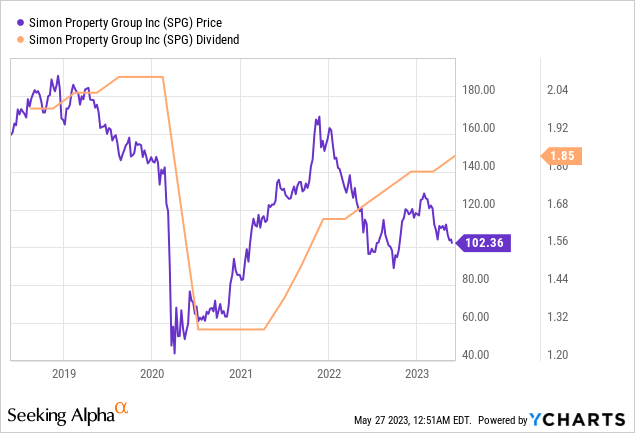

I’m now looking to buy Simon Property Group (NYSE:SPG) due to its dividend yield moving up to 7.2%. This happened on the back of a quarterly payout that was recently hiked to $1.85 per share, a 2.77% increase from the prior figure. The dividend payouts have been on a marked rise since they were suspended for a quarter during the pandemic and eventually cut by 38% when they resumed. What’s the play here? That the retail REIT will be able to boost its quarterly payouts to its pre-pandemic level of $2.10 in the near term. There is a lot at stake here, with the shopping centre and mall owner trading far above its tangible book value. Whilst this can be entirely justified with cash flow from operations outstripping its tangible book value on an annual basis, a highly diversified retail portfolio, and high occupancy rates, the wider REIT universe is characterized by double-digit yields available for cents on the dollar.

Hence, a long Simon position is entirely built on the growth of the dividends, and its eventual return to its pre-pandemic trendline, which had seen this payout raised every year in the decade before the pandemic. The yield has moved higher in recent months on the back of commons that are down by 13% since the start of the year, the selloff deepening in March on the back of the regional banking crisis and pertinent fears around the health of US commercial real estate. However, I think Simon is a buy here on the back of a robustly covered dividend yield, healthy occupancy rates, and an expansion of FFO.

Seeking Alpha

Revenue Beats As Occupancy Rises

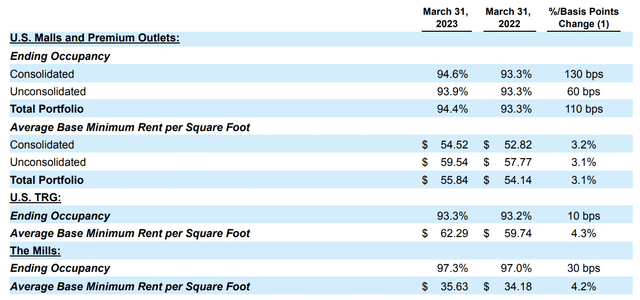

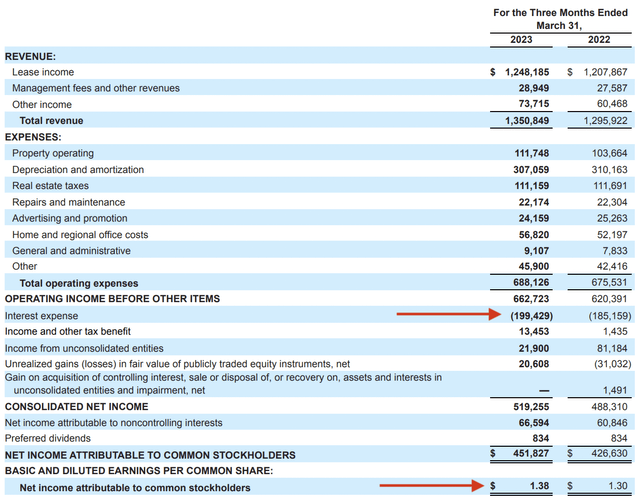

Simon last reported fiscal 2023 first-quarter earnings that saw revenue come in at $1.35 billion, an increase of 3.8% over the year-ago comp and a beat by $80 million on consensus estimates. Higher lease income drove most of the revenue gains, with occupancy at their US malls and outlets moving up 110 basis points to 94.4% as of the end of the first quarter. However, it did decline sequentially from a 94.9% occupancy in the prior fourth quarter.

Simon Property Group

The retail REIT also saw its average base minimum rent per square foot grow by 3.1% year-over-year to $55.84. This came as reported retailer sales per square foot grew 3.3% to $759 for the trailing 12 months as of the end of the first quarter. Simon would also see domestic property net operating income rise 4% year-over-year against total operating expenses of $688.1 million, a sequential drop from $715.7 million in the fourth quarter but a small 1.86% increase from the year-ago comp.

Simon Property Group

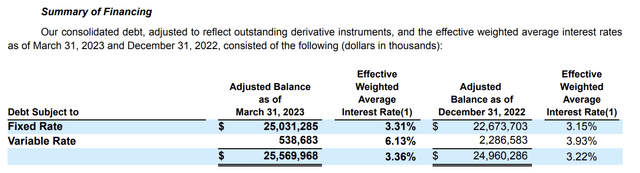

I like how little interest expenses increased from their year-ago comp against a Fed funds rate that increased from near-zero to a 5% upper range as of the end of March. This came on the back of fixed-rate debt forming around 98% of their financing and at an effective weighted average interest rate of 3.31%. The REIT has a blended weighted average interest rate of 3.36% when its variable rare debt is included, and recently secured a $5 billion revolving credit facility at SOFR plus 82.5 basis points.

Simon Property Group

FFO Outlook And Total Returns For The Rest Of 2023

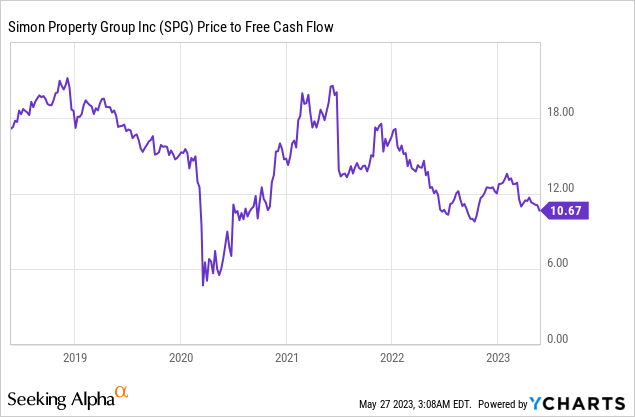

The last two years for the stock market have been defined by disruption and decline, perhaps chaos. 2023 saw the regional banking crisis get aggregated with the specter of a recession to push down the valuation of REITs. Simon now trades on a price-to-forward FFO multiple of 8.49x, around 28% lower than its peer group median. On a price-to-free cash flow basis, the REIT sits at its lowest level since 2020. Simon saw its first-quarter FFO come in at $2.74 per share, an increase of $0.04 from the year-ago quarter but a miss on consensus estimates for FFO to come in at $2.81 per share. This meant a 67.5% payout ratio when set against their raised quarterly dividend. Crucially, it also means there is more capacity for raises in the near future.

Indeed, Simon could increase the quarterly to its pre-pandemic level of $2.1 per share and its payout ratio would still sit below 100% at 76.65%. Simon also increased its guidance for 2023 FFO per share to be in the range of $11.80 to $11.95 from a prior outlook of $11.70 to $11.95. This new guidance at the top end would also outperform the consensus of $11.93 by $0.02. Hence, whilst I like the abnormally high yield on cost of the preferreds (NYSE:SPG.PJ) at 7.7%, they’re still trading above par and the yield on the commons is increasingly converging. From a macroeconomic viewpoint, 2023 will likely see a continuation of the disruption. Total returns this year could see dividends continue to do the heavy lifting. I’m looking to start a position in the commons later this month.

Read the full article here