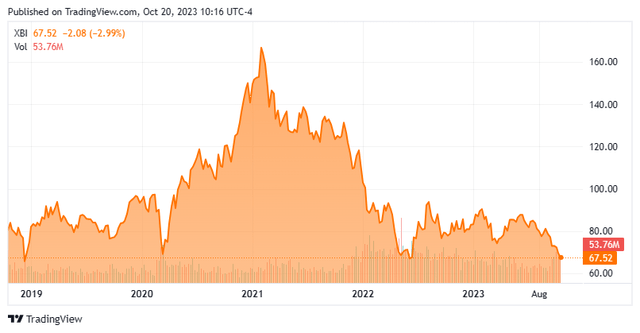

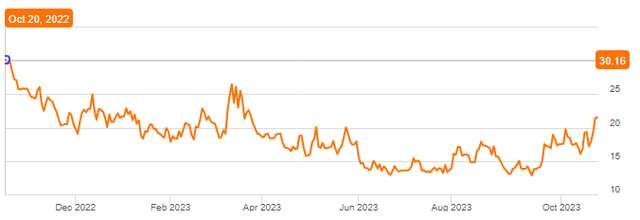

Higher beta parts of the market are faring even worse. The SPDR® S&P Biotech ETF (XBI) which consists of small and midcap biotech holdings is now down nearly 60% from its highs in early 2021. This ETF is right at support levels that have held for more than a half decade. If it breaks through this floor, it does not bode well for the high beta areas of the market.

Seeking Alpha

As I noted in my article ‘2007 Deja Vu‘ earlier this week, I voiced again my concern about the rapidly deteriorating conditions in the commercial real estate markets. I am especially concerned about what that means for the regional banking system given regional banks originate some 70% of CRE loans and hold 30% of CRE debt.

Seeking Alpha

This morning, one of the larger regional banks in the nation, Regions Financial Corporation (RF), reported third quarter results. The stock is getting hit hard today as numbers missed estimates thanks largely to higher deposit costs. Provisions for credit losses also moved up sharply to $145 million sequentially from $118 million for the second quarter.

VIX (Seeking Alpha)

The VIX has also shot up from under 13 five weeks ago, to over 21 currently. We are still below the level of 26.5 hit in mid-March of this year when the second, third and fourth largest bank failures in U.S. history occurred, headlined by Signature Bank. I did take some large profits in my bear put spreads against the SPDR® S&P Homebuilders ETF (XHB) late in trading on Thursday (and probably left some money on the table).

I will probably do the same with some of my long-dated bear put spreads against the QQQs and SPDR® S&P 500 ETF Trust (SPY) should the VIX shoot above the 25 mark as I think the market could get a temporary bounce when Microsoft (MSFT) and Apple (AAPL) report Q3 numbers next week.

Outside of that, I am doing little trading within this increasingly uncertain market. 50% of my portfolio remains in short-term treasuries yielding 5.5% and the 40% of my portfolio allocation that is in the market is via covered call holdings for the downside risk mitigation. The rest is in cash and a good dollop of long-dated, bear put spreads as highlighted in the paragraphs above.

And that is my current game plan as we close out a volatile week of trading on an option expiration day.

Confidence is ignorance. If you’re feeling cocky, it’s because there’s something you don’t know.“― Eoin Colfer, Artemis Fowl.

Read the full article here