A Quick Take On Sapiens International

Sapiens International Corporation N.V. (NASDAQ:SPNS) provides a range of insurance and financial services industry software products worldwide.

I previously wrote about Sapiens, also with a Hold outlook.

I’m still cautious about the company’s valuation and prospects for higher growth as conditions continue to slow.

For the near term, I’m on Hold for Sapiens, although the stock is worth putting on a watch list.

Sapiens International Overview

Holon, Israel-based Sapiens International Corporation N.V. was founded in 1982 to provide software solutions to insurance and financial services firms for a variety of functionalities.

The firm is headed by Chief Executive Officer Roni Al-Dor, who was previously President of TTI Telecom.

The company’s primary offerings include:

-

CoreSuite

-

UnderwritingPro

-

ApplicationPro

-

IllustrationPro

-

ConsolidationMaster

-

Others.

The firm acquires customers through its in-house sales and marketing efforts as well as through partner referrals and sales.

Sapiens International’s Market & Competition

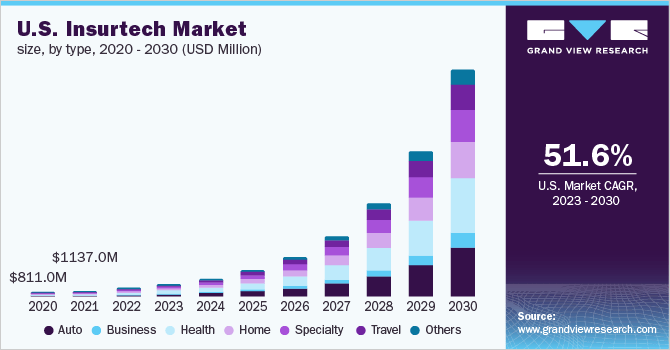

According to a 2023 market research report by Grand View Research, the global market for Insurtech software and services is expected to grow from $5.5 billion in 2022 to $161.1 billion in 2030.

This represents a forecast very high CAGR of 52.7% from 2023 to 2030.

The main drivers for this expected growth are the need to increase efficiencies through automation along with improved technological offerings.

Also, the chart below shows the historical and projected future growth trajectory of the U.S. Insurtech market from 2020 to 2030:

U.S. Insurtech Market (Grand View Research)

Major competitive or other industry participants include:

-

Lemonade

-

Guidewire

-

Insurity

-

Majesco

-

BrightCore

-

DXC Technology

-

Insuresoft

-

OneShield Software

-

Duck Creek Technologies

-

Others.

Sapiens’ Recent Financial Trends

-

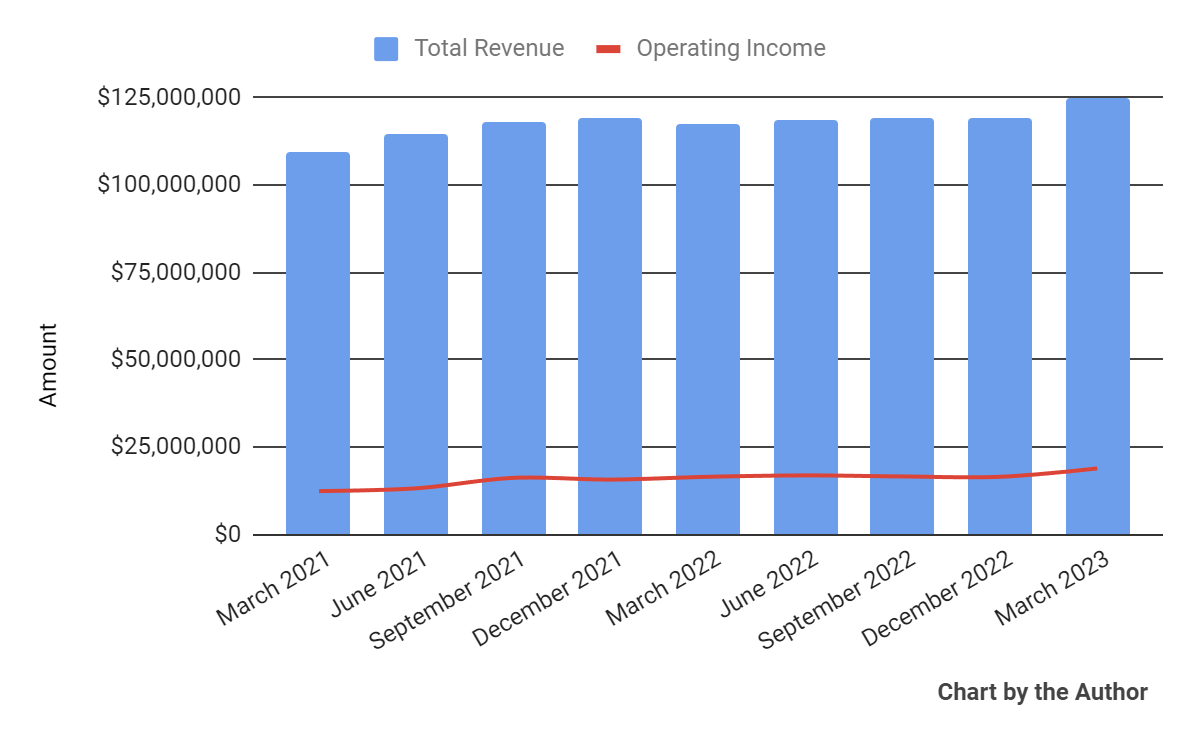

Total revenue by quarter rose markedly in the most recent quarter; Operating income by quarter also moved up.

Total Revenue and Operating Income (Seeking Alpha)

-

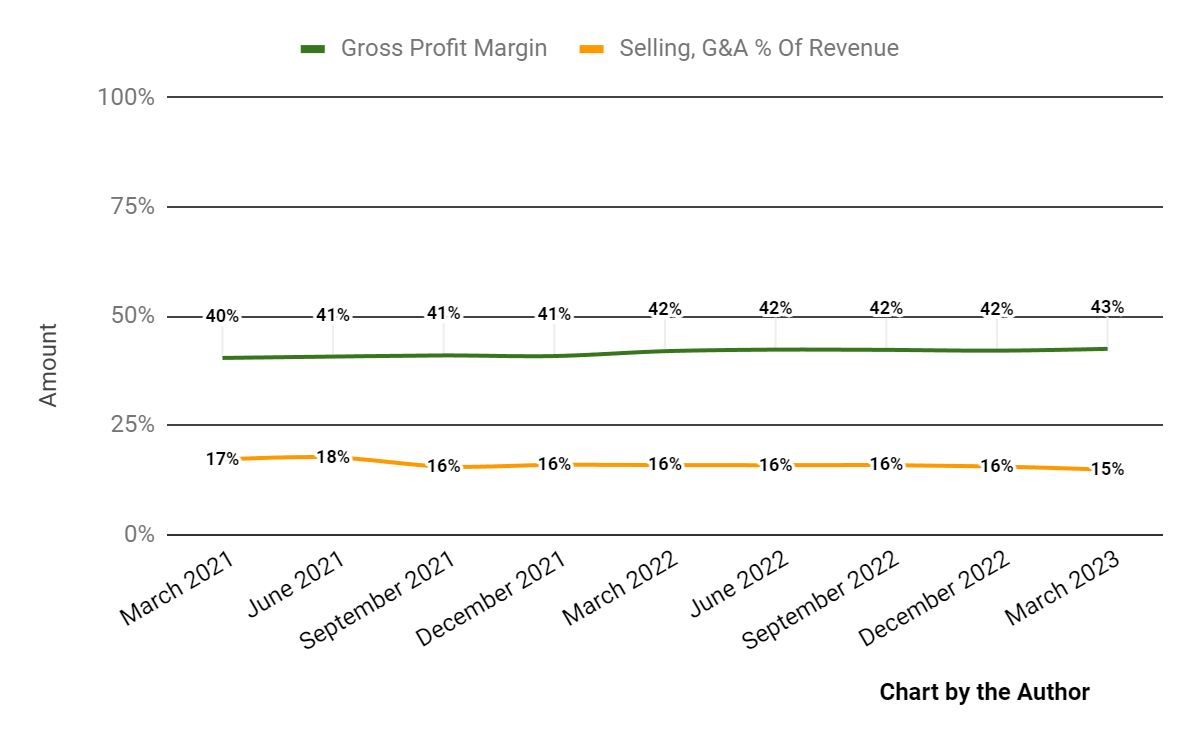

Gross profit margin by quarter has trended slightly higher in recent quarters; Selling, G&A expenses as a percentage of total revenue by quarter have trended slightly lower more recently.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

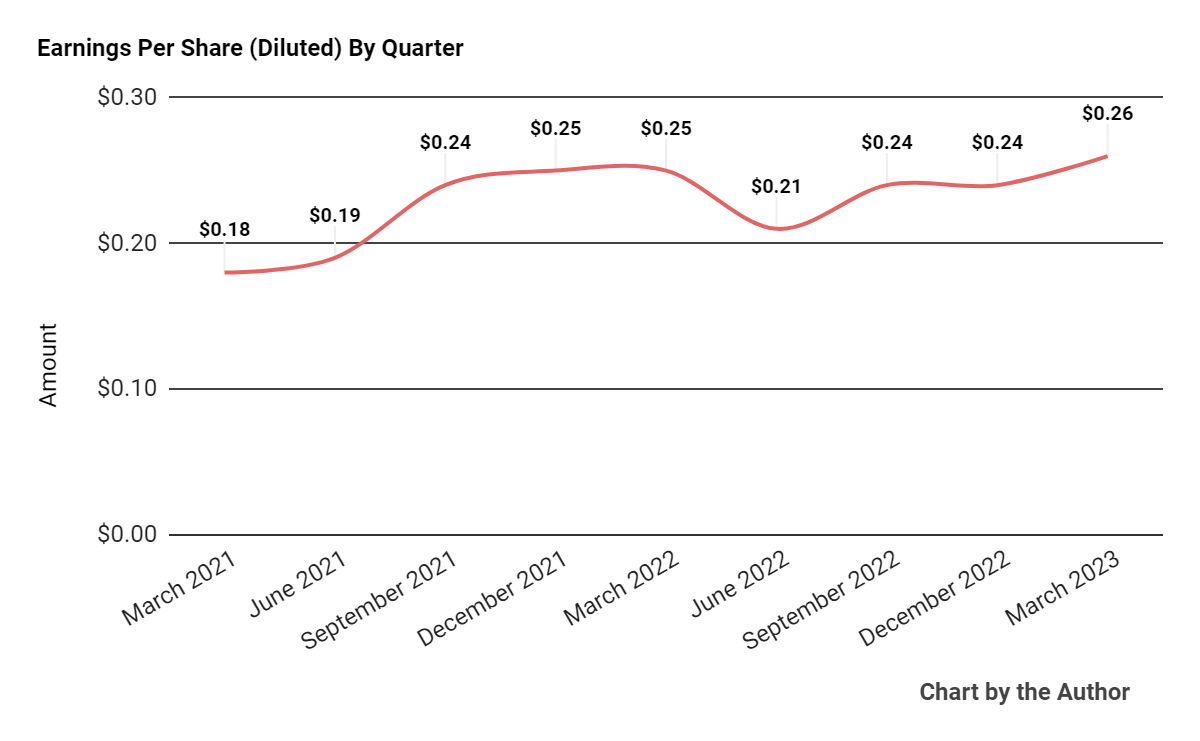

Earnings per share (Diluted) have reached an eleven-quarter high of $0.26 per share in Q1 2023.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

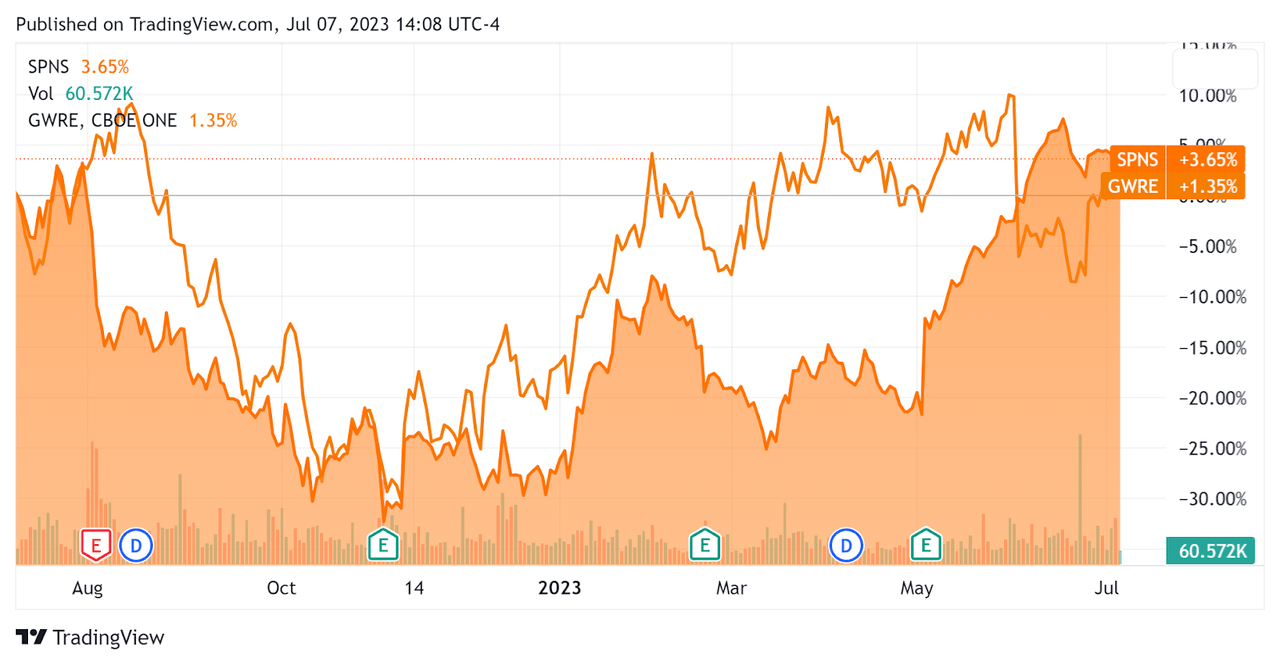

In the past 12 months, SPNS’s stock price has grown by 3.65% vs. that of Guidewire Software, Inc.’s (GWRE) rise of 1.35%, as the chart indicates below.

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $181.7 million in cash and equivalents and $59.3 million in total debt, of which $19.8 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was $44.6 million, during which capital expenditures were only $3.0 million. The company paid $3.8 million in stock-based compensation, or SBC, in the last four quarters.

Valuation And Other Metrics For Sapiens

Below is a table of relevant capitalization and valuation figures for the company.

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.9 |

|

Enterprise Value / EBITDA |

16.2 |

|

Price / Sales |

3.0 |

|

Revenue Growth Rate |

2.7% |

|

Net Income Margin |

11.0% |

|

EBITDA % |

17.6% |

|

Net Debt To Annual EBITDA |

-1.4 |

|

Market Capitalization |

$1,460,000,000 |

|

Enterprise Value |

$1,370,000,000 |

|

Operating Cash Flow |

$47,640,000 |

|

Earnings Per Share (Fully Diluted) |

$0.95 |

(Source – Seeking Alpha.)

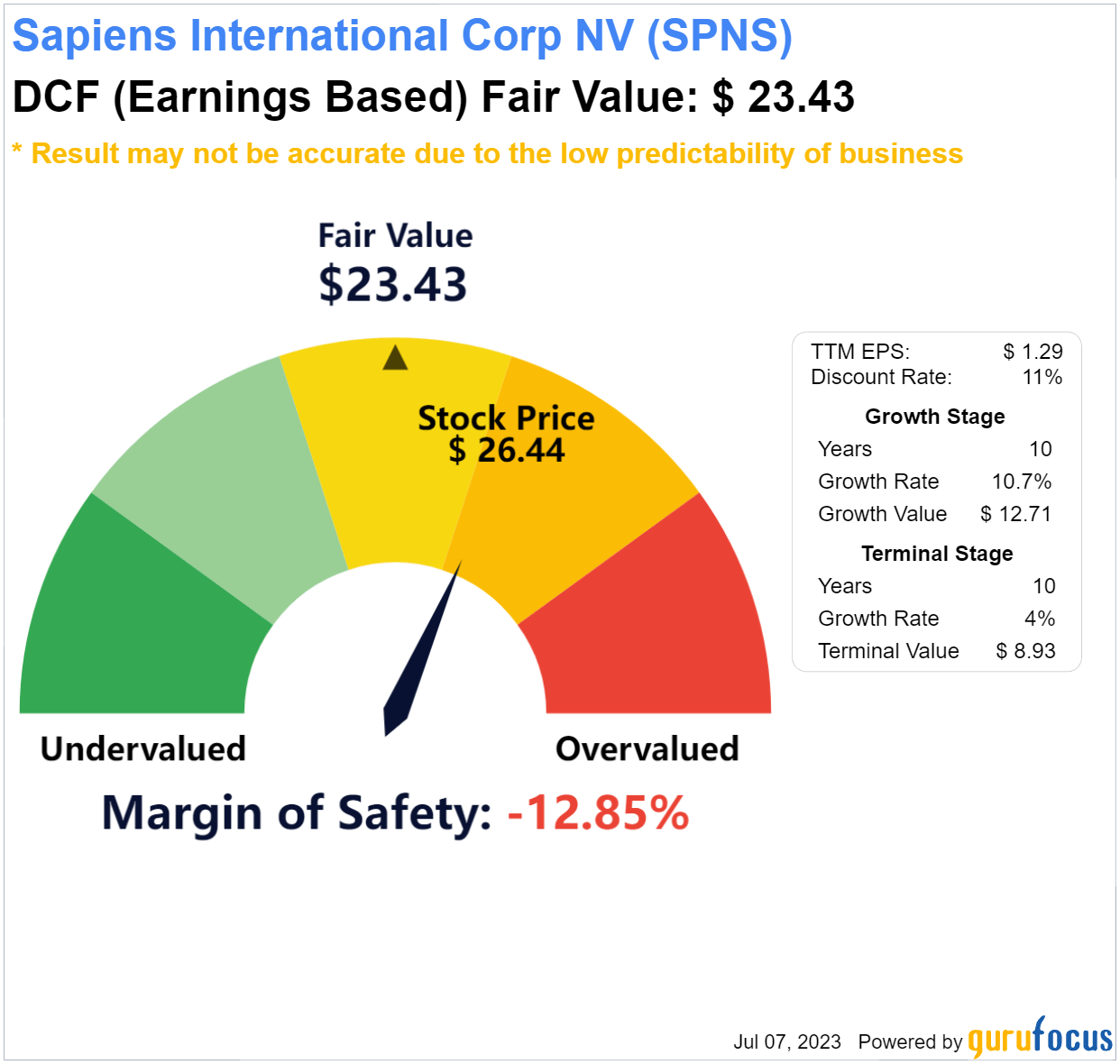

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings.

Discounted Cash Flow Calculation – SPNS (GuruFocus)

Assuming generous DCF parameters, Sapiens International shares would be valued at approximately $23.43 versus the current price of $26.44, indicating they are potentially currently overvalued, with the given earnings, growth, and discount rate assumptions of the DCF.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

SPNS’ most recent Rule of 40 calculation dropped to 20.3% as of Q1 2023’s results, so the firm’s performance for this metric has fallen, per the table below.

|

Rule of 40 Performance |

Q2 2022 |

Q1 2023 |

|

Revenue Growth % |

11.8% |

2.7% |

|

EBITDA % |

17.7% |

17.6% |

|

Total |

29.5% |

20.3% |

(Source – Seeking Alpha.)

Commentary On Sapiens

In its last earnings call (Source – Seeking Alpha), covering Q1 2023’s results, management highlighted that the North American region is “returning to growth” as the company provides property & casualty insurance, worker’s compensation, reinsurance, life insurance and annuity products there.

Leadership views the worker’s compensation market in North America as a key opportunity after two years of slowdown during the pandemic.

Europe remains the company’s highest growth region and management continues to focus its efforts on the German market.

On technology development, management’s top priority is “to provide a persona-based package for agents and for customers on top of each one of our core products, life, and P&C.”

Leadership did not disclose any company, customer or revenue retention rate metrics.

Total revenue for Q1 2023 rose 5.9% YoY and gross profit margin increased by 0.5%.

Selling, G&A expenses as a percentage of revenue dropped by 1.1% and operating income grew by 14.5% YoY.

Looking ahead, non-GAAP revenues for 2023 are expected to grow at 7.3% YoY and non-GAAP operating margin is expected to be 18% at the midpoint of the range.

If the firm achieves its revenue growth target, it would represent a significant acceleration over the 2022 result of only 2% growth vs. 2021.

The company’s financial position is quite strong, with high liquidity, low long-term debt and ample free cash flow generation.

SPNS’ Rule of 40 performance has been in need of improvement and has worsened in recent quarters.

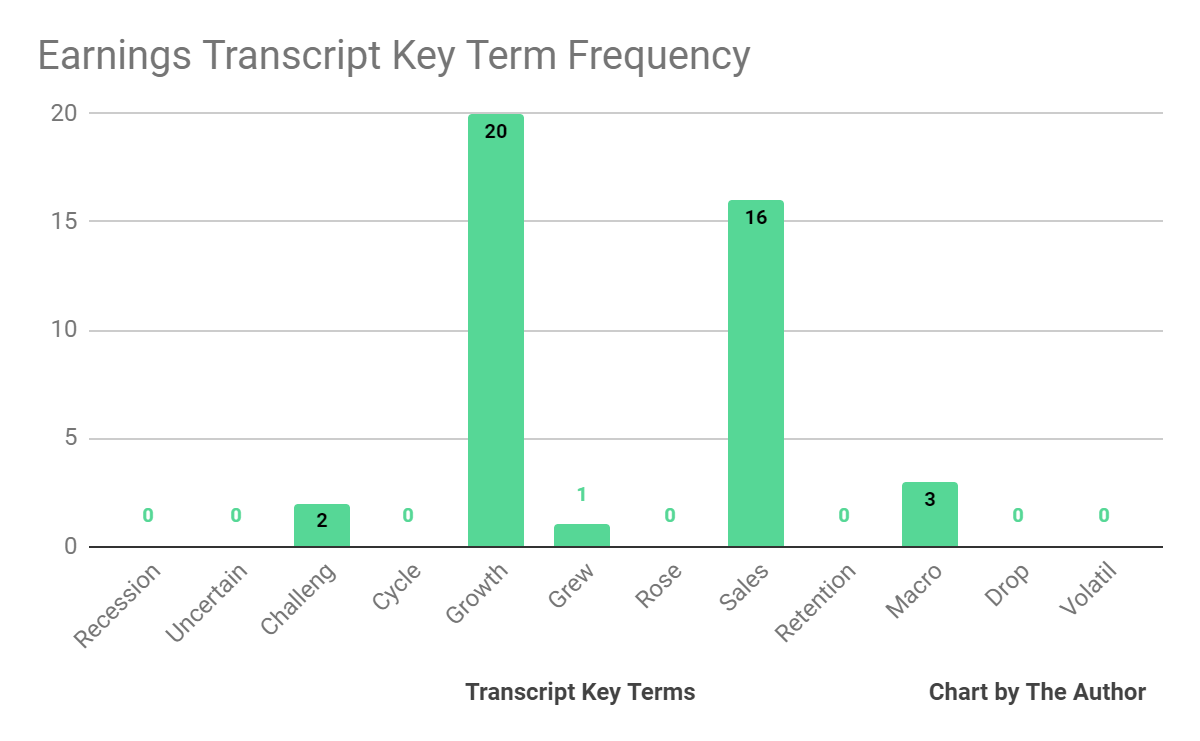

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below.

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited “Challeng[es][ing]” two times and “Macro” three times.

Analysts questioned company leadership about its European business and North American growth opportunities.

Management has made a number of restructuring moves in North America especially in its sales organization, and believes it can produce higher growth there from those changes, cross-selling existing clients and adding new logos.

Regarding valuation, my discounted cash flow calculation for SPNS suggests the stock may be overvalued despite a very generous growth rate assumption of 10.7%.

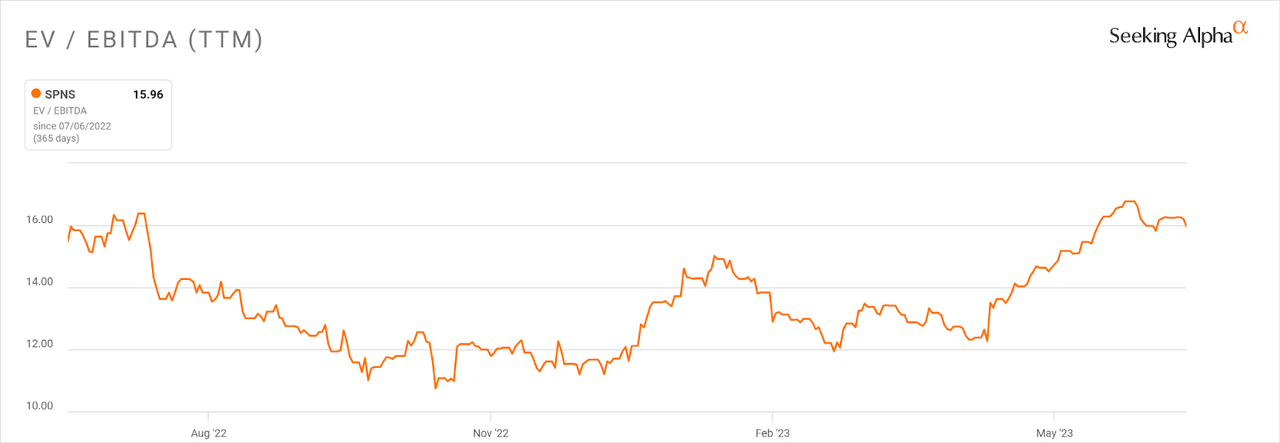

In the past twelve months, the firm’s EV/EBITDA valuation multiple has dipped and risen to about the same level as it began the one-year period, as the chart from Seeking Alpha shows below.

EV/EBITDA Multiple History (Seeking Alpha)

The primary business risk to the company’s outlook is softer sales activity as a higher cost-of-capital environment reduces client propensity to spend.

While the company’s valuation multiple has risen along with many other technology companies in recent months, I’m still cautious about the company’s valuation and prospects for higher growth as conditions continue to slow.

For the near term, I’m on Hold for Sapiens International Corporation N.V., although the stock is worth putting on a watch list.

Read the full article here