Investment Thesis

SoFi Technologies, Inc. (NASDAQ:SOFI) is a battleground stock. This means that there are both bears and bulls on either side of the stock. And both sides put across ferocious arguments. Whilst I have a bearish tilt when it comes to SoFi, I can also recognize some aspects where SoFi is delivering strong prospects, particularly when it comes to its adoption curve.

However, while many have been quick to argue that SoFi is a cheaply valued stock, that’s where I draw the line. I don’t believe that SoFi Technologies, Inc. stock is particularly undervalued. In fact, I find that its peers are significantly cheaper-priced. And I also highlight that this sector is becoming increasingly competitive.

Some Necessary Perspective

SoFi is a one-stop fintech company that focuses on providing various financial products and services, including student and personal loans, mortgages, and more. It aims to be a comprehensive and personalized financial platform for individuals, or members – as they like to refer to customers.

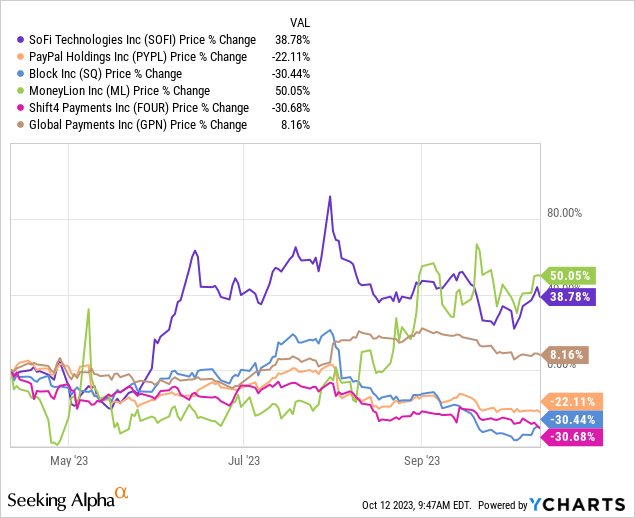

SoFi doesn’t directly offer payment processing services like PayPal (PYPL), Block (SQ), or Global Payments (GPN) for that matter, but they are peers in the broader range of financial services and products. And I’ve opted for the graphic that follows to show a broad selection of fintech companies. Again, the point of this exercise is to highlight the general investment sentiment facing fintech.

And what you see is that in the past 6 months, SoFi’s share performance has sizzled. Admittedly, this is from a low base from earlier in the year. Nevertheless, the point still remains. Investor appetite for this general sector has been relatively muted. But this hasn’t stopped SoFi from charging ahead.

In fact, we should recall that some of its peers are already highly profitable and consistently generating strong free cash flows, for instance, PayPal. And here I’m not referring to stock-based compensation added back to bolster EBITDA. Nevertheless, investor appetite for getting involved in this sector remains relatively subdued. Why?

Investors are concerned that there are just too many competing products vying for market share. As a result, it is still uncertain if they will be able to maintain their current level of profitability. That is why I find it difficult to get enthusiastic about SoFi. I’m forced to ponder whether SoFi will be able to stand out in a more constrained and competitive context.

This takes me to the next section, thinking about 2024.

2023 is Closing, 2024 Brings Up Questions

SOFI revenue growth rates

SoFi’s 2023 is expected to close on a very strong footing. Since SoFi performed so well in the first half of 2023, the second half of 2023 would have to be especially weak to materially undermine 2023 as a whole.

Nevertheless, I believe the message coming out of SoFi is still relatively clear. SoFi’s growth rates are slowing down.

SA Premium

I recognize that these revenue estimates are purposely conservative to allow for SoFi to sandbag these results. But even if we add 5% to both Q3 and Q4 SoFi revenues, the business is clearly slowing down. There’s no ambiguity. And how much will investors be willing to pay for a business that is in the process of becoming ex-growth?

SOFI’s Stock Multiple — Not Stretched, But Not Cheap

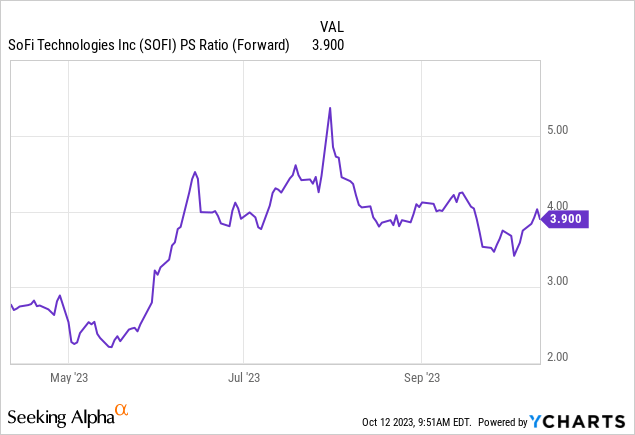

In the past several months we’ve seen SoFi’s multiple expand. And not just expand, but actually double from around 2x forward sales to around 4x forward sales.

Can we expect SoFi’s multiple to expand further in 2024? Perhaps. However, recall that SoFi is now expected to grow in the high 20s% to 30% CAGR. So, clearly, slowing down.

But then I recall that there are businesses like PayPal or even MoneyLion (ML) that are priced at approximately 8x EBITDA, or less than 3x EBITDA, respectively. I have to wonder whether SoFi can truly support its 20x forward EBITDA valuation? (disclosure: I’m long ML). I find myself too unsure, and unwilling to deploy my hard-earned capital here.

The Bottom Line

SoFi is undeniably a battleground stock, with passionate arguments on both sides.

While I lean bearish on SoFi, I can’t ignore the promising aspects, particularly its adoption curve. However, I remain skeptical about its valuation; I don’t see it as particularly undervalued when compared to cheaper peers.

The financial services sector is fiercely competitive, and investors are cautious due to concerns about profitability sustainability amidst fierce competition.

I’m left uncertain about whether SoFi Technologies, Inc. can truly stand out in this competitive landscape, especially as 2024 approaches with questions about its growth rates and valuation multiples.

Read the full article here