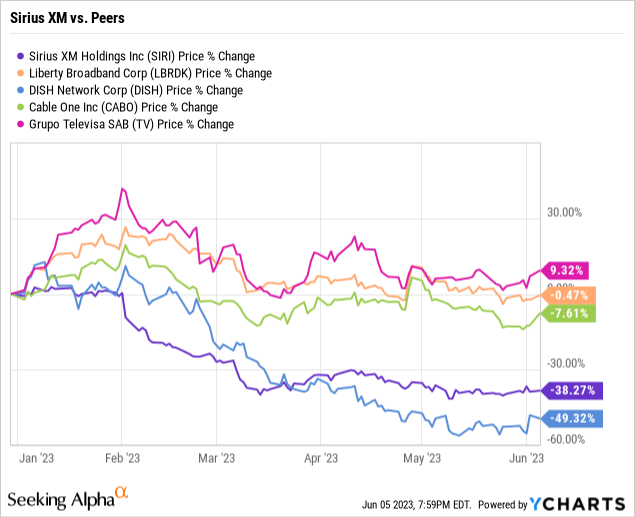

Sirius XM (NASDAQ:SIRI) now sells at 12.10 FWD P/Es and is down 38.17% YTD. I entered a position at $3.83 on April 4th and $3.44 on May 9th. Sirius XM has been especially beaten down with only DISH (DISH) having larger losses YTD out of its peers. Sirius XM is an unpopular stock due to its lower growth rates, but at current prices, I see the stock as a small buy. As Benjamin Graham states in his book The Intelligent Investor, “the stock market is a popularity contest in the short term, but a very accurate weighing scale in the long term.” Sirius XM is definitely not a popular stock due to the slow growth over the last few years, but has been unjustly oversold this year.

Buying Opportunity

As shown above, Sirius XM’s peers are all also done YTD but only SIRI and DISH have dropped over 30%. After falling over 30% in the last year, is there value in buying Sirius XM at the current price? According to Benjamin Graham’s value investing strategy, in order to find value in common stocks, they must be selling at a low multiple in relation to earnings. For example, 15 is the maximum P/E ratio Graham would recommend buying. He also restricts the P/B ratio to 1.5. The only exception to a stock not satisfying both criteria is if the P/E multiplied by the P/B is less than 22.5. Sirius XM does not satisfy the P/B ratio due to the heavy debt on their balance sheet which is a major concern and will be addressed later.

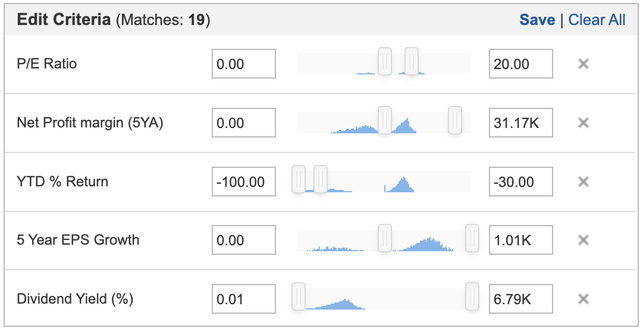

Using the simple stock screener, Sirius XM is one of 19 remaining. Volume over 500k was also one criterion but not shown in the image below.

Beat Up Dividend Stocks (Investing.com Stock Screener)

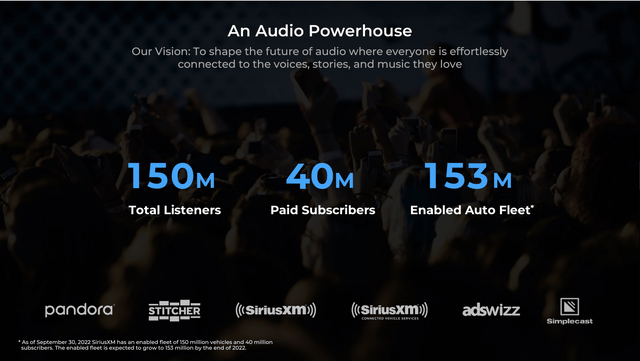

SIRI is still an “audio powerhouse” with over 150 Million total listeners including 40 million paid subscribers. Sirius XM’s price and market cap have dropped most likely due to concerns of slow growth which has been a theme in the last few years as they already own a large market share of cars in the US.

Sirius XM’s an Audio Powerhouse (Sirius XM’s Investor Presentation)

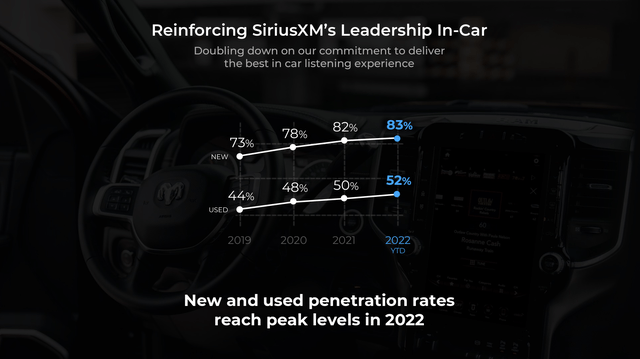

Dominance in Car and Growth Opportunities

Sirius XM continues to grow their influence in cars with their fleet now topping 153 Million including penetration rates of 83% and 52% in new and used cars respectfully. Along with committing to their success for in-car entertainment, SIRI is pushing XM Everywhere, “The Next Phase to our Evolution.” XM Everywhere will help expand away from cars by adding streaming services with a new revamped app, exclusive content and expanded reach through new distribution channels and promotional agreements. Adding Podcasting to Pandora is also another potential growth channel.

Sirius XM’s In-Car Dominance (Sirius XM’s Investor Presentation)

Sirius XM’s also expanding their ad network to further encompass the audio advertising ecosystem. This will further push growth in their ad platform which already grew over $100M YoY in their fiscal 2022.

Dividend Growth

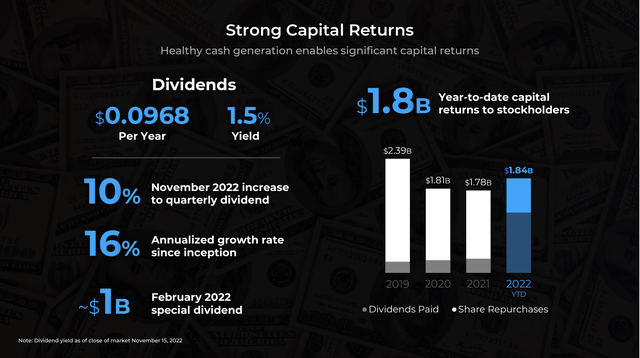

Sirius XM continued their consistent dividend growth with a 10% increase in November. Consistent dividend appreciation makes me even more comfortable with entering into a position at essentially 7-year lows. SIRI paid out a special $1 Billion dividend in 2022 adding to the potential appeal and growth opportunities to the dividend play here.

Sirius XM Dividend Growth Rate and Summary (Sirius XM’s Investor Presentation)

Investment Risks

With every investment comes risks, with Sirius XM we have to worry about their large amount of debt along with their weak growth. As mentioned before, Sirius XM did not pass Graham’s P/B ratio due to having over $9B in debt leading to a Tangible Book Value/Share of -$2.46. This heavy debt could certainly hinder both growth rates and dividend growth rates in the future. However, they were still able to increase dividends back in November and have kept steady at the new quarterly dividend of $0.0242/share.

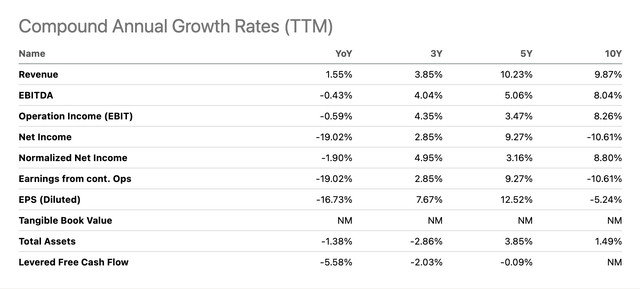

Siris XM’s Slow Growth (Seeking Alpha)

Slow growth has been a problem for Sirius XM over the last several years and they’re even predicting a negative self-pay net adds for this year. Revenues and earnings have barely grown over the last 3 years hovering between 2-5% growth. Even though we won’t see any 20%+ growth rates from SIRI, it’s still a stable profitable company with an appreciating dividend.

Overall Verdict: Buy And Hold

Sirius XM shows some promise as a value pick, with a P/E GAAP FWD and TTM 30% lower than the general sector showing upside. Any correction towards the sector P/E would ensure gains from our investment with the added benefit of a small dividend. While there is some upside with SIRI, I’m calling this a buy and hold until the stock recovers to 2022 levels and will likely sell around the 52-week high of $6.85. Despite the heavy debt and slow growth rates, I am long on SIRI, and I entered a position at $3.83 on April 4th, 2023 and $3.44 on May 9th, 2023.

Read the full article here