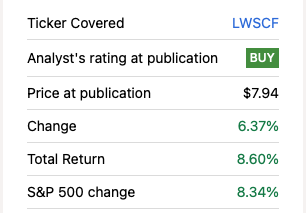

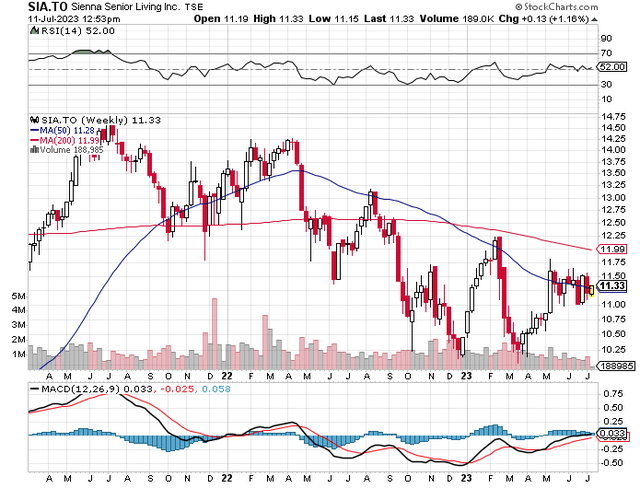

I last covered Sienna Senior Living (OTCPK:LWSCF)(TSX:SIA:CA) a few months ago from which the stock has recovered a little and, thanks to its massive dividend, beat the U.S. market returns, as shown in the table below.

Seeking Alpha

(The company reports in Canadian dollars, so the figures in this article are in CAD$ unless otherwise noted.)

Recent Results

Since then, the company has reported its Q1 results, which appear to be an improvement from a year ago. The occupancy rate improved about 3% for its retirement and long-term care (“LTC”) portfolios to 87.8% and 96.8%, respectively.

Recall that its LTC portfolio is supported by government funding, which at least partly explains why its LTC portfolio has a higher occupancy. The Q1 MD&A wrote, “Our [LTC] operations saw steady resident admissions through the quarter, with most communities returning to occupancy levels at or above 97%, making them eligible for full funding.”

Its assets include 43 LTC communities (with 6,691 beds), 39 retirement residences (with 4,445 suites), and 11 managed residences (with 1,283 beds or suites) in the Canadian provinces of Ontario, Saskatchewan, and British Columbia.

Sienna Senior Living Q1 MD&A

Adjusted revenue climbed 14.5% to $199.6 million, but the adjusted operating expenses more than kept pace with an increase of 14.9% to $163.3 million.

The same-property net operating income (“NOI”) climbed 9.9%, driven by change in same-property NOI of 11.0% for the retirement portfolio and 9.1% for the LTC portfolio. Total NOI climbed 13.0% to $36.3 million.

The administrative expenses increased moderately by 5.4% to $8.4 million. The adjusted EBITDA, a cash flow proxy, rose 14.3% to $30.6 million. The operating funds from operations (“OFFO”) also rose 14.3% to $18.4 million, while the adjusted FFO rose 10.6% to $18.2 million.

On a per-share basis, the OFFO and AFFO rose 5.9% and 2.5%, respectively, to $0.253 and $0.254. So, the payout ratio based on AFFO was 94.0%. Although the AFFO payout ratio was an improvement from 96.3% a year ago, it’s still high for most dividend investors’ comfortability or standard. Hopefully, an improving operating environment and a better control of costs would keep its dividend safe.

The company’s financial ratios show a mixed view with the debt to gross book value rising to 44.5%, the weighted average cost of debt rising to 3.6%, the interest coverage ratio falling to 3.2, but the debt to adjusted EBITDA falling to 8.4 and the debt service coverage ratio remaining flat at 1.8. Nonetheless, its debt obligations appear to be manageable.

Challenges

Some recent challenges include inflationary pressures on costs that have been impacting its margins. Sector-wide staffing challenges required Sienna to use a higher level of agency staff, which has been a key factor in its cost increase.

Sienna has been working on reducing the reliance on agency staff, while engaging and retaining team members. By reducing the number of staffing agencies it works with, Sienna has been able to reduce agency rates by about 15%.

Other than inflationary pressures, higher interest rates could also weigh on Sienna’s bottom line.

Valuation, Dividend Safety, and Returns Potential

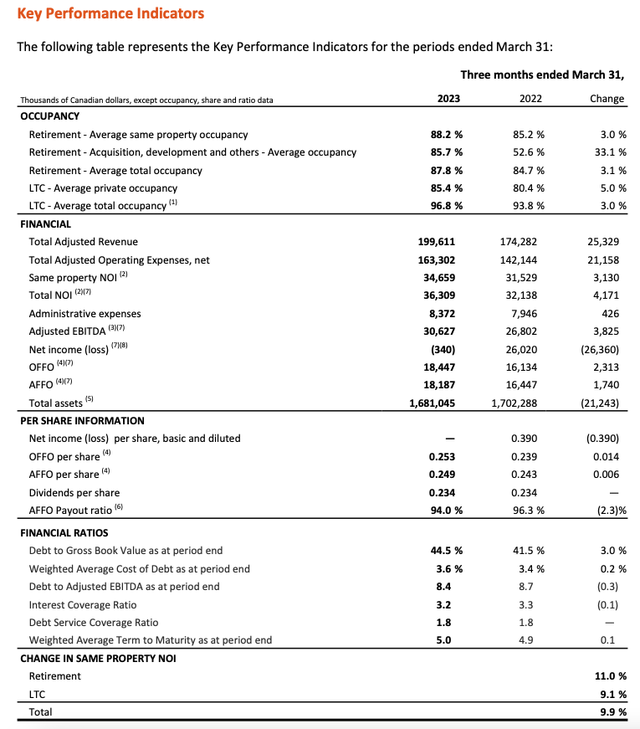

Sienna Senior Living lacks recent coverage on Seeking Alpha. However, Wall St. analysts have a 0-18 month price target of $13.50 on the stock, which represents a discount of about 16% at $11.35 per share at writing. This target also implies near-term upside potential of about 19%.

Seeking Alpha

If the stock maintains its monthly dividend of $0.078 per share, it can add about 8.2% of returns per year based on the current yield. However, as stated earlier, its payout ratio is high and therefore, leaves little margin of safety.

Also, its trailing-12-month free cash flow payout ratio was about 114%. So, it’d be natural for investors to question the safety of its dividend despite the company having maintained or increased its dividend since 2011. Notably, in half of the past 12 years, the company only maintained its dividend.

Low dividend growth seems to be common in the sector. For your reference, Sienna stock’s 12-year dividend growth rate was almost 3% — aligning more or less with the long-term rate of inflation.

Technically

Technically, the stock appears to be basing, but today the 50-week simple moving average remains a resistance. The next resistance would be about $12.

Stockcharts

Canadian Senior Housing Demand

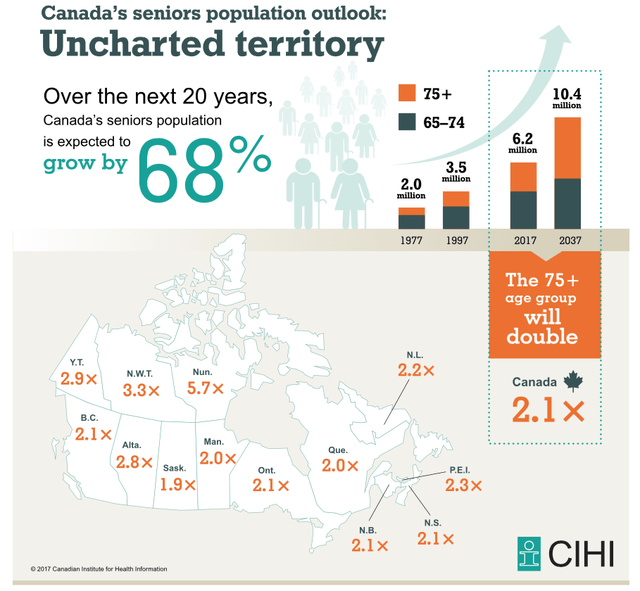

There’s a long-term trend in a rising aging population in Canada, which should lead to greater demand for senior housing.

Canadian Institute for Health Information

In 2017, the Canadian Institute for Health Information stated that “over the next 20 years, Canada’s seniors population — those age 65 and older — is expected to grow by 68%.”

Statistics Canada published that “On July 1, 2022, almost one in five Canadians (18.8% of the population; 7,329,910 people) was at least 65 years of age.” In 2021, it also expected the aging population to increase to 24% by 2036. One main conclusion for its report on housing needs for seniors was that “there is a need to increase the supply of housing for seniors overall, with options that consider the range of health needs and income status of seniors,” for which Sienna Senior Living would come into play.

Investor Takeaway

Cushman & Wakefield published a 2023 Canadian Seniors Housing Industry report, noted that “Favourable supply and demand fundamentals are expected to lead to a strong multi-year growth and recovery cycle…” and “…2023 [could be the time to] put capital back to work on an attractive risk/return basis at a higher yield and increasingly pronounced discount to replacement cost.”

Sienna Senior Living trades at a slight discount of roughly 16% and offers a massive dividend of 8.2%. It has shown improving operations, but high inflationary pressures and regular staff shortages remain a challenge that it continues to navigate.

There’s a long-term demand for senior housing, but the last decade or so history indicates a translation to low dividend growth. Furthermore, the high payout ratio also leaves little margin of safety for the dividend. Therefore, we rate Sienna as a cautious buy for high-risk investors seeking total returns.

Notably, the company will be reporting its Q2 results on August 10 after market close. Interested investors can wait until then for the latest results and outlook of the company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here