Downturn in handset shipments is weighting on Qualcomm Inc. (NASDAQ:QCOM) to record a noticeable decrease in financials in the quarter ended March 2023, although the company met its own forecasts for revenue and net profit. The lower-than-expected recovery in China is frustrating the management, which forecasted a 9% decline in global smartphone sales in 2023 at best. Still, I believe the fundamental case of the company looks very attractive, due to the continued investments in technology leadership and active development of promising areas of chipsets for IoT and the automotive industry. I am rating QCOM with a Buy, thanks to a number of quality points. In particular, the company has a strong record of delivering high profitability numbers on a resilient basis; diversification efforts to shape a more favorable mix of offerings; synergy effect potential from 5G expansion and strong position to benefit from market and demand profile normalization.

Outlook and financial overview

The adoption of 5G technology is somewhat slowing down, but it remains a key long-term driver for Qualcomm. The global number of 5G points is 142k compared to 86k as of November last year and 17k a year prior to that. As a result, the pace of technology adaptation has decreased over the past year, and the possible reasoning behind the trend could be a weak global macro environment. However, the potential of widespread diffusion remains huge, as most European countries have less than 50% coverage, while not to mention the developing countries are yet to adopt the technology at all.

This favorable backdrop has a double effect on Qualcomm. First of all, the company produces high-performance chips to supply the key OEMs in the global smartphone market. And since the flagship product, Snapdragon 8 Gen 2, was released, the company is preparing to present a Gen 3 version. The latter is rumored to move to a 3nm process, manufactured by TSMC, and become a great hit next year. The second part of the 5G synergy effect for QCOM lies in the patent rights for communication standards. The combination of patent rights to established wireless standards and 5G OFDMA holds promise for the company’s licensing segment. And it’s not just about 5G, as in many developing countries 2G/3G networks continue to have a significant presence. Add to that the new agreement with Samsung (OTCPK:SSNLF) spanning through 2030, which already covers 6G technologies and confirms the long-term potential of the QTL segment.

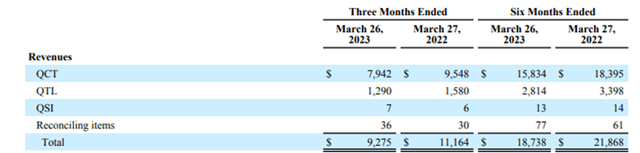

Financial results (company reports)

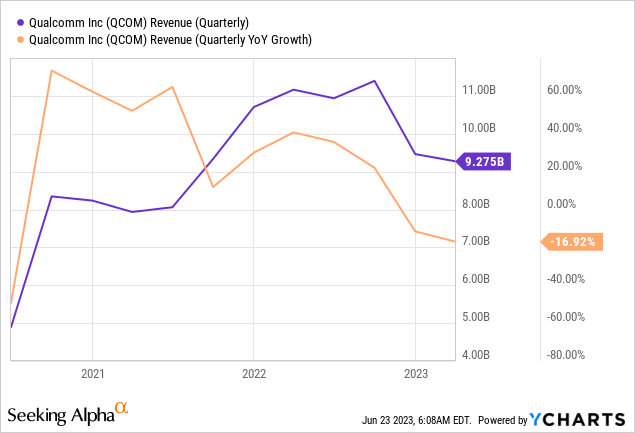

Overall, the falling smartphone sales hit the company’s bottom line significantly. Total revenue fell 17% YoY to $9.3 billion, while adjusted EPS fell 33% YoY to $2.15. QCOM met its own forecasts for the quarter, but investors likely perceived the management’s expectations for the next quarter in a negative way. In particular, further decline in revenue to $8.5 billion midpoint (-8.6% QoQ) and drop in EPS to $1.80 midpoint (-16% QoQ). China’s slow recovery, inflation and general macro uncertainty gave led the company to forecast at least 9% drop in global handset sales for FY2023.

At the same time, the company continues to diversify towards IoT and Automotive, which are already combined a decent 20% of revenue. Global IoT spending is forecasted to grow at a 10.4% CAGR over the 2023-2027 period, while the number of IoT devices with internet connection could more than double over this forecast horizon up to 27 billion. At the same time, the acquisition of Veoneer opens up new prospects for the Snapdragon Digital Chassis automotive platform, on which a significant part of leading auto OEMs are cooperating with QCOM. Moreover, global connected car sales increased by 12% last year and accounted for more than half of overall car sales.

The company’s opportunities in the segment of ARM processors for laptops are overshadowed by Apple so far. According to benchmarks, the latest Snapdragon 8cx Gen 3 is significantly underperforming the Apple M2. This is fair enough due to Apple’s lead in the ARM chipset market for laptops, but QCOM is about to release a competitive processor, named Oryon, this year. This could be a point for Qualcomm to truly compete with rivals. Generally, everyone is looking for great performance, battery life, compatibility and form factor. Apple’s offerings combine the above features fairly well, and this is the kind of hardware the Oryon should be in order to be competitive. The rumors hint at a 12-core chip with an 8/4 blend of performance/efficiency cores, which could provide a superior performance. Still, there is a point that Qualcomm could leverage to excel Apple. In particular, thanks to the increasing diffusion of Ai, its integration into the Arm-based devices could result in more efficient and improved performance, as well as user’s experience for various generative tasks.

Could be a Buy in a downturn?

Against the backdrop of the cyclical challenges in the semiconductor industry, some consumer electronic chip companies predict growth in the second half of the year, which is in line with the expected dynamics of the semi-market. QCOM is not, as it becomes clear, the management believes the excess inventory needs more time to unwind.

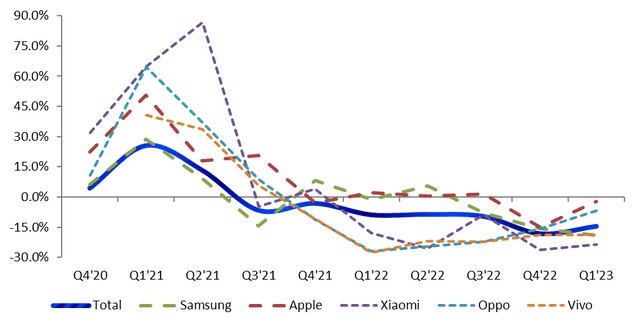

However, we can notice the emerging trend of normalization in the chart below, which delineates smartphone shipments. And despite total shipments being tilted to get up to the surface, it is still early to predict the recovery of overall consumer demand. Regarding stockpile levels, I believe that the holiday season at the end of the year could accelerate the reduction of inventory, which along with 5G diffusion, could bring inventory to quite a sound level. These could ensure a decent and favorable basis for the growth to rollout in 2024. And with the future growth likely pushed off into the next year, QCOM stock is still a Buy for me. But later on this point, let’s examine whether Qualcomm is a Buy in the cyclical downturn.

Smartphone shipments growth (IDC; prepared by author)

We could notice that the company’s revenue dynamics used to be somewhat more resilient, remaining above market shipment trends. This is fair for the period from 2021 up to the end of 2022. However, the company’s cyclical outperformance resulted in a high base and paid its price in the first quarter of 2023, where QCOM’s revenue dynamics fell short. Going forward, this could be the case for the next quarter, according to management’s forecast, and at least for another one, in my view.

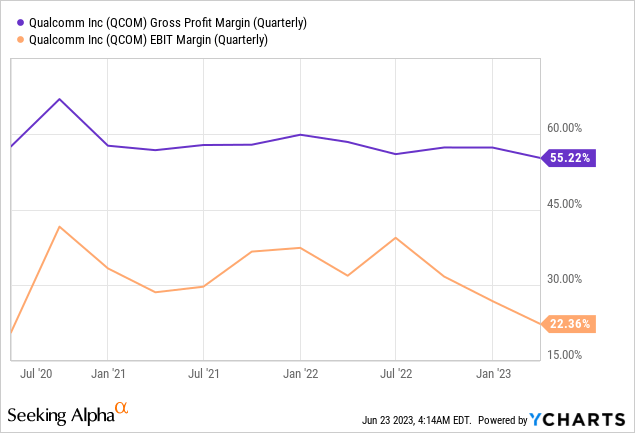

Examining the company’s profitability, we could observe the gross profit and operating profit margins hanging around 60% and 30% levels, respectively. Although the latter dipped during the last quarter, the company proved to deliver good profitability against the market dynamics.

Going into the next quarter, executives expect further slipping of operating margins in the main segments. And despite being unclear when they could bottom out, the company is delivering high and resilient profitability numbers.

However, one might say that the company broke its resilient track record in the first quarter, especially on the profitability side. Fact remains and it’s fair enough for the financial performance to reflect the market weakness at some point, but how about this.

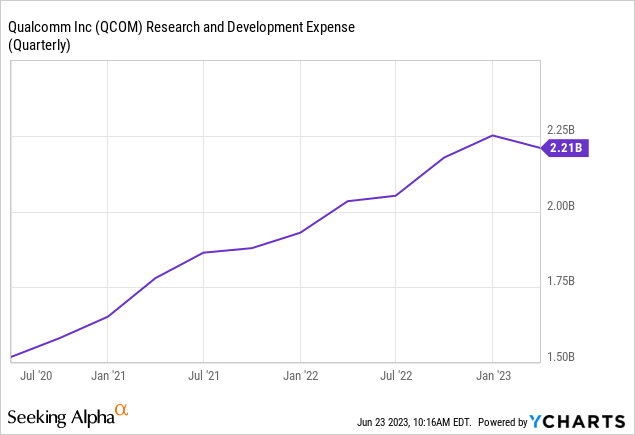

Qualcomm has a strong focus on R&D. Although the expenditures lost their steam slightly in the recent quarter, they amounted to 24% of revenue compared to 18% a year ago. Summarizing the above trend, it is obvious that the company is not cutting back on innovation investments. This is a significant point of quality for me, and between compromising a portion of margin or investments, the latter seems more reasonable in my view.

Valuation

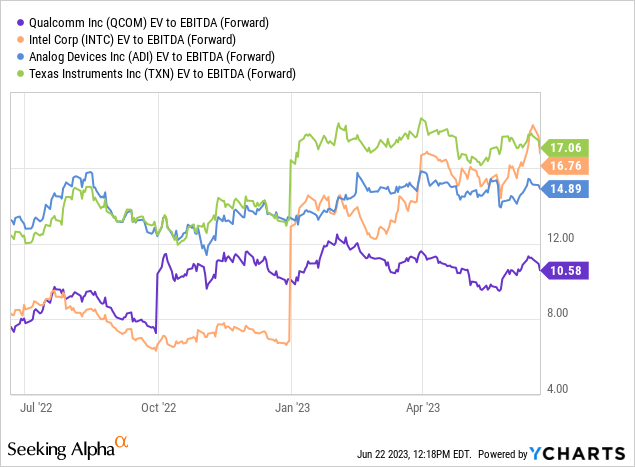

Looking at the valuation, we can find QCOM stock trading at a prominent discount on the EV/EBITDA forward multiple compared to Intel (INTC), Analog Devices (ADI) and Texas Instruments (TXN).

Qualcomm is trading at an EBITDA forward ratio of 10.6x, which represents a 37% discount to the mentioned peers’ median of 16.8x. As a result, adjusting for cash and IB debt, the equity value should come at $210.9 billion or $189 per share, implying a significant 63% upside potential.

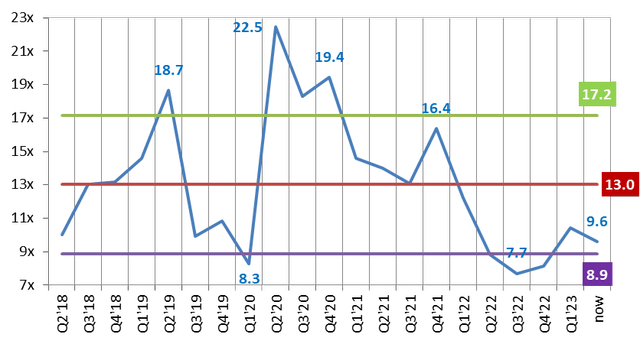

Examining the TTM EV/EBITDA trend closer, we could find the ratio near the violet line on the following chart, which is one standard deviation below the 13x mean line.

TTM EV/EBITDA trend (Seeking Alpha)

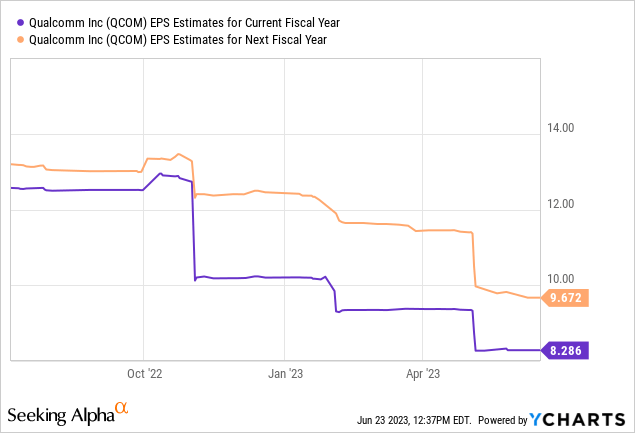

It should be noted, that in order for QCOM to reach the peers’ median EV/EBITDA level, the stock should be trading near the green line (one standard deviation above the mean). However, if we suppose a conservative mean reversion level and incorporate a 13x EBITDA multiple in the valuation, it still provides a decent 25% upside room. In the meantime, analysts significantly trimmed the EPS estimate for 2024 to $9.67.

In my view, the gap between estimates for next and current EPS should tend to increase. This may be the case at least because the first smartphones on Snapdragon 8 Gen 3, which is supposed to beat A17 bionic chipset, could come early in the next year.

Overall, I believe that QCOM is a good Buy even in a cyclical downturn, as the company has a strong record of resilient performance. The current valuation gap is quite significant, where the EV/EBITDA ratio is moving close to one standard deviation line below the mean reversion level. I think that the company could significantly benefit as market conditions and inventory levels normalize due to the continued investments in technology leadership, focus on diversification and product roadmap.

Risk factors

The main risk for the company remains a further deterioration in the smartphone market as a result of a prolonged macro downturn, since the segment generates 2/3 of QCOM’s total revenue. Additional uncertainty comes from the expected uneven recovery in China, as well as the unclear path of interest rates in the US and Europe.

Takeaways

Qualcomm managed to remain highly profitable even in the backdrop of the prolonged downturn, while the diversification strategy continued to shape a more favorable revenue-mix. The company has a great potential to extract synergy effects from 5G expansion, where the continued adoption of the technology provides for significant growth prospects, while the large portfolio of patents and licensing could reinforce its profitability. Although QCOM fell below the cycle performance in the recent quarter, it has great potential to deliver an above cyclical growth rate going forward due to the higher content in 5G smartphones. The latter works out additional resilience, meaning higher revenues with similar global smartphone shipments. Not to mention the generative AI, the full capabilities of which can be released once pulled out of the cloud to the edge. As a result, QCOM’s shares may be a Buy on the outskirts of good times, as well as during bad times.

Read the full article here