Overview

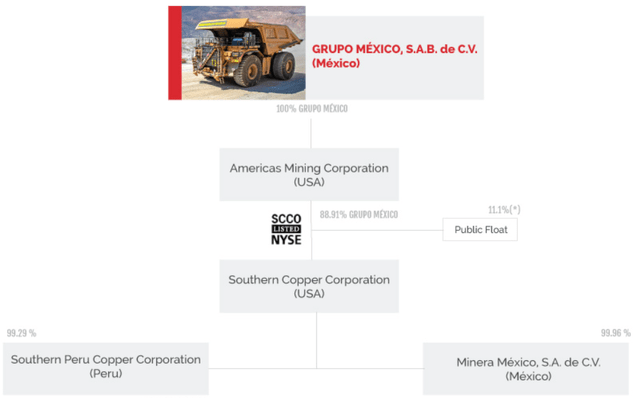

Southern Copper Corporation (NYSE:SCCO) is one the world’s largest copper mining companies, it is a subsidiary of Grupo México, so the public float is relatively small. The reporting currency is U.S. Dollars.

Figure 1 – Source: Southern Copper Website

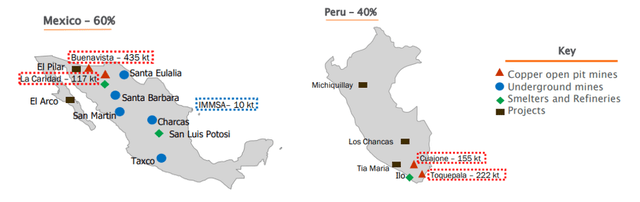

The company has about 40% of production coming from Peru and the remaining 60% from Mexico, where the large Buenavista mining complex has over time accounted for about 45% of total copper production.

Figure 2 – Source: Southern Copper Q3 2023 Presentation

Southern Copper is, as the name suggests, a copper-focused mining company where about 75-80% of revenues has come from copper lately. There is also a decent amount of molybdenum sales and more minor amounts of silver, zinc, and other sales.

Figure 3 – Source: Southern Copper 10Ks

The copper reserves were estimated to almost 100Blbs in 2023, including the development projects, which can be put in relation to an annual copper production of 2Blbs in 2023. So, fair to say there are plenty of reserves for a very long time, even if production grows substantially over time.

Figure 4 – Source: Southern Copper 2023 10K

Financials

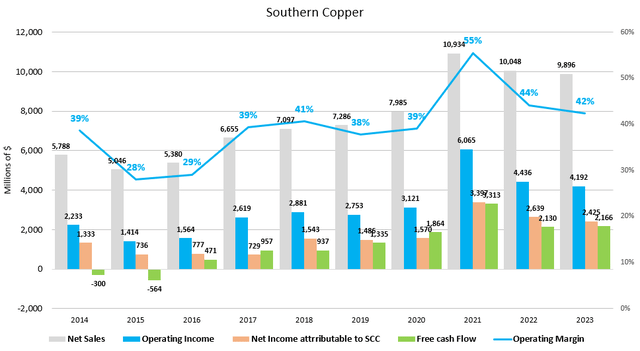

The below chart illustrates some key financials over the last decade for SCCO, where the company has generated a positive net income in each of the last 10 years and the free cash flow has been positive in the last 8 years. The company has had an average operating margin of around 40% over the last decade, which is, of course, an extremely impressive figure for a cyclical mining company. The profit margin and free cash flow margin have been around 20-25% during the last 5 years.

Figure 5 – Source: Southern Copper 10Ks

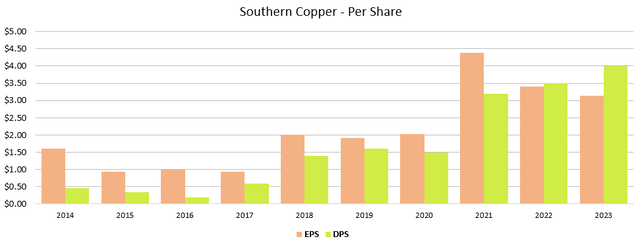

Due to the strong profitability and relatively low capital requirements to sustain current operation, SCCO has paid out most of what it generates in earnings via dividends lately. There haven’t been any substantial buybacks recently, which is understandable given the very low free float.

Figure 6 – Source: Southern Copper 10Ks

When looking at the balance sheet and leverage ratios, it might look like the company has quite a bit of financial leverage with a net debt to the last twelve months’ EBITDA of 1.0 and a debt-to-equity ratio of 0.94. However, financial leverage is of minimal concern in my view for the following reasons.

- SCCO has very low operating costs and consequently a high operating margin, which makes the company much less exposed in a period of lower copper prices compared to many of its peers.

- The are minimal near-term maturities for the debt and we are talking about fixed rate debt.

- For a mining company, the sustaining capital requirements have shown to be low for existing operations, so there is less need to keep more liquidity and equity capital compared to most mining company.

Figure 7 – Source: Southern Copper 2023 10K

Future Growth

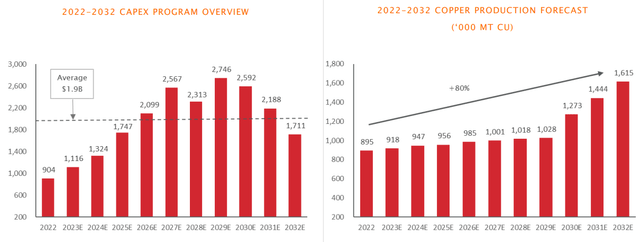

Looking forward, the company is indicating for more capital spending. The annual capex is expected to be around $2B over the coming decade, provided all the growth projects are approved by the board, which is almost double the capex spending we have seen over the last few years.

However, from the capital investments, the company is also expected to grow production over time, more slowly in the next few years and more substantially around 2030. We are looking at some rather substantial capital investments, but it is worth remembering that SCCO could be generating more than $4B in operating cash flow in 2025, without using overly aggressive commodity prices. That figure is expected to grow over time as well.

Figure 8 – Source: Southern Copper Q3 2023 Presentation

Valuation & Conclusion

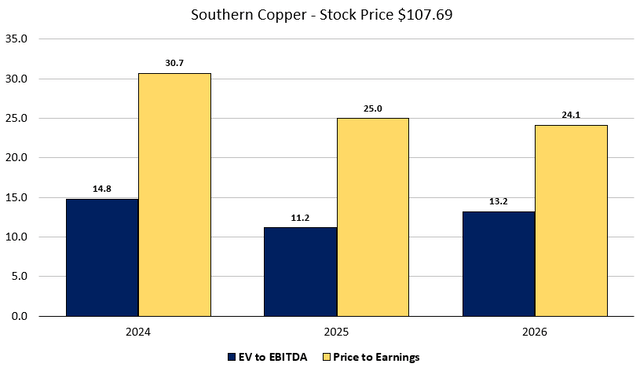

The chart below is based on estimates from Koyfin, the share price at the time of this writing, and financials as of Q4 2023. SCCO is presently trading with a forward-looking double-digit EV to EBITDA and a price to earnings ratio in the 24-31 range.

Figure 9 – Source: Koyfin

There is little doubt this is a quality company, but this valuation looks rather extended at this point. In the chart below, we can also see that the company is now trading at the upper end of the ranges these valuation multiples have been in during the last 5 years. So, timing wise, I would be cautious with Southern Copper Corporation stock at these levels.

Figure 10 – Source: Koyfin

One potential concern with Southern Copper is that it operates a couple of large open pit mines in Mexico, where the current administration has expressed desires to ban open pit mining on new concessions. First off, this is likely more about election rhetoric than concrete plans, and even if the current or the next administration were to try to implement it, there likely isn’t enough support to push something like that through. So, I think the threat to operating open pit mines from comments like these is minimal.

With that said, along with the negative rhetoric, it has also become more difficult to receive new mining permits in Mexico lately. So, the current valuation makes even less sense if we consider the fact that Mexico has become less mining friendly, at least on the margin.

Overall, Southern Copper is one the highest quality mining companies around. It has an excellent operating margin, a great return on equity of around 30% over the last 20 years, relatively low sustaining capital requirements, and has distributed much of its earnings to shareholders over time. So, a premium valuation might be justified, but the current valuation still feels excessive. I am relatively constructive on copper prices, so neutral on the stock, but Southern Copper Corporation stock is probably closer to a sell than a buy at this level.

Read the full article here