Exiting shorts

As I previously discussed, I had what I define as a modest short on S&P500 the entire 2023, since Jan 1st. Specifically, I was short Dec call options with the strike price 4400. This option is now out of money, and given the time expiration, this short position can be exited with profits.

Here is the chart of the SPX Dec 4400 call from January 2023:

RJO Brien

I viewed this as an appropriate strategy for 2023, within my tactical framework (as I did not expect the market to rise significantly in 2023, but also the timing of the next leg down was uncertain).

By the way, the market did rise significantly during the first half of 2023, and short position was in the money during the summer, but I remained convicted that the market was in a “bear market rally”, and it would reverse.

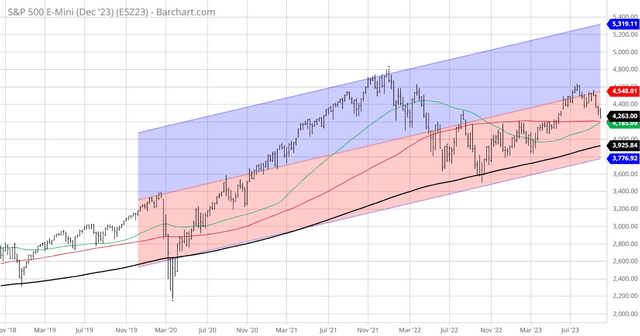

Specifically, after the debt-ceiling resolution in June, S&P500 (SP500) broke the key resistance on long term chart (red line), led by the megatech AI stocks (QQQ). The rally ended as the 10Y yields started rising after Japan tweaked the monetary policy in late July and allowed the JGB yields to rise up to 1%.

The events to follow raised the significant issues with the supply (deficits) and demand (foreign buyers) for US Treasury Bonds (TLT), which continued to boost 10Y real yields. At the same time the Fed reiterated the “higher-for-longer” policy, and even boosted the neutral rate expectations.

All of this was negative for the stock market, and SP500 (SPX) sold off, back to the 4200 level where the breakout started in July (the red line). Here is the chart:

Barchart

Thus, I am modifying my tactical positioning in S&P500. I exited the short calls, and I am planning for the next move.

Still bearish

I have also explained my strategic positioning strategy for the stock market. Specifically, the default position is Long, unless:

- There is a significant risk for a liquidity shock, specifically coming from expectations of aggressive monetary policy tightening, but also other sources. The stock market sells off mostly due to PE multiple contraction in this situation, so overvalued market is specifically vulnerable and bubbles usually burst in this environment (for example, 1987).

- There is a significant risk of an imminent recession, where earnings have to be sharply downgraded (any recession).

- There is a significant risk of a credit crunch, or forced selling due to spike in credit risk, systematically important bankruptcies (for example Lehman Brothers).

So, what is the current situation?

First, the Fed induced liquidity selloff happened in 2022. Now, the Fed expects to hike one more time in 2023, and cut two times in 2024.

Second, the current earnings expectations for SP500 are extremely bullish for 2024, with expected EPS growth of around 11%. Obviously, the analysts do not predict a recession in 2024. However, if they are wrong, and we do have a recession 2024, the earnings would have to be sharply downgraded. Given the inverted yield curve, and recent the bear steepening of the yield curve, the recession is highly likely. Thus, I am bearish – this is a valid reason to sell stocks. I already predicted that S&P500 fair value is around 2800 in a recessionary environment.

Third, the credit spreads are very tight, and given the fiscal deficits, and other supply/demand issues with the US Treasuries, the issues with Commercial Real Estate (XLRE) and Regional Banks (KRE), slowing Chinese economy, the credit crunch is likely, but not imminent.

Thus, going back to the chart above, the next leg down in S&P500 (below the red line) would have to be due to an imminent recession and earnings downgrade, particularly from the big tech companies such as Apple (AAPL).

So, let’s go back to my original short thesis from the end of 2022 – an imminent recession. Well, that recession keeps getting delayed. The data towards the end of 2022 was pointing towards an imminent recession. Then, we got the January surprise in payrolls.

As I speculated after my visit to Las Vegas, 2023 was the real post-covid reopening, and people revenge traveled and kept spending their covid excess savings, and even getting deeper in credit card debt. As a result, the economy boomed. Is the consumer now tapped out? Are the excess savings gone? What about the student loan repayments? Possibly. Yet, the data keeps showing a strong labor market. Can there be a full-employment recession? Possibly.

More aggressive short

I indicated that I would short more aggressively once the 4200 level is broken, which is also the 100ma average support on 5Y chart. I suspect there are lots of stop loss orders below 4200.

The fundamental trigger for the more aggressive short is the 2024 earnings downgrade and the early evidence of a recession. That’s the recessionary selloff within my framework.

End of the year rally?

However, at the same time, it is important to consider the probability of the end-of-the year rally, which could go towards the new highs.

Again, the possible trigger for the end-of-the-year rally is the delayed recession. It is very possible that the revenge spending extends to the holidays – that would be the “last hoorah” for the consumer. The strong labor market report increases the probably of a continues growth.

At the same time, the Fed has to be done soon – weather is another hike, which is very likely, or even two more hikes, which I think are necessary, the Fed is transitioning to holding rates, and tightening as inflation falls – that’s real rate tightening. And this is happening while the economy is still growing.

Will the UAW strike be resolved soon? Will the fiscal budget be approved before the Nov 17th deadline? Any positive resolutions to these events could propel the end-of-the year rally.

Implications

Whether the recessionary selloff happens next week or in few months, it’s coming, and I do see S&P500 at 2800. Long term investors should be in the short term T-Bills at 5.5% yield, possibly even extending duration to 12 months at 5.44% yield. Thus, strategically, my rating for S&P500 for is still a Sell.

Tactically, we have learned to be careful – we are timing the recessionary selloff – which keeps getting delayed, and thus, in the meantime we need to acknowledge the possibility of the end-of-the-year rally. Thus, tactically, I am Neutral on S&P500 now.

Read the full article here