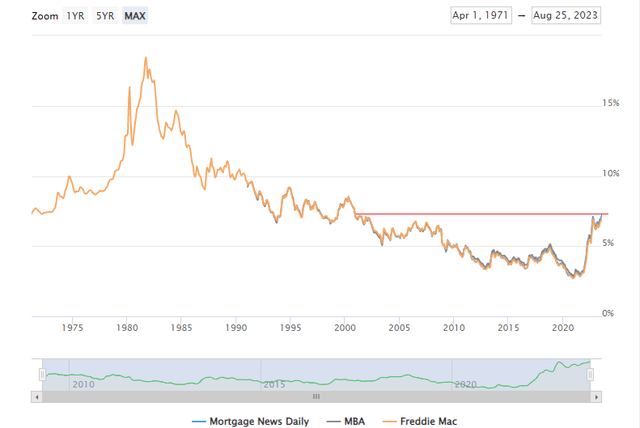

Mortgage rates have climbed to the highest levels in 20 years. As the Fed continues to raise interest rates, with the probability of a November hike now topping 50%, and amid ongoing bond market volatility, the cost to borrow in the real estate market has been on the rise for the last three years.

I have a hold rating on the iShares Mortgage Real Estate Capped ETF (BATS:REM) for its high yield and strong liquidity. But there are also significant risks today, including concentration and seasonality.

30-Year Fixed Rate Mortgage: 20-Year High Borrowing Cost

Mortgage News Daily

According to the issuer, REM seeks to track the investment results of an index composed of U.S. real estate investment trusts (REITs) that hold mortgages. It offers investors exposure to the U.S. residential and commercial mortgage real estate sectors as it targets a subset of domestic real estate stocks and REITs, which invest in real estate directly and trade like stocks.

REM is not a large fund with total assets under management of just $624 million, but it sports a trailing 12-month dividend yield of 10.4% now that mortgage rates have been on the rise. Liquidity is also strong with the fund – its 3-month average volume is more than 400,000 shares while its 30-day median bid/ask spread is only four basis points. The 32-holding portfolio has a moderate expense ratio of 0.48% as of August 24, 2023.

REM: Rising Dividend Yield Care of Surging Mortgage Rates, Lower REIT Prices

Seeking Alpha

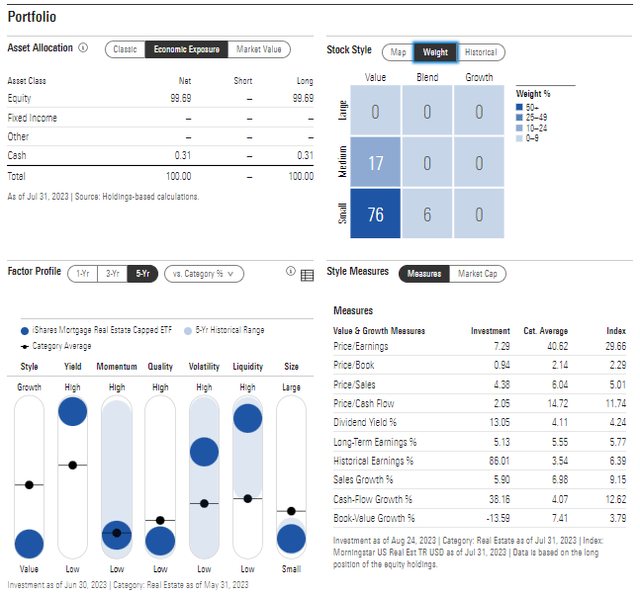

Digging into the portfolio, data from Morningstar show that REM is very much in the small-cap value lower-left box of the Style Box. Key risks with small and cyclical stocks exposed to the real estate market include adverse interest rate movements and weaker consumer confidence and strength. A key difference between now and the mid-2000s, though, is that homeowners generally have a considerable amount of equity in their residences collectively. Still, new home buyers could feel stress should broader economic conditions deteriorate, leading to foreclosures quarters and years down the road.

Its 3-year standard deviation is high at 29.5%, per iShares, while its 3-year equity beta is also lofty at 1.4, implying that it moves much more than the S&P 500 on a daily basis. The portfolio appears cheap on valuation after two years of steep declines.

REM: Portfolio & Factor Profiles

Morningstar

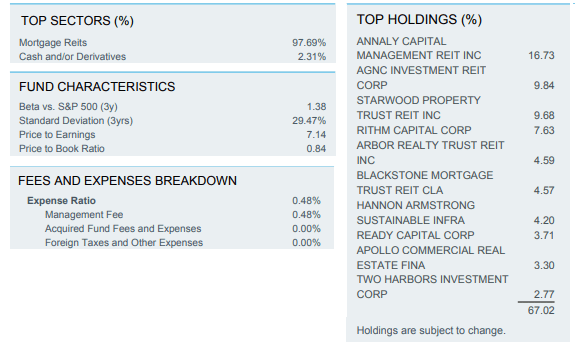

Another major risk is REM’s concentration. Just the biggest four positions comprise more than 40% of the portfolio, so monitoring trends with those companies (listed below) is important if you keep REM as an overweight.

REM: A Concentrated Play, High Relative Volatility

iShares

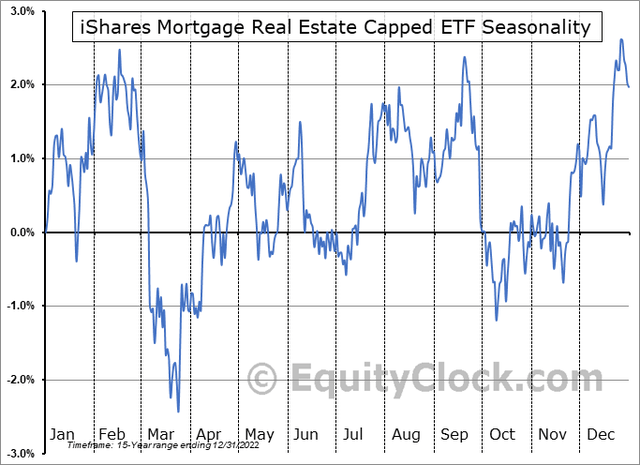

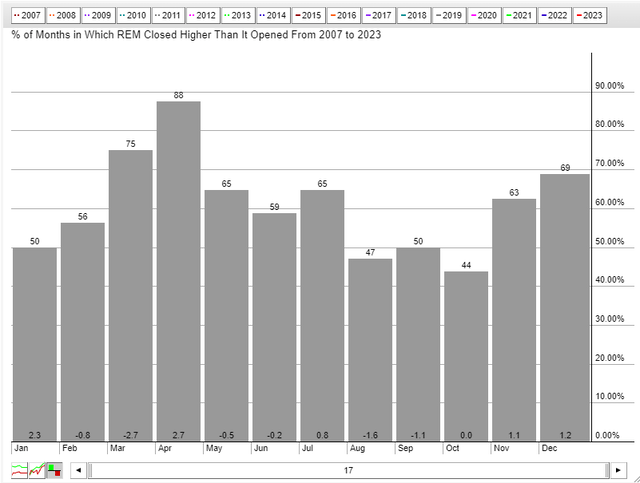

Seasonally, REM tends to make a second-half low in early October when averaging its 15-year performance history, according to data from Equity Clock. Overall, the fund has not performed very well over the years. Digging deeper, though, the fund tends to rally in November and December, with positive returns in 63% of all Novembers and 69% in all Decembers, returning more than 1% in each of those months, on average, per StockCharts.com seasonal data.

Risky Seasonality Through Mid-October

Equity Clock

November-December Often More Bullish

StockCharts.com

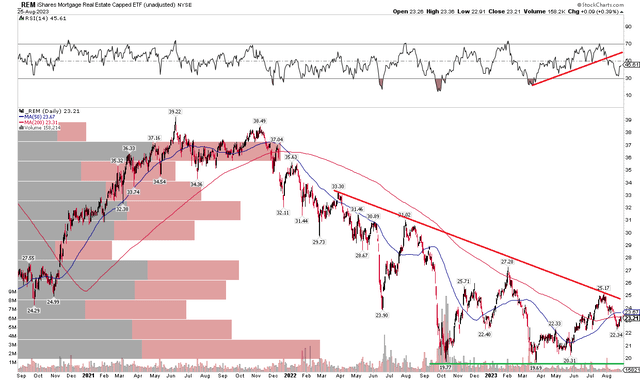

The Technical Take

Since I initially covered REM, the fund has underperformed the broad market, but it is also up better than 8% since mid-October last year, so it has not all been bad. Notice in the chart below that the fund is now holding key support in the $19 to $20 zone.

Moreover, REM’s long-term 200-day moving average has flattened out, with the share price straddling above and below that line. Still, I see a downtrend resistance line that comes into play just below $25 – so REM rising above that mark would be helpful to the bulls. The RSI momentum index at the top of the chart, however, has broken an uptrend line that began this past March, so the fund could be susceptible to a bit of downside as we head into a bearish stretch on the calendar.

Overall, long with a stop under $19 appears to be a prudent play.

REM: Bearish RSI Trend Break, Shares Holding Key 2023 Support

StockCharts.com

The Bottom Line

I have a hold rating on REM. Its high yield and improving chart are appealing, but a downtrend remains in play, and this is a highly risky part of the equity universe currently. Longer-term, its growing yield is much more appealing today versus a year or two ago.

Read the full article here