PTC Therapeutics (NASDAQ:PTCT) is a biopharmaceutical company specializing in developing and subsequently commercializing next-generation drugs to treat orphan diseases. The company’s portfolio consists of several medicines, the flagship of which is Translarna (ataluren), which is approved for the treatment of patients with a nonsense mutation Duchenne muscular dystrophy and brought PTC Therapeutics $115 million in the first three months of 2023, up 45.2% from the previous year. In the next four months, we expect to publish the results of three registration-directed trials, which could open an exciting new chapter in the company’s history if they reach the primary and secondary endpoints.

PTC Therapeutics’ Financial Position

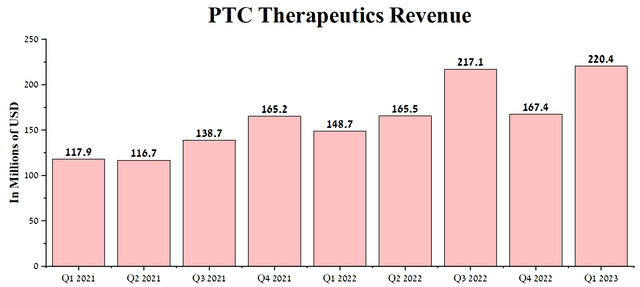

Since the publication of the previous article, “PTC Therapeutics: One Of The Leaders In The Treatment Of Rare Diseases,” the company’s revenue continued to show positive dynamics and amounted to $220.4 million in 1Q 2023, up 48.2% year-on-year.

Author’s elaboration, based on Seeking Alpha

We believe that the emerging upward trend will continue in the coming quarters, driven by increased demand for the company’s essential medicines, and in particular for Translarna for the treatment of nmDMD, which continues to be actively introduced into clinical practice in new regions and Emflaza, approved for the treatment of DMD, patients’ access to which continues to expand.

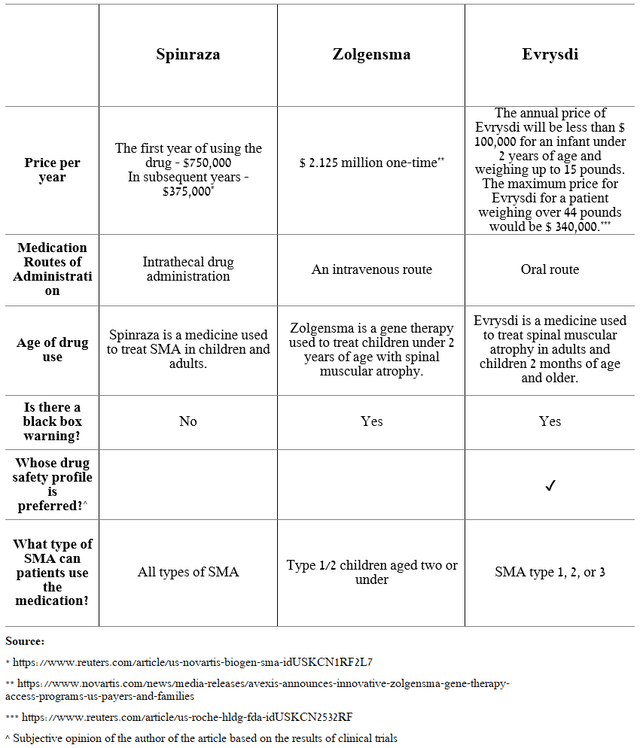

Evrysdi (risdiplam), a medicine developed in partnership with Roche Holding (OTCQX:RHHBY) (OTCQX:RHHBF) and the SMA Foundation and used to treat spinal muscular atrophy (SMA) in adults and children aged two months and older, is also a significant contributor to PTC Therapeutics’ revenue. SMA is a genetic disease that progresses throughout a patient’s life and affects the motor neurons of the spinal cord. This leads to a gradual loss of muscle strength and can eventually be fatal. This deadly disease affects approximately 1 in 10,000 newborns, requiring healthcare providers to constantly increase treatment costs and improve methods for diagnosing SMA. The active ingredient in Evrysdi helps to increase the amount of the survival motor neuron (SMN) protein, which is necessary for the normal functioning of motor neurons, ultimately contributing to a significant slowdown in the progression of this genetic disease.

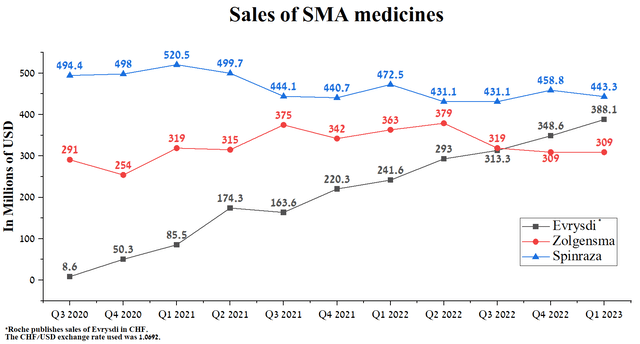

Overall, risdiplam is the company’s third-highest-grossing medicine, with sales of CHF 363 million in Q1 2023, up 60.6% year-over-year. As a result, PTC received $30.8 million in royalties from Roche Holding over this period. The only competitors of Evrysdi are Novartis’ (NVS) Zolgensma and Biogen’s (BIIB) Spinraza, which were actively prescribed by doctors until 2020, but since the appearance of the PTC Therapeutics’ product on the market, the situation began to change, not in their direction. The main reasons for the improved sales of Evrysdi are the oral route of administration, a more favorable safety profile, continued geographic expansion, and improved patient access.

Source: Created by author

Sales of Zolgensma, a gene therapy, were $309 million in Q1 2023, down $54 million from the prior year. We assume that this is mainly due to the many side effects caused by the treatment relative to competitors. So, in mid-2022, the company reported that two children died due to acute liver failure after being treated with a Novartis product.

However, Biogen’s Spinraza sales continue to decline year-on-year and quarterly, totaling $443.3 million in the first three months of 2023.

Source: Author’s elaboration, based on quarterly securities reports

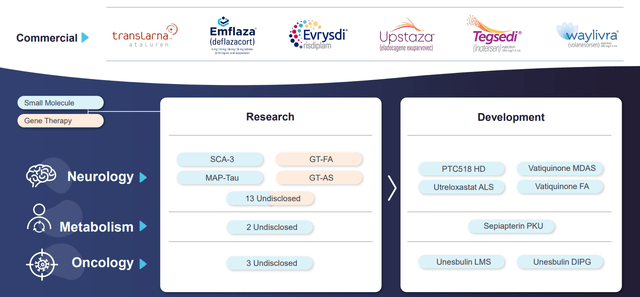

The company’s management continues actively promoting PTC Therapeutics’ product candidates for the final phases of clinical trials, intending to file registration applications with regulatory authorities in the next two years. The company has a range of products for treating rare monogenic diseases that affect the central nervous system, including Upstaza (eladocagen exuparvovec) for treating aromatic L-amino acid decarboxylase deficiency. In addition, PTC Therapeutics is developing compounds based on the Bio-e platform that target oxidoreductase enzymes that play a critical role in the pathology of several CNS diseases. The two most advanced experimental drugs of this platform are vatiquinone and utreloxastat. PTC Therapeutics’ focus extends beyond treating central nervous system illnesses. They are actively working on developing unesbulin for treating two of the most challenging cancers to treat, leiomyosarcoma and diffuse internal pontine glioma, in their R&D department.

Source: PTC Therapeutics Pipeline

The company’s extensive pipeline is pushing up research and development spending to $195.1 million in Q1 2023, an increase of about $55 million from the prior year.

Source: Author’s elaboration, based on Seeking Alpha

On the one hand, in the case of positive data on registration-directed Phase 3 trials, this can lead not only to an increase in interest from investors but also to attract Big Pharma, which continues to actively seek assets to acquire to mitigate the risks associated with the loss the exclusivity of their blockbusters.

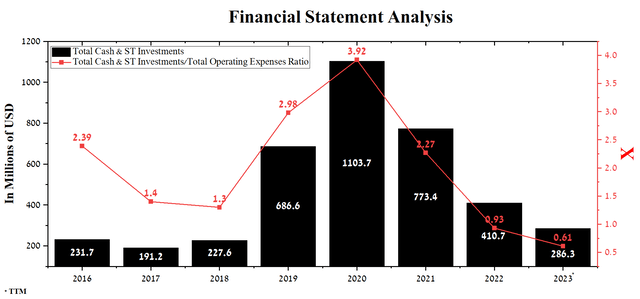

On the other hand, PTC Therapeutics’ cash and short-term investments totaled $286.3 million at the end of the first quarter of 2023, significantly less than the first three months of 2022. Based on current and future spending rates, we estimate that the company’s management will have to issue convertible notes or conduct a dilutive secondary public offering totaling at least $250 million. The need for this is related to the terms of the loan agreement with Blackstone, which was concluded at the end of October 2022 for $1 billion. PTC Therapeutics is required to maintain consolidated liquidity of at least $100 million at the end of each quarter, with this amount increased to $200 million after certain events are reached.

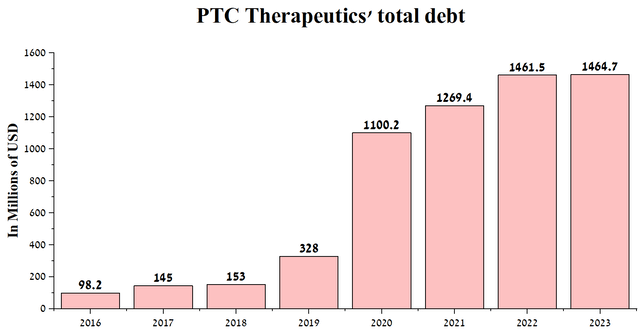

PTC Therapeutics’ total debt is $1,464.7 million at the end of Q1 2023, up slightly from 2022. In addition to the loan agreement with Blackstone (BX), in September 2019, the company issued 1.50% convertible senior notes totaling $287.5 million, maturing in 2026.

Source: Author’s elaboration, based on Seeking Alpha

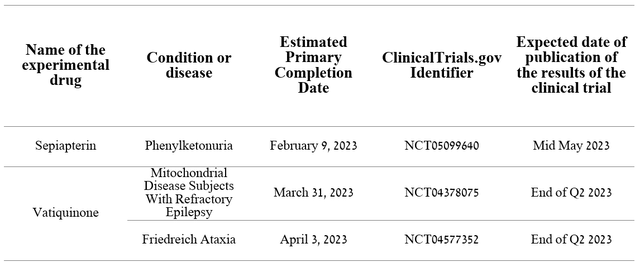

We believe that the current high spending on R&D will gradually decrease due to the completion of three large Phase 3 clinical trials evaluating the efficacy and safety profile of sepiapterin for the treatment of phenylketonuria and vatiquinone for the treatment of Friedreich’s ataxia and the reduction of motor seizures associated with mitochondrial diseases.

Source: Author’s elaboration, based on clinicaltrials.gov

Based on the results of the smaller clinical studies we analyzed, we expect all three of the above clinical trials to meet their primary endpoints with a high degree of probability, leading to regulatory filings in the first half of 2024.

Conclusion

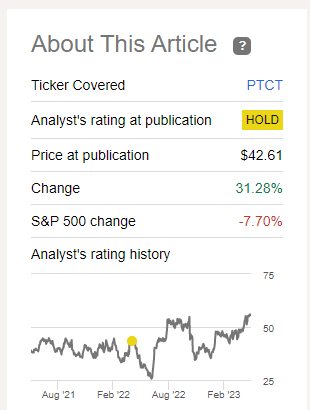

Since publishing the last article on PTC Therapeutics, the company’s share price has risen 31.28%, outperforming the iShares Biotechnology ETF (IBB) and the S&P 500 (SPY). The company’s investment interest growth was driven by increased sales of PTC Therapeutics’ medicines and pending results from three registration-directed trials in the next four months.

Source: Nathan Aisenstadt – Seeking Alpha

We continue to believe that 2023 will be a watershed year for PTC Therapeutics, which could open a new chapter in its history. However, due to high R&D spending and the need to maintain consolidated liquidity of at least $100 million at the end of each quarter by the terms of the agreement with Blackstone, we lowered our previous target price of $94 per share to $78. We also expect that the company’s shares will be subject to increased volatility until the end of the third quarter of 2023, which should be especially considered by more conservative investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here