Overview

Prudential Financial (NYSE:PRU) is a big player in the financial services sector with a value of around $33 billion. Prudential manages a wide variety of assets worth approximately $1.415 trillion as of the latest earnings news. They offer services such as asset management, insurance, and retirement advisors to customers. PRU’s reach extends across major regions such as the United States, Asia, Europe, and Latin America. Prudential provides a wide range of financial solutions, including life insurance, annuities, retirement plans, mutual funds, and investment management, through its many subsidiaries and related companies. These offerings are available to both individuals and institutions.

International Exposure

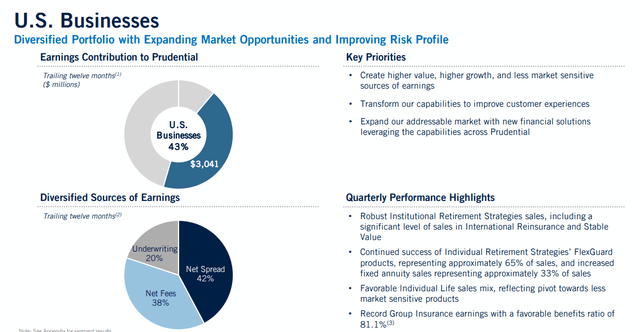

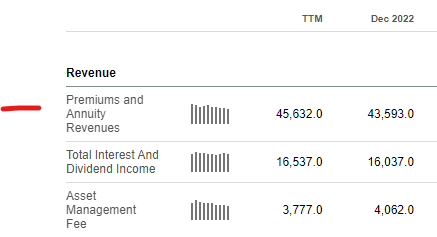

PGIM is Prudential’s global investment management business, and it maintains a strong investment performance. Their business portfolio is diverse and it includes retirement strategies, individual life, and group insurance operations. A majority of their business comes from premiums and annuities. PRU has ongoing success in their retirement strategies products and this part of the business represents two-thirds of their total sales, approximately 65%. Next, fixed annuity sales are the remaining majority of their sales, coming in at approximately 33% of sales.

Prudential’s Investor Presentation

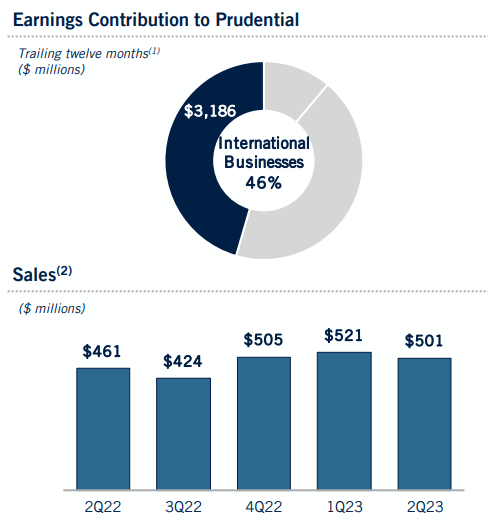

The international businesses section is also notable, although total sales of Q2 in 2023 came in $20M less than the prior quarter. Prudential has a sizeable part of their business revenue coming from international sources, mostly Japan, coming in at approximately 46% of total sales in comparison to the 43% that U.S business accounts for.

Sales from the international side of business in 2Q22 equaled $461M and this increased over $40M in 2Q23 for a total of $501M. This represents an 8.6% increase in sales YoY, which instills some confidence that sales are trending in the right direction post-pandemic. Prudential plans to grow in specific fast-developing emerging markets by investing in both natural business expansion and strategic M&A (mergers & acquisitions).

Prudential’s Investor Presentation

I also noticed that PRU leadership are making strides to continue growing their business by making strategic partnerships as well as embracing AI-based tools. A statement from the CEO on the last earnings call:

We also announced a strategic partnership with Nayya, a leading benefits experience platform. The new partnership will allow group insurance clients to harness AI and data science capabilities to make more informed workplace benefit decisions. And we are also using chatbot technology and robotic process automation to reduce transaction processing time across our U.S. businesses.

As part of our continuous improvement framework, we are focusing on creating a linear, faster and more agile company, so that we can better meet the needs of our customers, while driving growth and efficiency. We have made good progress in this area, having exceeded the target we established two years ago, but we think there is more work we can do. We are evaluating additional opportunities including further evolving our operating model, simplifying our organizational structure and streamlining decision making. – Charlie Lowrey, CEO

Higher Dividend

PRU’s recently declared quarterly dividend of $1.25/share leaves us with a current yield slightly over 5%. Usually, higher yields may leave investors scratching their heads trying to figure out if this is an indication of a yield trap. While that can be argued, they managed to continuously raise distributions throughout the course of the pandemic and I fully expect this to continue because of PRU’s profitability metrics.

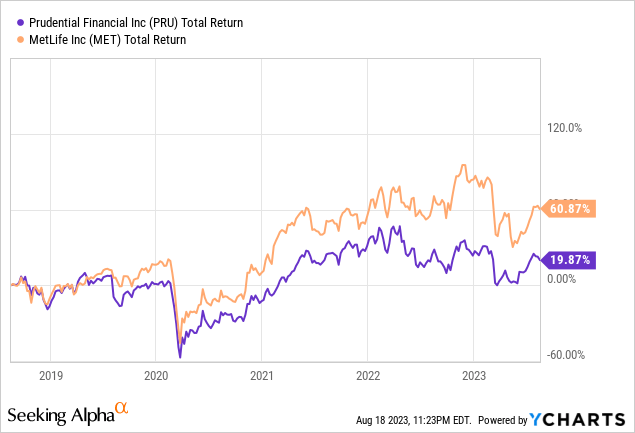

The 5 year dividend growth rate is 8% and this is outstanding for a stock that already pays a high starting yield of over 5%. Not to mention, they’ve increased the dividend payouts for 15 consecutive years in a row. In addition, the payout ratio sits at a conservative 48% which leaves plenty of room for continuous growth. We can see that over a 5-year period, MetLife (MET) significantly outperforms Prudential. I think it’s important here to determine where you value lies: are you pursuing total return or do you like higher yields that are capable of providing a reliable source of income?

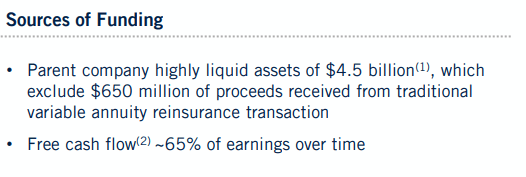

With that said, PRU is sitting on a lot of cash, so I am not concerned about any sort of dividend cuts. I believe we will see many more dividend raises in the future.

Prudential Investor Presentation

Valuation

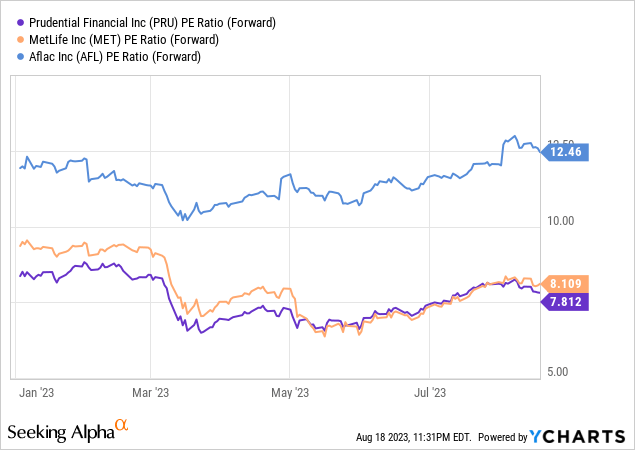

PRU’s forward PE is 7.98 compared against the sector’s 9.97 PE ratio. We can also see that PRU’s PE is beneath their peers. This can indicate that PRU may be priced at a slight discount of approximately 25%.

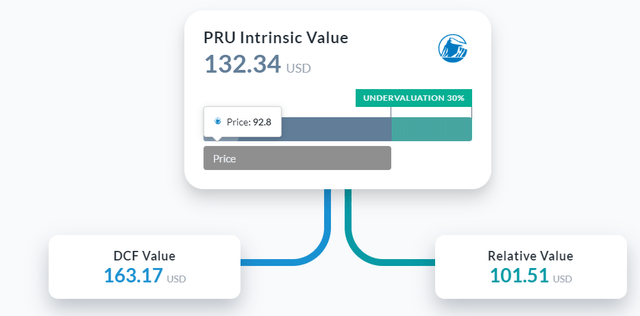

From an intrinsic value perspective, we calculated that PRU’s price currently sits at a 30% undervaluation. We reference a stock’s intrinsic value to get an estimate of fair value based on their cash flow, profitability, earnings, and debt. Blending these two together, we can determine that the price is currently undervalued by roughly 27%. Also, the price currently sits around the pre-pandemic levels and I believe these levels make for a good entry on a long term outlook. I plan to sit back and enjoy the dividends in the meantime.

Alpha Spread

Despite the intrinsic value estimate, the current price is a bit in a weird spot as it looks like it sits in a fair value range according to its price history while simultaneously being undervalued compared to its peers based on these valuation metrics. I believe there is a disconnect here, and I plan on capitalizing.

Risk

Unlike banks, Prudential doesn’t have lots of people’s deposits to worry about, but it deals with retirement accounts of insurance policyholders. Still, this doesn’t mean their investment portfolio can’t lose value. Prudential may have to deal with challenges like a drop in the value of assets they manage, which can be due to higher interest rates, clients withdrawing, and lower stock prices. In their latest earning’s call, we can see this as a possibility:

Our GAAP net income was $576 million lower than our after tax adjusted operating income, primarily driven by mark-to-market losses on currency and interest rate derivatives, and losses on fixed maturity sales, driven by higher rates. – Rob Falzon

Forward looking, it’s important to note that a majority of PRU’s business revenue is from insurance premiums and annuities. This means that they are reliant on premiums consistently bringing in more than what the claims have to pay.

Seeking Alpha

Conclusion

In conclusion, Prudential Financial stands as a robust player in the financial services sector, boasting a substantial market value of approximately $33 billion. Operating across diverse regions such as the United States, Asia, Europe, and Latin America, PRU has lots of international exposure.

The company’s commitment to shareholders is evident in its consistent dividend payouts, with a 5-year dividend growth rate of 8% and a yield exceeding 5%. From a valuation perspective, PRU appears attractively priced, with a forward PE ratio of 7.98, reflecting a discount of approximately 25% compared to peers.

However, it’s important to acknowledge the inherent risks. While Prudential isn’t burdened by the deposit liabilities that banks face, it must contend with challenges related to fluctuations in the value of managed assets. In summary, Prudential Financial emerges as an appealing investment choice, boasting a solid dividend yield, attractive valuation, and global diversification.

Read the full article here