SeaWorld Entertainment, Inc. (NYSE:SEAS) officially opened its first international location last month in Abu Dhabi; management has yet to specify the financial implications this will have on the business. One thing is for sure, there is much positive feedback coming from enthusiastic visitors, many of whom have classified the park as the world’s best aquarium. For a company that was once drowning in bad press, this could potentially positively impact enthusiasm for the new rides yet to open in its USA based parks. Although the stock price has rewarded investors with returns of 42.02% over the last year. The company is still reporting a decline in attendance, partially blaming lousy weather, the timing of its new rides and a lack of international visitors.

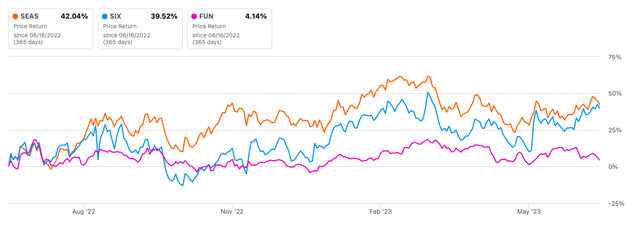

One-year stock trend (SeekingAlpha.com)

However, its top line continues to increase quarter by quarter due to increased spend per capita. Although the historically higher attendance summer quarters are coming up, SeaWorld has not provided convincing evidence that visitors could return in great numbers. Furthermore, it still needs more staffing across many of its parks. While I am enthusiastic about its international location and the expenditure on new rides and park upgrades, I recommend a hold rating due to the uncertainty of international travellers returning and cautious consumer discretionary behaviour trends in the market.

Company updates

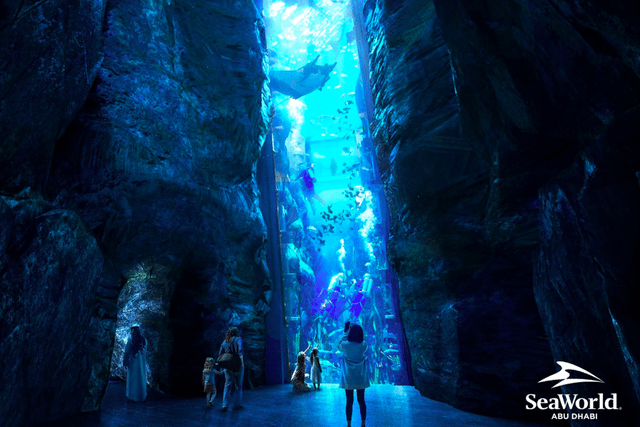

After eight years in the making, in May 2023, SeaWorld opened its first-ever international marine life and theme park, SeaWorld Yas Island. It is also the first new SeaWorld park that opened in thirty years and has a lot going for it, including the world’s largest single-tank aquarium.

SeaWorld Abu Dhabi (SeaWorld)

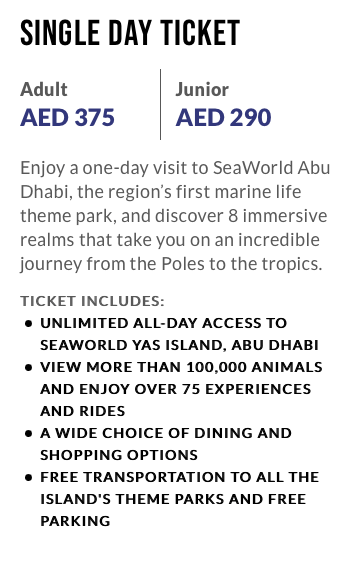

A single-day adult ticket costs a little over $100, giving customers access to over 75 rides, experiences, restaurants, and parking. SeaWorld has a licensing arrangement with its partner in Abu Dhabi and has yet to reveal the financial setup for this agreement. During the Q1 2023 Earnings call, management explained that the income statement would benefit from revenue and then a percentage of the adjusted EBITDA and expects to see it deliver low to middle single-digit millions from an EBITDA perspective this year and ramp up according to the park’s popularity.

Day ticket to the park (seaworldabudhabi.com)

Within the States, SeaWorld has been increasing park experiences by investing in park upgrades, mobile applications and rides. At the same time, the company is investing in technology and capital to take on cost reduction efforts, aiming to reduce costs of up to $50 million, mainly connected to labour. SeaWorld has had various new rides opening up in 2023. However, bad weather events and a lack of international attendance have negatively affected attendance. In Q1 2023, parks saw an attendance of 3.4 million visitors, 25,000 less than one year prior. One of the strengths has been its pricing strategy which has increased spending per cap, and its mobile app, which is increasing purchase orders; total revenue through the app increased by 200% YoY. Furthermore, SeaWorld says it will open its first hotel in 2025 and another in 2026. There needs to be more information regarding the financing of these initiatives.

Financials and valuation

Revenue continues on a steady upward path for the company. For its first quarter of 2023, total revenue increased by 8.4% YoY reaching $293.3 million. Although the company continues to see a decrease in attendance, its pricing strategy and increased spending opportunities have increased total revenue per capita to 9.2%. The company posted a loss of $16.5 million, compared to one year prior at a loss of $9 million. Adjusted EBITDA increased YoY to $72.4 million.

Annual revenue and gross profit (SeekingAlpha.com)

SeaWorld has a strong balance sheet which includes $54.8 million in cash, and the company has $426.4 million in liquidity with a total leverage ratio of 2.7x. The company’s cash generation peaks through the upcoming summer quarters, therefore clearly putting the business in a good position in its higher earning quarter historically. The company spent $69.8 million on CapEx in Q1 of 2023, expecting to further spend $250 to 270 million on Capex in FY2023.

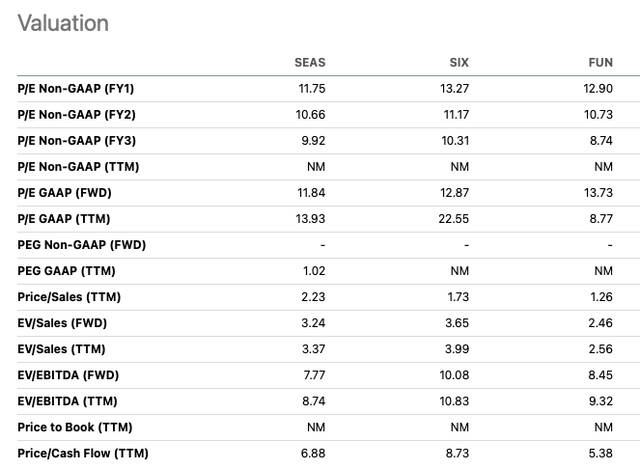

The stock is trading well below its average target price of $75.36 and has outperformed its peers on price return over the last year with returns of 42.04%. Furthermore, it has a lower FWD price-to-earnings ratio of 11.84, compared to Six Flags (SIX) at 12.87 and Cedar Fair (FUN) at 13.73, indicating that the stock may still be undervalued. However, it has a high price-to-sales ratio of 2.23, and although the company has been heavily investing in its parks to increase attendance, we are still seeing attendance drop year on year.

One year stock return versus peers (SeekingAlpha.com) Relative peer valuation (SeekingAlpha.com)

Risk

The amusement park industry still needs to get back to higher attendance numbers; this is an issue across the industry. Furthermore, the unpredictable consumer discretionary spending behaviour due to the ongoing loom of a recession could impact the upcoming summer season in which the company traditionally sees high cash generation and peak visitation numbers. An ongoing issue is the expense and labour required to run the business. The company has yet to find a solution for its labour shortage; it recently initiated a search for 10,000 open positions across its parks for seasonal and longer-term roles.

Final thoughts

SeaWorld’s new international location has potential for long-term benefits and could open up future licensing opportunities, but it is still too early to understand the full financial benefits of the business. While the top line is increasing, SeaWorld is facing high costs and a decrease in visitors. With uncertainty around consumer spending and international visitors yet to return, I suggest a hold rating until we gain more insight into the historically high-performing summer quarters.

Read the full article here