Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) is a pharmaceutical company headquartered in Tarrytown that has played a key role in the fight against COVID-19. Since then, it has continued to rapidly expand its portfolio of medicines aimed at combating cancer, rare diseases, infectious diseases, and eye diseases. Under Leonard Schleifer’s leadership, the company pursued an aggressive R&D policy, resulting in consistent revenue growth year-over-year and maintaining one of the highest operating margins among major pharmaceutical companies.

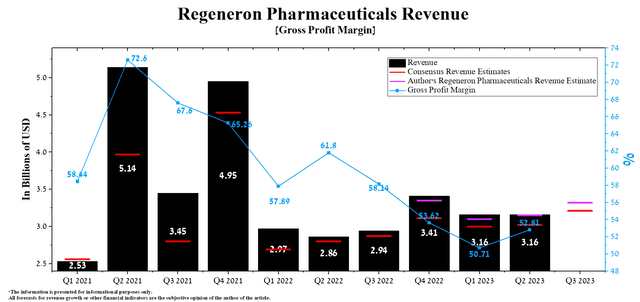

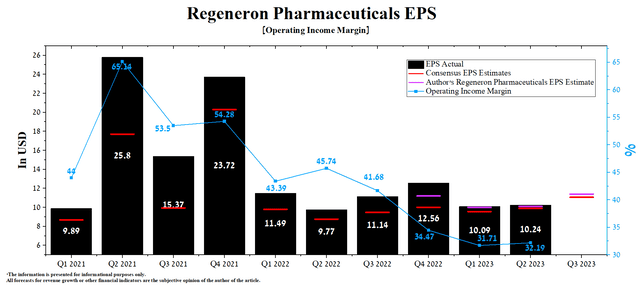

For the three months ending June 30, Regeneron Pharmaceuticals generated revenue of $3.16 billion, slightly exceeding our forecast. On the contrary, Q2 Non-GAAP EPS stood at $10.24 per share, surpassing our expectations by $0.14 but, more importantly, beating analysts’ consensus expectations by $0.34.

This was primarily due to higher revenue from the collaboration with Sanofi of $944 million, up 39.2% year-over-year due to continued strong demand for Dupixent. The mechanism of this monoclonal antibody is also based on the inhibition of IL-4 and IL-13 signaling, which helps reduce inflammation in such widespread diseases as atopic dermatitis, eosinophilic esophagitis, and severe asthma. As a result, Mr. Market favorably assessed Regeneron’s financial report, which not only reflected a rise in its share price by more than 13% but outperformed iShares Biotechnology ETF (IBB), which is under downward pressure due to the Inflation Reduction Act.

TradingView

Although the second half of the third quarter of 2023 was filled with positive events for the company, such as signing a contract with HHS worth $326 million to develop drugs to prevent COVID-19 and FDA approval of a high-dose version of Eylea, we believe that the price level at which the risk/reward profile will be attractive is $755-$757 per share.

We initiate our coverage of Regeneron Pharmaceuticals with a “hold” rating for the next 12 months.

Regeneron Pharmaceuticals’ Q2 2023 financial results and outlook for the second half of 2023

Regeneron’s revenue for the second quarter of 2023 was $3.16 billion, an increase of 10.5% compared to the second quarter of 2022.

Author’s elaboration, based on Seeking Alpha

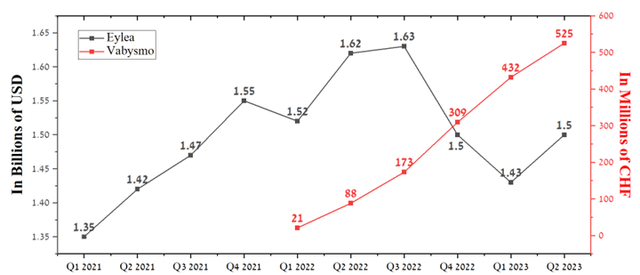

Moreover, the company’s actual revenue beat Wall Street analysts’ consensus estimates in nine of the last ten quarters despite falling sales of its blockbuster eye disease drug Eylea (aflibercept) due to increased competition in the global anti-VEGF market caused by Roche Holding’s approval (OTCQX:RHHBY) of Vabysmo in late January 2022. Eylea sales reached about $1.5 billion in the second quarter of 2023, up 4.9% from the previous quarter. At the same time, demand for Roche’s product remained extremely strong, thanks to less frequent intravitreal injections for patients suffering from wet age-related macular degeneration (wAMD) and diabetic macular edema (DME) relative to competitors.

Author’s elaboration, based on quarterly securities reports

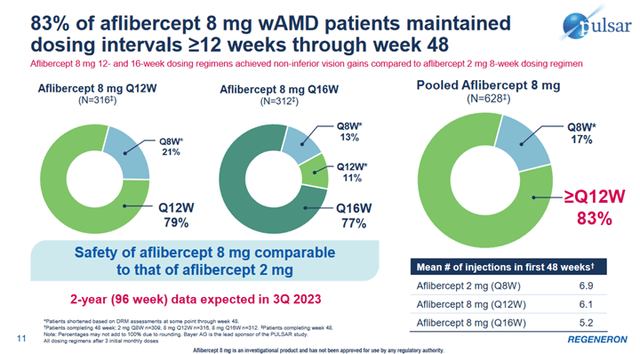

However, after the FDA approved the high-dose version of Eylea in August 2023, Vabysmo’s advantage was negated. Regeneron’s medicine is administered every 2-4 months for treating wAMD and DME and every 2-3 months for treating DR, which is comparable to Roche’s product. As a result, we believe that sales of Eylea will begin to recover again, and more rapid growth will start in the first half of 2024.

Regeneron Corporate Presentation

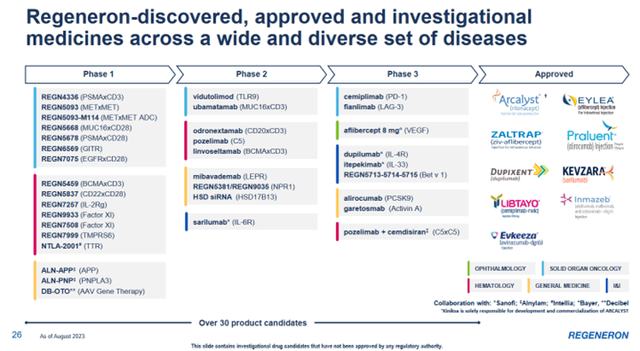

One of the key factors that positively impacts Regeneron’s share price is its extensive portfolio of experimental drugs, which include treating life-threatening conditions such as non-small cell lung cancer and ovarian cancer. An active R&D program led by George Yancopoulos and numerous partnership agreements for the joint development and commercialization of next-generation medicines with leaders in the pharmaceutical industry are pivotal factors expected to drive the company’s revenue and cash flow growth in the upcoming years.

Regeneron Corporate Presentation

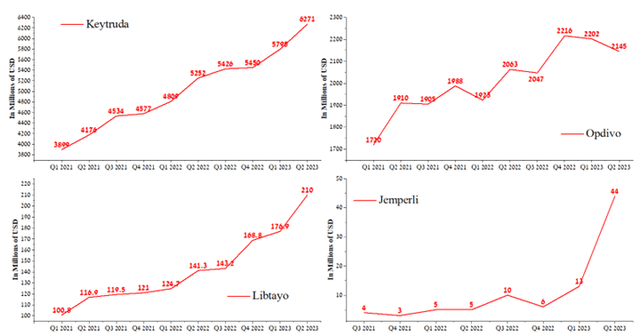

According to Seeking Alpha, the company’s revenue for the third quarter of 2023 is expected to be $3-$3.35 billion, which is 6.3% more than analysts’ expectations for the second quarter of 2023. At the same time, following our model, Regeneron Pharmaceuticals’ total revenue will be slightly higher than the median value of this range and will amount to $3.32 billion. This will primarily be due to stronger sales of Dupixent and Libtayo. Demand for Libtayo (cemiplimab-rwlc), a human IgG4 monoclonal antibody, continues to snowball despite tightening pressure from Merck’s Keytruda (MRK), Bristol Myers Squibb’s Opdivo (BMY), and GSK’s Jemperli (GSK).

Author’s elaboration, based on quarterly securities reports

Regeneron’s operating income margin in Q2 2023 was 32.19%, up slightly from the previous quarter. We predict that it will reach 35% in 2023, and by 2024, the value of this financial metric will grow to 38.4% due to increased sales of medicines and lower inflation in the United States and the European Union.

The company’s earnings per share (EPS) for the three months ended June 30, 2023, were $10.24, up 4.8% year-over-year and, just as importantly, continuing its trend of beating analyst consensus estimates in recent years, thanks in part to its share repurchase program. At the same time, at the end of the second quarter, the remaining authorization to repurchase Regeneron Pharmaceuticals shares amounted to $2.332 billion, which will allow its management to minimize the impact of short sellers on the company’s share price.

Author’s elaboration, based on Seeking Alpha

According to Seeking Alpha, the company’s EPS for the third quarter of 2023 is expected to be $9.14-$13.05, which is 10.5% higher than the consensus estimate for the second quarter of 2023. Regeneron’s Non-GAAP P/E [TTM] is 18.7x, 2.2% higher than the sector average and 22.77% higher over the past five years. On the other hand, the Non-GAAP P/E [FWD] is 19.67x, which is one of the factors indicating that the company is overvalued in the current period of growing concerns due to the impact of the Inflation Reduction Act on the pharmaceutical industry.

Conclusion

On August 3, Regeneron Pharmaceuticals unveiled its financial results for the second quarter of 2023, which not only beat analysts’ expectations but also managed to demonstrate that demand for such innovative drugs as Dupixent, Kevzara, and Libtayo is growing at a faster rate than many on Wall Street expected.

At the end of the second quarter of 2023, Regeneron’s total debt was about $2.7 billion, up slightly from 2021. However, thanks to label expansion of its approved drugs in recent quarters, the company’s EBITDA stabilized in 2023 after the withdrawal of EUA of REGEN-COV, which brought in billions of dollars during the COVID-19 pandemic. As a result, the total debt/EBITDA ratio remains below 0.6x, allowing the company’s management to continue adhering to an aggressive M&A and R&D policy.

The second half of the third quarter of 2023 was filled with positive events for the company, such as signing a contract with HHS worth $326 million to develop drugs to prevent COVID-19 and FDA approval of a high-dose version of Eylea. However, considering technical analysis, we believe that the price level at which the risk/reward profile will be attractive is $755-$757 per share.

We initiate our coverage of Regeneron Pharmaceuticals with a “hold” rating for the next 12 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here