After the trajectory of the S&P 500 (Index: SPX) dropped below both the dividend futures-based model’s redzone forecast range and its 200-day moving average, the latter of which matters to people who buy into technical analysis, we set up a useful question to answer. Here’s the set-up and question:

The S&P 500’s trajectory breaking below the bottom end of the redzone forecast range comes as the index coincidentally dropped below its 200-day moving average. For the record, the upper and lower limits we set for the redzone forecast range are not based on the moving averages used in technical analysis, which we view as unreliable indicators at best. It’s more useful to ask if that change is an an outlier event or a warning signal indicating order is breaking down in the stock market.

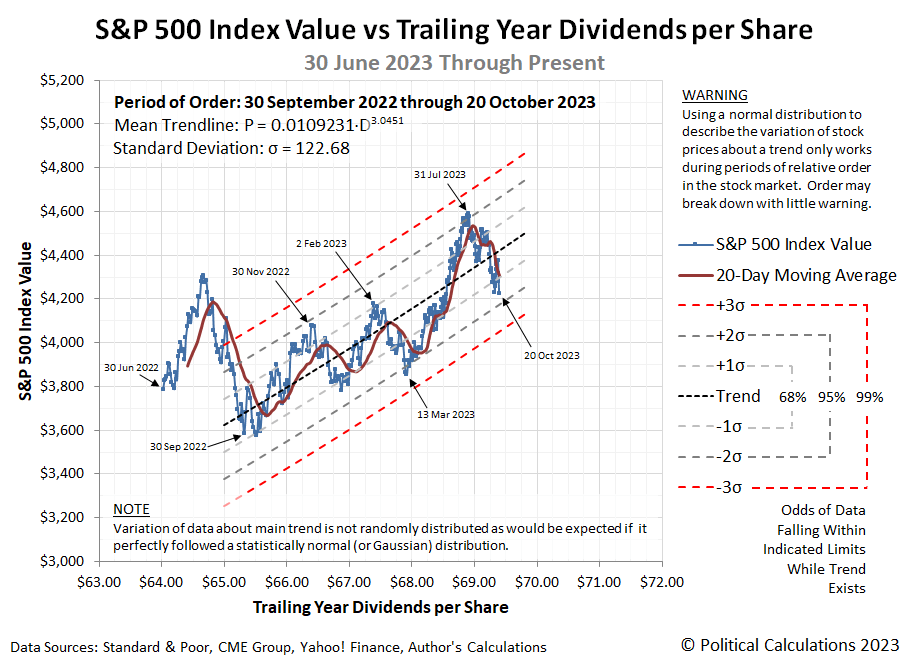

We can find the answer to these questions by borrowing some well-established techniques from statistical analysis. In the following chart, we’ve tracked the day-to-day trajectory of the S&P 500 index with respect to its trailing twelve-month dividends per share.

Framing the data this way allows us to first verify the S&P 500 has been in a relative period of order since September 30, 2022 and to establish the range where we would expect to find the value of the index while that order holds. We find that through Friday, October 20, 2023, the level of the S&P 500 is neither an outlier nor has the current period of relative order for the index broken down.

For it to be either, the S&P 500 would need to first drop roughly another four percent from its October 20, 2023 closing value. If then it were an outlier, it would quickly bounce back up above the red-dashed line and resume following its established trend. If order were to break down instead, the S&P 500 would stay below the red-dashed curve for a sustained period of time.

Of the two scenarios, having order break down is the one to worry about, because that would be a real sell signal. To understand why that matters, check out what happened after investors got the “ultimate sell signal” in 1929.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here