The Shopify Investment Thesis Appears Bright, Thanks To The Two Pronged Approach

We previously covered Shopify (NYSE:SHOP) in May 2023, discussing the management’s decision to shed its logistics segment.

We believed that this was a prudent strategy indeed, since it allowed the company to better focus on its higher-margin SaaS offerings, while accelerating its market share in the headless commerce solution market globally.

Combined with the guidance of Free Cash Flow [FCF] profitability for every quarter of 2023, thanks to the improved monetization rate, it was unsurprising that the SHOP stock had also took off then.

For now, SHOP has met expectations with another quarter of positive earnings in FQ2’23, with adj operating income of $146M (+570.9% QoQ/ +447.6% YoY) and FCF generation of $97M (+12.7% QoQ/ +211.4% YoY). This is despite the moderate revenue growth to $1.69B (+12.6% QoQ/ +31% YoY).

We believe that this promising development is attributed to two key strategies.

One, SHOP has raised its subscription prices by +34% from April 2023 onwards, triggering the gross margin expansion of the highly profitable Subscription Solution segment to 80.8% (+2.1 points QoQ/ +4.1 YoY) in the latest quarter.

Two, the shedding of logistics segment has been the right call after all, since the management has already guided up to 3 points improvement in its overall gross margins from the next quarter onwards. This is compared to the 49.3% (+1.8 points QoQ/ -1.4 YoY) reported in FQ2’23.

The improved profitability is unsurprising indeed, since the Shopify Fulfillment Network and Deliverr have been previously dilutive to its Merchant Solutions gross margins.

For example, SHOP reported Merchant Solutions gross margins of 38% (+0.8 points QoQ/ -2.3 YoY) in the latest quarter, down from its FY2021 levels of 42.9% (+2.1 points YoY) prior to the acquisition of Deliverr.

With FQ3’23 expected to fully benefit from both the hiked prices and the logistics divestiture, it is unsurprising that market analysts have priced in the acceleration of SHOP’s profitability by FY2023, compared to the previous projection of FY2025.

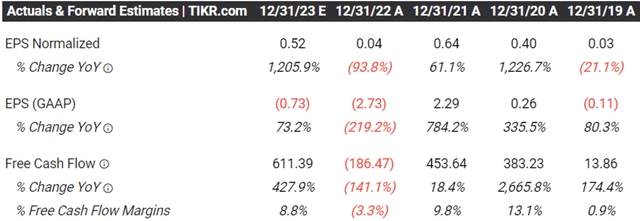

SHOP’s Projected Profitability

TIKR Terminal

The projected improvement is drastic indeed, with market analysts expecting adj FY2023 EPS of $0.52 (+1,205.9% YoY) and FCF generation of $611.39M (+427.9% YoY). The expanded profitability will further boost its healthy balance sheet, with net cash of $3.87B (-2% QoQ/ -35.9% YoY) in the latest quarter.

In addition, despite the elevated interest rate environment, there are early signs of market sentiment recovery, with Amazon (AMZN), the global e-commerce giant reporting smashing FQ2’23 performance with revenues of $134.38B (+5.5% QoQ/ +10.8% YoY).

The same has been reported by PayPal (PYPL), with the fintech recording nearly +6.5% MoM growth for branded checkout volume in June 2023 and another +8% MoM in July 2023, as “the highest monthly growth rate since the end of the pandemic.”

These developments corroborates with SHOP’s expanding Gross Merchandise Volume [GMV] of $55B (+10.8% QoQ/ +17.5% YoY) and Gross Payment Volume of $31.7B (+15.2% QoQ/ +27.3% YoY) in FQ2’23.

Its Monthly Recurring Revenue has also expanded to $139M (+19.8% QoQ/ +29.6% YoY), with Plus merchants contributing $41M (+5.1% QoQ/ +21.6% YoY).

With the July 2023 CPI appearing to be moderating at +3.2% YoY, compared to +8.5% a year ago, we believe consumer spending may return to its steady growth state as the inflation trend moves in the right direction.

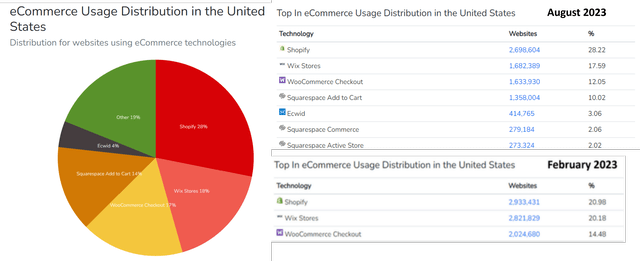

SHOP’s Market Share in the US eCommerce Usage Distribution

Built With

With the Fed expected to pivot in the near term, SHOP’s prospects appear to be very bright indeed. This is significantly aided by its growing market share in the US eCommerce Usage Distribution to 28.22% by August 07, 2023 (+7.24 points from February 2023).

In the long-term, SHOP’s entry into the advertising market is not overly speculative as well, with the recent introduction of Audiences, as “a tool that helps (sellers) to find new customers by generating an audience list for advertising platforms.”

With the platform only generating improved conversion rate and GMV for now, we believe its monetization of Audiences (amongst other advertising tools) is only a matter of time, as similarly witnessed with AMZN’s Amazon Ads offerings and Sponsored Display.

It is important to note that AMZN has had great success in the segment, with accelerating advertising revenues to an annualized sum of $42.72B (+12.4% QoQ/+22% YoY) by the latest quarter. This is on top of the growing global digital ad market share to 12.4% in 2023 (+0.7 points YoY), thanks to its multi-channel offerings.

Therefore, with the management already laser focused on growth and profitability, while tapping into multiple AI opportunities, we believe the SHOP still has a long runway ahead of it.

So, Is SHOP Stock A Buy, Sell, or Hold?

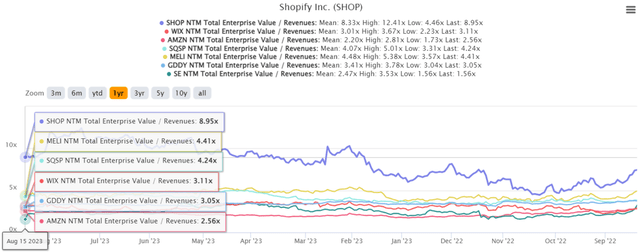

SHOP 1Y EV/Revenue Valuations

S&P Capital IQ

Then again, these promising developments have also over inflated SHOP’s valuations to NTM EV/ Revenues of 8.95x, compared to its 1Y mean of 8.00x, its e-commerce peers’ median of 0.91x, and IT service peers’ median of 3.07x.

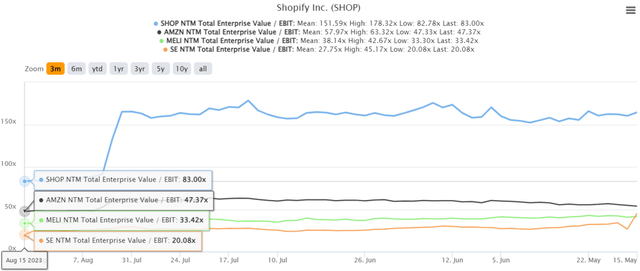

SHOP 3M EV/ EBIT Valuations

S&P Capital IQ

The same is also observed with SHOP’s NTM EV/ EBIT of 83.00x, compared to its e-commerce peers’ median of 8.87x and IT service peers’ median of 18.90x.

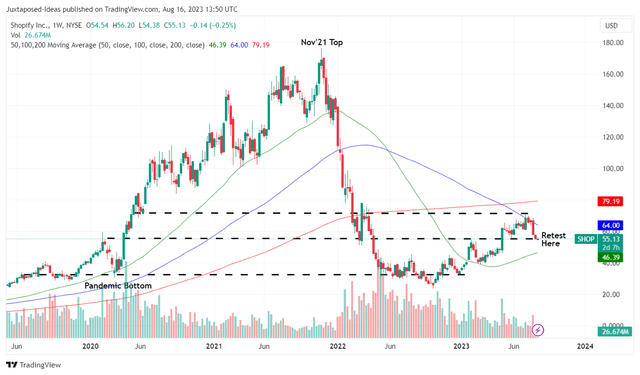

SHOP 5Y Stock Price

Trading View

Therefore, while SHOP’s recent pullback may seem attractive, thanks to its accelerated profitability and high growth cadence, we are not convinced by the lofty valuations yet.

While the stock may be a great addition to most portfolios, investors may want to wait for a further retracement to our previous buy recommendation of low $40s in March 2023 for an improved margin of safety.

We prefer to rate the SHOP stock as a Hold here. There is no need to rush.

Read the full article here