In my most recent article on the Brazilian water and waste management company, SABESP (NYSE:SBS), operating in the state of São Paulo, I maintained a neutral stance on the state-owned company due to the uncertainties surrounding its potential privatization. I considered Sabesp as an event-driven case.

However, besides Sabesp reporting solid results in the second quarter, the best may still be ahead, with significant pro-privatization developments occurring in recent months. Notably, the long-awaited approval of the general guidelines for the company’s privatization by the State of São Paulo governor has taken place.

While there are still risks and uncertainties surrounding the privatization process, particularly in discussions within the São Paulo state legislature, the chances of Sabesp being privatized in the first half of 2024 have significantly increased with the recent steps and declarations from the São Paulo government.

Considering the potential for an attractive valuation of this state-owned company, I am inclined to shift my stance from neutral to bullish. Sabesp shares may have relative upside potential throughout the second half of this year.

Sabesp’s Q2 results

Sabesp reported solid results for the second quarter. The São Paulo state company disclosed a recurring EBITDA of R$2.2 billion, marking an impressive 44.4% year-over-year increase.

Sabesp’s IR

This outcome can be attributed to the robust performance of operating revenues and the positive impact of the company’s Incentivized Dismissal Program (IDP), which reduced operating costs. These benefits are likely to continue in the future. Assuming a payback period of approximately one year for the expenses associated with the IDP, we can anticipate that this margin will become reasonably recurrent, provided that all other cost lines remain stable.

Operating revenue (excluding construction revenue) reached R$5.2 billion, representing a substantial year-over-year increase of 16.6%. A 9.6% tariff adjustment influenced this growth in May 2023, higher billed volumes (up 2.6% year-over-year, reaching 557 million cubic meters), and a more favorable revenue mix due to an increase in the number of residential customers who pay higher tariffs compared to industrial and commercial customers.

Manageable costs and expenses amounted to R$3.9 billion, reflecting a 21% year-over-year increase. As mentioned, this quarter was impacted by the extraordinary cost associated with the IDP provision, which amounted to R$530 million with an estimated payback period exceeding 12 months.

Finally, the financial result, driven primarily by the appreciation of the Brazilian real against the dollar and the yen, shifted from a negative R$167 million in the second quarter of 2022 to a positive R$205 million in the current quarter. This undoubtedly contributed to the net profit of R$743 million, marking a substantial 76% year-over-year increase.

Important steps toward privatization

At the end of July, Sabesp shares reached their yearly highs as the Governor of São Paulo, Tarcísio de Freitas, unveiled the long-awaited general guidelines for the privatization of the company. Governor Tarcísio de Freitas stated that Sabesp’s privatization project is underway and will be one of the largest ever undertaken in Brazil.

He confirmed that the chosen model for privatization is a follow-on model. Alongside this preferred alternative, three other models were considered for the company’s privatization. The first model resembled that of Eletrobras (EBR), with stricter regulations and a wider dispersion of capital. Partial or complete sale of the company was also considered.

Governor Tarcísio believes the follow-on model is the most adaptable for Sabesp, offering greater capital concentration to attract critical investors. He added, “The aim is to offer a greater concentration of capital to attract reference investors.”

The São Paulo government anticipates that the privatization of Sabesp will receive approval from the State Legislative Assembly (ALESP) in 2023, according to the São Paulo Secretary for the Environment, Infrastructure, and Logistics.

Once the privatization model gains approval, the government will initiate the first phase of the process. Aside from presenting the bill to ALESP, this stage will focus on structuring the model, considering regulatory, accounting, and legal aspects. To achieve this, the government intends to intensify its dialogues with municipalities.

Regarding the model’s structure, Governor Tarcísio de Freitas emphasized defining an excellent regulatory model. This suggests that it will be a mixed-type contract with regulation to ensure investments are secured.

The second stage should become operational next year, likely in the first half of 2024 (1H24), to avoid coinciding with the municipal elections at the end of 2024. During this phase, the focus will be on engaging in more structured conversations with investors through roadshows. Subsequently, the government hopes to commence implementing the privatization project next year.

With the chosen model, the São Paulo state government anticipates adding at least R$10 billion to the business plan for privatizing Sabesp. The new forecast is for R$66 billion in investments, compared to the previous estimate of R$56 billion, as Governor Tarcísio de Freitas outlined. A portion of the privatization funds will be allocated to initially reduce tariffs without negatively impacting the company’s cash flow or other shareholders.

Risks

While recent developments favoring privatization have made significant progress, several key issues present risks. The sale of stakes to a strategic partner will focus investors’ attention on the company’s new governance structure. Another critical concern is the regulatory model, which aims to lower tariffs and ensure municipalities fulfill their concession obligations.

Nevertheless, the primary risk lies in the political challenge of engaging with São Paulo’s legislative and executive branches. However, the ongoing debate fosters a balanced model that benefits all stakeholders.

Valuation

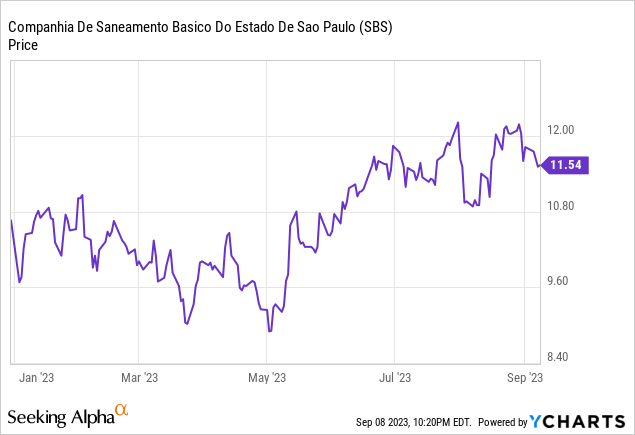

Sabesp has been trading at a multiple of 0.84x its EV/RAB (regulatory asset base) this year. Since approving the general privatization guidelines at the end of July, Sabesp’s shares have fallen 10% amidst uncertainty but have promptly corrected to exceed 52-week highs.

However, for investors who, like me, were skeptical about the future of Sabesp’s privatization and are now more confident, this could still be a good entry point. This multiple, in theory, makes the risk-return still attractive. Sabesp as a state-owned company, assuming that there will be no further cost cuts apart from the more than 1,800 employees who will leave the company by 2024, the fair multiple would be below 0.80x.

Now, looking at Sabesp as a private sector company, assuming, among other things, a reduction in the cost of capital and better long-term operating performance, the fair multiple would be approximately an EV/RAB above 1x, which would leave the company still with the potential for a considerable upside.

The bottom line

In my analysis, Sabesp continues to be an event case. In other words, unlocking the company’s value is closely linked to the possibility of privatization. Although there are still risks, the recent steps taken by the São Paulo state government have been essential in this regard, and I see the likelihood of privatization increasing considerably.

Still seeing a good entry opportunity at the current valuation, I think that investors who are patient and enter with a bullish position in Sabesp are likely to reap good rewards as privatization materializes. I’m upgrading my stance on Sabesp from previously neutral to bullish.

Read the full article here