The staggering year-to-date gain of 42% in the Invesco NASDAQ 100 ETF (NASDAQ:QQQM) has begun to raise concerns that the market is approaching overbought territory, which could result in a healthy price correction. However, market fundamentals and the outlook for technology, consumer cyclical, and communications stocks suggest that this may not be the case. Valuation also indicates that stocks still have room to rise and have not reached a point where a price correction is imminent. Low short interest, high liquidity, and strong momentum all rule out the possibility of a healthy price correction unless a tail event or any big fundamentals shift occurs in the near term.

Market Fundamentals and Bullish Trend

The current stock market uptrend appears to be strong because it is supported by improvements in economic market fundamentals and corporate outlook. The Fed appears to be on track for a soft landing because it has managed to reduce inflation without causing the economy to enter a recession. Healthy economic growth trends are reflected in US GDP growth of 2% in the first quarter, compared to an initial expectation of less than 1%. The market now expects Q2 GDP growth of around 2.4%. The strong job market also suggests that there is no imminent risk of an economic downturn. The unemployment rate fell to a 52-year low of 3.4% in April and is now hovering around 3.6%. Early in 2023, regional banks faced some challenges, but the most recent findings indicate that there is no immediate liquidity risk in the financial sector. In fact, higher interest rates continue to help the bank’s profitability despite slower loan growth and higher deposit retention costs. In the second quarter, US banks’ average net interest income increased to over $20 million from roughly $15 million in the prior year. In response to the successful outcomes, the Vanguard Financials Index Fund ETF (VFH), which monitors the performance of the financial sector, increased by about 9% in the last month.

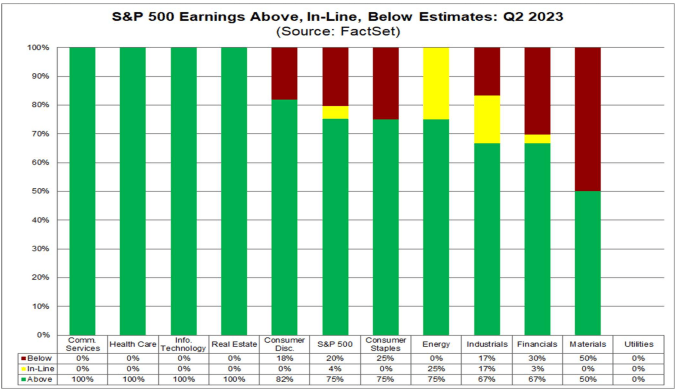

Q2 Earnings Beat (FactSet)

The S&P 500’s earnings are yet another factor bolstering the bull trend. The S&P 500 has gained about 4% since earnings season began almost two weeks ago. According to FactSet data, 78% of companies outperformed expectations in the first quarter, and 75% of companies have done the same in the second quarter. Mega and large caps from consumer discretionary, communication, and technology have so far produced particularly strong results for the second quarter. These sectors are the hub of growth stocks and have made significant contributions to the current bull market.

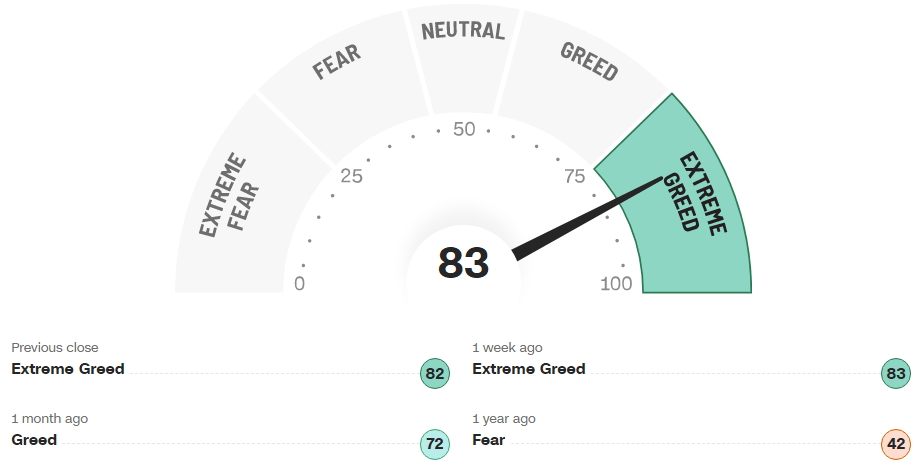

Fear & Greed Index (CNN)

Investor sentiment is another element that can affect the direction of the market. According to CNN’s fear and greed index, investor sentiment has reached extreme greed levels, indicating that trading volumes are increasing and investors are showing confidence in risky investment options. Wall Street currently expects the S&P 500 index to grow by another high mid-single-digit percentage point in 2023. If the S&P 500 extends its gains in the second half as expected, high-beta stocks are likely to produce much higher price returns. A sharp drop in short interest also reflects the positive mood. For example, SPDR S&P 500 ETF Trust (SPY), which tracks the performance of the S&P 500, has a short-interest ratio of 1.8, down from 2.34 the previous year. This ratio shows that it only takes 1.8 days for all short shares of ETF to be covered or bought back by the market. The high-beta Invesco NASDAQ 100 ETF has also seen a 37% decline in short interest over the past two weeks.

QQQM’s Portfolio Holdings Supports Uptrend

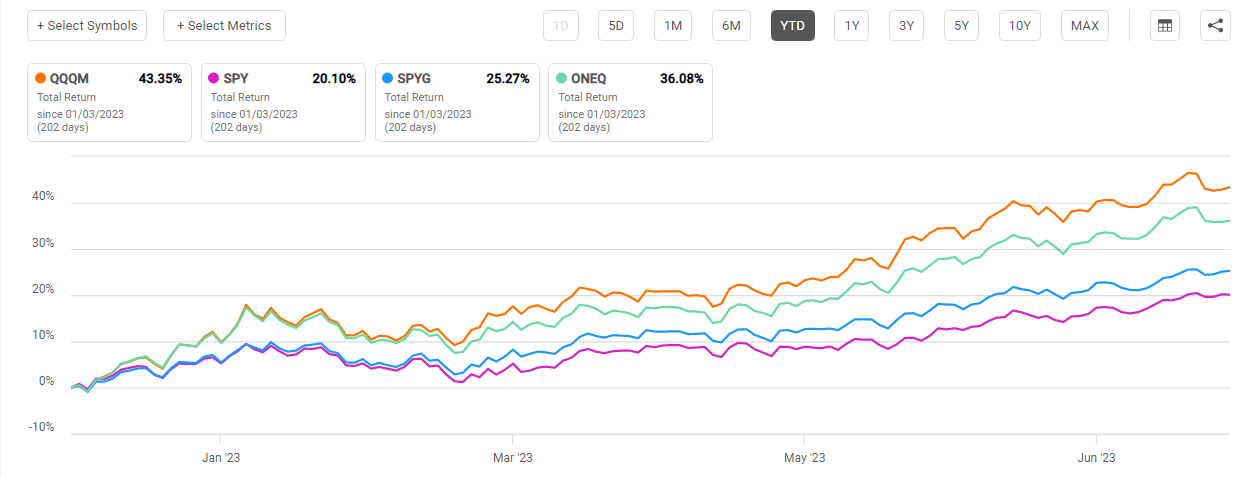

QQQM price change vs SPY, ONEQ and SPYG (Seeking Alpha)

As the current stock market bull run is fueled by mega and large-cap companies from technology, consumer cyclical, and communication sectors, investing in these areas could help investors achieve lofty returns in the bull run. Right now, there are several NASDAQ and growth-focused ETFs available in the market that can help investors generate market-beating returns during the bull run. However, in my opinion, the Invesco NASDAQ 100 ETF is more appealing than the others because it tracks the performance of the 100 largest companies listed on the NASDAQ index, with more than 80% portfolio exposure to the technology, consumer cyclical, and communication sectors. As shown in the chart above, QQQM has generated a total return of 43% year to date, compared to 25% for SPDR® Portfolio S&P 500 Growth ETF (SPYG), 36% for Fidelity Nasdaq Composite Index ETF (ONEQ), and 20% for SPDR® S&P 500 ETF Trust (SPY).

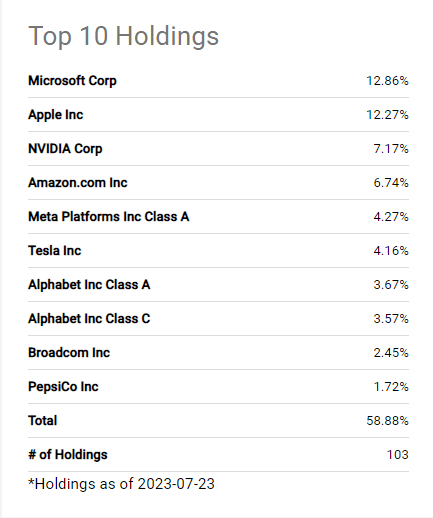

QQQM top 10 stock holdings (Seeking Alpha)

Its portfolio holdings include companies that are winners and drivers of the bull market. Furthermore, their share price appreciation is supported by solid fundamentals and financial growth trends rather than speculation. A large number of QQQM’s portfolio holdings have also benefited significantly from the rising demand for artificial intelligence. For example, Microsoft (MSFT), its largest stock holding, has seen a 45% increase in share price year to date, owing to solid financial results and a strong position to capitalize on emerging opportunities in the AI business. Microsoft has been aggressively investing in emerging technology in order to gain a competitive advantage. Its total investment in OpenAI, the most popular conversational AI tool ChatGPT, has reportedly risen to $13 billion. For the June quarter, the company exceeded revenue and earnings estimates, and CEO Satya Nadella stated that the company is “focused on leading the new AI platform shift, assisting customers in getting the most value out of their digital spend, and driving operating leverage.”

NVIDIA (NVDA), it’s third largest stock holding, was a major player in the development of ChatGPT, alongside Microsoft and OpenAI. Following the success of ChatGPT, NVDA has seen a massive increase in demand for its chips. Aside from using its chip to power AI tools, it continues to release more AI-powered products, such as an AI supercomputer platform. This year, NVDA is expected to see a 61% revenue boost due to the high demand for AI-related products. According to Mizuho analyst Vijay Rakesh, the company has the potential for unlocking $300 billion in AI-related revenue by 2027. Its shares are up a whopping 221% so far in 2023 due to AI buzz. Another chip manufacturer, Broadcom (AVGO), has been aggressively cashing in on the rising demand for AI. In 2024, generative AI could generate more than 25% of the company’s semiconductor sales, according to CEO Hock Tan.

In addition to a 50% stake in the technology sector, its portfolio includes mega- and large-cap stocks from the consumer cyclical and communications sectors. Both sectors had the highest earnings growth among the 11 S&P 500 sectors in the first quarter, and the trend continued in the second quarter, thanks to strong performance from mega and large caps such as Amazon (AMZN), Meta Platform (META), and Alphabet (GOOG) (GOOGL). According to Wall Street estimates, Amazon will earn $1.59 per share, compared to a loss of $0.27 per share. Furthermore, earnings are expected to increase by 62% in 2024 and 43% the following year. Alphabet has surpassed revenue and earnings expectations for the June quarter. Its revenue increased by 7% year on year, while earnings per share increased to $1.44 from $1.21 in the previous year’s quarter. QQQM’s portfolio also includes value stocks from the consumer defensive, healthcare, utilities, and industrial sectors, with a combined weightage of less than 20%.

Valuations and Quant Ratings

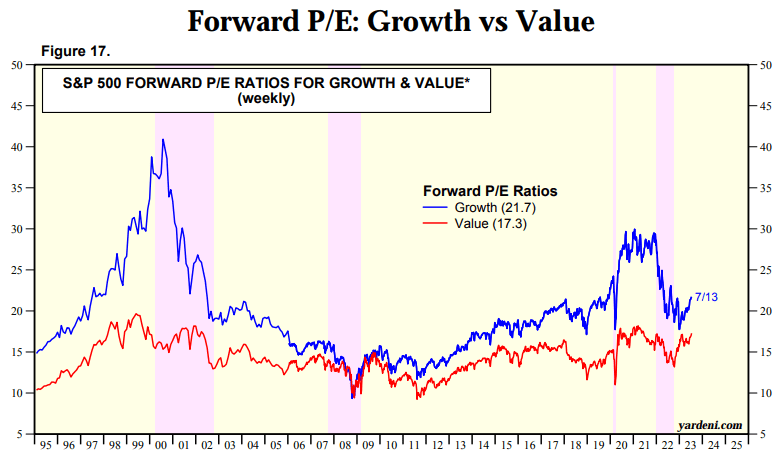

S&P 500 forward PE for growth and value stocks (Yardeni.com)

The forward valuations of growth stocks increased from recent lows as a result of a sharp price increase in 2023. However, valuations are still much lower than they were two years ago and are comparable to pre-pandemic levels. Forward valuations such as price to earnings and price to sales are likely to gain support as growth companies anticipate solid financial growth in the second half and in 2024. Value stocks are also trading in line with the past five-year average despite a recent share price gain. Overall, even though valuations have risen recently, they are still not as high as they were during the bull runs of 2000 and 2022. As a result, there is little chance of a healthy price correlation in the near term, and there is still room for more upside.

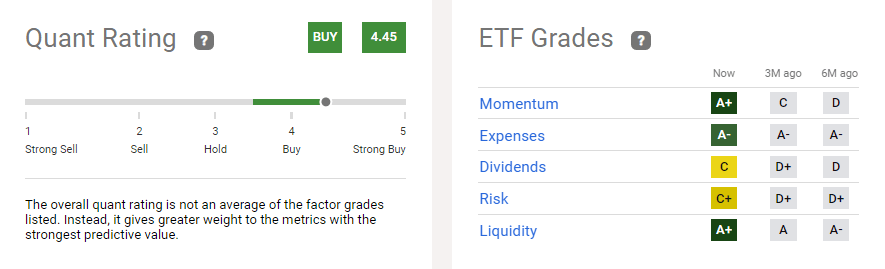

QQQM Quant Rating (Seeking Alpha)

According to SA’s quantitative analysis, QQQM is approaching a strong buy zone. The ETF received a very high rating for momentum, expenses, and liquidity factors. The A plus grade on the momentum factor emphasizes the robust strength of the upward trend. Furthermore, a negative A score on its expense ratio of 0.15% looks promising given the likelihood of higher returns than key market indices. Its expense ratio is also significantly lower than the median for all ETFs, which is around 0.50%. Additionally, the rising trading volume is highlighted by the A plus grade for the liquidity factor. Growth in volume during an uptrend is a sign that investors are confident in future performance and are interested in buying.

Risk Factors to Consider

For an investor with a low-risk tolerance, QQQM appears to be a risky play. Its share price is highly volatile and can experience a sizable price decline during bear markets. In addition, the ETF is vulnerable to a range of risk factors, including the Fed’s rate-hike strategy and a downturn in the economy. For instance, there may be a risk of price volatility and the reversal of an uptrend if the Fed raises rates more than once in the second half and maintains them higher for an extended period of time. High standard deviations and a concentration of more than 50% of the portfolio in the top ten stocks also make it a risky bet.

In Conclusion

The stock market appears to have more room for growth, with little chance of a significant price drop in the near future. In light of this, investors are advised to hold onto their positions in high-beta ETFs, such as the Invesco NASDAQ 100 ETF. Additionally, it is still trading in the buy range for investors seeking higher returns at a high level of risk. The portfolio structure of the ETF places it in a favorable position to not only profit fully from the bull run but also to generate returns that are substantially higher than those of the larger market index.

Read the full article here