Elevator Pitch

I continue to assign a Buy rating to Salesforce, Inc. (NYSE:CRM) stock. With my earlier write-up published on June 7, 2022, I reviewed CRM’s financial results for the first quarter of fiscal 2023 (YE January 31).

In the current update, I outline my positive view of Salesforce’s recently announced price hikes, which supports my Buy rating for CRM. The rollout of new AI solutions have been a major factor in prompting CRM to increase its product prices, and I expect Salesforce to utilize pricing as a key lever for margin expansion going forward.

Price Hikes

Salesforce will “raise list prices an average of 9% across Sales Cloud, Service Cloud, Marketing Cloud, Industries and Tableau” beginning in August 2023 as reported by Seeking Alpha News on July 11, 2023. It is reasonable to assume that investors have a favorable view of CRM’s proposed price hikes, as Salesforce’s share price rose by +3.9% and +2.8% on July 11 and July 12, respectively.

There are two things that are worth noting about the increase in Salesforce’s list prices.

Firstly, AI played a significant role in providing support for CRM’s recently disclosed price hikes. In Seeking Alpha News’ July 11, 2023 article referred to above, it was highlighted that “recent generative AI innovations” were one of the key factors that justified Salesforce’s price increases.

Secondly, Salesforce’s CFO Amy Weaver had previously noted at UBS (UBS) Women in Tech Summit on June 13, 2023 that “pricing and packaging, bundling” are the major levers that the company can pull to “power our margin difference (expansion) for the upcoming years.”

In the subsequent sections, I will discuss how CRM’s new AI offerings have helped to provide support for the company’s price hikes, and outline Salesforce’s profitability improvement goals which will be boosted by the increase in list prices.

Generative AI

In recent months, CRM has rolled out a number of new AI solutions, which have strengthened the case for the company’s product price increases.

Salesforce issued a media release in early March that it had launched Einstein GPT, that it referred to as “the world’s first generative AI CRM (Customer Relationship Management) technology, which delivers AI-created content.” In late June, CRM announced that it will be bringing Sales GPT and Service GPT to the market, which the company described as applications offering “generative AI capabilities for Sales Cloud and Service Cloud”, respectively.

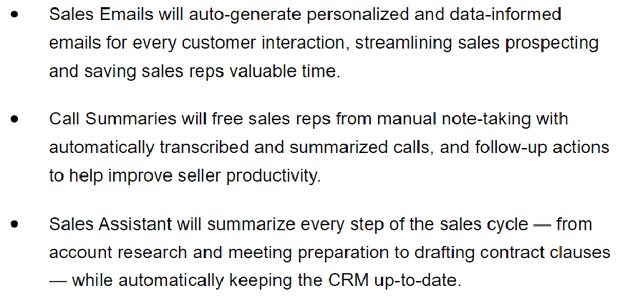

The Key Features Of Sales GPT

Salesforce’s June 29, 2023 Press Release

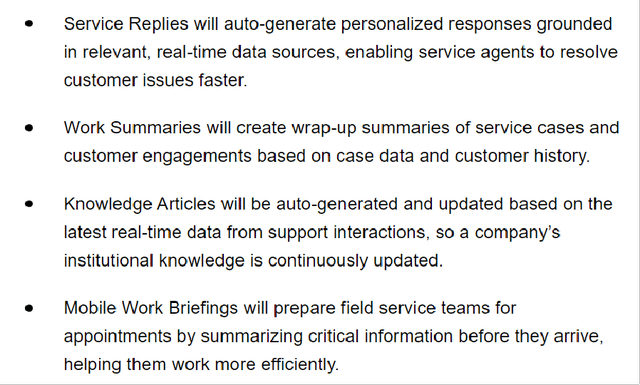

Service GPT’s Main Features

Salesforce’s June 29, 2023 Press Release

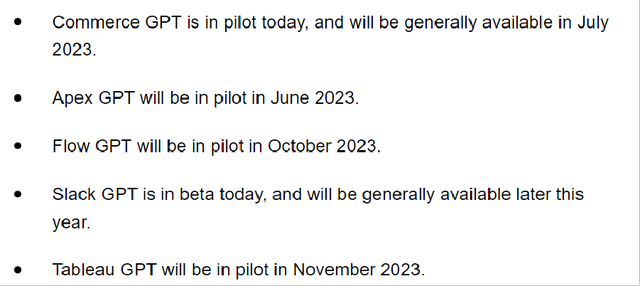

Looking forward, CRM has plans to introduce generative AI capabilities for its other products such as Slack and Tableau in the months ahead as detailed below.

Salesforce’s Timeline For Rolling Out Other New GPTs

Salesforce’s June 12, 2023 Media Release

The Potential Benefits Of Utilizing The Commerce, Slack And Tableau GPTs

CRM’s AI Products Website

At the Jefferies (JEF) Software Conference on June 1, 2023, COO Brian Millham emphasized that he has “this belief that if the (generative AI) technology is driving value for our customers, we should be able to monetize it.”

Considering that Salesforce has recently come up with new AI solutions that benefit its customers, it is unsurprising that the company has decided to raise prices now.

Future Profitability

Salesforce guided for a +5.5 percentage points expansion in the company’s normalized operating profit margin from 22.5% for FY 2023 to 28.0% in FY 2024, when it announced its Q1 FY 2024 results at the end of May. Wall Street analysts expect CRM’s non-GAAP adjusted operating margin to further improve to 30.8%, 32.8%, and 34.4% for FY 2025, FY 2026, and FY 2027, respectively as per S&P Capital IQ’s consensus data.

As a comparison, CRM was previously only targeting to achieve a relatively lower normalized operating margin of 25% by FY 2026 as per disclosures at its Investor Day in September last year. It is clear that Salesforce’s profitability outlook has become much more favorable, thanks to the company’s new-found pricing power driven by the rise of generative AI.

CRM highlighted at the UBS Women in Tech Summit in the middle of last month that the company’s adjusted operating margin could potentially increase from 28.0% for full-year FY 2024 to 30.0% in Q1 FY 2025. Specifically, Salesforce’s CFO Amy Weaver noted that cost optimization measures had boosted the company’s profitability in prior quarters, but she stressed that “how do we go to market” (for which pricing is a key factor) will be the key factor that determines CRM’s future profitability improvement potential.

As such, Salesforce’s recently revealed price increases are much more significant than what they seem on the surface. The introduction of new AI offerings has given CRM the power to initiate price hikes, and this could raise the ceiling for Salesforce’s long-term operating profit margin.

Closing Thoughts

My bullish view of Salesforce remains unchanged, taking into account the company’s potential for margin expansion. With the rise of generative AI, CRM has lots of opportunities to launch related offerings to support future price hikes (or other price optimization measures like bundling), which will play a key part in driving its profit margins higher in time to come.

Read the full article here