Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on April 23rd, 2023.

We recently outlined exactly what was going on with the preferred closed-end funds in great detail. To summarize concisely, higher interest rates were causing portfolio values to drop due to being fixed rate preferreds. Higher interest rates were also impacting leverage costs for these leveraged CEFs. In March, the bank collapses saw some underlying holdings in these funds be completely wiped out. Preferred CEFs overwhelmingly invest in financial preferred.

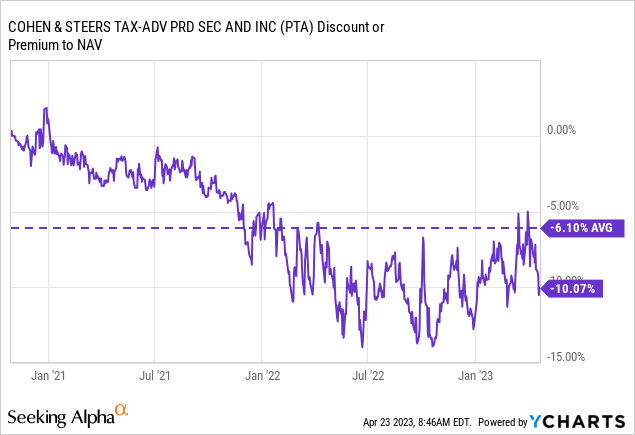

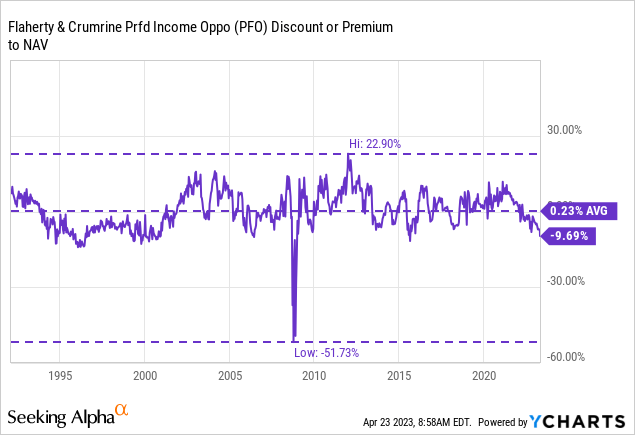

This is a follow-up of sorts from that prior coverage when we took a look at the entire preferred CEF space. Today, we are looking at two specific funds as they appear quite attractive based on their discounts and considering the overall crash in preferreds. The two names that appear the most attractive at this time are the Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund (NYSE:PTA) and Flaherty & Crumrine Preferred Income Opportunity Fund (NYSE:PFO).

| Ticker | Notes | Price | Yield | P/D | Z |

| (DFP) | 84% fixed-to-float | $17.95 | 7.65% | -7.66% | -1.2 |

| (FFC) | 74% fixed-to-float | $14.01 | 7.97% | -7.03% | -1.7 |

| (FLC) | 73% fixed-to-float | $14.88 | 7.70% | -8.09% | -1.0 |

| (PFD) | 72% fixed-to-float | $10.21 | 6.93% | -6.16% | -1.9 |

| (PFO) | 72% fixed-to-float | $8.01 | 7.49% | -9.69% | -2.3 |

| Average | 7.55% | -7.73% | -1.6 | ||

| Ticker | Notes | Price | Yield | P/D | Z |

| (PSF) | 84% fixed | $17.77 | 9.12% | -7.52% | -1.0 |

| (LDP) | 85% fixed | $17.56 | 9.23% | -8.88% | -0.9 |

| (PTA) | 85% fixed, Term (10/27/2032) | $17.14 | 9.38% | -10.03% | -0.1 |

| Average | 9.24% | -8.81% | -0.6 |

Both of these funds could benefit not only from a discount contraction should it occur but from a potential rebound in the preferred space overall. Additionally, both of these funds are leveraged, meaning that they will experience greater volatility and risks. Both of these funds are also exposed to AT1 bonds or CoCos. Credit Suisse (CS) saw their CoCos completely wiped out. These types of holdings aren’t present in their non-leveraged ETF counterparts, such as iShares Preferred and Income Securities ETF (PFF).

Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund

- 1-Year Z-score: -0.05

- Discount: -10.03%

- Distribution Yield: 9.38%

- Expense Ratio: 1.67%

- Leverage: 36.62%

- Managed Assets: $1.64 billion

- Structure: Term (anticipated liquidation date is October 27th, 2032)

PTA’s investment objective is quite simple, “high current income.” They also have a secondary objective that is similarly as simple, “capital appreciation.”

To achieve this, they will invest “at least 80% of its managed assets in a portfolio of preferred and other income securities issued by U.S. and non-U.S. companies, which may be either exchange-traded or available over-the-counter.” They also will “seek to achieve favorable after-tax returns for its shareholders by seeking to minimize the U.S. federal income tax consequences on income generated by the Fund.”

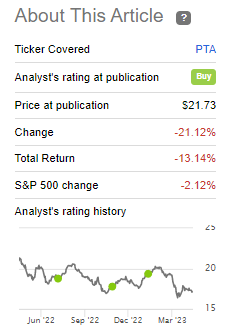

PTA has been the preferred fund I’ve been most bullish on starting in March 2022. Suffice it to say that it was way too early as those higher interest rates started to chip away at the fund. Although I’ve been wrong, and I certainly admit that, the biggest hit for the fund came last month when the bank failures sparked a steep drop.

PTA Performance Since Prior Update (Seeking Alpha)

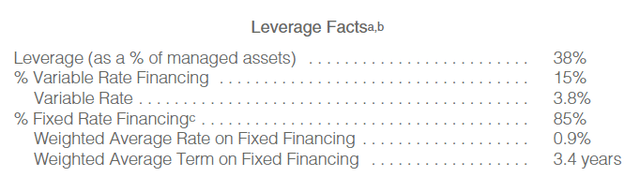

One of the benefits of the fund has been its fixed-rate financing at around 85%. That meant that the fund was largely hedged against higher interest rates impact in terms of leverage costs.

PTA December 2022 Leverage Facts (Cohen & Steers)

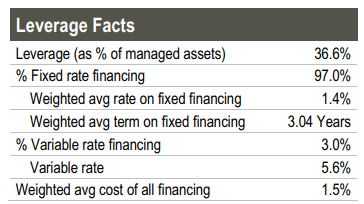

In fact, according to their last fact sheet for the period ending March 2023, fixed-rate financing is now at 97%. However, I suspect this could be due to deleveraging and not necessarily fixing more of their borrowings.

PTA March Leverage Facts (Cohen & Steers)

I suspect this to be the case because their total managed assets dropped by roughly $273 million from January 31st to March 31st. Some of that was due to the drop in the fund’s underlying portfolio. However, the leverage ratio also dropped with the latest stats, which wouldn’t happen when a portfolio is falling in value.

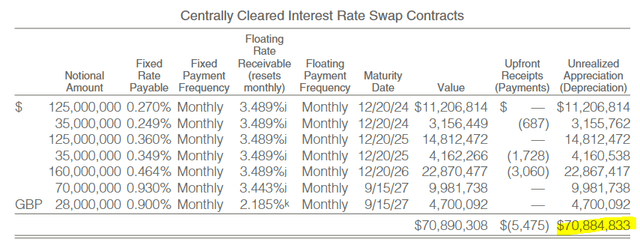

Most of this was fixed-rate due to interest rate swaps where the offset comes in the form of capital appreciation. In the last annual report, which is a bit dated at this point, we saw they were sitting on nearly $71 million in unrealized appreciation on their interest rate swaps.

PTA Interest Rate Swap Gains (Cohen & Steers)

In that same report, they listed that they realized nearly $3.9 million from their interest rate swaps. They also have over $20.2 million in realized gains contributed to by forward foreign currency exchange contracts. So there is more going on in this fund than it might first appear, but it has been to the fund’s benefit.

These gains directly go against the realized losses and unrealized losses in the portfolio. Of course, the unrealized losses were so overwhelming that we still saw declines in the fund anyway, but relatively speaking, things could have been even worse.

One thing that PTA has avoided is cutting its distribution, but I don’t know how much longer that will last. They actually raised their payout starting in 2023, bucking the trend of most funds cutting in a down year. While they saw their net investment income move up a touch, it certainly wasn’t warranted to raise.

With a deleveraging event in March, it is quite likely that we will see NII drop going forward. Therefore, pressure on its distribution is elevated. Most of their peers have already cut now, the Nuveen preferred and the Flaherty & Crumrine suites.

Now with the bank failures wiping out some of their debt, I suspect they are in a position where a cut makes even more sense. Still, in my opinion, the fund remains attractive due to its deep discount. What might be interesting to note is that the fund’s discount actually narrowed during the height of the March bank collapse pandemonium before falling back down to the current level.

YCharts

Flaherty & Crumrine Preferred and Income Opportunity Fund

- 1-Year Z-score: -2.34

- Discount: -9.69%

- Distribution Yield: 7.49%

- Expense Ratio: 1.36%

- Leverage: 41%

- Managed Assets: $196.5 million

- Structure: Perpetual

PFO’s investment objective is “to provide its common shareholders with high current income consistent with preservation of capital.” To achieve this, they will invest “under normal market conditions, at least 80% of its managed assets in a portfolio of preferred and other income-producing securities. Preferred and other income-producing securities may include, among other things, traditional preferred stock, trust preferred securities, hybrid securities that have characteristics of both equity and debt securities, contingent capital securities, subordinated debt and senior debt.”

That leaves them fairly flexible to invest anywhere in the fixed-income space. They note that “at least 25% of its total assets are in companies principally engaged in the financial services sector.” That is easy to achieve as the largest issuer of preferred stock is generally from the financial/insurance industry.

PFO is trading at one of the largest discounts in its history, well below its long-term average, which shows it actually usually trades at a premium.

YCharts

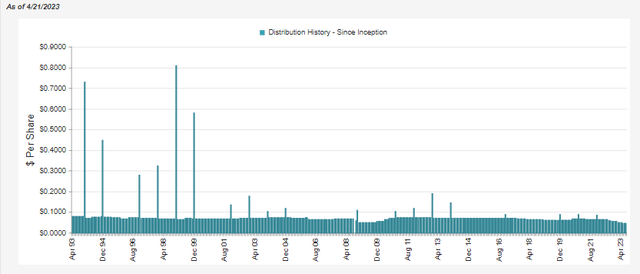

However, it’s likely due to the continual cuts in its distributions that have been plaguing the whole F&C suite of funds. I actually discussed PFO in more detail fairly recently and explained what was going on.

To briefly recap, it’s simply due to the higher interest rates and the fact that they chose not to hedge for higher rates. As long as the Fed is raising rates, which is expected in May, these funds will continue to cut their distributions. While the fund has adjusted its distributions historically, we haven’t had an increase in interest rates as fast as the one we saw last year in decades. This is an old fund, but it hasn’t experienced anything like this previously, even with its early 1990s inception. Therefore, the distribution cuts have been coming just as fast and furious as the Fed was doling out hikes.

PFO Distribution History (CEFConnect)

However, by cutting, they should be limiting most of the NAV erosion by overpaying their distributions. Most of the portfolio declines have simply been due to falling preferred values and having some of their preferreds wiped out in the last month’s bank fiasco.

At this point, it doesn’t appear that they have deleveraged at all, as borrowings stood at $80.6 million at the end of April 21st, 2023. That is where it was previously, and the leverage ratio ticked higher, as expected, due to the drop in the value of its portfolio. So that should help keep up some of their NII, except for the higher borrowing costs that will still be pressuring their NII.

Conclusion

PTA and PFO appear to be the more attractive funds in the preferred space with the latest look at valuations. However, preferred funds have been hit by higher interest rates and then crushed by bank failures in March. The dust might not be completely settled on that either, as the Fed hiked after that and is expected to have at least one more hike in them. A pause in hikes could see these preferred funds also stabilize; if we see cuts later in 2023 or 2024, as is expected by some, we could see these funds potentially respond positively. Seeing discount contraction could be another potential catalyst for better performance.

Of course, the risks should also be considered here. They remain leveraged funds, and that means moves in either direction are amplified. More bank failures and a deep recession, even with rate cuts, could still see the losses mount on these funds. That could trigger more deleveraging and the potential permanent losses that come with that event. Less aggressive investors could consider non-leveraged ETFs instead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here