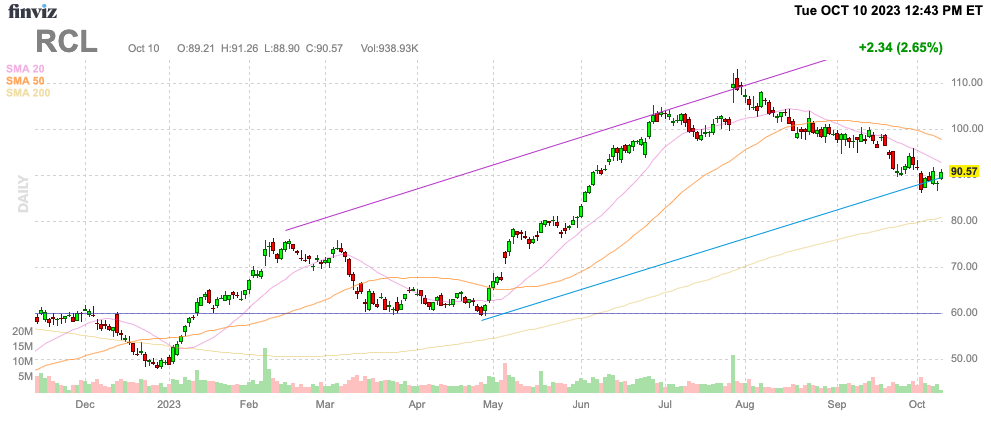

Whenever conflict occurs in the world, travel stocks like Royal Caribbean Cruises Ltd. (NYSE:RCL) dip. The cruise line stock has now fallen over $20 from the highs, while the prospects for cruise travel hasn’t changed one bit. My investment thesis remains ultra Bullish on the cruise line stock, though the industry is headed into the off season as the calendar heads towards winter.

Source: Finviz

2025 Trifecta

While a war between Israel and Palestine might cause some minimal impact to global travel, Royal Caribbean isn’t likely to be greatly impacted on meeting 2025 goals. Carnival Corporation (CCL) had recently reported financial impacts from higher fuel costs and oil prices and initially surged over 4% on the conflict. Again, though, these short-term blips in higher fuel costs aren’t how investors should value the cruise line stock.

Royal Caribbean had outlined 2025 financial targets, and investors should value the stock based on the likelihood of the company still hitting those targets based on this conflict. The trifecta targets aren’t reliant on this conflict being resolved anytime soon.

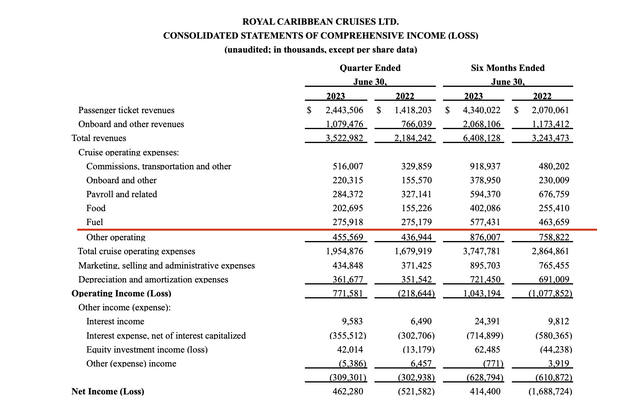

Besides, the cruise line reported a $1.82 EPS in Q2 and forecast a massive Q3 EPS of $3.43. Royal Caribbean is already running at a $7+ EPS rate when factoring in a normalized EPS target of $0.73 for Q1 after reporting a loss in Q1 2023 due to lingering Covid impacts on booking levels and prices during 2022.

The market continues to act like Royal Caribbean hitting these below Trifecta targets are difficult:

- Triple Digit Adjusted EBITDA per APCD, to exceed prior record Adjusted EBITDA per APCD of $87 in 2019.

- Double Digit Adjusted Earnings per Share to exceed the prior record Adjusted Earnings per Share of $9.54 in 2019.

- Return on Invested Capital (“ROIC”) in the teens to exceed the prior record ROIC of 10.5% in 2019 through optimizing capital allocation and enhancing operating income.

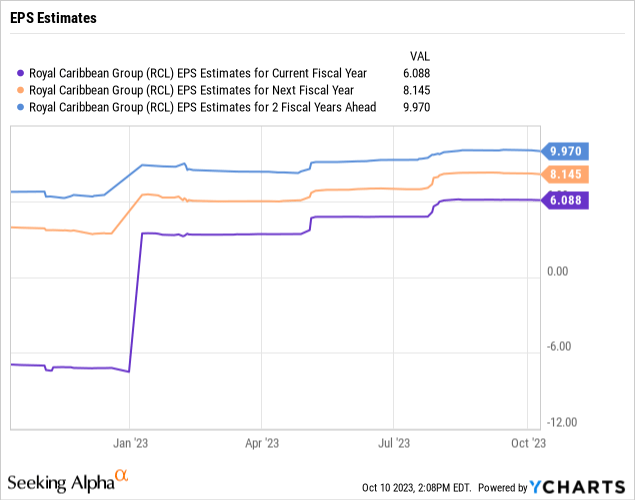

The easiest focus for shareholders is the EPS target. Royal Caribbean has forecast an EPS to hit a record by 2025. The cruise line is forecasting adjusted EBITDA targets of $100+ to far exceed the 2019 levels of $87 per APCD, highlighting how higher debt costs and diluted shares outstanding will restrict EPS, though still at record levels.

The company is already 70% on the way to hitting the 2025 EPS target of $10+. Royal Caribbean will easily boost the EPS above those levels by just repaying debt and reducing interest expenses over the next 2 years, yet analyst estimates are now back below $10.

Fuel Impact Overstated

Carnival highlighted how FY23 numbers would be impacted by higher fuel costs leading to a selloff in the cruise line. In essence, Carnival guided to FY23 adjusted EBITDA numbers in line with expectations with the FQ3 beat offset by some $125 million in higher fuel costs and unfavorable currency impacts since the June guidance.

At the time, WTI oil (CL1:COM) peaked above $90/bbl and had fallen leading up to the conflict in the Gaza Strip. Oil has rebounded to $86/bbl, but prices haven’t surged (at least yet) due to the battle being contained within the Palestine/Israel border region.

Carnival forecasted now using 16% less fuel per ALBD than in 2019. The constant shift to more fuel efficient ships helps reduce the impact from fuel costs.

Royal Caribbean only spent $276 million on fuel during Q2 with revenues up at $3.5 billion. Fuel costs are only 8% of revenues, suggesting the market is overreaching on the impact of higher fuel prices.

Source: Royal Caribbean Q2’23 presentation

Fuel costs definitely drive overall costs in the short term and impact yields, but fuel costs don’t drive the business over the long term. The airlines are far more impacted by fuel than the cruise lines.

Takeaway

The key investor takeaway is that investors should use any weakness in Royal Caribbean Cruises Ltd. stock due to higher fuel costs or the conflict in Gaza as an opportunity to own the stock. The cruise line stock only trades at 9x 2025 EPS targets, making for a cheap stock to own here.

Read the full article here