This is a follow-up article to my initial report on Smart Sand (NASDAQ:SND) published in February 2023. In hindsight, there are a few aspects to the business I was off on, primarily their profitability and debt servicing. Smart Sand has done a tremendous job in turning around their profitability and improving their contribution margin through improved efficiency in their mining operations. Despite their drastically improved contribution margin and profitability, I will be upgrading my rating to SELL from Strong Sell previously. Despite the improved margin, SND shares trade at a relatively high premium and have historically experienced a price spike post earnings with waning decline. Given their expensive valuation and price volatility, I provide SND a price target of $1.66/share.

Operations & Financials

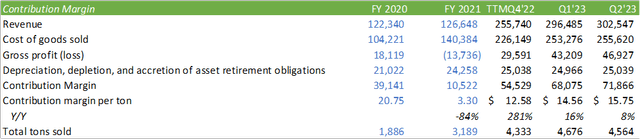

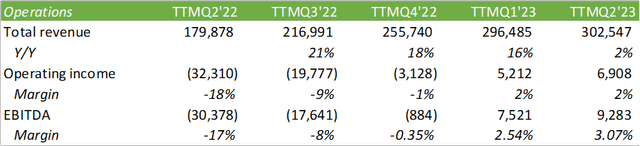

On a TTM basis, Smart Sand has improved their contribution margin by 8% to reach $15.75/ton, providing improved margins to achieve $9mm in EBITDA. This is a significant improvement from a year ago off of their q3’22 contribution margin of $12.75. Though margins are moving in the right direction for Smart Sand, they still remain compressed when comparing to pre-C19 margins of $28/ton and $43.24/ton for the fiscal years 2018 and 2019, respectively.

Corporate Reports

This has trickled positively into their ability to generate cash from operations. Smart Sand has been able to improve their EBITDA margin to 3% on a trailing basis on lower volumes production.

Corporate Reports

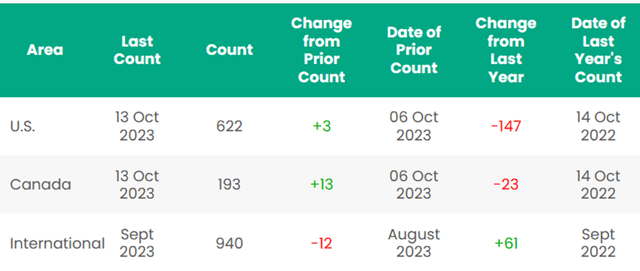

There may be some challenges arising in 2h23 as activity has moderated in the Marcellus. Using Baker Hughes (BKR) rig count, rigs peaked at 42 gigs in the Marcellus for 2023 and is currently sitting at 29. This is a -29% decrease in rig activity in the basin. The Permian has also experienced a significant decline in activity with rigs down 10% from the previous year.

One aspect worth noting is the increased interest in offshore drilling. Offshore rigs in the US are up 57% from the previous year and is expected to continue to generate interest on a global basis. Despite the ESG value Smart Sand brings, offshore drilling is said to be less carbon intensive and provide stronger operational efficiencies at these higher oil prices. More information relating to the offshore drilling space can be read in my recent report on Transocean (RIG). Below is a summary of Baker Huges’s rig count.

Baker Hughes Rig Count

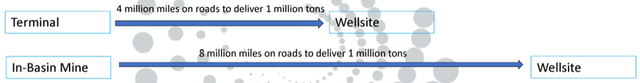

Considering regional mining, Smart Sand outlined the convenience of rail terminals when compared to trucking in-basin sands. According to their August 2023 investor presentation, distance from the terminal to the wellsite is roughly half the distance on average when compared to trucking from in-basin mining sites.

Investor Presentation

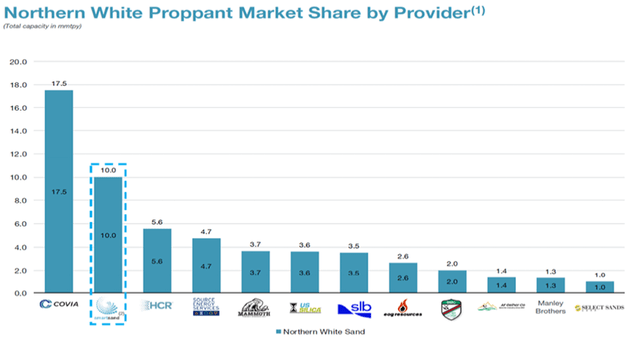

Ultimately this value proposition will come down to additional costs for operators and drilling activity. Considering the lower rig counts across basins as well as the lower volumes of sand sold in q2’23, this value alone may not be strong enough to drive sales growth. The value Smart Sand does bring to the table is being the second largest provider of Northern White sand.

Investor Presentation

The value of being the second largest provider is that Smart Sand has some control on pricing and volumes in which their operations are vital to the market for Northern White sand. Smart Sand has 499mm tons in reserves across their three properties. Assuming constant production, Smart Sand has 49 years of reserves on hand. Ultimately, the value of Northern White sand will come down to whether alternatives are as effective when considering price and effectiveness. By controlling their corner of the market, Smart Sand potentially has the capability to limit volumes on the market to improve pricing, assuming their product is factually superior for well production. Management did voice that prices for Northern White sand were moderating going into q3’23 and may remain at the lower end of the $14-17/ton range for the remainder of the year. With rig count in mind, it might be safe to take the conservative approach and assume the lower end of the range when projecting out contribution margins for 2h23.

Valuation

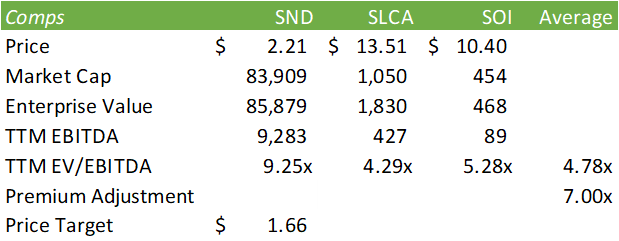

SND shares are currently trading at a relatively high premium when compared to their peers at 9.25x EV/EBITDA. I believe SND requires a higher trading multiple when compared to its peers given their low level of net debt at 0.21x EBITDA and their terminal operations. At this time I am adjusting up my recommendation to a SELL with a price target of $1.66/share.

Corporate Reports

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here