A Quick Take On SecureWorks

SecureWorks Corp. (NASDAQ:SCWX) reported its FQ2 2024 financial results on September 7, 2023, missing revenue but beating consensus earnings estimates.

The firm provides companies with security software and services to manage their IT cyberthreat environment.

I previously wrote about SecureWorks with a Hold outlook.

While leadership is cutting costs and reducing headcount and demand for its Taegis platform continues to increase, overall revenue continues to decline.

My opinion on SCWX is to Sell.

SecureWorks Overview And Market

Established in 1999, Atlanta-based SecureWorks specializes in delivering a range of endpoint security and vulnerability management solutions to organizations of various sizes.

CEO Wendy Thomas, formerly the CFO at Bridgevine and VP Finance at First Data Corporation, leads the company.

SecureWorks’ main products and services comprise:

– Taegis Extended Detection & Response [XDR]

– Managed Detection & Response

– Vulnerability Management

– Managed Services

– Security Assessments & Training.

SecureWorks wins clients through direct sales and marketing strategies, partner referrals and technological collaborations. Currently, the company serves over 2,000 customers utilizing its flagship Taegis XDR platform.

A 2021 market research study by Verified Market Research estimated the global endpoint security market at approximately $13.4 billion in 2020, with the forecast rising to $24.7 billion by 2028 representing a CAGR of 7.9% between 2021 – 2028.

This growth prediction stems from the anticipated increased adoption of AI/ML technologies and IoT applications fueling the demand for innovative endpoint security solutions.

Moreover, a growing number of complex malware attacks necessitates antivirus/antimalware solution providers to continuously update their detection tools with the most recent security patches.

Key vendors that offer or are in the process of developing endpoint security solutions include:

-

McAfee (Intel)

-

Symantec Corporation

-

ESET

-

AVG Technologies

-

Cylance

-

Palo Alto Networks

-

FireEye

-

F-Secure

-

Webroot

-

Okta

-

Sophos.

SecureWorks’ Recent Financial Trends

-

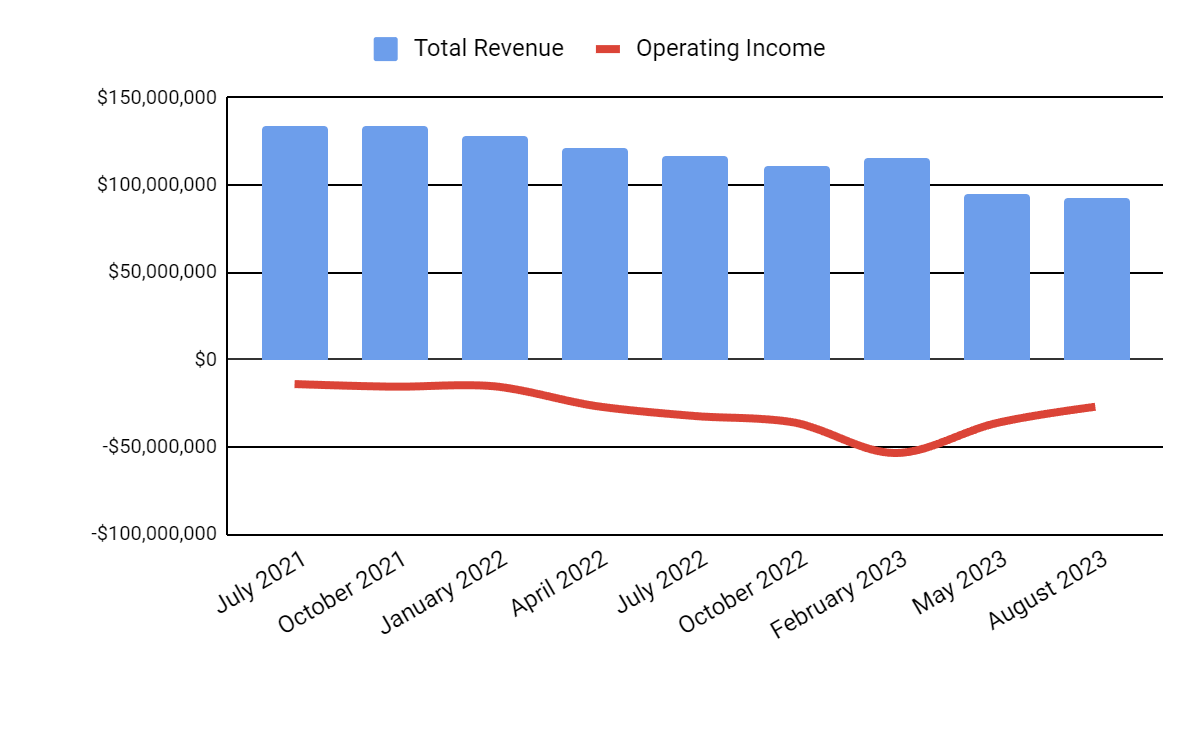

Total revenue by quarter has continued to decline; Operating income by quarter has remained substantially negative.

Total Revenue and Operating Income (Seeking Alpha)

-

Gross profit margin by quarter has trended lower in recent quarters; Selling and G&A expenses as a percentage of total revenue by quarter have moved materially higher more recently.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

Earnings per share (Diluted) have trended further into negative territory, a worrying trajectory.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

In the past 12 months, SCWX’ stock price has fallen 33.97% vs. that of the iShares Expanded Tech-Software Sector ETF’s (IGV) rise of 27.74%:

52-Week Stock Price Comparison (Seeking Alpha)

For balance sheet results, the firm ended the quarter with $64.9 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash used was a hefty ($92.8 million), during which capital expenditures were $1.7 million. The company paid $33.8 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For SecureWorks

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.2 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

1.3 |

|

Revenue Growth Rate |

-17.1% |

|

Net Income Margin |

-31.8% |

|

EBITDA % |

-28.2% |

|

Market Capitalization |

$532,070,000 |

|

Enterprise Value |

$477,040,000 |

|

Operating Cash Flow |

-$91,150,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.54 |

(Source – Seeking Alpha.)

SCWX’ most recent unadjusted Rule of 40 calculation was negative (45.3%) as of FQ2 2024’s results, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 Performance (Unadjusted) |

FQ4 2023 |

FQ2 2024 |

|

Revenue Growth % |

-13.4% |

-17.1% |

|

EBITDA % |

-24.0% |

-28.2% |

|

Total |

-37.4% |

-45.3% |

(Source – Seeking Alpha.)

Sentiment Analysis

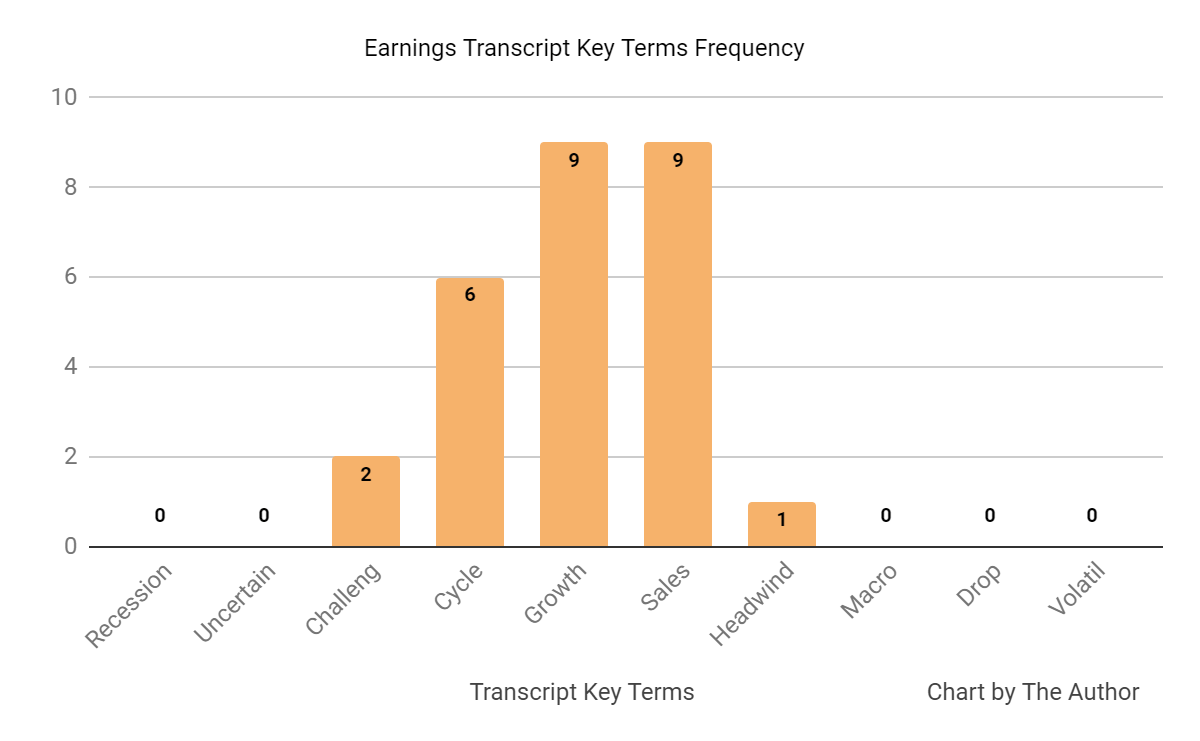

I prepared a chart showing the frequency of various terms mentioned (or not) in management’s most recent earnings call:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

The chart shows relatively few negative words mentioned outside of two instances of “challenges” and one of “headwind.”

Analysts questioned management about its sales efforts to drive customers to the firm’s Taegis platform and about sales cycle dynamics.

Leadership responded that the firm is expanding into Europe and the Middle East through partners there and that the company is seeing elongated sales cycles as companies are currently more fiscally conservative.

SEMRush’s website traffic monitoring shows that site visits have dropped materially over the past two years, as the chart shows here:

Organic Traffic History (SEMRush)

Commentary On SecureWorks

In its last earnings call (Source – Seeking Alpha), covering FQ2 2024’s results, management highlighted the growth in ARR for its Taegis XDR platform.

Leadership noted its partner-led go-to-market model through MSSPs, solution providers, cyber risk partners and technology alliance partners.

After the end of the quarter, the company announced a 15% workforce reduction and planned reduction in real estate expenses.

Management didn’t disclose any company or revenue retention rate metrics.

Total revenue for Q2 2023 fell 20% YoY and gross profit margin slid 0.4%.

Selling and G&A expenses as a percentage of revenue dropped 0.6% year-over-year and operating losses were reduced by 16.5% to $26.9 million for the quarter.

The company’s financial position is not good, with $65 million in cash but $93 million in free cash used in the past four quarters.

The firm’s Rule of 40 performance has been poor and is getting worse.

Looking ahead, fiscal 2024 revenue is expected to contract by 21.9% YoY, worse than fiscal 2023’s decline rate of 13.43% over fiscal 2022.

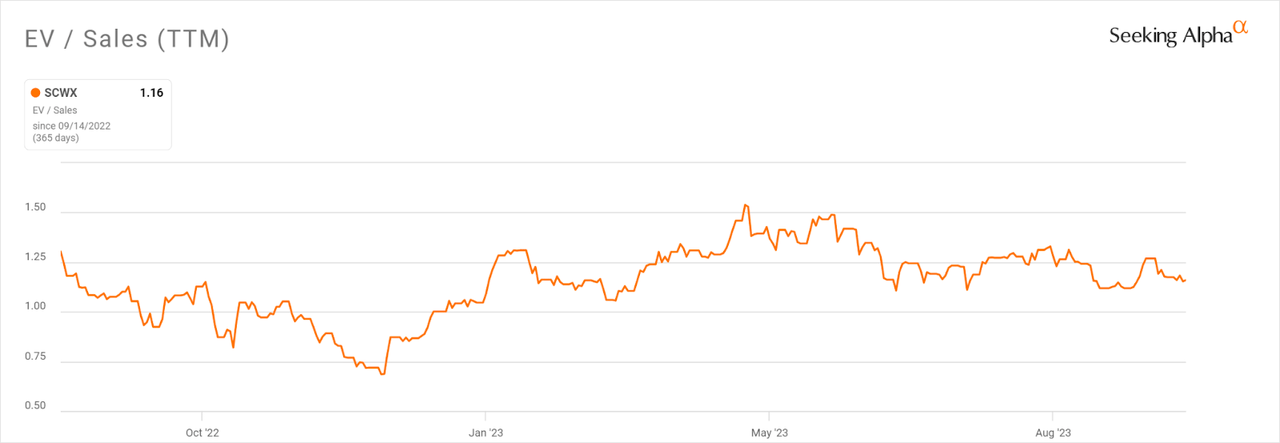

In the past twelve months, the firm’s EV/Sales valuation multiple has fallen by a net of around 11%, as the chart from Seeking Alpha shows below:

EV/Sales Multiple History (Seeking Alpha)

A potential upside catalyst to the stock could include an improvement in sales cycles and demand growth for its flagship Taegis platform.

However, given a cautious business environment and the continued bite from higher interest rates, I’m not optimistic.

While management is making moves to reduce operating losses, overall revenue growth through partners is not yet showing up in its financial results.

My opinion on SecureWorks Corp., therefore, is to Sell.

Read the full article here