Building a passive income snowball is a great way to save for retirement because:

- It enables you to measure your financial readiness for retirement by how your passive income stream measures up against your estimated retirement living expenses instead of having to guess how long your principal will last.

- It steers you away from more speculative companies and towards highly profitable businesses instead.

- It enables you to sleep well at night during market volatility given that your source of wealth is measured in dividend checks rather than selling shares at whatever price the market is currently offering you.

While there are several ETFs – such as the Schwab U.S. Dividend Equity ETF (SCHD) – and even individual stocks – such as Enterprise Products Partners (EPD) and Realty Income (O) – that can serve as effective core holdings of a retiree’s passive income portfolio, one high yielding ETF that appears to be quite popular with retirees that we believe they should steer clear of is the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI).

In this article, we will examine why this ETF is so appealing to many retirees and then share three reasons why they should steer clear of it.

Why JEPI ETF Is So Appealing To Retirees

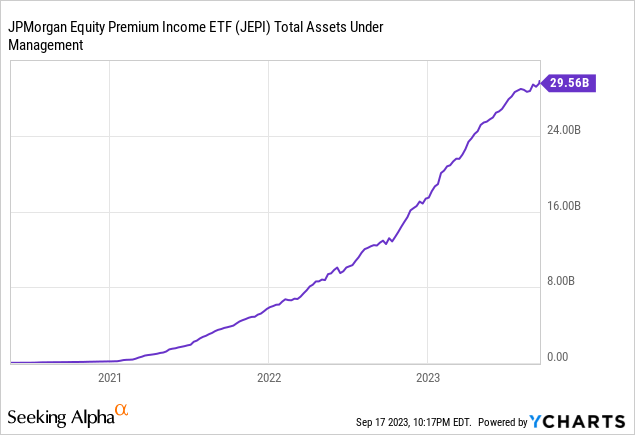

JEPI is clearly a popular ETF as evidenced by its rapid growth in assets under management since launching just a short time ago:

This rapid growth in AUM is even more noteworthy when considering that JEPI pays out such a high yield, thereby retaining much less cash than the vast majority of other ETFs.

The three most likely reasons why JEPI has so much appeal to income investors are:

- Its massive yield currently sits at 9.7% on a trailing twelve-month basis. This means that JEPI provides significant cash flow to investors and accelerates their ability to cover their living expenses with passive income

- Its monthly payout policy means that investors get the aforementioned hefty cash flow stream hitting their accounts on a more regular basis than what is offered by most ETFs. This more regular dopamine hit can serve as a boost to investor psychology during bear markets and also can make matching passive income to living expenses a more streamlined process.

- Its broad diversification (with 137 holdings and only 15.41% of its portfolio allocated to its top 10 holdings) that includes substantial (17.51%) exposure to technology is attractive given that technology stocks rarely offer attractive dividends. As a result, JEPI provides investors the opportunity to benefit from the high growth potential of technology businesses – including large holdings in Amazon (AMZN) and Microsoft (MSFT) which are its first and third largest holdings right now – while still enjoying a hefty income yield.

Reason #1 To Avoid JEPI: Its Expense Ratio Is Rather High

One reason why JEPI is not a great choice for retirees is that its 0.35% expense ratio is rather high compared to many other passive income funds. For example, SCHD’s expense ratio is only 0.06%. While over a single year, 0.29% does not seem like very much, throughout a long period that amount can add up.

For example, a $500,000 retirement nest egg invested in each of these stocks – assuming an equal pre-fee total return of 10% for each of them – will turn into $5,343,961.49 for SCHD after 25 years and $5,002,486.26 for JEPI after 25 years. That equates to a whopping $341,475.23 difference (68.3% of the original principal) throughout a 25-year retirement from just fees alone!

As legendary investor Warren Buffett once said:

Performance comes, performance goes. Fees never falter.

Reason #2 To Avoid JEPI: Its Yield Is Unpredictable

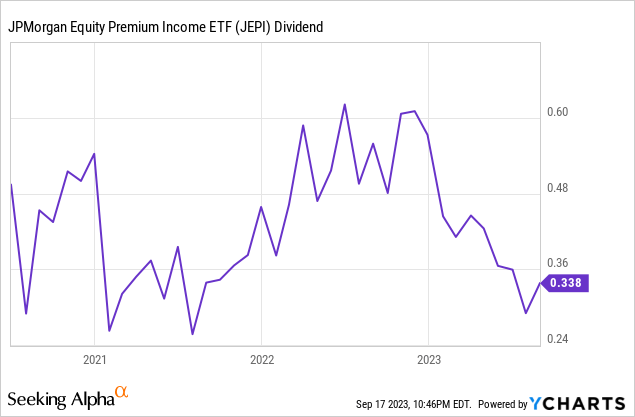

Another reason why JEPI is less than ideal for retirees is that – while many funds like SCHD have fantastic long-term dividend growth track records – JEPI’s payouts are quite volatile month-to-month and it generates little to no dividend growth to speak of over time:

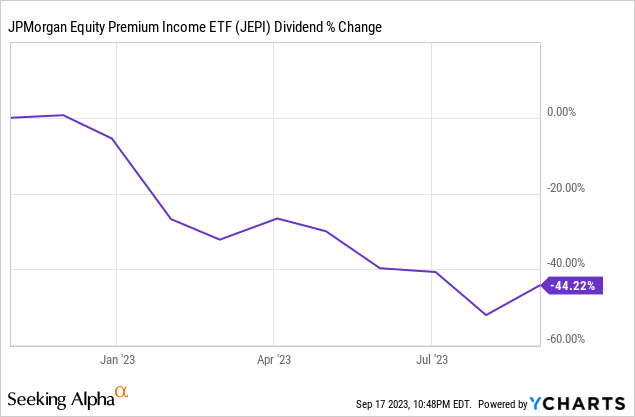

This is because JEPI generates the vast majority of its cash flow from the options premiums that it gets from its proprietary covered call strategy instead of from dividend growth in its underlying holdings. What this means is that JEPI’s yield is not quite as attractive as it appears on the surface since it can potentially gyrate significantly over a short period. For example, JEPI’s monthly payout has declined by nearly 50% from its level last October and November:

As a result, when retirees budget their living expenses relative to their expected passive income from JEPI, they need to account for very wide variances in cash flow from month to month.

Reason #3 To Avoid JEPI: Its Total Return Performance Is Unimpressive

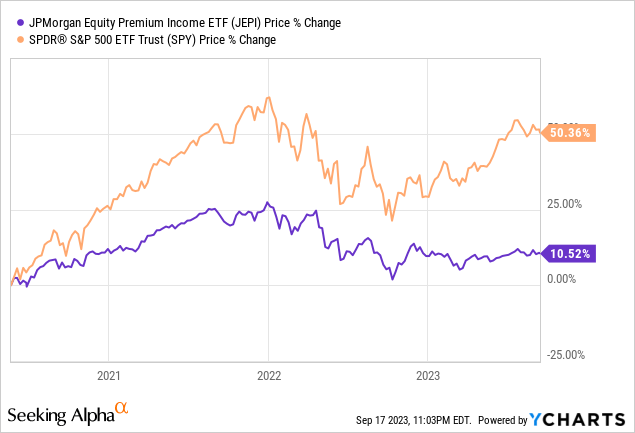

Last, but not least, JEPI’s total return performance thus far has been unimpressive. While the idea of generating a ~10% passive income yield from an equity ETF that also includes a large allocation to tech stocks may sound like a dream come true investment opportunity, this surface-level impression turns out to be quite misleading.

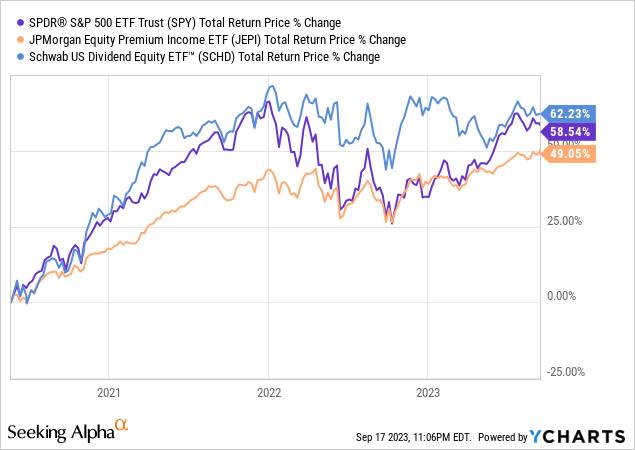

The reality of the situation is that JEPI’s yield is artificially inflated by the options premiums that it generates from its covered call strategy and the trade-off is that it forfeits considerable upside potential. As a result, it is not nearly the attractive growth machine that its considerable underlying tech stock allocation implies. Instead, investors can expect that the vast majority – if not all – of its total return over the long term will come from its monthly distributions. The fund’s history thus far has proven this to be the case, with JEPI only delivering 10.5% in capital appreciation since going live in 2020, roughly one-fifth of the appreciation enjoyed by the S&P 500 (SPY) over that span.

Moreover, if/when the markets pull back to a more normalized long-term performance trajectory, JEPI’s stock price may end up in the red relative to its launch price.

Additionally, despite its hefty monthly payout, JEPI’s total return performance has meaningfully lagged SPY’s and SCHD’s since it launched:

Investor Takeaway

JEPI’s fat yield, monthly payout, and considerable tech exposure all have served to seduce many investors, thereby resulting in its assets under management ballooning to an impressive ~$30 billion in a relatively short period.

However, when looking under the hood, the appeal of the fund largely vanishes as its expense ratio, unpredictable monthly payouts, and weak total return performance make it a less-than-ideal long-term holding for any investor, including a retiree.

Read the full article here