If the Federal Reserve is serious about “fighting inflation” enough to bring it down to their 2% target, then we believe inflation is still far too high to justify a “pause” in interest rates hikes, much less rate cuts.

Here are six charts to prove our point.

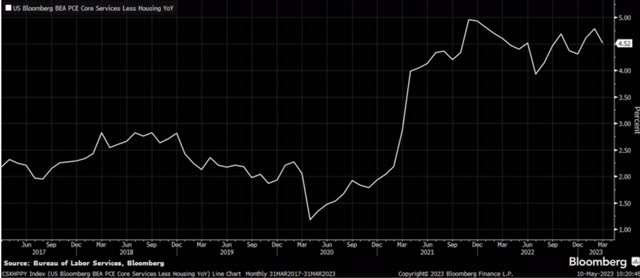

#1: “Super Core” Inflation Remains Stubbornly High

The chart below shows the key inflation gauge Fed Chair Jay Powell is focused on, which is referred to as “super core” inflation. It is PCE Services less Food, Energy and Housing inflation. It is up 4.5% year-over-year, which is more than double the Fed’s 2% target. It has remained stubbornly high for nearly two years, despite one of the most aggressive Fed tightening cycles in history.

Bureau of Labor Services, Bloomberg

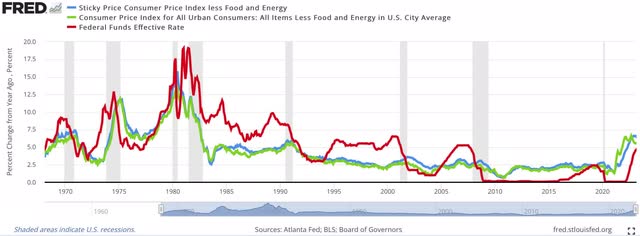

#2: The Fed Does Not Cut Rates When Inflation Is This High

This next chart shows the Fed has historically raised the Federal Funds Rate (red line) above both Sticky Price CPI less Food and Energy (blue line) and Core CPI less Food and Energy (green line). The current Fed Funds target rate of 5% to 5.25% is still below the 6.3% increase in Sticky Price CPI less Food and Energy and the 5.5% increase in Core CPI less Food and Energy in April. And keep in mind that food inflation was up 7.7% in April. High food inflation is a major hardship for consumers, which makes it an important political issue that pressures the Fed to keep hiking rates.

FRED

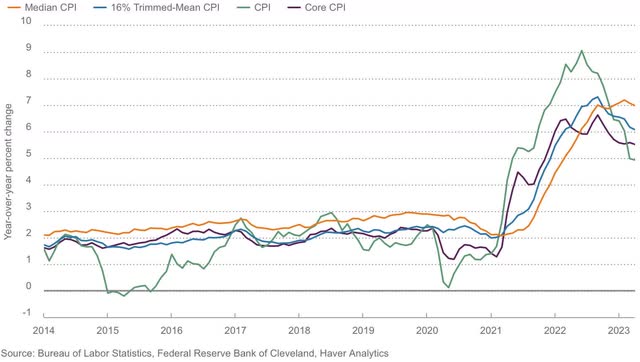

#3: Median CPI Hasn’t Budged In Eight Months

Another important inflation measure the Fed focuses on is Median CPI. According to the Cleveland Fed, “Median CPI is the one-month inflation rate of the component whose expenditure weight is in the 50th percentile of price changes. By omitting outliers (small and large price changes) and focusing on the interior of the distribution of price changes, the median CPI…can provide a better signal of the underlying inflation trend than either the all-items CPI or the CPI excluding food and energy (also known as core CPI).”

Median CPI (orange line) increased 7% in April, which is more than triple the Fed’s 2% inflation target, as shown below. This measure of inflation has been stubbornly high for the past eight months, ranging between 6.9% and 7.2% since September 2022.

Cleveland Fed

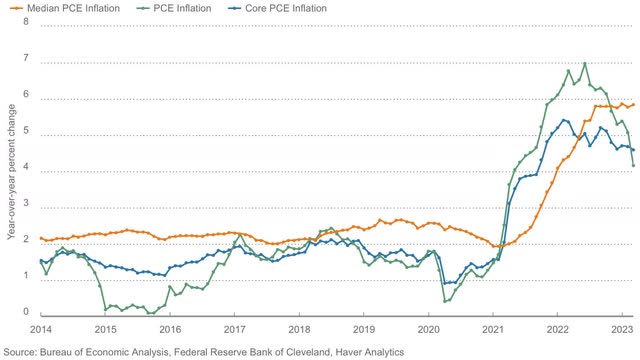

#4: Median PCE Hasn’t Budged In Nine Months

A similar measure is Median PCE. According to the Cleveland Fed, “Median PCE inflation is the one-month inflation rate of the component whose expenditure weight is in the 50th percentile of price changes. By omitting outliers (small and large price changes) and focusing on the interior of the distribution of price changes, the median PCE inflation rate can provide a better signal of the underlying inflation trend than either the all-items PCE price index or the PCE price index excluding food and energy (also known as the core PCE price index).”

The following chart shows Median PCE (orange line) increased 5.8% in March. It has been remarkably steady for the past nine months at 5.8% or 5.9%, which is nearly triple the Fed’s 2% inflation target.

Cleveland Fed

#5: Inflation Expectations Remain Very High For The Coming Year

Consumer inflation expectations remain high and are starting to rise again. This is very concerning since consumer expectations strongly influence wage negotiations and the prices companies must charge to pay those wages. The May University of Michigan consumer survey shows that consumers expect 4.5% inflation over the coming year. This chart shows inflation expectations for the coming year have been rising lately.

University of Michigan

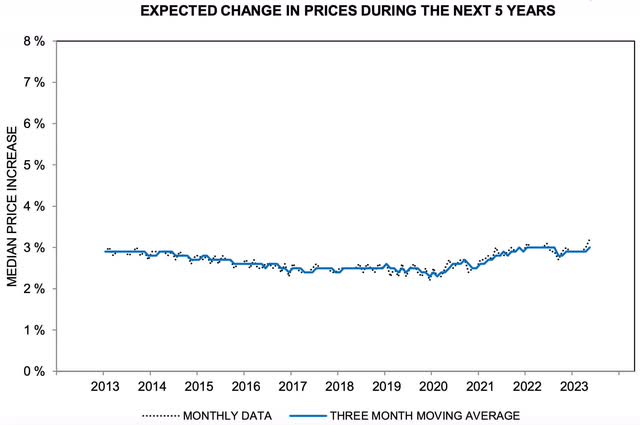

#6: Inflation Expectations Are Rising For The Next Five Years

Perhaps more concerning is consumers expect 3.2% inflation over the next five years, which is up from 3.0% in April and more than 50% higher than the Fed’s target. This chart shows five-year inflation expectations are also rising.

University of Michigan

Both Rate Hikes & Rate Cuts Are Potentially Bearish

Based on these facts, we believe if Jay Powell wants to be remembered as a successful inflation fighter like former Fed chair Paul Volcker, he needs to see these core measures of inflation and inflation expectations come down much closer to his 2% target before he can consider pausing rates, much less cutting them.

The market is now pricing in a 40% chance of another rate hike in June, up from only 10% about a week ago. More rate hikes with the yield curve inverted, money supply declining, an ongoing banking crisis and most leading economic indicators pointing toward recession this year is not a bullish recipe for the stock market.

If the banking crisis and/or a recession becomes bad enough, it could pressure the Fed to pause or cut rates, even if inflation remains well above their target. Then we’d have 1970s-style “stagflation”, the worst of both worlds. Needless to say, that would also likely not be bullish for stocks and other risk assets.

We believe the Fed truly is between a rock and a hard place and investors are likely to pay the price either way – unless inflation starts slowing significantly soon.

Read the full article here