Take calculated risks. That is quite different from being rash. – George S. Patton.

Investment strategies have evolved tremendously over the years, with different financial products catering to various investor needs. Among these, Exchange-traded notes (ETNs) have gained popularity due to their unique features.

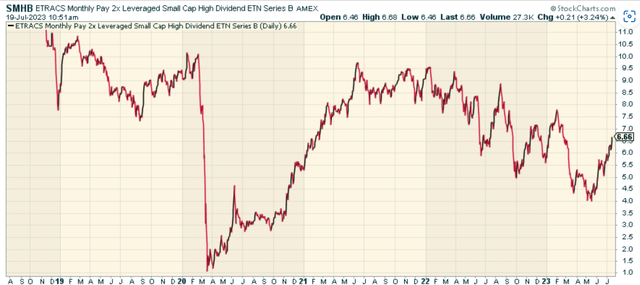

One such ETN that has garnered attention is the ETRACS 2xMonthly Pay Leveraged US Small Cap High Dividend ETN (SMHB). Offering an enticing high yield, it is a product that attracts income-seeking investors. However, it is not without its risks, and potential investors should carefully weigh these before investing.

Stockcharts.com

SMHB: An Overview

Launched in late 2018, SMHB is an exchange-traded note that provides 2 times leveraged long exposure to the monthly compounded performance of the Solactive US Small Cap High Dividend Index. This underlying index comprises 100 constituents, all of which are high dividend-paying small-cap companies.

As an ETN, SMHB is essentially a senior, unsecured, unsubordinated debt security. This means that investors’ returns are linked to the total returns of the market indices associated with the underlying stocks, less investor fees. It’s noteworthy that if the index constituents do not make distributions, investors will not receive any coupons.

SMHB is managed by ETRACS, a part of UBS Group (UBS), that offers innovative investment products, providing easy access to markets and strategies that may not be readily available otherwise.

The Unique Strategy of SMHB

The primary objective of SMHB is to offer investors a high yield of over 18%, and it has an annual fee of 0.85%. However, it’s important to understand that this high yield is accompanied by specific risks. One of the key strategies of SMHB is its focus on small-cap, high-dividend companies in the US. By leveraging the Solactive US Small Cap High Dividend Index, SMHB aims to offer investors double the average yield of these companies. However, this comes with its own set of challenges, as small-cap stocks are generally more volatile than their large-cap counterparts.

Potential Risks Associated with SMHB

Risk 1: Counterparty Risk

As an ETN, SMHB doesn’t hold any assets to guarantee its value. It is essentially a debt security issued by UBS and is subject to the credit risk of this financial institution. This means that if UBS were to face a major financial crisis or bankruptcy, the value of SMHB could plummet, resulting in significant losses for the investors.

Risk 2: Leveraged Drift

Leveraged ETNs like SMHB can suffer from a phenomenon known as “leveraged drift.” This occurs due to the compounding effects of gains and losses over the investment period. In a volatile market, the impact of leveraged drift can be significant, leading to larger losses or smaller gains than expected.

Risk 3: Forced Redemption

Another risk associated with SMHB is the possibility of forced redemption. If the value of the underlying index drops more than 50% in a month, UBS may force the redemption of SMHB to avoid losses. In such scenarios, the redemption value for investors could be zero.

Key Takeaways

While SMHB offers a high yield and can be useful for short-term investment strategies, it may not be the best option for long-term investment. It bears risks like counterparty risk, leveraged drift, and forced redemption that typical exchange-traded funds, or ETFs, do not have. Potential investors must carefully consider these risks and their financial goals before deciding to invest in SMHB.

Future Outlook

Given the current macroeconomic environment, the prospects for small-cap stocks remain mixed. Yes breadth is widening, but there are a lot of zombie companies that may not make it in the next year. On one hand, the Federal Reserve’s approach to stimulating the economy could lead to a favorable environment for small-cap stocks and, by extension, for SMHB. On the other hand, a global economic slowdown could adversely affect small-cap performance.

I think if you like small-caps for a trade, there are better options out there, but this remains an interesting strategy to watch and potentially allocate to for a moment in time.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here