Executive Summary

In June 2019, I wrote an article about Greenlight Re and reanalyzed the company’s performance in June 2021. In 2022, I decided to review the company’s fundamentals.

Over the last three years, I considered Greenlight Capital Re (NASDAQ:GLRE) was a reinsurer with a meager operating margin wholly dependent on investment income to offset recurring underwriting losses.

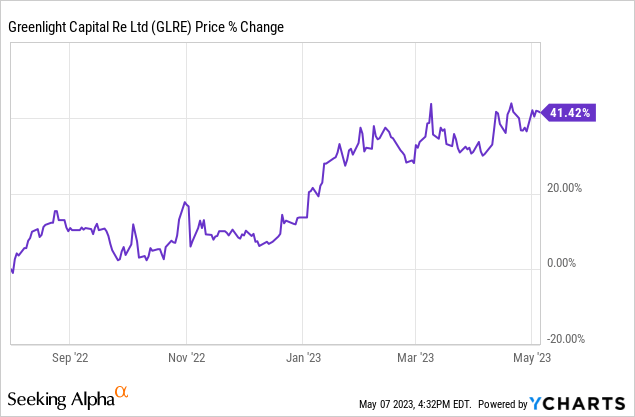

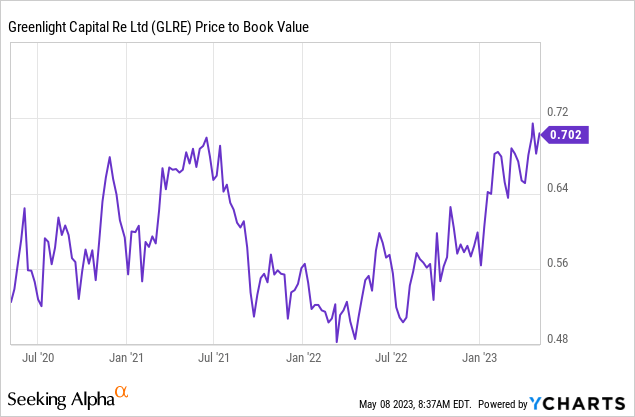

Nonetheless, Mr. Market decided the lean period was over for the Bermuda-based reinsurer. From August 2022 to now, the company’s market value grew by 41% to $358 million for a shareholders’ equity of circa $500 million.

I’d like to know if my opinion about David Einhorn’s investment vehicle has fluctuated.

A Still Meager Operating Performance But Some Upcoming Changes

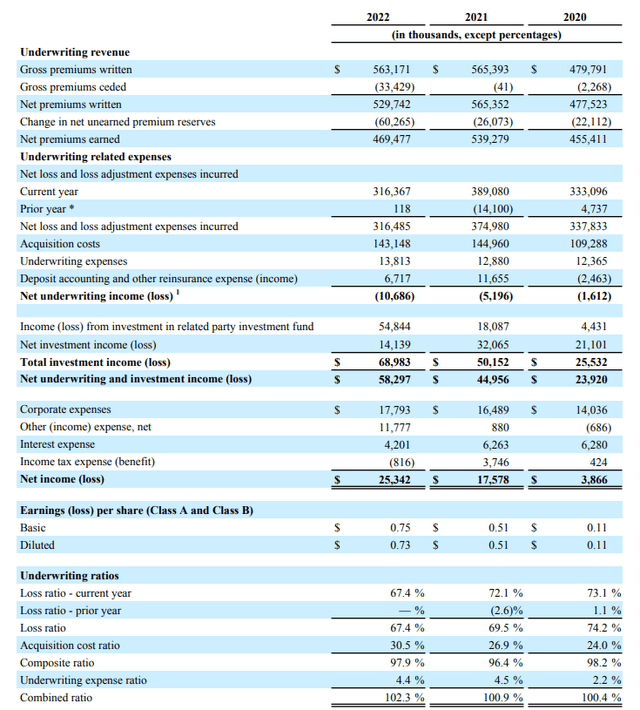

Greenlight Re is a Bermuda-based reinsurer present in non-life reinsurance markets. In 2020, 2021, and 2022, the reported combined ratio was 100.4%, 100.9%, and 102.3%, respectively. The underwriting losses doubled in 2022 to $10.6 million from $5.2 million in 2021.

Greenlight Re – Latest 10K

Nonetheless, the loss ratio declined sharply from 72.1% in 2021 to 67.4%, while the reinsurance portfolio was affected adversely by the Russian-Ukrainian conflict ($13.8mn) and higher catastrophe losses in the U.S. and abroad ($25.7mn).

The improvement in the loss ratio was driven by the company’s decision to terminate its participation in some reinsurance programs, like particular motor and workers’ compensation businesses.

Furthermore, the company entered into new retrocession agreements to reduce its exposure to marine, energy, health, and property losses.

Terminating some reinsurance programs and the new retrocession schemes prove that GLRE intends to de-risk the portfolio.

Unfortunately, the new initiatives did not yet bear fruit, as the underwriting margins were still negative. The increase in the combined ratio was driven primarily by the acquisition cost ratio, which jumped by 3.6 points to 30.5%. This deterioration was the favorable loss development related to the mortgage portfolio, which incorporates profit commissions back to the seating insurers.

A Bright Future In 2023?

During the fourth-quarter conference call, Simon Burton, Greenlight Re’s CEO, mentioned the reinsurance industry was experiencing a significant capital void. Reinsurance placements closed at 25% to 50%, depending on the risk classes. He also added that he was pleased with the quality of the business written by Greenlight for 2023.

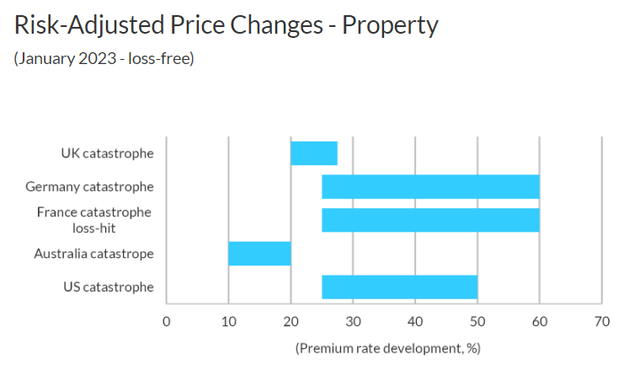

Undoubtedly, substantial price increases have impacted the global reinsurance market for the 2022/2023 renewals. According to a report by Fitch, reinsurers’ underwriting margins are likely to expand by 4pp on average in 2023 due to significant price rises, tighter terms and conditions, and the withdrawal of cover related to the war in Ukraine.

Most property reinsurance markets saw price increases of 20%-60% following sizeable natural catastrophe losses in 2021 and 2022. Losses from Hurricane Ian in Florida contributed to the doubling of some prices in the U.S.

Fitch Ratings

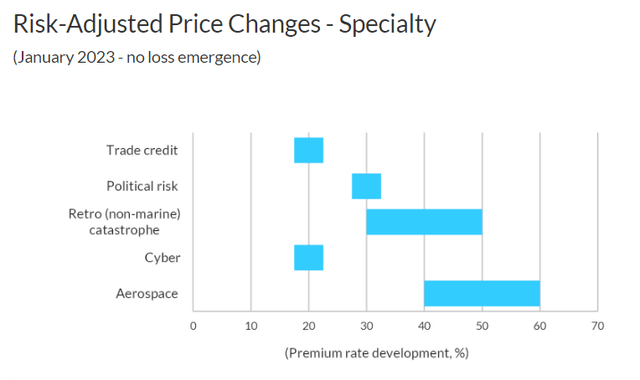

Among specialty lines, political risk and aerospace saw significant price increases driven by losses from the war.

Fitch Ratings

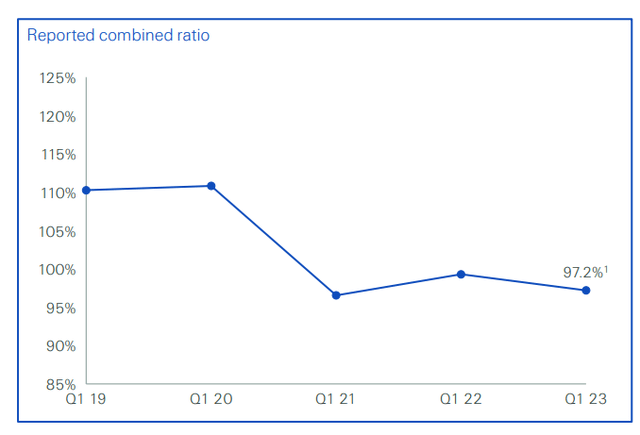

Some of the reinsurers have already published their first-quarter results. Swiss Re (OTCPK:SSREF) recorded a combined ratio of 97.2% from 99.3% one year ago in the same period.

Q1 2023 Presentation – Swiss Re

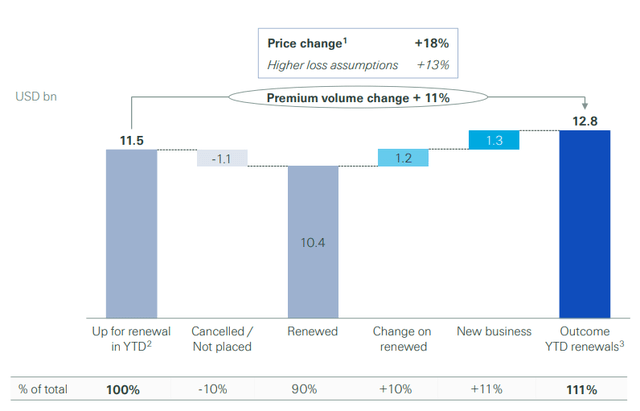

The combined ratio improvement was primarily driven by an 18% price increase on renewed policies (60% of the total treaties). However, the reinsurance portfolio was adversely affected by inflation and loss increases representing a 13% adverse effect. The 5% net price increase might be translated into circa three percentage points benefit to the combined ratio (underwriting year).

Q1 2023 Presentation – Swiss Re

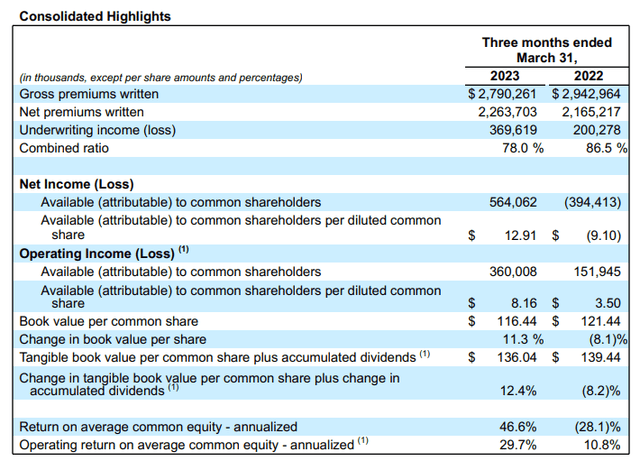

Another reinsurer, RenaissanceRe (RNR), delivered first-quarter solid results, with an overall combined ratio of 78% or an 8.5 point drop compared to last year in the same period.

RenaissanceRe – Q1 2023 Press Release

Even though Greenlight Re might not record this level of underwriting margins, investors could expect the company to be favorably impacted by the price increase trend observed in the reinsurance market. Underwriting operations might deliver profits in 2023 if the catastrophe costs remain contained.

The Investment Portfolio Performance

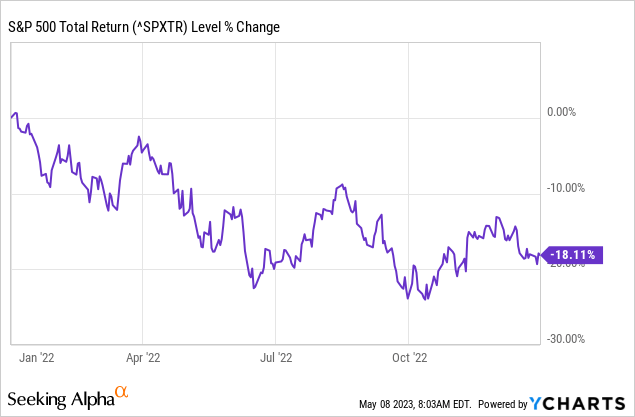

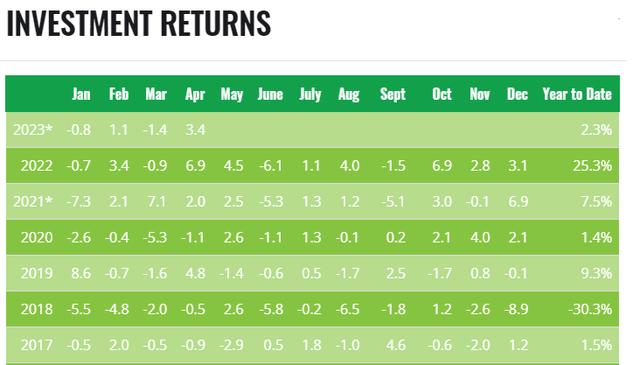

My last article showed that GLRE’s investment portfolio underperformed S&P 500’s return. In 2022, the Bermuda-based insurer’s investment portfolio returned at 25.3%, vs. an adverse performance of 18.11%.

In other words, David Einhorn-managed portfolio outperformed the S&P 500 massively during 2022, thanks to its short-oriented strategic allocation.

Nonetheless, over a more extended period (e.g., from 2017 to 2022), S&P500’s total return performance was 91.3%, while GLRE’s investment portfolio returned a performance of circa 5.6%, as the portfolio took a -30% hit in 2018, penalizing the overall performance of the portfolio.

Investor Relation Website – Greenlight Re

Consequently, GLRE would have delivered better results by investing in a plain-vanilla S&P 500 ETF.

2023: Year Of The change?

Greenlight Re will publish its first-quarter results in a few days. The investment income would be lower than one year ago in the same period, as the total return for Q1 2023 should be -1.11%, vs. a 1.65% total return in Q1 2022.

Nonetheless, the underwriting operations might deliver profits. Under a 97% combined ratio scenario, the underwriting activities would record a pre-tax underwriting income of $3.75 million vs. a pre-tax underwriting loss of $7.7mn in Q1 2022.

Therefore, investors might be pleased by the improvement of the underwriting operations, although they should keep in mind that the investment portfolio would have performed poorly during the first quarter.

Consequently, the company’s market capitalization might go upward, reducing the discount on the book value. As of December 2022, the fully diluted book value per share amounts to $14.59, vs. a current stock price of $10.14, or a price-to-book of circa 0.70.

A valuation based on a 0.8-0.9 price-to-book might result in a stock price change to $11.6 – $13.1, i.e., a potential upside of 15% to 30%.

However, this upside will only materialize if the underwriting operations deliver improved margins. Thus, the book value discount reduction is interlinked with the operating performance of the reinsurer, which remains an over-the-cycle poor performer. Again, I will pass and not invest in GLRE stock, although I wish all Greenlight’s shareholders to be rewarded for their loyalty after many struggling years.

Read the full article here