Investment Thesis

Samsara Inc. (NYSE:IOT) has a mighty compelling narrative plus a richly priced stock.

My thesis for investors’ upside comes less from the expectations for a higher re-rating on the stock’s multiple, and more based on the assertion that if investors are able to buy Samsara’s stock now and hold for a couple of years, they’ll be rewarded as the company’s intrinsic value grows into its valuation.

Why Samsara? Why Now?

Samsara’s Connected Operations Cloud and suite of Internet of Things (“IoT”) devices enable businesses in various industries to harness IoT data. More specifically, Samsara’s Connected Operations Cloud platform enables businesses relying on physical operations to utilize Internet of Things data for actionable insights and operational improvements.

At its core, Samsara leverages IoT connectivity to provide real-time data and operational visibility, and productivity to physical operations. Further, Samsara’s Connected Operations Cloud sets out to deliver improvements in safety, efficiency, and sustainability.

Samsara offers a purpose-built solution to drive higher physical asset utilization. In plain English, Samsara connects the physical world to IoT connectivity and cloud computing workflows.

In my previous analysis, titled Inflection Quarter, I said,

If you read my work frequently, you’ll have read me say, follow the customer growth, because the customer knows best. If the customer growth rates are higher than 30% y/y, the company is clearly doing ”something” right.

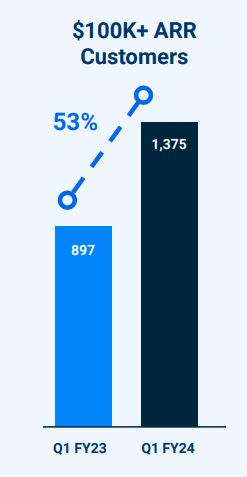

With that in mind, consider the update below:

IOT Q1 2023

The graphic above gets to the heart of my bull case. Any time you have paying customers clamoring for a platform, that’s all the insight you need to know if a business is flourishing or not. In fact, I argue that the customer adoption curve is perhaps the most insightful consideration for any investment.

With this context in mind, let’s discuss Samsara’s financials.

Revenue Growth Rates Continue to Grow Rapidly

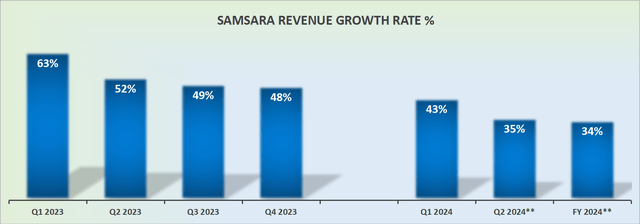

IOT revenue growth rates

As you can see above, fiscal Q1 2024 reported more than 40% CAGR against what was the most challenging quarter of the year.

Naturally, this implies that the likelihood that by fiscal H2 2024, Samsara will ”only” be growing by around 30% CAGR is relatively small. For this, I’ve assumed that since we know that since fiscal H1 2024 is likely to grow by around 40% CAGR, and the average for the year is guided for 34% CAGR, this implies that at present the second half is only expected to grow by 30% CAGR.

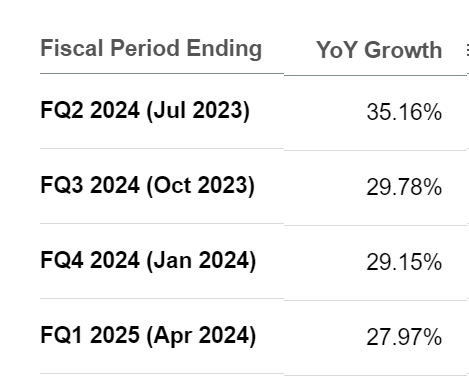

SA Premium

And true to form, that’s exactly what you see here. Analysts following the company have what I believe are relatively muted expectations for Samsara. And I don’t believe that is, in fact, what will play out.

Indeed, I strongly believe that Samsara will upwards revise its fiscal 2024 outlook when it reports its fiscal Q2 2024 results in a few weeks’ time. After all, consider this.

SA Premium

Samsara has a history of beating revenue estimates by around the mid-single digits.

Even if we assume that, over time, the size of these beats become smaller, I believe that it’s more than likely that for now, Samsara’s underlying fundamentals have enough momentum, that it’s going to end up beating fiscal Q2 2024 revenues by at least 3% on the upside.

Thereby leaving it well-positioned to upwards revise its full-year outlook. Next, we’ll get to the bearish consideration.

Profitability Profile Leaves a Lot to be Desired

Samsara finished fiscal 2023 with non-GAAP operating margins of negative 12%.

And looking ahead to the end of fiscal 2024, its guidance points to a negative 5%. Even if we presume that Samsara has left itself some room to positively impress investors, I don’t believe that in this year, Samsara will end with non-GAAP breakeven.

What’s more, Samsara recently had an Investor Day, and its Investor Day curiously made no mention of it making meaningful strides to reach breakeven profitability this year, or soon for that matter.

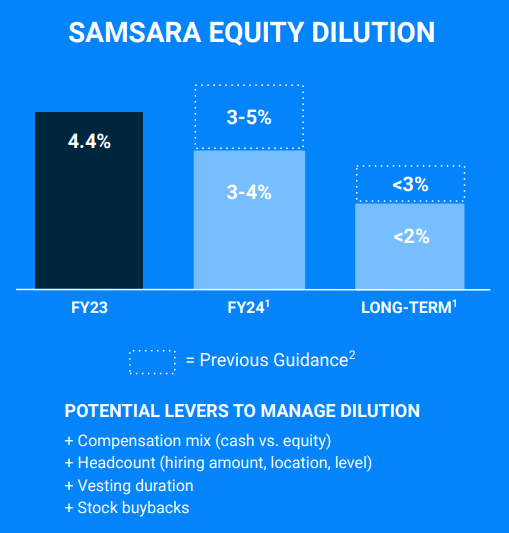

IOT Investor Day

What Samsara does point to is that going forward Samsara will see its SBC expense tricky lower, as management prefers to take compensation in cash rather than equity.

Next, we’ll discuss Samsara’s valuation.

Samsara is Not a Cheap Stock

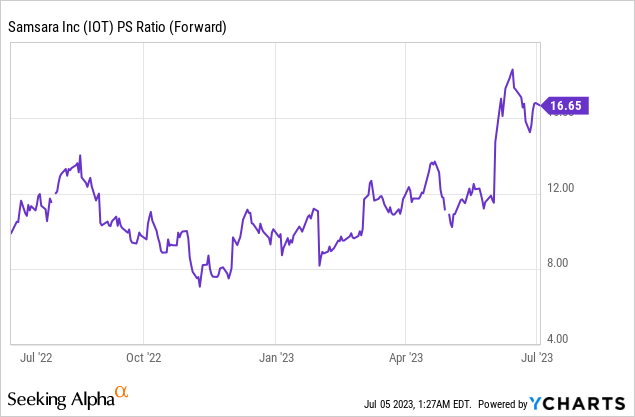

As you can see above, in the past several months, Samsara’s P/Sales multiple has gone from around 8x forward sales to slightly more than double that multiple.

In other words, it’s difficult to argue that the stock is underpriced. That being said, even if we suspect that the stock is fairly priced, an investor that sticks around with the stock for, say, around 2 years, may be paying a fair valuation at the start, but the stock will grow into its valuation.

In other words, investors should not buy Samsara stock on the presumption of further multiple expansion, but sit and wait for intrinsic value to catch up with its valuation.

The Bottom Line

Samsara offers a compelling narrative and a pricey stock.

My investment thesis is based on the belief that holding Samsara’s stock for a couple of years will be rewarding as the company’s intrinsic value grows.

The company’s customer growth is strong, and its revenue growth rates continue to rise rapidly.

While profitability remains a concern and Samsara Inc. stock’s valuation is high, patient investors can expect the company’s growth to catch up with its valuation. Therefore, investing in Samsara should be based on intrinsic value rather than expecting further multiple expansion.

Read the full article here