SpartanNash (NASDAQ:SPTN) is a grocery wholesaler and retailer. With razor thin operating margins the company is currently taking a hit from the rising interest rate environment. While the company has interesting characteristics from a value and dividend investing standpoint, valuable real estate holdings and long streak of dividend increases, an investor should rather see and wait how the company overcomes the headwinds in the market environment.

Grocery vendor criticized by activists

SpartanNash is a grocery wholesale (71% of revenues) and retail (29%) company. For the wholesale segment the U.S. military is a major end customer representing one third of the wholesale segment revenue. In the retail segment SpartanNash operates 145 owned stores in the Midwest region under three different brands, 81 pharmacies and 36 fuel centers. The company has 20 distribution centers located in the eastern half of the U.S. SpartanNash has annual revenues of $9.6 billion and employs 14 000 people.

Last year there was an activist investor campaign on SpartanNash. Their research points out several shortcomings in the recent history of the company.

Activists, Macellum Capital Management and Ancora, blamed SpartanNash on spending close to $1 billion in capital expenditures and not achieving EBIT-growth. The three acquisitions by SpartanNash, for $334 million, have not contributed to growth in profits but doubled the long-term debt. Activists also criticized the company for holding on to its real estate, which could have been realized at a value of 2.5 times its market capitalization at the time.

Furthermore, the activists accused the board for not having adequate experience in the industry, high top management turnover, overcompensating the management for poor performance and a lack of alignment with the other investors. As a result of the mismanagement SpartanNash stock has performed poorly compared to its peers and it has lagged behind in terms of revenue and EBITDA growth. At the time of the first letter to the SpartanNash shareholders the stock was trading 40% higher than it’s today.

Interest expenses could eat the profits

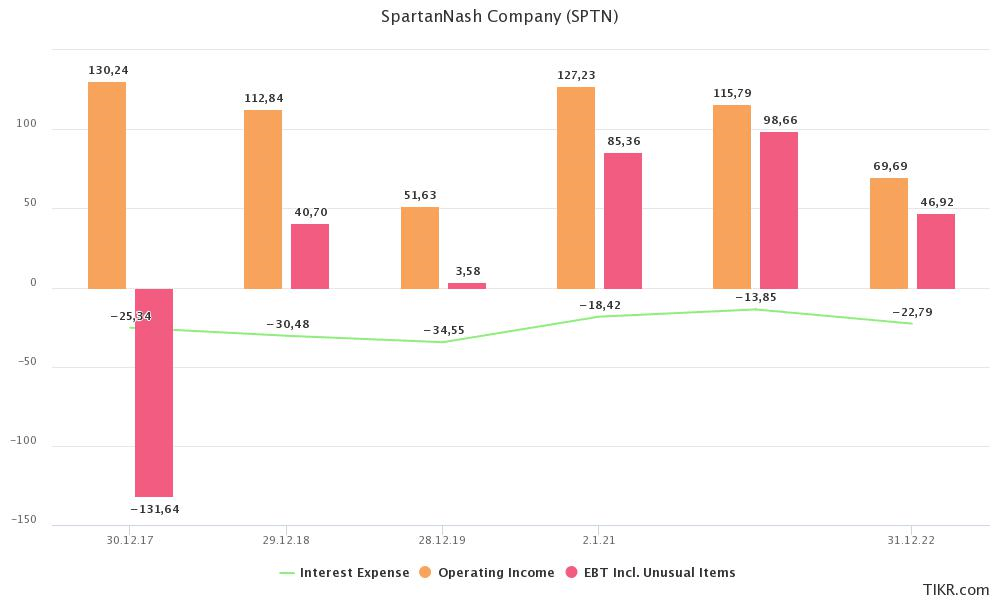

Due to the relatively high amount of debt and thin operating margins, SpartanNash is suffering from the increase of interest rates. Nearly 90% of its debt is variable rate debt. In the first quarter its interest expenses increased 177% or by $7 million, which severely hurt the company’s net earnings by consuming the operating income in its entirety. The higher interest expense affected the EPS negatively by $0.15. This is what happened already in 2022, per the 10-K:

Interest expense increased $8.9million, or 64.5%, to $22.8million in the current year from $13.9million in the prior year primarily due to rising interest rates. The weighted average interest rate for all borrowings, including loan fee amortization increased 1.83% to 4.65% in 2022,compared to 2.82% in 2021.

The company expects the interest expenses to be between $37-42 million for the full year, 62-98% higher than last year. Last year the company produced an operating income of approximately $70 million. By very simple mathematics the earnings before taxes are in danger to halve only due to the interest expenses, if there’s no other major improvements in the sales and operations. According to the data collected by Tikr, analysts expect the earnings before taxes to contract by approximately 8% supported by an increase in revenue (3.5%) and EBITDA (4.9%). The estimates most likely factor in the transformational programs and their benefits that the company is guiding for.

Historical interest expense, operating income and EBT. (Tikr)

SpartanNash pursues to draw investors’ attention to adjusted EBITDA figures. In the Q1 the adjusted EBITDA was flat year on year. However, this can mislead people to believe that everything is fine. Above mentioned interest expenses are an actual cash cost. It appears that the company stacks away interest expenses under the other expenses line in the adjusted EBITDA reconciliation.

In the Q1 SpartanNash also reported $4 million of restructuring costs as a result of a closure of two retail locations, which is a rather normal expense in retail business. Additionally, stock based compensation is significant totalling approximately a half of the net earnings. In the latest Q1 a positive development continued with private label. The share of private label sales reached 21% in the latest quarter growing 8%, much faster than the overall sales.

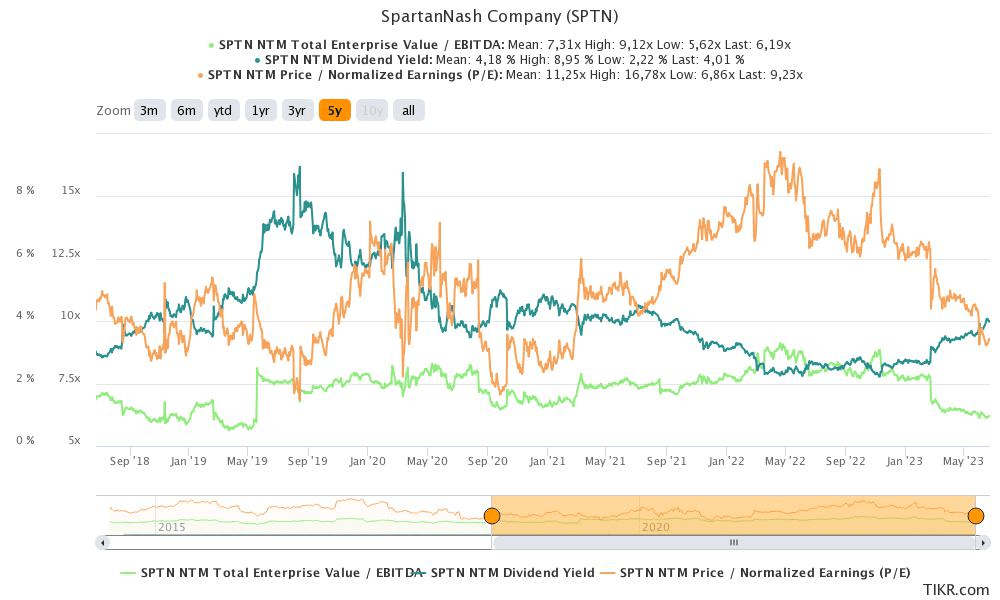

Valuation doesn’t justify the risk yet

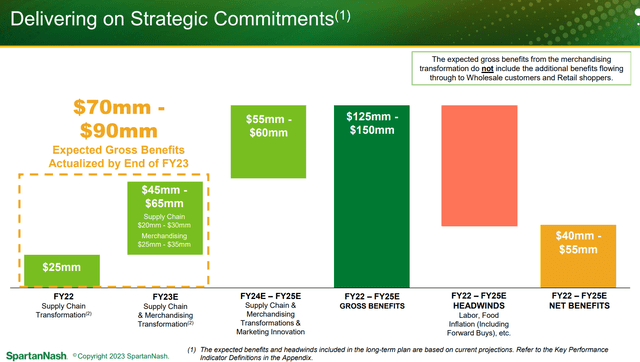

The recent decline in share price appears to be simply a reaction to the quarterly EPS trending down to a lower level. Until the interest environment changes to the better or the company reduces its indebtedness, the stock could be under pressure during the upcoming quarters. It’s difficult to spot how the company could overcome the headwinds by operational measures, although the company highlights its merchandising and supply chain transformation, which could total $45-$65 million of “gross benefits” in 2023.

Benefits of transformation programs. (Company material)

None of the key forward-looking multiples have reached their five year lows. EV/EBITDA of 6.2x is coming close to the level seen in 2019, but at the time interest rates were much lower and the whole stock market was in a special situation. The forward-looking P/E stands currently at 9.2x, which is below the 5-year mean, but the stock has been trading around 7.5- 8x in the recent past. It takes time for the company to sharpen its operations and before that interest expenses could eat away the earnings.

Forward looking multiples and dividend yield. (Tikr)

There are seven analysts following the company with an average target price of $28.2. The variance is rather high ranging from $23 up to $34.

The dividend appears secure

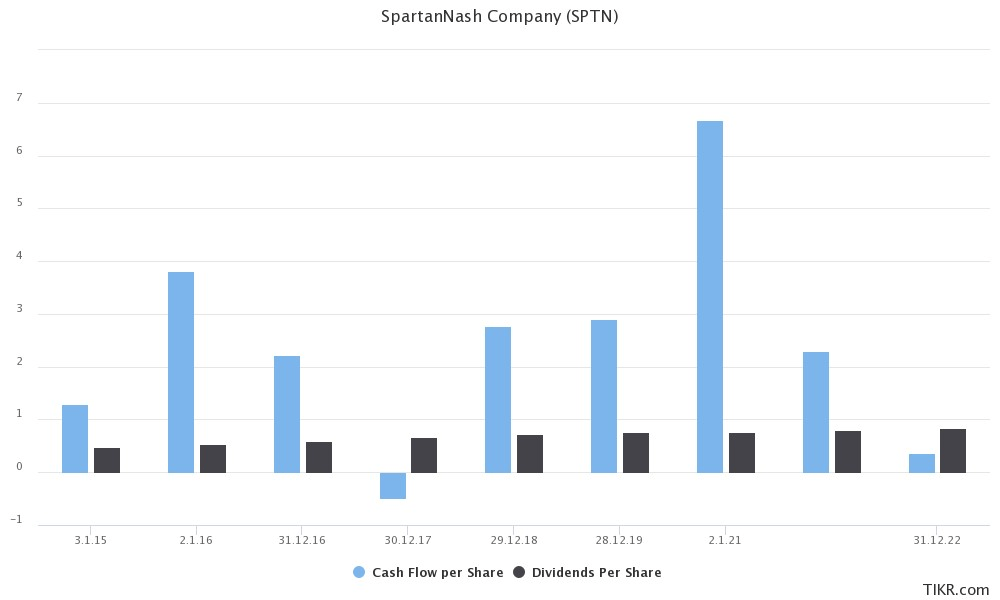

SpartanNash pays an annual dividend of $0.86 translating to a dividend yield of 4%. The payout stands at 40%, but can significantly rise if the earnings stay below the last year’s level. The company has been increasing the dividend for 12 consecutive years with an average five year growth rate of 4.3%.

Although the dividend has been well-covered by the cash flow in the past, according to Tikr the cash flow from last year didn’t cover the dividend. The cash flow for the Q1 was negative, which has been a typical cash flow profile for SpartanNash.

Cash flow and dividend per share. (Tikr)

SpartanNash has done a significant amount of buybacks too without a significant effect on the shares outstanding. This is probably where the company can obtain funding to preserve its dividend. Funding the dividend by an increase of debt should be an alarming sign. However, pulling back capital expenditures and inventories will rather easily secure the dividend.

Conclusion

SpartanNash is an interesting company in the grocery distribution industry. However, at the moment it appears the downside risk is larger than the upside. Valuation isn’t yet attractive enough to start a position before there are internal or external signs of improvement in the margins that are largely hit by the interest expenses. If the company succeeds with its transformational projects and realizes the benefits, the stock could be entering a buy zone sooner.

Read the full article here