Thesis

Radcom Ltd’s (NASDAQ:NASDAQ:RDCM) recent Q2 report revealed non-GAAP EPS of $0.13 that beat by $0.09, revenue of $12.4M that beat by $0.09M and ultimately showcased impressive financial success and a series of strategic moves that position the company for future growth. Notably, the appointment of a seasoned industry veteran and strategic partnerships with DISH and Google Cloud exhibit the company’s potential for expansion. However, this article argues that despite these promising developments, Radcom’s historical stock performance and valuation metrics currently raise concerns for investors.

Company Overview

Specializing in 5G-ready, cloud-native network intelligence and service assurance solutions, RADCOM Ltd. has positioned itself as a vital player in the evolving telecom space. Their standout product, RADCOM ACE, is a comprehensive suite of solutions providing end-to-end network visibility, data filtering capabilities, and advanced business intelligence tools that underpin key decision-making processes.

Moreover, their diverse technology applicability spans mobile to fixed networks, making them adaptable in the face of changing market demands. Established in 1985 and headquartered in Tel Aviv, RADCOM distributes its solutions through a combination of direct sales and a network of global resellers.

Radcom’s Q2 Earnings Highlights

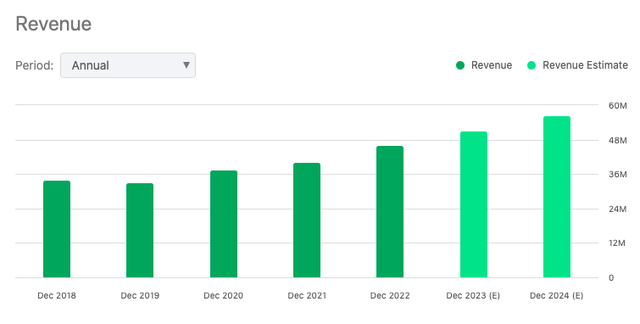

With an impressive showing this past quarter, Radcom has set numerous financial benchmarks. The technology firm pulled in a $12.4 million revenue stream in the second quarter alone, marking an unbroken streak of growth for sixteen straight quarters on a year-over-year basis.

Seeking Alpha

A major board-level appointment stands out as a pivotal moment for Radcom. The nomination of Andre Fuetsch, a seasoned industry veteran with significant executive tenure at AT&T, signals a potential game-changer for Radcom’s strategic direction and anticipated future growth trajectory.

The success of Radcom’s technology is exemplified in their partnership with DISH. Assisted by Radcom’s assurance solution, DISH has triumphed in delivering advanced 5G networks to a significant portion, over 70%, of the U.S. population, showcasing the practical effectiveness of Radcom’s offerings.

In terms of cloud strategy, Radcom’s recent integration with Google Cloud opens up promising new avenues. By expanding its solution to Google Cloud’s vast user base, Radcom not only diversifies its own customer base but also extends its market reach. Concurrently, Radcom’s innovative use of generative AI could deliver operational efficiencies for network operators, including identifying and addressing areas of potential revenue leakage.

The acquisition landscape also has favorable news for Radcom. According to management, the company’s recent acquisition of Continual has already begun to bear fruit. The deal has received positive feedback from customers and has started to open up a pipeline of potential business opportunities.

Looking at the bigger picture, the company’s strong financial performance, combined with its solid business backlog and enhanced assurance capabilities, appears to strengthen Radcom’s confidence in reaching its ambitious goal: surpassing the annual revenue threshold of $50 million.

Performance

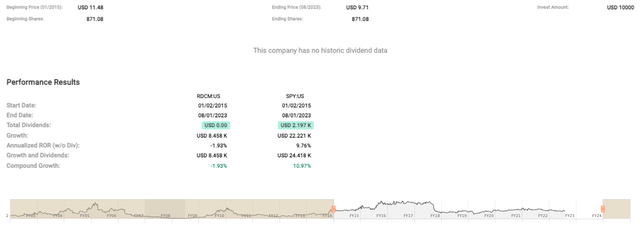

To put it frankly, it appears that RADCOM has not exactly been a gem in the investment world in the medium-term: The decline in price from USD 11.48 in 2015 to USD 9.71 in 2023 certainly leaves a sour taste.

Fast Graphs

The negative annualized rate of return (ROR) of -1.93% only adds salt to the wound especially when you compare this with the the S&P 500 Index which posted a profitable annualized return of 9.76%, even before accounting for dividends, and you see just how lackluster RADCOM’s performance has been. A $10,000 investment in RADCOM would have shrunk to approximately $8,458, while the same investment in the S&P 500 would have grown to an impressive $22,221. When dividends are accounted for, the gap only widens further to an intimidating $24,418 by comparison.

Moreover, the absence of dividends is a glaring weakness in RADCOM’s investment proposition.

Valuation

One of the more jarring metrics for me is the Adjusted (Operating) Earnings Growth Rate (see chart below) that’s running negative at -2.34%. This suggests that RADCOM’s operational efficiency is dwindling, and the firm is experiencing some contraction, which in a competitive marketplace, rings alarms for me.

Fast Graphs

Now, let’s talk about the Blended Price to Earnings (P/E) ratio, standing at a high 34.46x, compared to the more conservative P/E=G ratio of 15.00x. This suggests that RADCOM shares are trading at a premium, which could mean overvaluation. When we juxtapose the high P/E ratio with the company’s negative growth, it becomes a tad more disconcerting. It’s like we’re paying more for less growth, which frankly, doesn’t seem like an appealing proposition to me.

Yet, there’s an interesting aspect that’s quite striking—the normal P/E ratio of 48.82x. This is significantly higher than the current blended P/E, which implies that the market has historically been willing to pay a higher price for RADCOM’s earnings. Could it be that the market sees some intrinsic value in RADCOM that’s not entirely visible through traditional financial metrics? Maybe, but that’s speculative.

So, I would urge investors to tread carefully. Yes, there could be potential, but the current metrics suggest a cautious approach is needed with RADCOM.

Risks & Headwinds

Even as Radcom continues to carve out a remarkable growth trajectory, there are potential clouds gathering on the horizon that bear watching. Factors beyond the company’s direct control, such as macroeconomic volatility, could potentially act as speed bumps in the accelerated rollout of 5G by various operators. Any slowdown could, in turn, indirectly affect Radcom’s revenue stream and overall profitability, injecting an element of uncertainty into future projections.

Further, despite the company’s expressed confidence regarding its recent integration with Google Cloud, real-world outcomes remain a variable. While the integration has undoubtedly broadened Radcom’s potential market, the actual reception of their services on this platform and the rate of customer acquisition are yet to be fully discerned. This element of uncertainty, thus, remains a factor to consider in Radcom’s near-term growth prospects.

Moreover, the company’s recent acquisition of Continual, while broadly viewed with optimism, has some associated risks and caveats. The successful melding of Continual into Radcom’s operations and the realization of the anticipated benefits are ongoing processes. The cost of the acquisition has raised Radcom’s operating expenses by 6%, which could potentially eat into profitability in the short term until the acquisition starts paying dividends.

Lastly, Radcom’s forward-looking approach is evident in its focus on artificial intelligence (AI) as a driver of future growth; however, this relatively nascent technology comes with its own set of unique challenges. The rate of AI adoption among customers, the need for continued investment in R&D, and the ongoing evolution of AI technologies are factors that could impact Radcom’s plans and strategies.

Final Takeaway

I’d rate Radcom as a “Hold”. The company has shown strong growth potential, with significant partnerships and a promising integration with Google Cloud, however, the stock’s past underperformance, high valuation, and potential risks associated with AI adoption and macroeconomic volatility suggest caution. In sum, while Radcom has set a path for robust future growth, its current financial metrics and risks imply that maintaining the current position without additional investment could be the most prudent approach.

Read the full article here