Investment summary

The equity stock of Sotera Health (NASDAQ:SHC) caught a tremendously strong bid last week and finished the session 20% into the green. The increase in market value is traced back to the fact it announced the end of its opt-in process [pertaining to the January 2023 settlements of ethylene oxide claims against it] in Illinois. As a result, SHC has decided to proceed with the settlements.

Per the company on June 22nd:

We are pleased that 99.7 percent of the eligible claimants are participating in the settlements. The agreements explicitly state that the settlements are not to be construed as an admission of liability, and Sterigenics maintains that its Willowbrook operations did not pose a safety risk to the surrounding community. As we have done throughout our history, we will continue to operate all our facilities in compliance with applicable rules and regulations and best industry practices to ensure the safety of our employees, the communities in which we operate and patients around the world.”

The question now is, what this means for the investment case of SHC moving forward. I’ll run through all of the moving parts here and share my investment opinion. Net-net, I rate SHC a hold, with unsupportive valuations, and a negligible change to the economic outlook of the company after the decision.

Figure 1. SHC 60-minute chart showing break in equity market value post-announcement

Data: Updata

Overview of critical facts

As a reminder, the case in question involves Sterigenics, a subsidiary of Sotera SHC. In January this year, the firm announced a settlement of $408mm to resolve a series of lawsuits regarding its Willowbrook sterilization plant in Illinois. The lawsuits alleged that exposure to a chemical known as ethylene oxide, emitted by SHC’s plant, was carcinogenic and caused severe illnesses among the plaintiffs.

After facing numerous lawsuits, Sterigenics agreed to pay the $408mm to settle the claims. The settlement was subject to the condition that the majority of plaintiffs provide opt-in consents. Of the 882 eligible claimants, 879 (99.6%) have chosen to participate in the settlement program, indicating its support.

There are critical facts investors must know in order to make the most informed investment reasoning here. These include:

- Opt-in participation and walkaway rights

- Whilst 99.6% of claimants opted to participate in the settlement program, the remaining 3 claimants who did not opt-in embedded an option for the settlers to exercise a set of walkaway rights.

- Good news for the company- the settlers waived their walkaway rights.

- Hence the settlement will proceed with the 879 claimants who opted in.

- Allocation of settlement funds

- The settlement funds will be allocated based on the findings and recommendations made by the plaintiff’s executive committee. I would note, this is typically quite a lengthy administration process, and thus wouldn’t expect a definitive answer on the allocations in the immediate term.

- The amount of payment assigned to those who did not opt-in are a non-statistical portion of the settlement.

- Two additional important things to consider with the non-settling crowd. First, their funds will be held in escrow until December 31 this year. Afterwards, if none of the non-participating claimants opt-in by the cut-off date– the funds will revert back to Sterigenics.

- For the settling claimants, funds will be released from escrow to them after that date.

- Implications to financials and forward estimates

- For one, there will be no additional charges beyond what’s already been incurred from Q4 FY’22.

- Management, therefore, expects the financial impact to be limited from here.

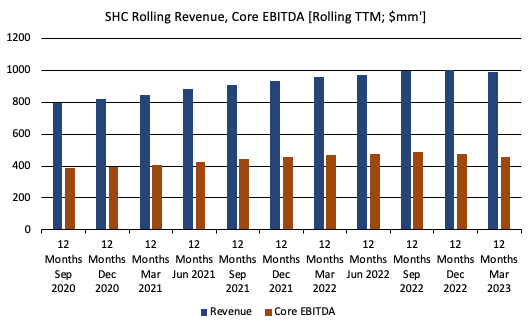

- Further, the company delivered $987mm in TTM revenue on core EBITDA of $456mm, and produced $540mm in free cash to the firm last period (TTM figures). That, and it has $648mm in cash on the balance sheet.

- It therefore stands to reason the $408mm charge will post no drains or pulls on liquidity.

Figure 2.

Data: Author, SHC SEC Filings

What to next for SHC?

An interesting state of affairs has emerged since the announcement last week. Each of these points have balancing implications to the SHC investment debate.

One, the market rallied the company back to a September FY’22 range, right before the debacle began to unfold (as shown in Figure 1 earlier). Naturally, this would imply a set of revised expectations, either on fundamental, or sentimental grounds.

Two, the analysis of sentiment in SHC’s equity stock is curious at present. On the one hand, the options market has investors positioned around calls with a strike of $20-$22.50. That is for July expiry. On the puts side, there is equal demand around the $20 mark, but also plenty of open interest around the $12.50 mark that are in the money. This is interesting. There aren’t too many reasons why any operator would write puts at $12.50 with the stock trading at c.$18 at the time of writing. There’s a chance they were slotted in last year, but unlikely in my view. Instead, it might suggest investors are happy to write puts at the discounted strike in the view SHC’s market price will never sink to that level. That could be bullish behavior.

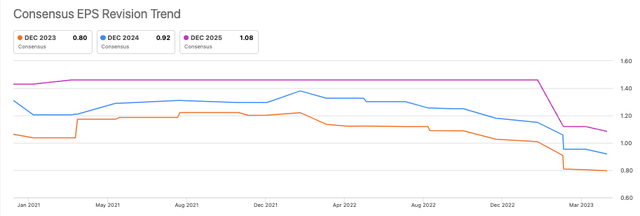

Three, despite the money at risk playing directional moves on SHC, analysts aren’t so rosy on the forward fundamentals. There have been 6 downward revisions on revenue and 5 on earnings in the last 3 months, and last week’s announcements did little to see the sell-side chasing SHC’s price gains. Consensus now expects 17% YoY decline in earnings this year and a 15-16% growth rate after that. I am alight with these numbers and would look for the firm to do ~$1-$1.1Bn this year on $0.80 in earnings.

Figure 3.

Data: Seeking Alpha

Valuation and conclusion

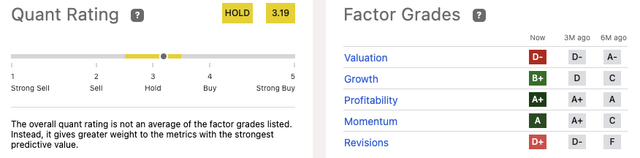

After the price extension, the market is charging 22x forward earnings to buy SHC and investors are selling at 13x forward EBITDA. As a critical fact in the investment debate- you are being asked to pay 19x forward the company’s net asset value.

Understandably, these are unattractive multiples that trade at significant premiums to peers on aggregate. Does SHC deserve the premium? On my growth assumption, to pay 19x forward for a year of negative growth and then no major recovery in subsequent years doesn’t make sense to my investment cortex. As a result, I rate SHC a hold for now.

These findings are well supported in the quant system’s findings, which places risks on valuation as well. Notably, the trends are constructive in profitability and price momentum, two factors that make sense based on the data.

Figure 4.

Data: Seeking Alpha

In that vein, whilst the latest price rally for SHC represents a set of revised market expectations, these are not well-supported by fundamental findings. The economic outlook of the firm hasn’t changed a great deal. But, one thing is for sure. In terms of sentiment, a “neutral” one would be better than a “negative” one in my opinion. The latter would attract selling activity, whereas the former at least inspires strong hands to keep hold of their stock. I would also bet SHC is wanting the Sterigenics saga to be put to rest and that’s why it reached a swift settlement. It will be interesting to see what’s in store next for the company in this regard. However, at 22x forward earnings and 19x book value investors are selling at a price sure to cause the intelligent investor a dizzy spell. In that vein, rate hold.

Appendix 1. SHC forward estimates

Data: Author Estimates

Read the full article here