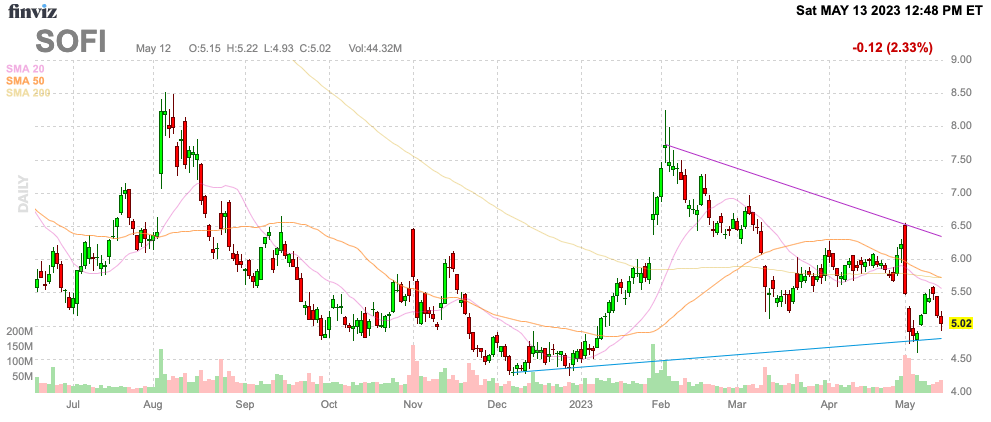

Following strong Q1 earnings, SoFi Technologies (NASDAQ:SOFI) has spent the last couple of weeks languishing around $5. The digital banking platform continues to execute at the highest levels during the regional banking crisis, yet the market finds every excuse to sell the shares. My investment thesis remains ultra Bullish on the stock offering investors the golden opportunity of buying SoFi at the lows while the business continues to excel.

Source: Finviz

Disconnect

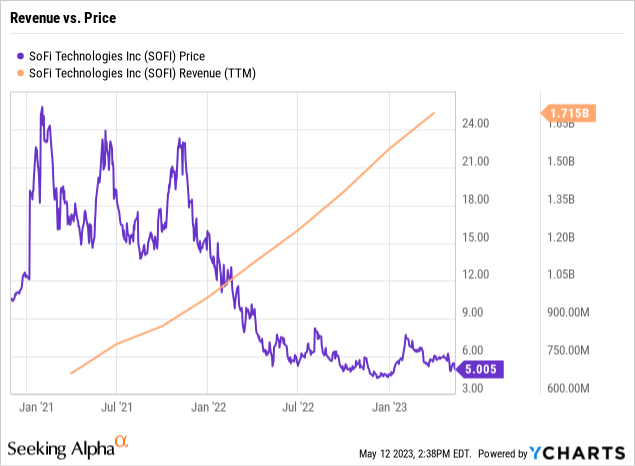

As a recap, SoFi reported Q1’23 revenues grew at a 43% clip. The report follows several quarters where the fintech had grown revenues by over 50% while their primary student loan refinancing business was impacted by the ongoing repayment moratorium.

During this whole period of being a public company, the stock has dipped regardless of the strong results. A lot of investors confuse the short-term stock action with the quarterly results due to SoFi trading at all-time lows. In reality, the company has nearly tripled revenue in the last couple of years.

The market clearly saw the stock as overvalued when trading up above $15 heading into the SPAC close in late 2021. SoFi has now traded near $5 for going on a year despite the massive sales growth and improvement in profits during the year.

The stock market constantly reprices assets leading to multiple compression in the case of SoFi. A lot of times, investors mistakenly confuse these moves as indicative of the quality of the related company.

SoFi just reported a quarter on May 1 where revenues smashed analyst estimates and grew 43% to reach $460 million. The digital bank even reported adjusted profits reported via the EBITDA metric at $76 million, nearly double estimates.

So either the stock was vastly over valued in the beginning or SoFi is now vastly undervalued. The stock started out trading at a premium valuation when the fintech went public via a SPAC, but the market has gotten far off base here.

SoFi guided to 2023 revenues of ~$2.0 billion and analysts forecast 2024 revenues will reach $2.5 billion for nearly 25% growth next year. The market cap has now fallen to only $4.8 billion in an indication of how whatever premium valuation existed at the time of the SPAC deal has completely disappeared.

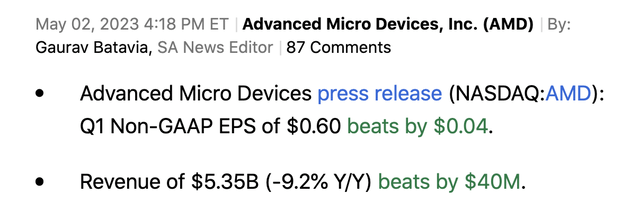

A big part of the disconnect is that investors don’t see SoFi as being profitable due to the use of an EBITDA metric. Though, the amount is much closer to an adjusted profit metric, a comment on my previous article pointed to how even AMD (AMD) was profitable.

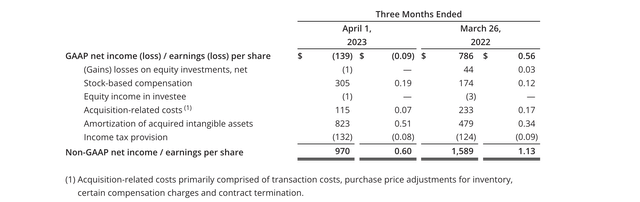

The ironic part here is that AMD is only profitable on a non-GAAP basis. The chip company reported a Q1’23 GAAP loss of $139 million due to the exact same issues reported by SoFi.

Source: Seeking Alpha

In the last quarter, AMD reported a non-GAAP profit of $970 million, or $0.60 per share. The prime additions back to income where stock-based compensation of $305 million and the amortization of acquired intangible assets of $823 million.

Source: AMD Q1’23 earnings release

Our view is that SoFi would see a much better stock price by shifting to an adjusted profit metric and away from the adjusted EBITDA metric that confuses investors into not realizing this is actually closer to an adjusted profit.

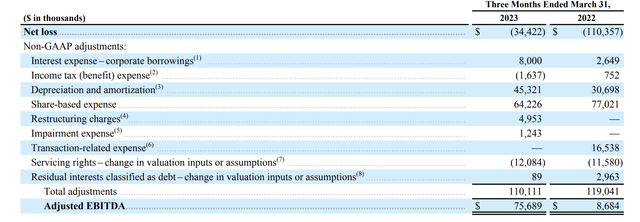

Based on the adjusted EBITDA table of SoFi, these same 2 charges for AMD amount to $110 million of non-cash cost leading to an adjusted profit of $65 million. Throwing in restructuring charges and impairment expenses, SoFi would’ve reported a Q1 adjusted profit of $71 million.

Source: SoFi Q1’23 earnings release

Similar to AMD, investors can use the adjustment tables to incorporate the accurate profits. In the case of SoFi and similar to AMD, the adjusted profits are the best method to value the stock, but unfortunately the data isn’t presented in this way.

Unlike AMD, SoFi management presents the case of reaching GAAP profits to the detriment of the stock. On the Q1’23 earnings call, CEO Noto made the following statement that only helps bearish investors push the narrative that SoFi isn’t profitable:

These trends increased the visibility and reinforce our goal of achieving positive GAAP net income in Q4 2023.

If SoFi instead stated the company had non-GAAP earnings of $71 million for an EPS of $0.08 based on 929 million shares outstanding, the short narrative would have a far different voice. The market is already willing to value a company like AMD based on non-GAAP numbers and SoFi should be no different considering the excluded charges are generally similar.

No Loan Issue

The market continues to push a false narrative that SoFi somehow has an issue with their loan book. The fintech now has a loan balance on the balance sheet topping $15 billion.

SoFi continues to list all of the loans as held-for-sale due to the intention to ultimately unload these personal and student loans to investors. The biggest issue is the concern that the fintech doesn’t correctly handle the expected losses on these loans, but this claim remains inaccurate.

As again highlighted on the Q1’23 earnings call, SoFi reports on a offset to revenues based on any expected lost value in the loans, not a write off due to loan losses:

And in terms of why we get confident in the sense that we would be able to sell the loans at where they’re currently marked, every single quarter we work with a third party valuation firm that marks to market each and every one of our loans on an individual basis to account for changes in every single factor that impacts loans. So that’s things like the weighted average coupon, default rates, prepayment speeds, benchmark rates, spreads as well as where secondary bonds and residuals are trading. So you see that mark to market take place every single quarter and that flows through the revenue line of our P&L.

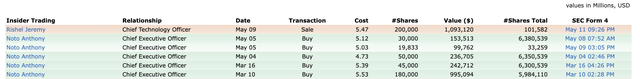

CEO Anthony Noto continues to repurchase shares due to his confidence in the financials of the digital bank. The CEO bought nearly 100K shares since the Q1’23 earnings report for nearly $500K. Noto now owns 6.4 million shares having doubled his stake since last May while the rest of investors have become very pessimistic.

Source: Finviz

Takeaway

The key investor takeaway is that the market has become very disconnected with the fundamental prospects of SoFi. The fintech is already highly profitable and the market constantly invents red flag to sell the stock that don’t actually exist.

Investors should continue using the weakness to buy shares alongside CEO Anthony Noto.

Read the full article here