The Invesco Global Listed Private Equity ETF (NYSEARCA:PSP) has some arguments for it and some against. On one hand, the large private equity firms that form the ETF have a lot of assets that can count for share value, and in general, the underlying multiples in some of the biggest names remain attractively low. However, these large balance sheets are also a concern as they could shrink in the face of impairments in a higher for longer environment. In all, PSP looks a little optimistically priced on a historical price basis, and we see more cons than pros here also with the trouble that the expense ratio on the ETF is quite high at 1.34% and offers almost no benefits over just buying a couple of the most famous PE names and owning them individually. Best avoided.

PSP Breakdown

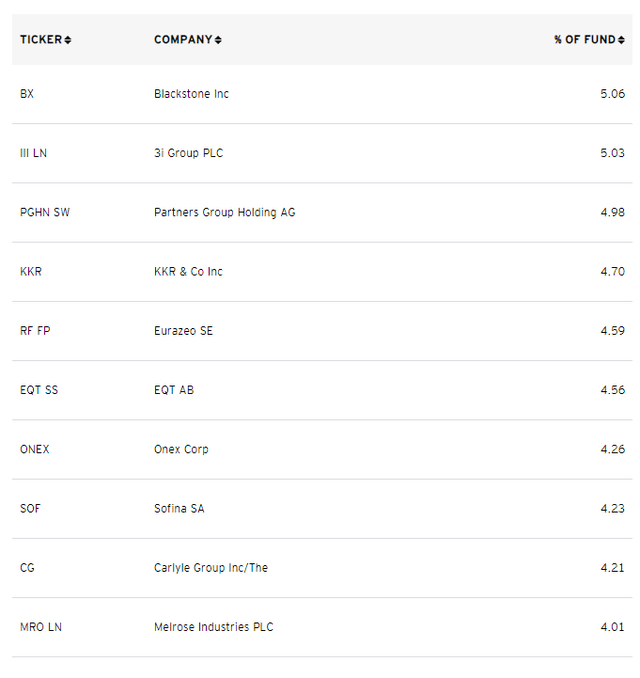

The ETF is moderately large with over 60 holdings on a selecting non-value-weighted basis in listed PE companies.

Holdings (Invesco.com)

Some of these are stocks we’ve covered individually in the past, which gives us some insight into what’s going on in the top holdings, which substantially depend on similar dynamics.

In particular, these companies had been beneficiaries of a low-rate environment in the high-ticket LBO deals, which depend on low financing costs to benefit from the full effects of leverage. The demand side in the economy is still holding up for now, but higher rates are a meaningful problem for all leveraged companies right now, and the higher for longer assurances by the Fed are a huge problem and create risks for the balance sheet.

These companies’ balance sheets share similarities in that they have mostly principal investments dominating their assets. We saw that broadly in the PE industry, 2021 was a massive bloat year in outlays, doubling the average. Considering the turnover of a portfolio is usually around 7 years in PE, which is on the conservative side, 2021 outlays and investments made alone probably account for about 20% of the average PE portfolio right now, where multiples were absolutely peaking and where interest rates could not have been lower. While some of this debt is locked in, there will be refinancing coming along over the next couple of years, and these investments could see serious trouble then. We are seeing reports of NAV-backed loans by PE now in order to deal with some of that financial distress. Deleveraging may be somewhat in play for previously established deals but there are likely minimal multiple effects helping out. In some of the more progressive and VC-oriented PE funds, there may be a saving grace in recent IPO activity in the AI and related spaces, but even those IPOs are not looking great once hitting secondary markets, and selectivity may already be a feature of markets at this point for any AI-related ideas.

Bottom Line

Their bread and butter, LBOs, are down 82% both because there is very little sponsor interest, and we’ve been seeing this in the advisory space by sponsor activity having to be offset by corporate M&A, mostly in the middle market and without leverage. The large balance sheets could become impaired to some extent over the next couple of years, and just as importantly, carried interest in store for these companies is going to be low since the huge outlays of 2021 are pretty much all going to take years before they even have a chance of closing just moderately above hurdle rates.

The last leg of inflation will be stubborn, and hostile interests in America are keeping commodity prices high to assure danger for the US economy and the need for continued monetary restriction. PSP is only 10% or so off all-time highs in recent years, and the distribution rate substantially explains that difference. We don’t think that the market is sufficiently discounting the risks of meaningful impairments on those investments.

There are more issues with PSP that investors need to consider, namely the expense ratio which is at 1.34%. That is really quite high, especially considering the skew of the ETF towards large-cap PE picks such as Blackstone (BX) and KKR (KKR). These stocks are liquid and easily accessed in the US markets, there really isn’t much reason for such a high expense ratio except for the stock picker’s fee. Therein lies the problem. The ETF is not actually value-weighted, where smaller caps are represented more highly than they would be if they were value-weighted. The issue is that PE firms are already portfolios of exposures to various private companies. The top holdings of this ETF are all pretty focused on the same types of LBO-appropriate businesses as well. There really isn’t that much benefit to diversification over picking a couple of these famous PE funds and owning them individually. It will not incur any expense costs except the basic custody costs that many brokers don’t even charge. This is another instance of paying for what you don’t need, on top of the fact that the entire sector is a little risky due to the higher for longer rate regime. Best to stay away.

Read the full article here