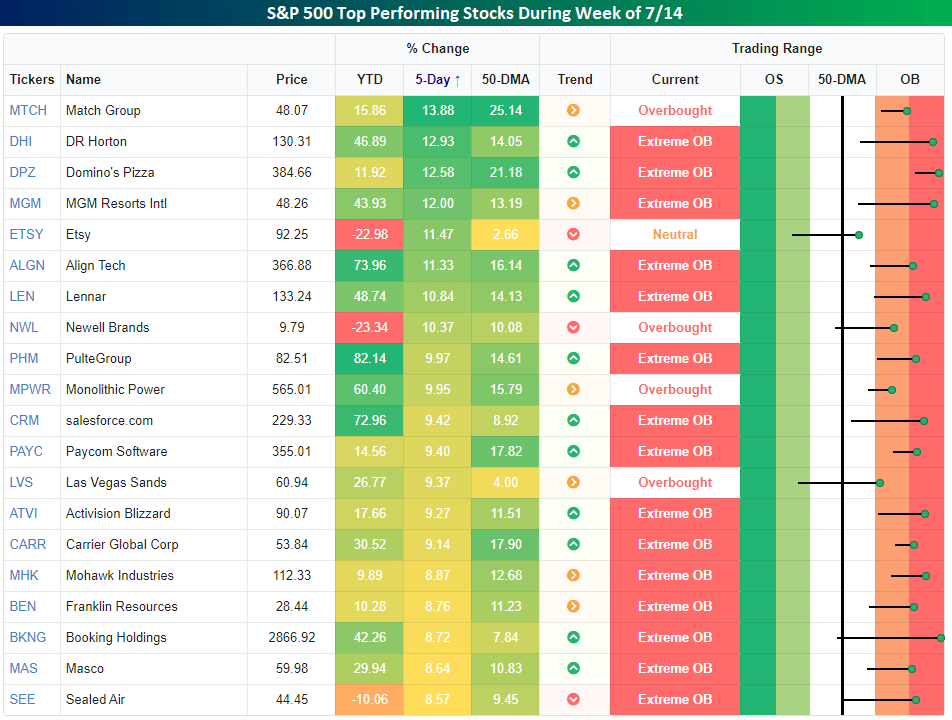

After weaker-than-expected inflation data inflated the prices of just about every financial asset, there were some very big winners by the end of last week. The table below lists the 20 top-performing stocks in the S&P 500 last week, which includes eight stocks that rallied more than 10%. Double-digit gains are typically considered very good for an entire year, so when large-cap stocks move that much in a week, it’s impressive. Topping the list, shares of Match (MTCH) gained nearly 14% followed by D.R. Horton (DHI), Domino’s (DPZ), and MGM Resorts (MGM). Among these four top performers and the other stocks listed, it is a somewhat eclectic group of stocks. One well-represented group on the list is the homebuilders. Along with DHI, Lennar (LEN) and Pulte (PHM) both also made the list. In terms of YTD returns, though, last week’s biggest winners weren’t solely the ones that have been rallying all along or the losers playing catch up; there was actually a little bit of everything. Three of the stocks listed (Etsy (ETSY), Newell (NWL), and Sealed Air (SEE)) are still down by double-digit percentages YTD while four (Pulte, Align (ALGN), Salesforce (CRM), and Monolithic Power (MPWR)) are up over 50%! Besides those extreme movers, there are also a few stocks that merely had single-digit YTD percentage gains before last week’s spikes higher. One thing that just about all of these stocks have in common now, though, is that they headed into this week at short-term overbought levels of a varying degree.

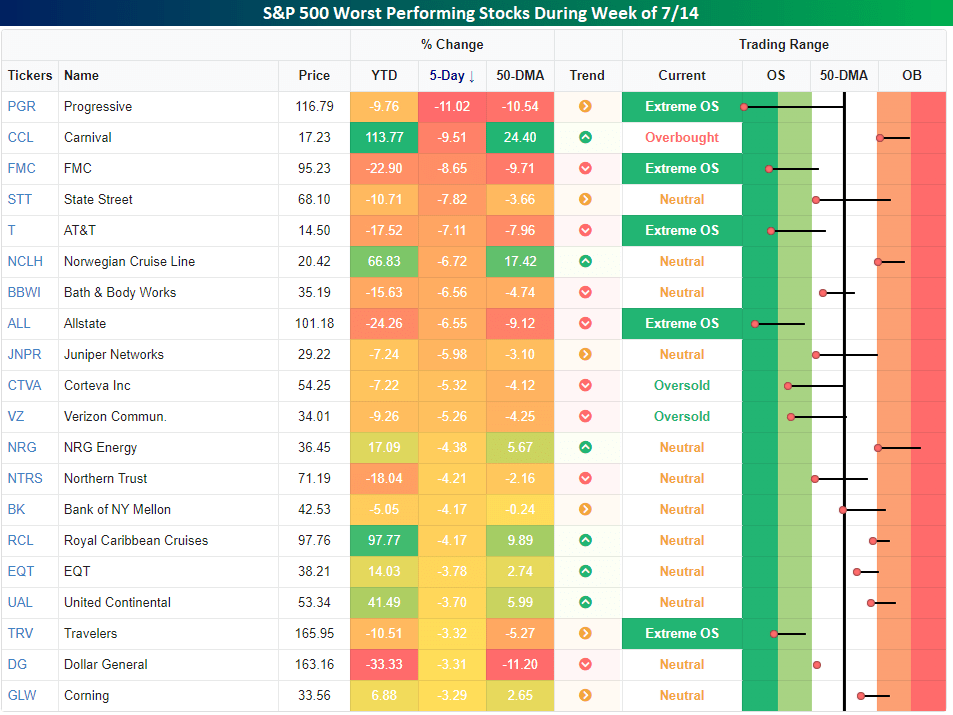

In total, there were just 88 stocks in the S&P 500 that declined last week, and only 53 of those fell more than 1%. Of those 53 stocks, the table below lists the 20 worst performers, which all fell more than 3%. This is also an eclectic group in terms of both their lines of business and their YTD performance heading into the week. The only stock down by double-digit percentages was Progressive (PGR) which now makes it down on the year as well. Right behind PGR, shares of Carnival (CCL) fell 9.5%, but unlike PGR, it’s still up by over 100% YTD. Besides CCL, two other cruise operators (Norwegian Cruise Line and Royal Caribbean) also sank during last week’s rising tide, but they have also seen huge rallies on a YTD basis. Financials are another sector that was well-represented on last week’s loser list. Besides PGR, State Street (STT), Allstate (ALL), Northern Trust (NTRS), Bank of NY Mellon (BK), and Travelers (TRV) all bucked last week’s bullish trend. Unlike just about all of last week’s winners, which are now overbought, many of the week’s worst performers are still trading within normal ranges of their 50-day moving averages.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here