Overview

After 5 consecutive quarters of cost-cutting and attaining profitability in 4Q22, management announced their decision to pivot to reinvestment mode in Shopee in 2Q23. E-commerce EBITDA fell sequentially during the quarter and is expected to continue in the coming quarters, contributing largely to the drawdown we have seen in recent weeks.

Digital Entertainment’s (“DE”) quarterly active users (“QAU”) and quarterly paying users (“QPU”) recovered QoQ, but revenue declined due to lower monetization. Digital Financial Services (“DFS”) reported increasing revenue and EBITDA, although modest growth in sequential growth and loan receivable implies growth is slowing.

Overall, the drawdown was warranted given the expected impact on the firm’s future profitability as the E-commerce shifts back to growth. On a positive note, the share price decline has created a reasonable upside to the valuation. You may also check out my previous coverage of the firm.

Digital Entertainment

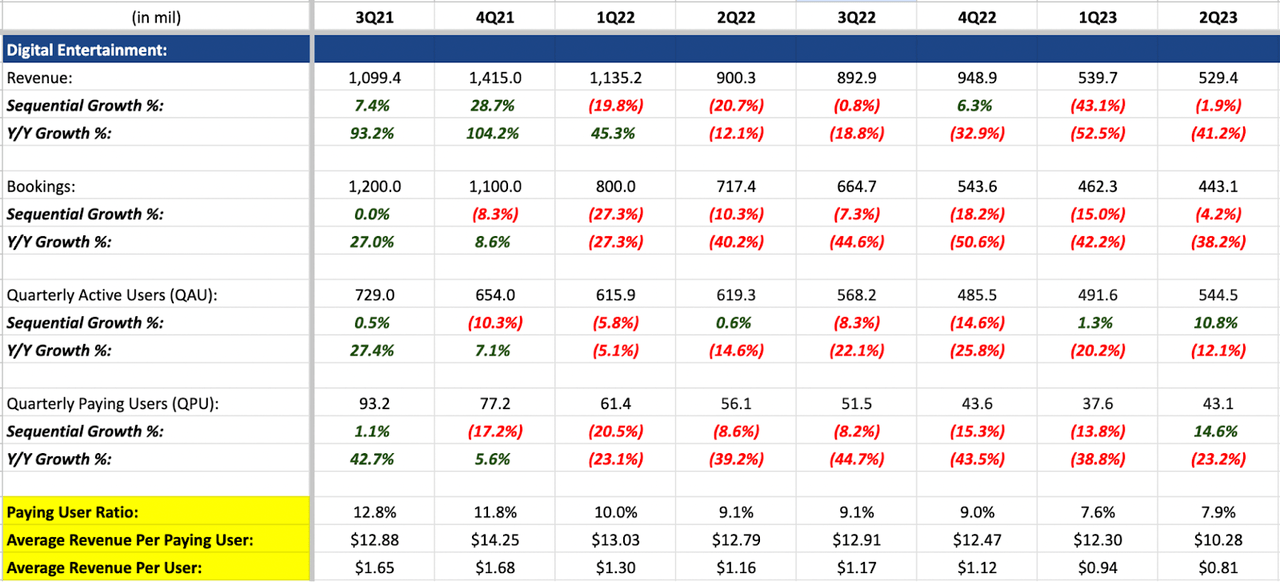

Author’s Image of Digital Entertainment’s Top-Line & Operational Metrics

DE’s QAU and QPU grew 10.8% and 14.6% QoQ, respectively, after several quarters of decline over the past 12 months. However, both ARPU and ARPPU declined QoQ, indicating lower monetization from the gaming segment, and revenue and bookings declined 4.2% and 2% QoQ, respectively. As this is the first full quarter of recovery in both QAU and QPU, it is still unclear if the user base could stabilize moving forward. Adjusted EBITDA did however grow moderately at 4% QoQ, after 7 consecutive quarters of sequential decline.

E-commerce

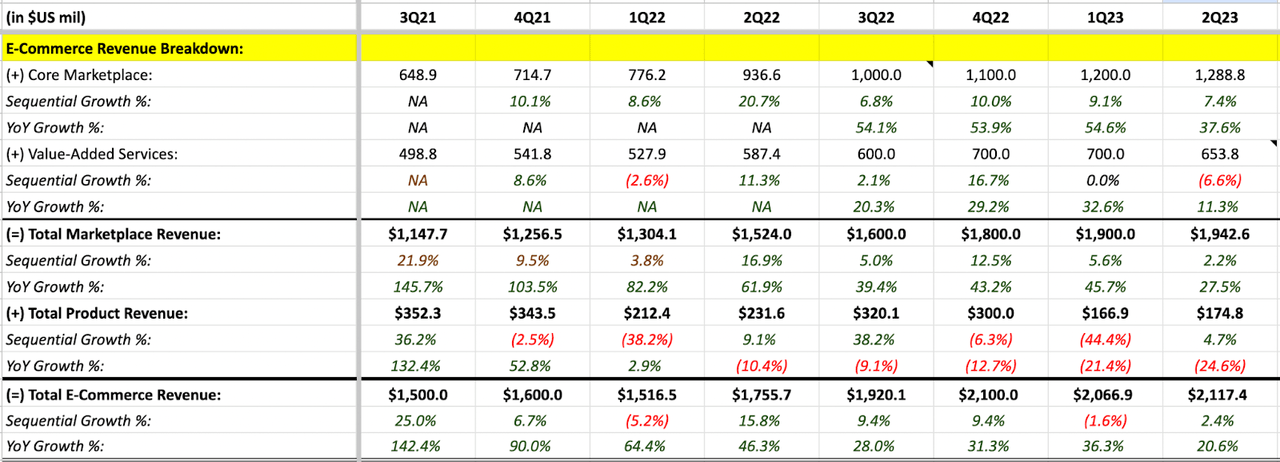

Author’s Image of E-Commerce Revenue Breakdown

Core marketplace revenue grew 7.4% QoQ as increased monetization continues in Brazil and SEA via uptake in commission rates, and value-added service (“VAS”) revenue declined 6.6% QoQ due to shipping subsidies as management pivoted to reinvestment mode. During the earnings call, management had also cited investment into livestreaming (a.k.a. Shopee Live) and short-form videos. Based on my personal experience with Shopee’s app, I have seen a noticeable uptick in the promotion of Shopee Live and the offering of discount vouchers. Overall e-commerce revenue increased 2.4% QoQ while overall adjusted EBITDA fell 28% QoQ. In terms of geographic markets, Asia market EBITDA fell 26% QoQ, while other markets (including Brazil) EBITDA loss improved 21% QoQ.

I believe this is partially in response to the increased competitive pressure from the social media platform, TikTok, and to defend market share given regional peers (a.k.a. Alibaba’s Lazada) have raised funds. In recent weeks, however, Indonesia’s government, Jokowi, imposed a ban on TikTok from facilitating transactions and payments. This benefits pure online marketplaces, including Shopee, as the threat of TikTok has now significantly diminished, but not completely. There remain several potential scenarios for the unfolding of this situation, including the possibility of TikTok introducing a separate e-commerce platform or current TikTok sellers or governmental bodies jointly petitioning against the ban, therefore, resulting in the ban being lifted.

Digital Financial Services

Digital Finance Service Revenue

While DFS revenue grew 53.4% YoY, DFS QoQ growth was modest at 3.7%, and loan receivables were stable QoQ at $2 billion, even though reported SeaBank Indonesia’s deposits are growing (Indonesia is its largest market). This implies that user bases might be stabilizing, and any growth moving forward will have to come from the scalability of the user base, and the expansion into other financial products. DFS’s adjusted EBITDA increased 38% QoQ, which is contributed by a sequential decline in S&M expenses that offset the EBITDA decline in Shopee.

Overview of Balance Sheet & Cash Flow Statement

Cash and cash equivalents, restricted cash, and short-term investments amounted to $7.1 billion as of 2Q23. The debt-to-equity ratio has steadily declined from 0.85 in 3Q22 to 0.58 as of 2Q23. Operating cash flow (“OCF”) for the quarter came in at $595 million, marking the third consecutive quarter of positive OCF.

In comparison to a year ago, the firm’s current ability to enter a reinvestment phase has improved due to a stronger balance sheet and positive cash flows. This situation also underscores the adeptness of the management in steering through the crisis.

Valuation

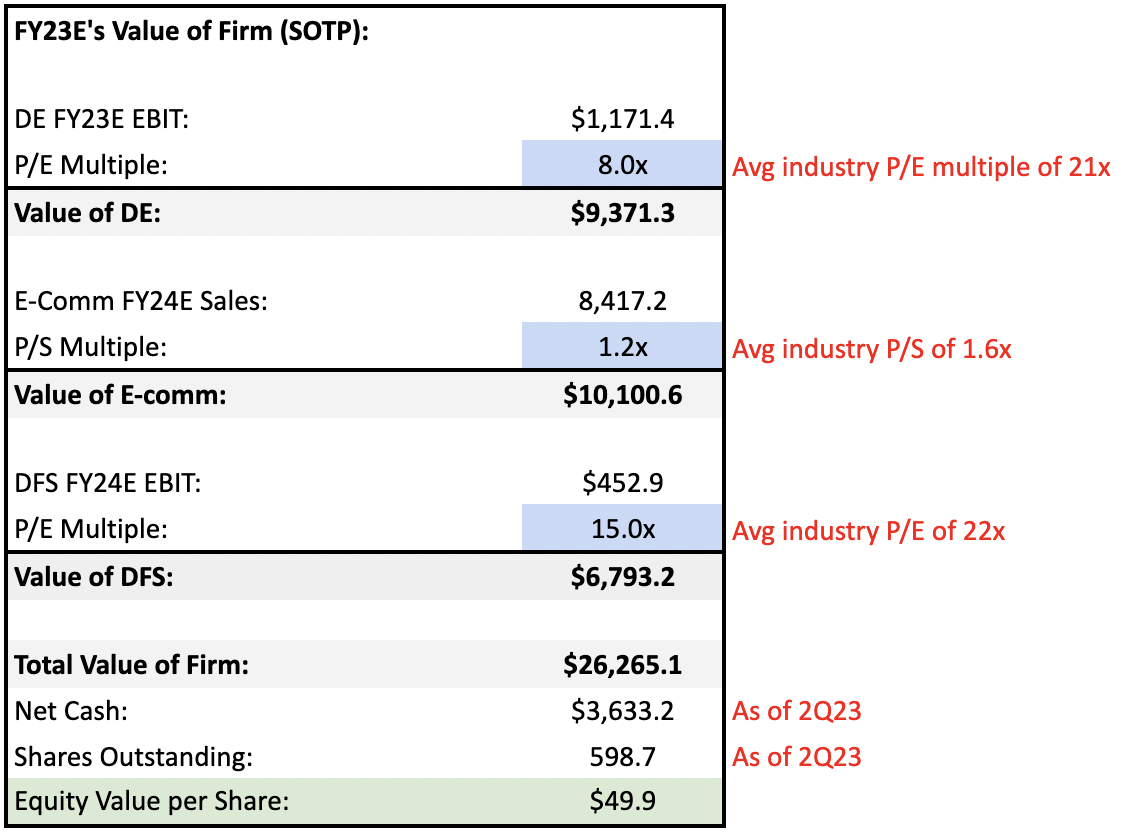

Author’s FY23E Valuation

My price target for the firm is $49.9 as of FY23E. For DE, my EBIT estimate is $1,171.4 million, and an 8x P/E multiple, due to the segment’s reliance on a single game. For E-commerce, sales are estimated to come in at $8,417.2 million, and the applied P/S multiple is 1.2x, compared to the industry average of 1.6x. DFS estimated EBIT is $452.9 million, with a P/E multiple of 15x, vs. an industry average of 22x due to its lower growth profile. In total, after accounting for net cash, and the number of shares outstanding, this produces an equity per share of $49.9, which is an upside of 15% from the current share price of $43.

Risks

Some of the key risks, while not exhaustive, include:

-

Digital Entertainment: Concern around the stabilization of DE’s QAU and QPU

-

E-commerce: Future decline in segment’s profitability as it shifts back to growth; increased competition; weaker-than-expected consumer spending due to inflation;

-

Digital Finance Services: Higher than expected credit losses

Conclusion

The drawdown was warranted given the lack of stabilization in DE’s QAU base, and the increasing concerns surrounding the E-commerce’s future earnings as it shifts back to growth in response to intensifying competition. However, on a positive note, the firm has come out of the crisis with an improved balance sheet and positive operating cash flow, positioning them more favorably to compete and invest in further growth from a year ago. The share price decline in share price has also created a reasonable upside to the firm’s valuation. All things considered, I rate it as a hold.

Read the full article here