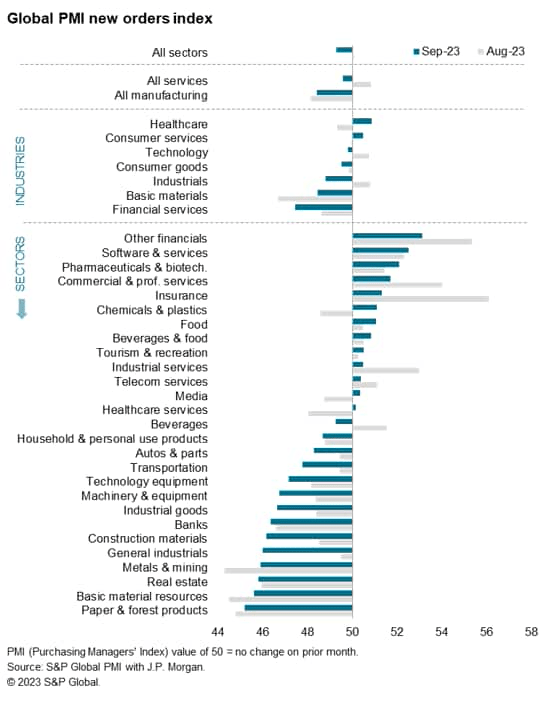

The Global PMI data – compiled by S&P Global across over 40 economies and sponsored by JPMorgan – showed a deepening downturn in demand for financial services in September, amid a further faltering of the post-COVID travel surge that had helped drive robust economic growth in the second quarter. The growing signs of weakness in interest-rate sensitive sectors has accompanied a spreading manufacturing malaise. The resulting renewed overall downturn in global demand in September bodes ill for economic growth momentum in the fourth quarter.

Global demand contracts

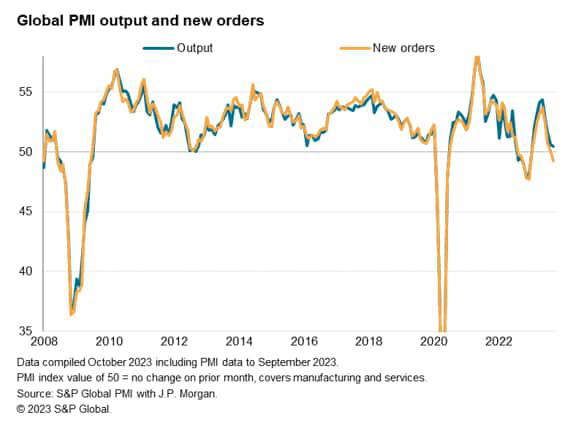

Global PMI survey data, based on data from S&P Global’s 40 national business surveys, showed the overall rate of output growth running close to stalled for a second successive month in September. The weak expansion represents a contrast to the relatively buoyant growth recorded by the survey earlier in the year, which had led to a strong second quarter global GDP expansion.

More worrying still are the September PMI data on new orders, which signalled the first fall in demand for goods and services since January.

These subdued recent readings therefore point to a slowing global economy, and raise risk in particular about growth momentum going into the fourth quarter.

Demand malaise spreads further from manufacturing

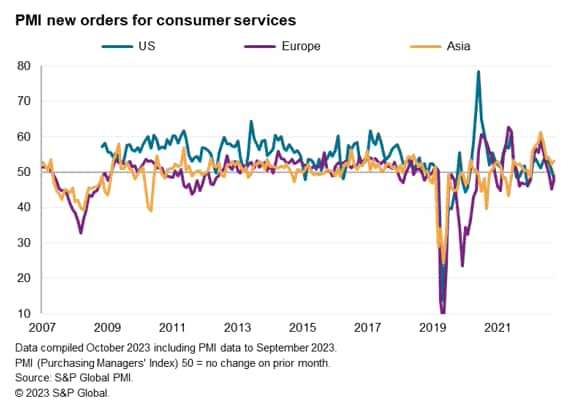

The key areas of economic weakness were evident in Europe and, to a lesser extent, the US – both of which are regions of the world that have seen interest rates rise sharply in response to cost-of-living crises. The resulting impact of rate rises has become especially notable in two main areas of economic activity, compounding a broader manufacturing malaise that has infected other parts of the economy.

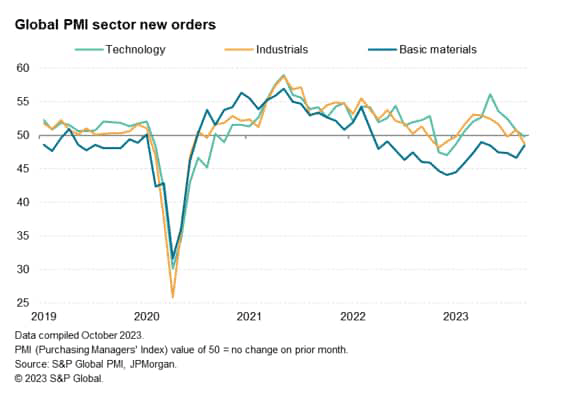

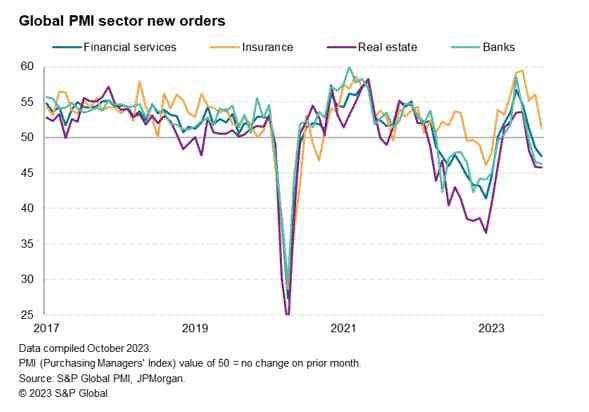

Looking at the major industries covered by the global PMI surveys, the steepest downturn in September was recorded in financial services, followed by basic material manufacturing. The latter has seen demand slump continually since early 2022 thanks to a post-pandemic switch in spending from goods to services, a broad-based winding-down of excess inventories accumulated during the supply fears of the pandemic, and recent disappointing factory activity, notable in mainland China.

More recently, this downturn in basic material demand has spread to technology and other industrials, the latter notably including providers of services to manufacturers.

Falling orders for financial services

In the financial services sector, companies are reporting reduced new business inflows thanks in part to tightening financial conditions. Although rising yields amid higher interest rates helped drive renewed demand for various financial products earlier in the year, buoyed by hopes that rates would soon peak, the overriding message from respondents in recent months is that higher borrowing costs are having an increasingly detrimental impact on demand. Most notable is the effect on real estate activities, which are now suffering one of the steepest declines seen among the 26 detailed sectors covered by the global PMI. However, this is not just a property market downturn, as banking sector demand is also falling at a marked pace and growth in insurance orders has cooled sharply.

Fading post-pandemic travel tailwind

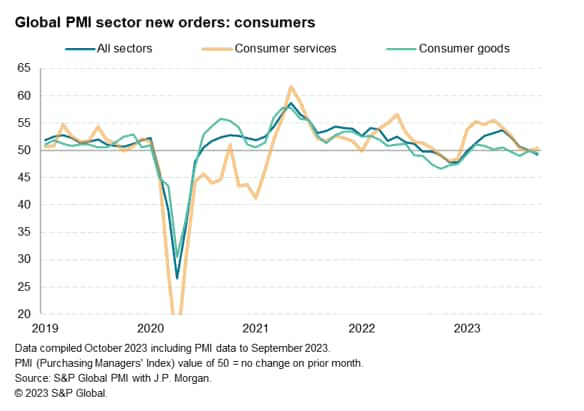

Another key development has been a marked fading of the rebound in demand for consumer services such as travel and recreation, which had boosted global economic growth in the second quarter.

The second quarter of 2023 saw the strongest period of consistent growth in new orders for consumer services recorded to date by the global PMI, barring only prior periods of loosened COVID-19 containment measures. Comparisons indicate that this upturn in spending on services diverted spend from goods, new orders for which have been broadly unchanged during this spending spree.

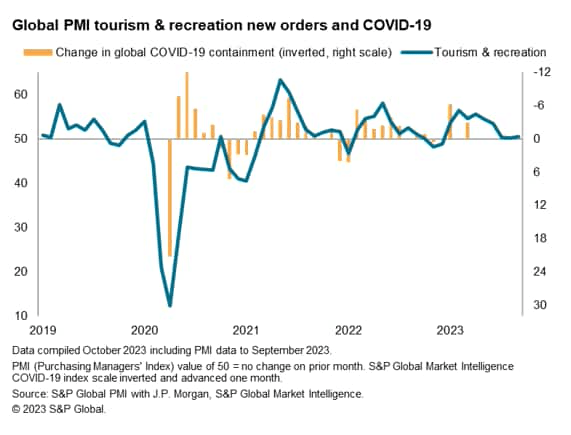

Charting the PMI data on demand for tourism and recreation activity clearly highlights the pandemic impact, with periods of loosened COVID-19 containment measures temporarily driving higher activity. In early 2023, the removal of containment measures in mainland China had led to a renewed wave in global activity.

However, this pandemic impact is now fading, and the September PMI data show new orders for consumer services having been largely unchanged for a third successive month, hinting at a markedly different picture of consumer demand compared to the second quarter.

Companies report that demand for consumer services has waned in part due to the increased impact on budgets from rising interest rates and the higher cost of living. Tellingly, a downturn in new orders for consumer services is especially pronounced in Europe, where orders have now fallen for three successive months, and in the US, where September saw the first decline in orders for consumer services since last December. In contrast, demand for consumer services remains relatively resilient in Asia, where the cost-of-living impact has been less marked and monetary policy has not needed to be as restrictive.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here