Investment Thesis

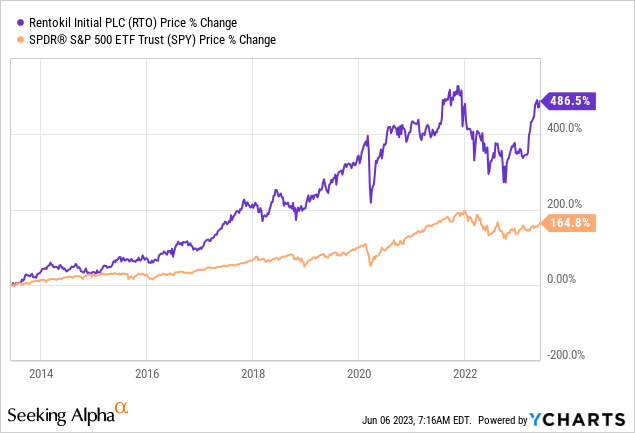

Rentokil Initial (NYSE:RTO) is another lesser-known compounder that performed extremely well in the past decade, with shares up over 480% during the period. The company operates in the highly attractive pest control industry which is large, expanding, and resilient. Its fragmented nature also presents further growth opportunities through acquisitions.

While the company is trading near its all-time high, its valuation remains attractive, with multiples significantly below major competitors. I believe the current price is more than justified for such a high-quality company with consistent growth. Therefore I rate RTO stock as a buy.

An Attractive Industry

Rentokil Initial is a London-based company that provides pest control and hygiene & well-being services. The company is one of the leaders in the industry operating in over 97 cities across the globe. I will focus mostly on pest control in this article as the segment accounts for 71% of total revenue while hygiene & well-being account for only 23%.

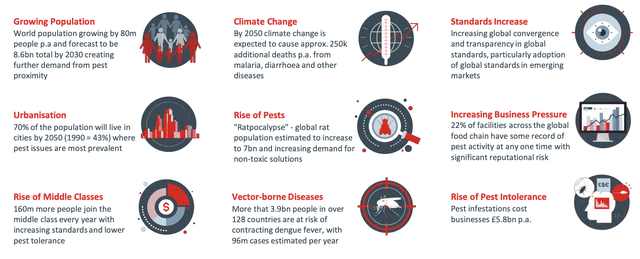

Pest control is one of the most attractive industries in my opinion. While the operations are mundane, it is a large and steadily expanding industry. According to Allied Market Research, the global market size of pest control is forecasted to grow from $22.6 billion in 2022 to $39 billion in 2032, representing a solid CAGR (compounded annual growth rate) of 5.7%.

There are multiple catalysts driving the market expansion. Urbanization and the increase in population is a major catalyst that continues to fuel demand, especially in emerging cities and countries. Climate change has also increased the proliferation of pests, as the rise in temperature favors their reproduction and survival rate. This and the growing awareness of health and hygiene amid the recent pandemic have also boosted the need for pest control services.

Rentokil Initial

The pest control market is extremely fragmented with many small and local players in the mix. According to the Rentokil Initial, there are 18,000 pest control companies in the US and 30,000 in Asia. This presents huge growth opportunities through market consolidation. The company had been actively acquiring smaller competitors in order to expand its scale. For instance, it acquired 15 companies in the first quarter and 52 in the last year. These ongoing acquisitions should help accelerate its expansion and growth.

The pest control market is also highly resilient due to its non-discretionary nature. Most customers will not reduce their spending even during downturns as they do not want to risk the potential proliferation of pests, which severely affects their health and hygiene. Given the industry’s resiliency, Rentokil Initial should be well-positioned to handle the potential economic slowdown moving forward.

Terminix Acquisition

In order to accelerate its expansion in the pest control market, Rentokil Initial acquired Terminix for a hefty $6.7 billion last year. Terminix is one of the world’s largest pest control companies with 2.9 million customers and has a strong presence in North America’s residential market.

After the combination, the company will become much more centered around pest control, with 75% of revenue coming from the segment, up from 62% previously. The business mix will also improve as 35% of revenue now comes from residential customers, up from just 12% previously.

The combination should be highly synergetic as it helps the company further expand its presence in key regions such as North America, which accounts for 50% of the total pest control market. It will also substantially increase the company’s service network and route density, which improves operational efficiency and coverage. The bottom line should also benefit from cost-cutting initiatives, especially around administrative and property-related costs.

Rentokil Initial

Discounted Valuation

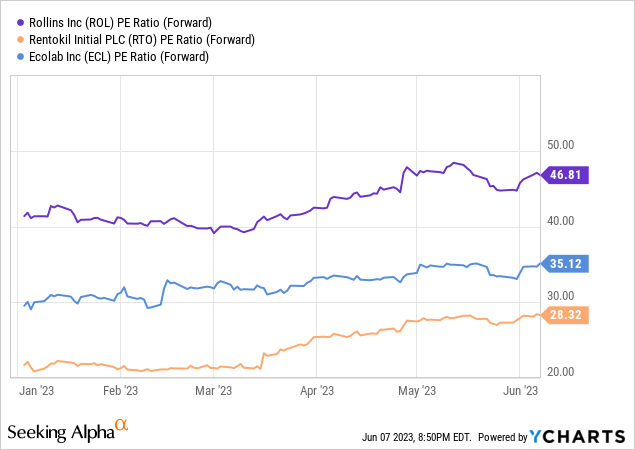

Despite the recent increase in share price, the valuation of Rentokil Initial still looks compelling in my opinion. The company is currently trading at a fwd. P/E ratio of 28.1x, which is discounted within the pest-control industry. As shown in the chart below, its largest competitors Rollins (ROL) and Ecolab (ECL) have an average fwd. P/E ratio of 41x, which represents a substantial premium of 45.9%. Rollins had been continuously trading at a premium valuation due to its heavy exposure to the attractive pest control industry. After the Terminix deal, Rentokil Initial is also now much more exposed to the industry and its valuation should catch up moving forward, which should offer meaningful upside potential.

Risks

Due to the market’s fragmented nature, competition is also pretty strong, especially from smaller companies. While Rentokil Initial has meaningful market shares, smaller players often lower their prices to compete, which put potential pressure on the company’s pricing. Another risk lies within the combination with Terminix. Unlike most bolt-on acquisitions, the size of this deal is quite large in size, which makes the integration of the business much more complex and harder. The management team will have to execute flawlessly moving forward in order to achieve their expected synergies.

Investor Takeaway

I believe Rentokil Initial will continue to perform well in the long run. The company should see durable revenue growth as it continues to benefit from organic market expansion and ongoing market consolidation. The acquisition of Terminix also vastly expand the company’s scale and increase its exposure to the pest control market. As the company becomes more of a pure pest control play, its valuation gap with peers should also contract, which presents meaningful upside potential. The current price seems compelling considering its prospects and valuation, and I rate the company as a buy.

Read the full article here