Prologis (NYSE:PLD) has strong business fundamentals, a sustainable dividend, and an attractive valuation making it an interesting income play in the REIT sector.

Business Overview

Prologis is a self-managed Real Estate Investment Trust (REIT) that owns industrial properties and began its operations in 1997. Its current market value is about $101 billion, and it is the largest REIT in the world by this measure.

Its property portfolio is based on logistics real estate, being exposed to several markets and countries, focused on markets with some barriers to entry and that offer good growth prospects. While it operates across four continents, some 85% of its revenue is still generated in the U.S.

Its business includes two main segments, namely Real Estate Operations and Strategic Capital. While most of its properties are wholly owned, Prologis also holds ownership interest in properties in the U.S. and internationally, through its co-investment ventures. This helps the company to spread risk with institutional partners, and further diversify its operations across different markets.

By being the largest industrial REIT focused on logistics, Prologis is well exposed to some long-term growth trends, such as the rise of e-commerce. This is an important demand tailwind for logistics space, given that e-commerce growth is an important driver of warehouse demand, to store and distribute goods. This setback has been an important driver of increasing rents and low vacancy, a trend that is not expected to reverse over the next few years.

Indeed, the penetration of e-commerce has steadily increased over the past decade in the U.S., and this trend is likely to continue over the next few years, boding well for Prologis’ growth prospects.

E-commerce sales (Prologis)

Taking into account the positive dynamics expected in the logistics market over the medium to long term, Prologis decided to make a large acquisition last year, in an all-stock acquisition of Duke Realty valued at some $23 billion including debt, boosting its size in the U.S. industrial market.

This acquisition added more than 550 new customers for Prologis, plus expanding its relationship with some 239 existing customers, and financially is accretive in the first year making it a good fit for its business.

Following this acquisition, Prologis had some 6,700 customers at the end of last June, spread across the U.S., Latin America, Europe, and Asia. It has more than 5,500 properties and its vacancy rate was 2.8%, which is a relatively low level, showing that it has a quality portfolio. Its largest customer is Amazon.com (AMZN), accounting for some 7% of the total rent, and its largest ten customers only account for 16% of total rent, showing that Prologis has a very good customer diversification.

Going forward, the company’s growth strategy is not expected to change much, being based on organic growth through rent increases, high occupancy levels, and controlling expenses, plus developing new properties that meet its customer’s needs. It may also continue to seek external growth opportunities if the opportunity arises, even though a large acquisition like it has performed recently with Duke Realty is not likely in the near term.

Financial Overview

Regarding its financial performance, Prologis has a positive growth track record boosted both by organic initiatives and acquisitions. Over the past few years, its Real Estate segment has accounted for 85 to 90% of its annual revenues and earnings, while the rest comes from its Strategic Capital segment, where it holds interests in unconsolidated ventures ranging from 15-50%.

In 2022, Prologis maintained a good operating momentum as strong demand in the global logistics market was a strong support for higher rents and low vacancy rates. In addition, the company completed the Duke Realty acquisition in October, thus its annual results also include three months of combined operations.

Rental revenue in the Real Estate segment amounted to $4.9 billion in the last year, an increase of 18.4% YoY, while revenues in the Strategic Capital segment were above $1 billion, up by 76% compared to 2021. Despite this strong increase in Prologis’ top line, showing that its business gains from a higher scale, its total expenses increased by only 14.5% YoY, showing a very good operating leverage from its business combination with Duke Realty.

This is also visible in the company’s operating income, which increased to nearly $2.3 billion, up by 41% YoY. However, Prologis reported lower gains from asset disposals, thus its operating income including real estate transactions was up by only 8% YoY, to nearly $3.5 billion.

During the first six months of 2023, Prologis has maintained a strong performance with total reported revenues increasing to $4.2 billion in the first semester of the year, up by 70% YoY, and its adjusted funds from operations (AFFO) increasing to more than $2.6 billion (+54% YoY). On a per share basis, its core FFO was $3.04 per share, up by 38% YoY, due to a higher number of shares following the acquisition of Duke Realty.

Cash flow metrics (Prologis)

For the full year, Prologis expects to maintain a very high occupancy rate, ranging from 97-97.5%, which bodes well for further rental growth ahead, and its core FFO should be between $5.06-5.10, excluding net promote income.

Going forward, its warehouse portfolio is expected to maintain positive growth over the next few years, supported by low vacancy across the U.S. and solid demand, plus further expansion through its own investments. While growth will naturally ease following the integration of Duke Realty and annual comparisons will become tougher in Q4 2023, plus development starts have somewhat softened in recent quarters due to the challenging economic environment, Prologis is expected to maintain a strong growth over the next few years supported by solid demand for logistic real estate and the company’s efforts to diversify its business to logistics services, which should provide another significant and recurring revenue stream over the long term.

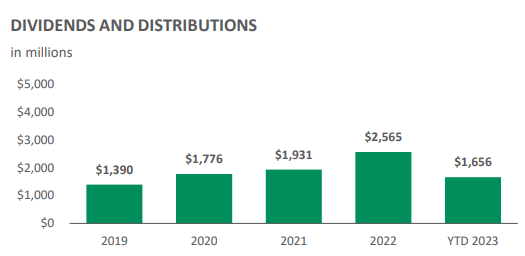

Regarding its dividend, Prologis has a good dividend history, growing its dividend strongly over the past few years. Its current quarterly dividend is $0.87 per share, or $3.48 per share, which at its current share price leads to a dividend yield of about 3.1%. While this is not a high-dividend yield, and there are other REITs that offer a higher yield, Prologis is nonetheless an interesting income play because its dividend is well covered by earnings and is likely to remain on a growth path in the near future.

Indeed, in H1 2023, Prologis dividend distributions amounted to $1.65 billion, which was more than covered by its AFFO of $2.66 billion, representing a payout ratio of 62%. This is somewhat conservative considering Prologis business profile and strong fundamentals, thus the company can easily increase its dividend and still maintain a conservative payout over the next few years.

Dividends (Prologis)

Moreover, its leverage position is also conservative within the REIT sector given that at the end of last June its net debt-to-adjusted EBITDA ratio was 4.4x, the weighted average maturity of its bonds is quite long at close to 10 years, and does not have meaningful maturities in the next couple of years. This means that Prologis financial position is quite strong and has good financial flexibility, which is another supportive factor for its dividend sustainability.

Conclusion

Prologis has a strong business model and fundamentals due to its leading position in the logistics industry, a position that is quite hard to replicate and gives it some competitive advantage over the long term. Additionally, its dividend is clearly sustainable and has good growth prospects, even though its dividend yield is not among the highest in the REIT sector.

Despite this strong backdrop, Prologis is not immune to weakening economic conditions and higher interest rates, which explain to some extent its share price weakness in recent months, and consequently relatively cheap valuation compared to its history. Indeed, Prologis is currently trading at some 20x forward FFO, while its historical average over the past five years is close to 25x FFO, thus Prologis seems to be an interesting income play right now.

Read the full article here