Investment Thesis

Rocket Companies, Inc. (NYSE:RKT) is a financial technology company with tech-driven businesses in real estate, mortgages, and financial services. Since covid 19 started, the mortgage and banking industries have been hurt, which has led to a drop in mortgage demand. The recent decline in demand for this financial product is due to the fact that the economy has become more inflationary, which has caused interest rates to skyrocket.

The economic adversities explain the 1.50% share decline on this company’s shares over the last year. However, despite the adversities, the company has proven resilient by reporting solid MRQ financial results after a series of poor financial performance. I attribute improving financials to the company’s new initiatives, such as the rocket rewards.

I am bullish on RKT stock in the long run because I believe the current headwinds, such as inflation and low demand, are temporary and will eventually subside. The company is currently implementing the reward strategy, and the results prove that it’s helping the company grow financially and its client base.

Financials: Is MRQ The Turning Point?

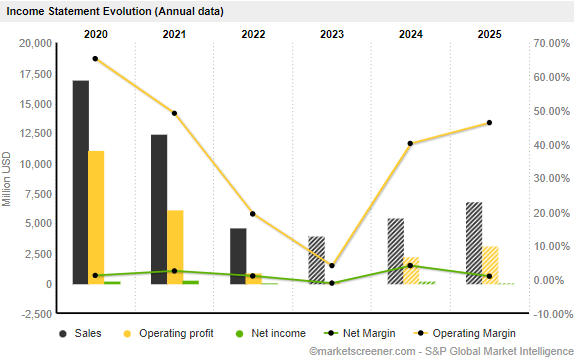

Since 2020, RKT’s financials have been on a downward trajectory, with its sales, operating profit, and net income declining from $16938M, $11058M, and $198M, respectively, in 2020 to $4628M, $896 and 46M respectively in 2022. This significant decline in financials can be attributed to economic adversities such as growing mortgage rates, resulting in low demand for houses and, consequently, low demand for mortgages.

Market Screener

After what I would call a financially difficult three years, RKT developed turnaround strategies—which I’ll talk about in the next section—and the MRQ’s financial outcomes improved. In the first quarter of 2023, adjusted sales came in at $882 million, more than the high end of what they projected. Both the adjusted EBITDA loss of $79 million and the adjusted loss per diluted share of $0.06 were better than the previous quarter. In terms of profitability, operating losses in Q1 were significantly lower than in the fourth quarter of 2022. Adjusted revenue grew by nearly $200 million quarter-over-quarter, while total costs grew by less than half that amount. As a result, Q1’s adjusted EBITDA loss of $79 million was much better than Q4’s loss of $204 million.

From these results, it is clear that the company’s financial situation has begun to improve, and I believe this marks a turning point for its financial situation. The optimistic projections of future revenues and expenses through 2025 shown in the preceding graph lend credence to this assertion.

The Turnaround Strategies

As a way of addressing a turbulent economic situation, the company came up with several interventions geared towards turning things around across different spheres of the company. To begin with, in April, Rocket Homes and Rocket Mortgage announced a new partnership called BUY+ and SELL+, which combines the two companies’ respective house search platforms and real estate agent referral networks. If a buyer uses a Rocket Homes partner realtor and gets financing via Rocket Mortgage, they can save hundreds of dollars on closing fees using the BUY+ program.

With SELL+, sellers who advertise their homes for sale with a Rocket Holmes-verified partner agent will receive a check from Rocket Homes for 1% of the sale price after the closing. A homeowner purchasing and selling can increase their savings using BUY+ and SELL+.

In addition, they have recently introduced the Rocket Visa Signature Credit Card, the first credit card that makes purchasing a home more accessible and homeownership simpler through everyday expenditure. Rocket Signature Cardholders receive 5% cash back on all purchases, which can be hundreds of dollars and helps with one of the biggest barriers to house ownership (affordability). The Rocket Signature Card targets potential homeowners at an earlier stage in the buying process, making it especially useful for reaching first-time buyers.

In addition to Rocket Money, their credit card gives them access to customers far early in the process and at much lower client acquisition expenses than conventional mortgage techniques. Even better, you may combine the points you earn with the Rocket Signature Card and its Rocket Rewards loyalty program.

On evaluating these initiatives, I find them very sound and effective in winning a considerable market share. To show how effective they have been, Rocket Accounts reached 27.6 million as of March 31, an increase of more than 2 million from the previous quarter. Moreover, the improving financials seen in the MRQ and future projections provide empirical evidence that these turnaround strategies are working. I anticipate this trend to continue over the long term as these initiatives serve as the company’s competitive advantage.

Falling Mortgage Demand: Short-term Headwind

Last week, a crucial indicator of home purchase applications decreased once more as consumer demand cooled in the face of rising mortgage rates. The MBA measure of mortgage applications fell by 1.4%. The MBA survey also shows that demand for refinancing fell by 1% last week. There has been a 42% decrease in refinancing applications compared to the previous year.

Home prices have been falling for months due to lower demand caused by increasing mortgage rates. The housing market has shown some signs of life as interest rates have gradually declined from their recent high of 7%. Nevertheless, the transition back to lower mortgage rates has not been easy.

Mortgage News Daily reports that rates have risen dramatically over the past month, with the typical rate on the popular 30-year mortgage currently sitting at about 6.89%, close to its highest level in two months. Nevertheless, These rates are considerably higher than just a year ago, when they were roughly 5%.

Although these numbers are cause for concern, I am optimistic that the current headwinds will pass and that mortgage demand will once again surge. This makes the near-term picture less than ideal, but I believe the company’s turnaround efforts will help to mitigate the negative impact.

Conclusion

The improved financials and rocket accounts show that RKT’s turnaround strategy works after a difficult period defined by falling financials. I think these initiatives will serve as growth drivers in the long run, which is good news for investors. Nonetheless, the dropping demand for mortgages shows that the short-term outlook of this industry is grim despite these positive efforts. Since these headwinds are short-lived, I wouldn’t recommend investing here until they subside, as doing so would be fraught with risk.

Read the full article here