Investment Rundown

Solaris Oilfield Infrastructure, Inc. (NYSE:SOI) has so far been able to offset some of the softening the natural gas market has experienced and still grow both its top and bottom line at an impressive rate. The last quarter highlighted the efforts the company has taken to deploy its new product offerings like AutoBlend Integrated Electric Blender and the Belly Dump Offloading Options. The outlook remains solid even if the natural gas market is softening slightly, a rebound seems like and that would be a major tailwind for SOI.

So far in 2023, the share price for SOI has had a tough start, down nearly 15%. The decline seems to have largely come from a worsening sentiment about companies in the sector being able to maintain strong margins and cash flows. But SOI has proven otherwise and grew its net income by 108% YoY and bought back 3.5% of the outstanding shares in the first quarter. This sort of shareholder-friendly incentive makes me very confident in rating them a buy now.

Company Segments

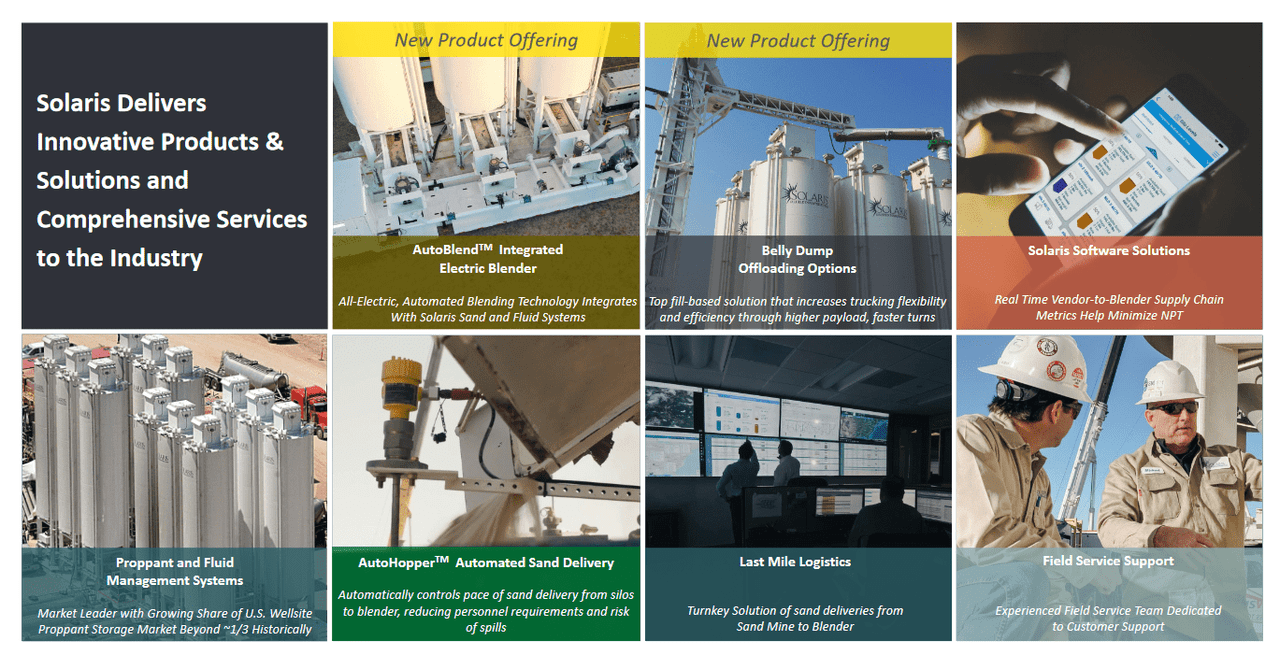

Solaris operates within the oil industry, providing equipment to larger companies involved in the refining and processing of oil. Their product lineup includes Top Fill Systems, Proppant Systems, Fluid Systems, and Integrated Electric Blender. According to their investor presentation, the management is committed to pursuing growth and innovation rather than stagnation.

Product Offerings (Investor Presentation)

Investing in SOI seems to offer an advantage over other oil companies that primarily focus on drilling and refining, as SOI’s revenue is not solely reliant on commodity prices. Instead, their success depends on selling their products to other companies in the sector. This can help mitigate potential volatility faced by traditional oil companies.

There is ongoing debate regarding increased drilling activities in the oil industry, with many licenses being issued. However, profitability remains a concern. Despite the significant shift towards green energy, the oil demand will persist for many years, and the transition will take time. As oil companies decide to initiate drilling projects based on their granted licenses, SOI will benefit from a substantial customer base. While relatively new to the industry, they have already established a sizable customer network.

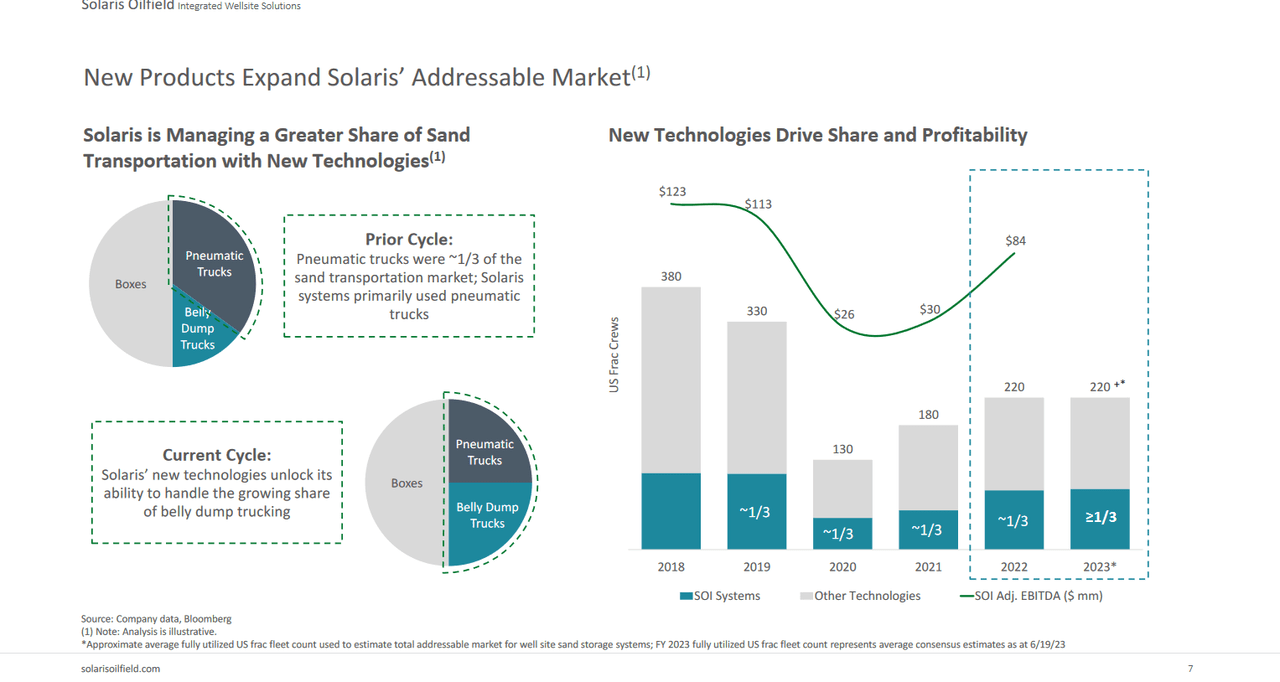

TAM For SOI (Investor Presentation)

SOI has been able to deploy several new products on the market and this has helped significantly in bringing in more revenues for the business and expanding margins. SOI has adapted efficiently to the current cycle which places a larger demand on belly dump trucks. SOI can cater to this very well given the new technology they have unlocked and new offers to customers. From the first quarter of 2023, nearly 29% of the revenues came from new technology the company had recently begun offering. This has helped drive a higher margin per frac crew, something the company sees growing to $2 – $3 million per frac crew once they have their full offerings online and up and running.

Earnings Highlights

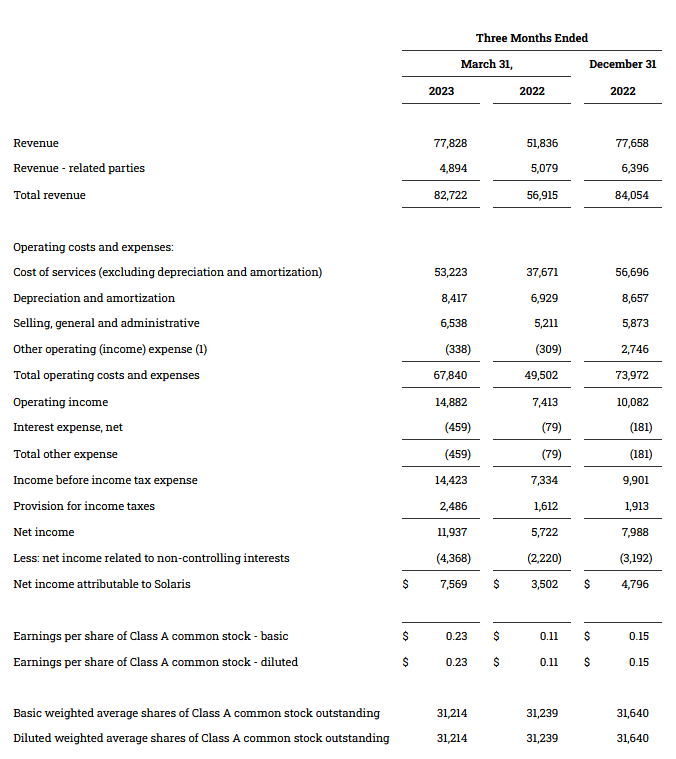

The first quarter of 2023 was a real success for SOI as it managed to grow both the top and bottom lines of the business.

Income Statement (Q1 Report)

Revenues grew by over 50% and net income increased 108% YoY. This type of growth should correlate to the share price increase in my opinion but the market seems to remain rather negative in its sentiment around SOI. Shares are more or less where they were when the release of the report happened, which tells me there is still ample time to invest in SOI right now.

Looking at the capital expenditures for FY2023 SOI expects it to reach between $65 – $75 million, which would be a decrease from the $81 million the company had in 2022. FCF for the first quarter was a negative $2 million but the distributable cash flow grew to $22 million, a 15% increase sequentially and 60% YoY.

Risks

Right now I think the most prominent risk that is associated with SOI is volatile and weak commodity prices. Natural gas prices have seen weakness and right now a stabilization in the market is necessary, which would make predicting future results for SOI much easier.

But I think that, even as natural gas prices have fallen, SOI has been working hard at expanding its product line to help offset some of the weakness and softness in the market.

As far as internal issues with SOI I think the quite high stock-based compensation is cause for concern. The company is announcing strong buybacks, but the effects of these are slightly muted as shares are issued as compensation. In the long run, this could cause shareholders to raise their voices or pull out investments. That would crumble the reputation of the management and be the reason for a lower multiple.

Shareholder Value

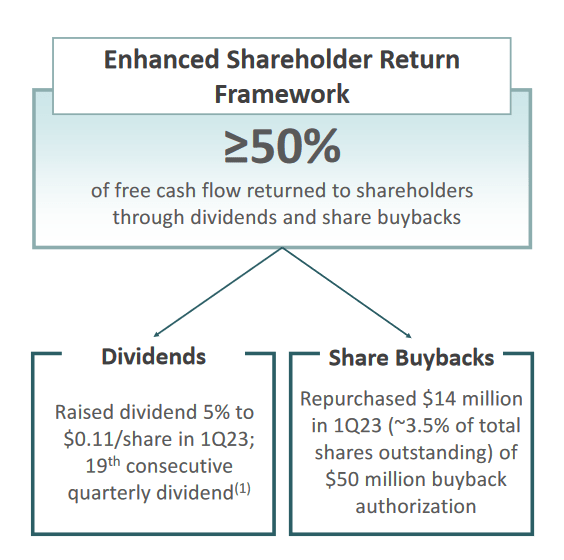

Right now I think one of the main appeals for investors to get into SOI is not only the fair valuation but also the strong dividend SOI has and the drive to buy back shares they have shown. Last quarter the shares were reduced by 3.5% which highlights the potential for strong shareholder value here right now. Together with a 5.8% yield starting a position right now seems like a solid decision. The company is just by its moves offering investors a nearly 16% return if you add the yield and the potential 10.9% reduction of shares as the company still has $36 million left to use.

Shareholder Return (Investor Presentation)

SOI is taking steps to ensure that investors are getting something from their investments, and the announcement of over 50% of FCF returned to shareholders is ensuring just that. Where attention should be placed for coming quarters is the reduction of shares and whether or not SOI can further improve the cash flows.

Valuation

As far as the valuation goes for SOI I think right now it’s at a very fair point. The company has an FWD multiple exactly in line with the sector, which suggests you aren’t overpaying based on peer comparison. To further strengthen the buy case now, SOI is trading around 15% below its 5-year average p/e of 10.6. That suggests that is room for an upside given historical measurements. But looking backward is never always the answer. I think one reason for a higher multiple would be the impact of the FCF conversion to shareholders. As the results materialize I think we will see a rise in the share price.

As far as similar companies with a similar market cap we have DMC Global Inc (BOOM). Just from a quick look, SOI comes across as a clear winner as BOOM doesn’t have a dividend and is trading at a higher multiple than SOI. Lower margins also don’t make BOOM out to be the winner here.

Final Words

For investors seeking a more “pick & shovel” play in the oil and natural gas industry I think that SOI is right now a very solid option. The company has seen its share price decrease by nearly 15% this year, but that hasn’t stopped SOI from buying back shares at the fastest rate in the last few years. Reducing outstanding shares by 3.5% in Q1 2023 alone.

With shareholder-friendly incentives like this, I think there is plenty of potential value to be had here at these price levels. It shouldn’t be left unsaid that SOI also has a 5.8% yield, fueled largely by operating cash flows. As a result of all this I am rating SOI a buy right now.

Read the full article here