I got it wrong – again, but it worked…

To get a prediction correct you need to be right on timing and direction. As I’ve demonstrated this is not an easy thing to do, especially from all the tinkering going on from fiscal profligacy to a rapid monetary regime. For my purposes, the conjecturing works very well. As I said in my last article I postulate on the direction of the market and as soon as the foundation for it is proven erroneous I change direction. Anyone following me could have and should have done the same. As soon as it was clear that not only did rates not move up with alacrity, but on Monday the 10-Year bond fell. Nearly all week it hardly meandered above 3.8%. So naturally Tuesday I took down my hedges and got aggressively bullish, I raised my risk profile. I focused about 20% of my trading account on an Oracle (ORCL) trade post the earnings report. I have ORCL in my long-term investment account and have been focusing on their pivot to cloud services, and AI for quite a while. As you might know, their report was stellar, with reports of new customer wins, projections of an additional $2B in revenue from current customers, and an acceptance generally that Oracle was not an up-and-coming player. I observed that ORCL was breaking out to new highs, once a large-cap stock breaks out on such a strong narrative I naturally gained a lot of conviction. Luckily, a large number of my Group Mind Investor community dove in with me. We went long with Call options at the 120 strike for an average +177% return and closed out on Friday. Now I am sitting at 20% cash in my trading account ready and waiting for what this week will bring

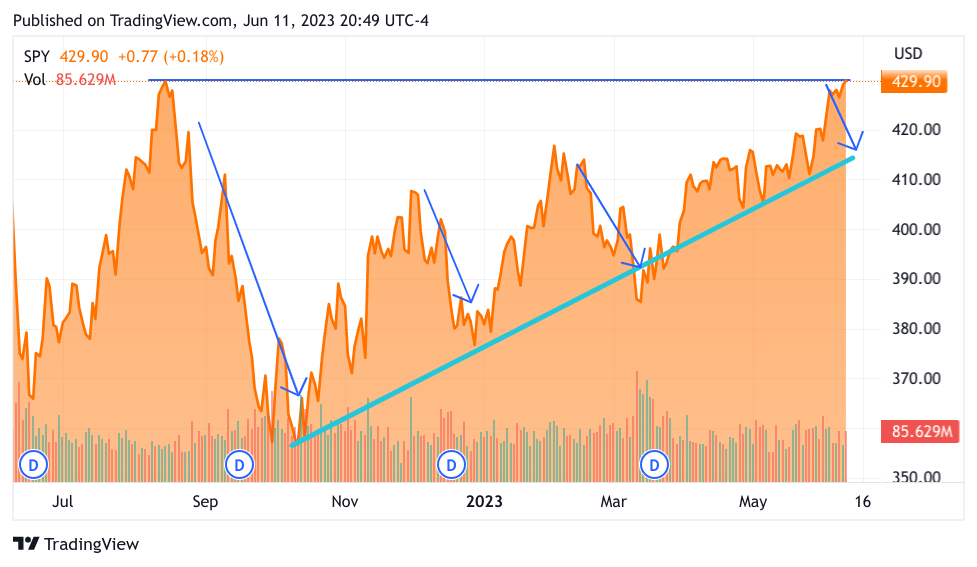

Why do I remain concerned about the rally? Let’s take a look at the chart from last week’s article.

TradingView

The above 6-Month SPY had the 4th arrow on the acute angle to the right with the imagined/hoped-for sell-off. Now let’s compare it to an updated chart for this week below.

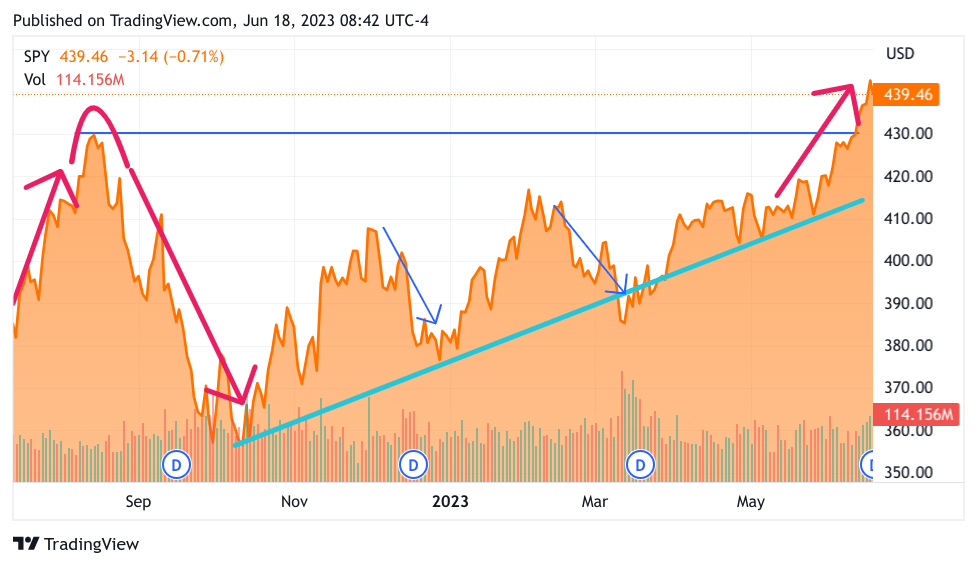

TradingView

I made a few small changes in the lines but it is the same chart as last week. First, let’s look at the right side of the chart. Clearly, we have broken out of the pennant formation. No surprise there, without the notion that a large block of debt coming to the market all at once would cause some selling a rally was a foregone conclusion. My fear is that the rally continues unabated and ends up resembling the right side of the chart perhaps as we approach 4500 on the S&P 500 (in this case represented by the S&P 500 ETF (SPY). At some point 4500+ as we get nearly 90 degrees, then the rally will be extremely fragile and less sustainable by the day. After that any small catalyst like a small rise in inflation or some small regional bank fails and all the latecomers run for the exits with the low-information traders not far behind leaving our indexes in shambles. Then it will take weeks if not months to get the derailed rally back on the rails and chugging upward again. Let me caveat by saying I have no idea how low it will get, I certainly can’t imagine seeing the lows of October certainly. Perhaps now that Fed President Powell with his “hawkish pause” stated that he sees two more 0.25% rate hikes economic news could shake things up. However, looking at the current economic calendar this week seems fairly benign. On Friday, June 30 we will have the Core PCE, the Personal Consumption Expenditures data reveal for May. This is supposedly Powell’s favorite indicator. He can tease out the rising cost of services, which he feels is the driver of inflation. My big question is, more employment means that there are more workers and that will lower the cost of services? By pressing down growth and jobs you are bolstering the cost of labor. We know interest rates are a blunt instrument and they seem to think it is their only one. They do have the bully pulpit, they can take both parties to task on spending and demand cuts from military and social earmarks… Anyway, I’m dreaming. Jay Powell is too much of a patrician to get down and duke it out with the politicians on both sides of the aisle.

My Trades

You already got my boasting from my ORCL trade. I did balance it out by sharing that I had losses from closing my hedges. Again, hedges should be seen as insurance. You should not load up on a hedge to protect your entire portfolio. Hedging is to soften the blow. Also, if you have a position that you are unsure of and you are going into a period of stress for (and from) the market. You should consider reducing the position and banking the cash. Cash is the least expensive hedge and you can deploy it instantly if a good opportunity makes itself known. I did go Long on Upstart (UPST) a name from the past that is coming in from the cold. I always kept a decent position in my long-term account. Now, I have a decent position in Call options and sold half. Oh, this was fun, I bought UnitedHealth Group (UNH) Call Options when it was $450, with a $460 strike the day after they had the negative change in forward guidance. The next day I sold it for about a 22% gain. I didn’t stick around longer because I really didn’t observe the price action on the stock so I lacked conviction to hang on. I ended the week going long Humana (HUM) and feeling pretty good about it since I have a little more time with both health services and insurance companies. I had a number of fast money trades mostly because I am taking advantage of some froth, and also because I am dancing the dance but my eye is firmly on the exit. I feel more relaxed this coming week since there is no economic news. I suppose they might be an important quarterly earnings report from a big name that could get some selling going. I would look to buy any kind of selling all this week and into early next week. The biotech micro and small-caps are treating us well so no complaints there. So in spite of some losses from hedging, all that was made up for and then some with some timely trades. I did have some long-term investments in Illinois Tool Works (ITW). I started positions in U.S. Bancorp (USB), Truist Financial (TFC), and added to KeyCorp (KEY) since I believe they have been overdone to the downside. I added to NET Power (NPWR) and Equitrans Midstream (ETRN) both in the energy infrastructure sector.

Happy Father’s Day and Juneteenth everyone…

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Have you ever bought a stock that everyone’s saying is great, only to find you bought near or at the all-time high that stock drops 20% immediately? What happened? By the time the average stock purchaser gets a stock idea, usually, it’s already overbought.

If this sounds like you, join our community Group Mind Investing which adheres to a Cash Management Discipline. We watch the market for you and uncover fresh trading and investing ideas. We identify sectors, trends, and individual stocks. You learn how to target a stock, buy and sell. Try our 2-week trial

Read the full article here