Value is back, value is back! Yeah, we’ve heard that one before. Value investing, which used to be thought of as the true-blue way to invest, the subject of classic books and the generator of consistent alpha, has become the butt of many investment industry jokes. Maybe the performance of the iShares S&P 500 Value ETF (IVE) and the iShares S&P 500 Growth ETF (IVW) since the start of 2017 has something to do with that perception. The scoreboard reads: 185% for IVW, 101% for IVE.

And, while doubling one’s money in seven years is about a 10% annualized return, today’s investor habitually wants what did the best in whatever past period they are fixated on. So growth gets the accolades and the assets, and value, like Charlie Brown at Halloween, just gets a rock.

But I’m here to say that there is value in value. Value equity ETFs, that is. However, like classic value investing itself, it takes some rigorous research to find it, whether the target is a single stock or, as in the case of Alpha Architect US Quantitative Value ETF (NASDAQ:QVAL), an Exchange Traded Fund. Because value is not the same as cheap. And the market is still not rewarding fundamentally sound and deep-discounted stocks. So today, seeking alpha in the equity ETF space is either a tactical idea or, in the case of my buy rating on QVAL, a long-term (2-3 year) outlook.

That’s because gains in any security require two things: owning it, and having the market lift its price. I can’t control the second part of course, but I can research, identify and characterize ETFs that I think will be the ones to consider first when value is again driving portfolio returns. Right now, a very small portion of the stock market is driving returns. But since a crystal ball is not an element of my investment process, I’m instead establishing a short-list of potential value ETFs that have what I think will succeed the next time the stock market is not such a dogfight, as it is now. QVAL makes the buy list because of its nature and long-term attractiveness, not because I think it is going to zip higher right away.

In a growth-obsessed market climate, Why bother with value at all?

As the S&P 500 continues to reach new heights, driven by narrow leadership in the Magnificent 7, it is important for investors to consider allocations that will help offset losses by a potential rotation out of these currently favored companies. Beyond the potential for above-market returns, a factor-based lens can be a useful way to achieve portfolio diversification and manage risk. By targeting separate factors with low correlations, investors can help offset periods of specific factor underperformance. The same goes for factors with positive correlations, a combination of positively performing factors can contribute to outperformance over time.

That leads me to value, which aims to target securities that are trading below book value, in an effort to capture upside potential when the market price is in their value. In QVAL, I see a focused value ETF that also stresses quality characteristics in their methodology, and targets the midcap segment of the US stock market.

Focused, the way I like my ETFs

QVAL starts with about 1000 stocks and filters down to a portfolio of roughly 50 holdings. QVAL equally weights these holdings to counteract a size bias. I am generally a fan of higher concentration, but not at a point in the market cycle when midsize stocks and value stocks have massively underperformed as they have. QVAL’s portfolio has an average market cap of $13 billion, so it is a “goldilocks” niche: its stock holdings are not too big, not too small.

This can be an added benefit for periods of outperformance, as the equal-weighting scheme incorporates some dimensions of the size factor, alongside Value. Size and value tend to be positively correlated factors, and the equal-weighting dimension of this fund may provide added tailwinds when the factor environment becomes more favorable towards value.

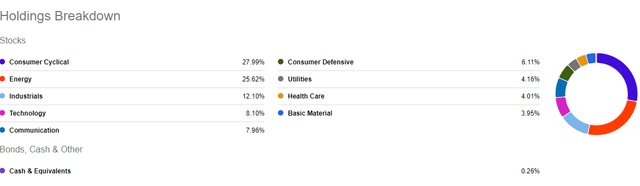

QVAL’s sector allocation is currently driven in large part by two sectors, cyclicals and energy, as detailed below. Industrials play an important supporting role, and those three account for about two-thirds of assets.

Seeking Alpha

This is different sector-neutral Value ETFs, which diversify more thoroughly across sectors. This can sometimes come at the expense of the level of factor exposure for an ETF. This is a differentiator for QVAL, that presents a more pure value play for investors that have high conviction in what the factor can offer investors.

Another one of Rob’s “scavenger hunts”

I am not shy about my strong belief that investors have overlooked a ton of very useful ETF products. That’s mass-marketing for you.

QVAL currently has about $300 million in assets. The fund’s passive manager, Alpha Architects, employs a more sophisticated filtering and selection process than standard value screeners.

A key attraction point for me is QVAL’s portfolio P/E ratio, which sits around 8x trailing 12-month earnings. Similarly, at 0.6x trailing sales, this is a bargain, even if the ultimate “headliner” catalyst (like a return of investor enthusiasm toward value and midsize stocks) is not yet upon us.

Frankly, I cannot believe how many ETFs (value, small-cap, non-US equity) trade at such a massive discount to the S&P 500. Short-term, QVAL represents “value” like the name says. But longer term, factoring in a renewed investor interest in valuation as an investment tool (versus paying any price for growth expectations), this ETF could turn out to be a generational buy if there ever was one.

One other key feature to note here: QVAL’s turnover has averaged about 100% a year. In other words, it is like a new set of 50 stocks every 12 months. “But Rob, isn’t that a bad thing, since mutual fund investors have said for years that high turnover raises trading costs, which detracts from returns?” My response (to my own rhetorical question, actually): that’s the proverbial picking up pennies in front of a steamroller!

Nothing but net

It has been a long time since I played basketball, but when I did so actively, the expression for a perfect shot was “nothing but net.” In investing for my portfolio, I care about expense ratio slightly more than not at all. That’s because in some cases, you get what you pay for. In modern markets, and in a part of the cycle where what fits QVAL’s criteria changes that rapidly, that’s a feature, not a bug. A feature of a changing market, which sprouts opportunity for ETFs that are governed by investment techniques that have the potential to add alpha.

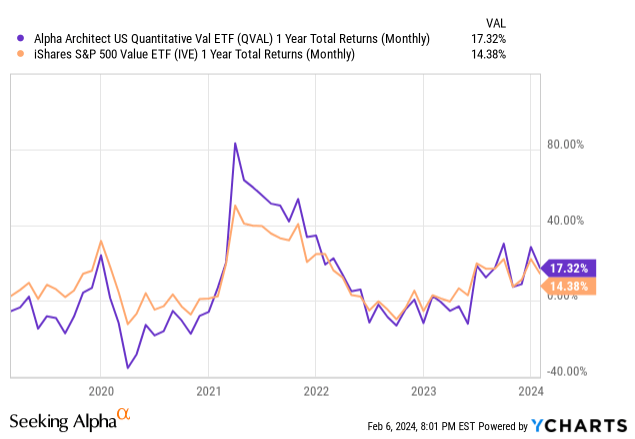

That chart above shows that even in a climate where large caps dominated, QVAL has been neck-and-neck with IVE over 1-year rolling periods. Combine value’s eventual resurgence with a comeback in the non-mega cap market segments, and you have a 1-2 punch that I can get excited about.

A Note On Methodology

QVAL is process-driven but it is actively managed, and has some complexity to its proprietary process. It is not 100% transparent in its methodology, but like most ETFs, it shows its holdings on a timely basis.

In addition, QVAL favors a single metric approach (EV/EBIT) to define Value. This is different from other approaches that define Value as P/B or P/E ratios. QVAL also attempts to control for quality characteristics with a proprietary “forensic accounting” screen for companies that might introduce more risk into the portfolio. So there is more ongoing work here beyond just trading to update the portfolio for inflows and outflows from investors.

QVAL: One for the value comeback

This ETF makes my short list of value ETFs I’ll consider. I can’t possibly own every ETF I cover or have a buy rating on, and I do not currently own QVAL. Like I said, it is a long-term investment if and when it does enter my portfolio. But as noted above, on a long-term basis, I like the approach here enough to give it a buy rating, which investors can interpret as they wish.

QVAL targets value investing explicitly in a well-constructed ETF package. Its current P/E ratio is one proof point demonstrating how the fund is able to capture the value factor effectively. QVAL also delivers a methodology that is more holistic relative to other value ETFs, incorporating considerations around quality and size. I rate QVAL a buy.

Read the full article here