Investment thesis

Our current investment thesis is:

- Sonic (NYSE:SAH) operates an attractive business model for those seeking exposure to the automotive industry. Its EchoPark expansion has significant potential based on current retail trends and consumer behaviors.

- Softening in the automotive industry due to economic conditions is concerning, threatening the improved position Sonic finds itself in.

- Despite its weak performance compared to the wider industry, it is positioned well relative to other dealers, with Management’s strategic vision particularly impressing us.

- We suggest patience until there is greater visibility over the company’s near-term trajectory.

Company description

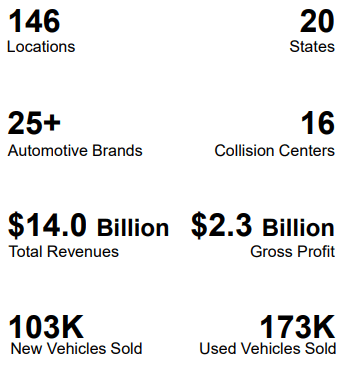

Sonic Automotive is a leading automotive retailer based in Charlotte, North Carolina. Founded in 1997, the company operates a network of dealerships across the United States, offering new and used vehicles, automotive repair and maintenance services, and financing options.

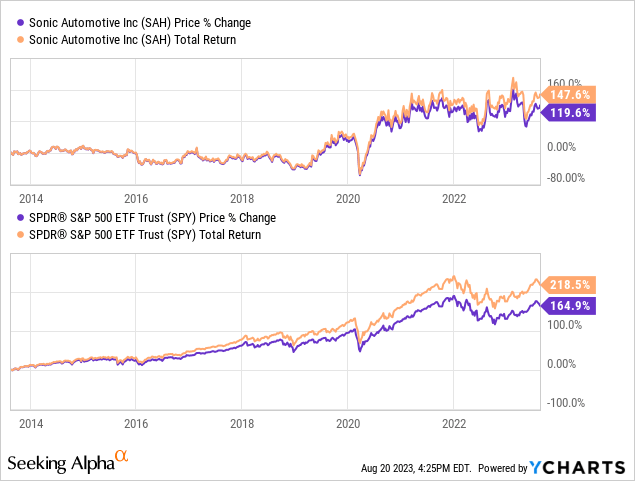

Share price

Sonic’s share price performance has been respectable, gaining most of its value in the last decade post-pandemic, following an improvement in financial performance.

Financial analysis

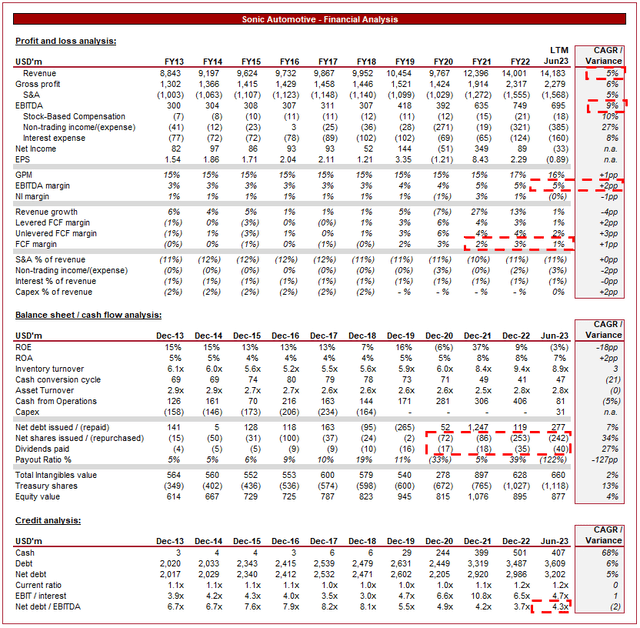

Sonic Financials (Capital IQ)

Presented above are Sonic’s financial results.

Revenue & Commercial Factors

Sonic’s revenue has grown at a respectable 5% during the last decade, with incredibly consistent YoY gains. This has clearly accelerated following FY20.

Business Model

Sonic operates a network of dealerships that sell new and used vehicles from various brands. The company represents multiple manufacturers, offering a wide range of vehicle options to customers, utilizing this offering in conjunction with its brand to attract consumers. This is an industry within which the development of a moat is difficult, as consumers will always be driven largely by price. For this reason, scale (presence and choice) and a well-regarded brand support an enhancement in competitive position.

Sonic Automotive

Sonic operates three primary brands (as opposed to dealerships, which in many cases represent a range of automotive brands):

- Sonic Automotive. Sonic’s core retail franchised dealership segment, with a diversified brand portfolio. This is the largest part of the business.

- EchoPark. An alternative approach to pre-owned vehicles and F&I sales. This is the growth segment of the business. The company offers below-market pricing with a no-haggle purchase experience.

- Sonic Powersports. Early-stage growth opportunities.

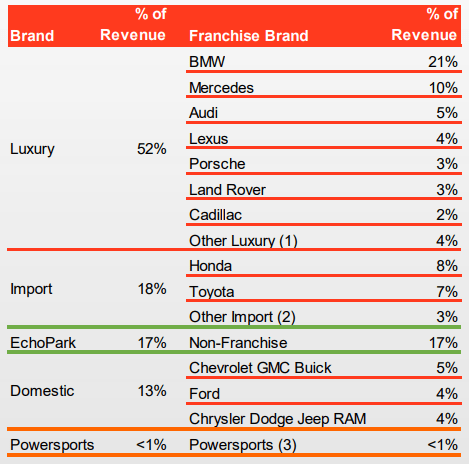

Sonic’s franchise brands are primarily in the luxury segment, with over 52% of revenue from 8 brands. These automakers have a long history and are well-regarded brands, positioning them for continued success and resilient demand. Further, the company offers a range of other brands, providing consumers with a large array of choices across brands and models, particularly when considered alongside their used segment.

There may be a concern with the transition to EVs, as the luxury automakers have generally lagged behind with the development of vehicles. Owners of these cars generally care less for EV technology and so the demand has not been sufficiently present.

Brands (Sonic Automotive)

In addition to vehicle sales, Sonic provides maintenance and repair services, including routine maintenance, repairs, and parts replacement. Further, the company also offers financing and insurance products to support the purchase of its vehicles.

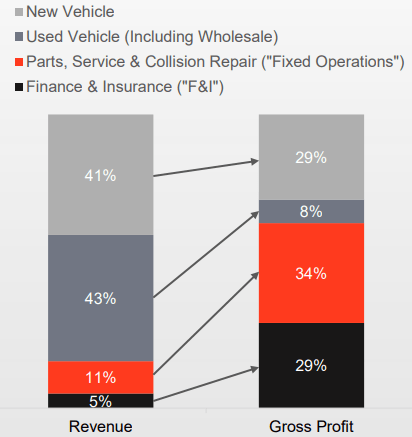

These services are crucial to the quality of its business model, as they offer an ongoing revenue stream and help drive increased sales. As the following illustrates, Fixed Operations and F&I provide the business with outsized profitability relative to the sale of vehicles.

GP (Sonic Automotive)

Sonic has invested heavily in its digital platforms and tools to enhance the customer experience. This includes online vehicle shopping, appointment scheduling for service, and digital communication with customers. This has been a requirement following technological development by many of its peers, contributing to an increasing amount of vehicle shopping occurring online.

At the forefront of this is EchoPark. This sub-brand is focused on pre-owned vehicles, the larger of the automotive segments and generally more stable compared to new ones. The brand seeks to capture customers through a simplified and convenient buying experience, with cars priced up to $3k below the market (/40% below new). Management is seeking to differentiate EchoPark through the convenience angle in conjunction with aggressive pricing, as well as a broad reach (target is 90% of the US population) and a reputable brand.

Management has big plans for this brand and believes they can capture c.10% of the market through this strategy. Convenience is focused on making the experience as seamless for the consumer as possible. This means a blended online and physical service, purchases completed within an hour (packaged with services as required), online appraisals for trade-ins, and online customer service.

We like this brand and its success is illustrated by its impressive growth rate. The current slowdown is a reflection of economic conditions (which we will discuss later) rather than a softening of the business model. We believe this will allow the company to achieve outsized growth in the coming years as it further rolls out nationally.

Growth (Sonic Automotive)

Management’s current strategic focus is:

- Franchised dealerships.

- Focus on achieving growth in Fixed Operations and F&I per unit.

- Pursue strategic acquisition opportunities where possible.

- Profitability enhancement through efficient cost allocation.

- EchoPark.

- Targeting a return to profitability.

- Resume national growth and improve e-commerce presence.

- Group.

- Focus on customer experience.

- Balanced capital allocation strategy.

- Further diversify the business model.

We like the approach taken by leadership, not just on a go-forward basis. There’s been a clear focus on expanding the capabilities of the company, rather than just focusing on its core competencies (new vehicle dealership). Investment has been made and the result is reflected in the improvement of financial performance. Going forward, we believe growth and profitability are key for EchoPark, as is cost minimization.

Automotive Industry

Sonic Automotive operates in a competitive landscape alongside various dealership groups and independent dealers. Key competitors include AutoNation (AN), Penske Automotive Group (PAG), Lithia (LAD), Carvana (CVNA), CarMax (KMX), and Group 1 Automotive (GPI).

Over the past decade, the automotive industry has experienced periods of growth (and recovery) following the global financial crisis. Improving economic conditions and consumer confidence have contributed to increased vehicle demand, although an outsized portion of this has been within the used vehicle segment. The average age of the US fleet continues to increase, which should support increased demand over time.

The industry is exposed to cyclicality, however, as consumers generally reduce large-scale expenditure when finances are challenged. With elevated rates and high inflation, consumers have seen a decline in affordability, as living costs rise rapidly.

The decline in demand has been less pronounced, likely due to the underlying strength in the market following the pandemic. With supply chain constraints, both the new and used segments experienced a supply/demand unbalancing, which is only now unwinding.

In its most recent quarter, Sonic experienced a 4.2% growth rate, slightly better than the quarter prior at 1.0%. Although this illustrates resilience, it should be noted that GP has declined in two successive quarters, reflecting the waning prices from softening demand.

Margins

Sonic’s margins have gradually improved over the historical period, not just driven by GPM (pricing improvement) but also operational excellence. The recent uptick is inevitably due to the post-pandemic boost, implying a degree of uncertainty about what normalized level the company can achieve as demand continues to soften.

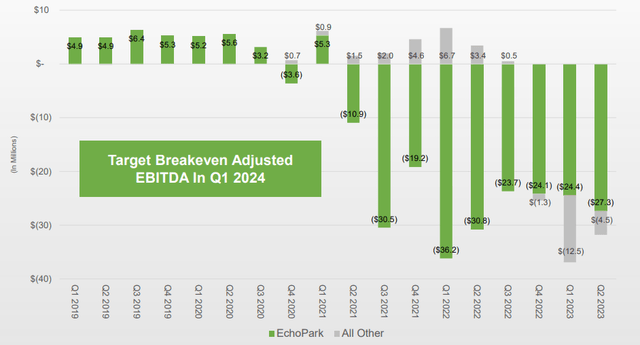

We suspect there will be continued downward pressure but an offsetting effect, as greater focus is given to transitioning EchoPark to profitability. As the following illustrates, the segment has lost its way as demand has declined, but a return to profitability has the potential to offset the growing weakness in prices.

Margins EchoPark (Sonic Automotive)

Balance sheet & Cash Flows

Sonic is conservatively financed despite the high ND/EBITDA ratio, as this is primarily comprised of leases.

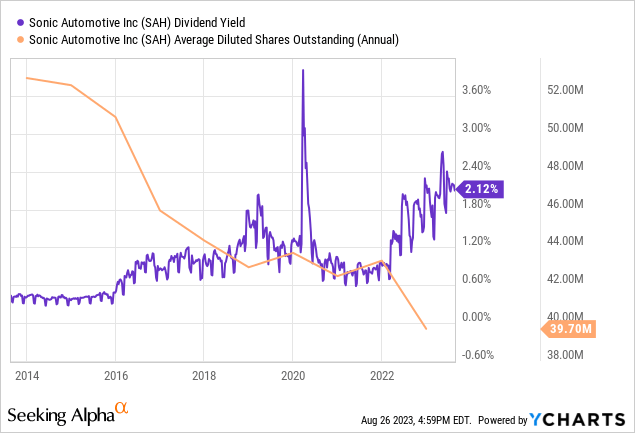

Given this, Sonic is positioned to distribute cash flows to shareholders, holding sufficient cash to cover near-term commitments and any other capital allocation needs. Buybacks and dividends have both been respectable, with current performance implying a continuation is possible.

Outlook

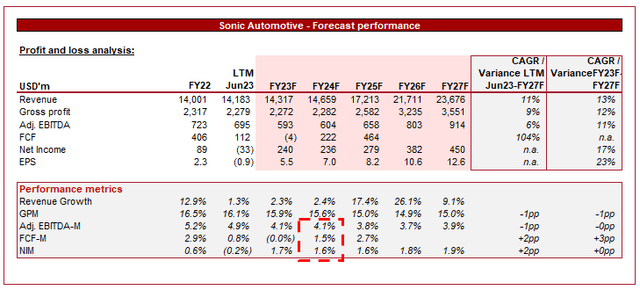

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting an improvement in growth, likely expecting a continuation of Echo Park’s strong performance. In conjunction with this, margins are expected to remain flat.

This appears broadly reasonable, although we suspect growth will not be in the double digits.

Industry analysis

Automotive Retail Stocks (Seeking Alpha)

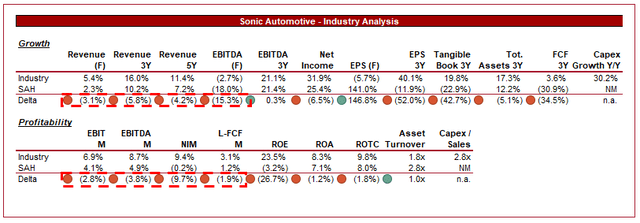

Presented above is a comparison of Sonic’s growth and profitability to the average of its industry, as defined by Seeking Alpha (19 companies).

Sonic underwhelms on a relative basis. The company’s growth noticeably lags the industry, with the expectation for this to continue. The reason is partially size, making it difficult to achieve absolute gains in a mature market. This said, this is broadly disappointing.

Further, margins also trail the average. This is due to the inclusion of the parts businesses within the cohort. These businesses generally have superior returns to automotive retailers. When compared directly to AutoNation and CarMax, Sonic outperforms.

Valuation

Valuation (Capital IQ)

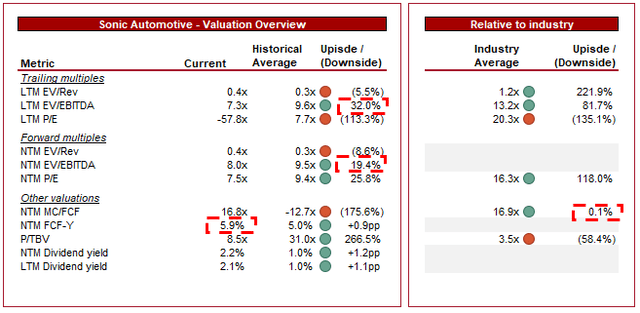

Sonic is currently trading at 7x LTM EBITDA and 8x NTM EBITDA. This is a discount to its historical average.

From a financial standpoint, Sonic is trading at an undeserved discount to its historical average. The business has higher margins, an improved growth trajectory, and positives that come with EchoPark. This said, the discount is likely a reflection of the uncertainty facing the business. Margin erosion and a growth slowdown would rapidly close this discount if Sonic continues to struggle.

Further, Sonic is trading at a substantial discount to its peer group on an LTM EBITDA and NTM earnings basis. The size of this discount adequately addresses the financial weakness relative to the peer group we feel.

Final thoughts

Sonic is a well-managed business with a quality business model. Management is clearly talented and is willing to take risks to achieve outsized returns relative to its peers. We believe the business has performed well to modernize itself and is positioned to continue its current growth.

Sonic appears attractively priced, particularly with a NTM FCF yield of 5.9%, but we are hesitant given the degree of uncertainty present in the market.

Read the full article here