Shell (NYSE:SHEL) is one of the largest oil companies in the world, with a market cap of just $200 billion. The company is diversifying its business, but as we’ll see throughout this article, it’s lower valuation with strong assets and diversification can enable the company to generate strong shareholder returns.

Shell Financial Performance

The company’s financial performance has remained strong relative to its valuation and more expensive western peers.

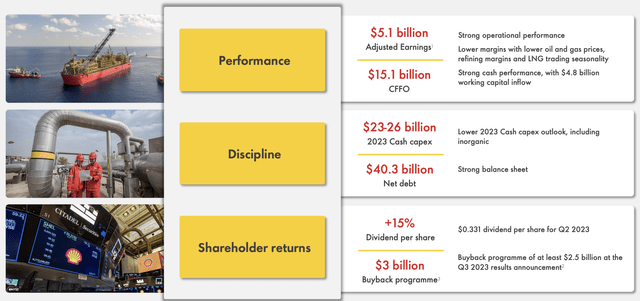

Royal Dutch Shell Investor Presentation

The company had $5.1 billion in adjusted earnings and $15.1 billion in CFFO. The company’s net debt of $40.3 billion is 20% of its market capitalization, which is incredibly manageable. The company’s 2023 capex is expected to be ~$24.5 billion, or $6.1 billion per quarter, meaning the company’s FCF is roughly $9 billion per quarter.

That’s a strong double-digit FCF yield for the company and helps to highlight its financial position. The company has an almost 5% dividend yield that it’s recently bumped up by 15%, showing its financial strength, and a $3 billion buyback program. Both of these shareholder returns are high-single digit returns that the company can comfortably afford.

Shell Commodity Prices

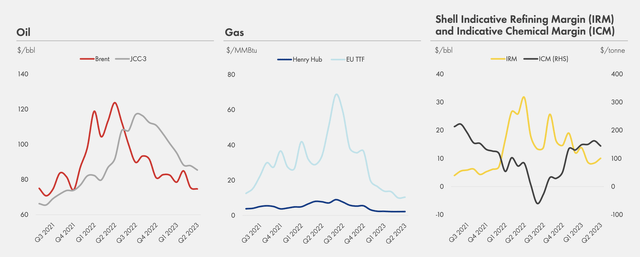

The company’s ability to drive returns remains subject to commodity prices.

Royal Dutch Shell Investor Presentation

The company saw Brent prices skyrocket before recent weakness. Recently, due to major efforts by OPEC+, prices have recovered to almost $85/barrel. That’s with almost 4 million barrels/day in production cuts that the company is working to maintain. That means Shell’s FCF should potentially increase from current levels.

From a natural gas standpoint, Henry Hub has remained week while EU TTF has remained strong. The company’s margins have seen some weakness in refining, but the overall integrated assets remain strong.

Shell Emissions

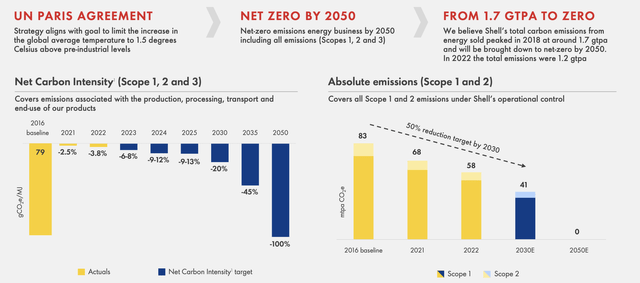

Shell has set an incredibly aggressive target of net-zero Scope 3 emissions by 2050.

Royal Dutch Shell Investor Presentation

The company’s emissions are baselined in 2016 although they peaked at 2018 at 1.7 gigatonnes per annum. The company’s reduction process will be difficult, especially for Scope 3 which is part of the company’s production. For Scope 1 and 2 the company is targeting a 50% reduction by 2030 although Scope 1-3 emission reductions will only be 20%.

The biggest question will be whether the company can accomplish its 2035 goal of a 45% Scope 1-3 reduction. Still this is much more aggressive than western companies and, if accomplished, it has an ability to protect the company’s business model. It will be a very difficult thing for the company to accomplish.

Shell Shareholder Return Potential

The company’s shareholder returns come from strong cash flow along with diversification.

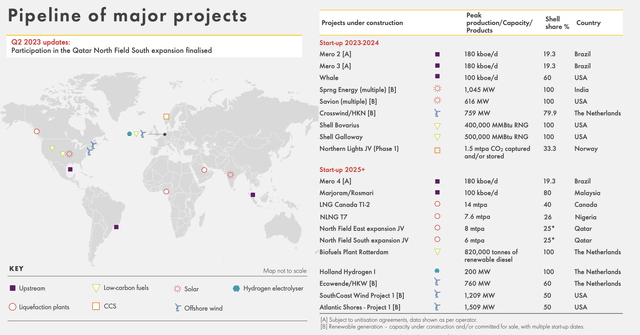

Royal Dutch Shell Investor Presentation

The company has a number of projects starting up in 2023-2024, with roughly 140 thousand barrels/day in new production. In 2025+ the company has much more than that coming along, but even more important than renewable energy, is the massive amount of LNG that the company has coming online. LNG is increasingly in high demand and popular.

The company is well positioned for this. Its share of LNG coming online is 11 mtpa. At the same time, the company has numerous renewable projects coming online which will help with its diversification and renewable energy goals. However, this is a segment it will need to ramp up for the energy targets discussed above.

Thesis Risk

The largest risk to our thesis, as the company revamps its portfolio, is crude oil prices. The company has a much lower valuation than its west coast peers, which helps it out, but it still needs high prices to be profitable. At current prices it’s profitable, but with market weakness in China, for example, oil prices could drop even with production cuts.

Conclusion

Shell has an impressive portfolio of assets. The company’s production remains strong along with its profit margins. The company’s FCF is some of the highest in the industry, and it trades at a lower valuation than its western peers. That helps the company substantially in terms of its ability to drive returns.

The company has recently increased its dividend substantially, and it’s working to repurchase shares. At the same time, the company has aggressive renewable targets that could help to protect its industry if it accomplishes them. Whether that happens remains to be seen. But, overall, Shell presents an impressive investment opportunity.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here