Thesis

Intermediate duration bonds seem to be the preferred way for institutions to take advantage of the current high rate environment. Some market participants believe that long maturity bonds have too high of a duration profile in an uncertain debt placement environment for the U.S. Treasury, whereas intermediate bonds offer the best of both worlds.

In this article, we are going to have a closer look at SPDR Portfolio Corporate Bond ETF (NYSEARCA:SPBO), its composition and analytics, as well as its forward, and articulate why we do not think a retail investor should jump into this name just yet.

What does SPBO actually do

As per its literature, the fund seeks to provide investment results that correspond to the performance of the Bloomberg U.S. Corporate Bond Index:

The Bloomberg U.S. Corporate Bond Index is designed to measure the performance of the investment grade corporate bond market. The Index includes publicly issued, investment grade, fixed-rate, taxable, U.S. dollar-denominated corporate bonds issued by U.S. and non-U.S. industrial, utility, and financial institutions. Bonds included in the Index must have $300 million or more of par amount outstanding and a remaining maturity of at least 1 year. The Index considers investment grade securities to be rated Baa3/BBB- or higher

By following the Bloomberg index, the ETF ends up containing over 4,000 names with an average yield to worst of 5.34% and a duration of 7 years. The fund contains mostly single-A and triple-BBB rated bonds, very similar to what the overall market looks like in the investment grade space. Corporate industrial bonds have the largest representation at 58%, followed by Corporate finance at 32%.

The option adjusted spread for the fund is 96 bps, which means the ETF gets only 96 over risk free rates for the corporate risk it takes. In effect, you can think of SPBO as a diversified corporate bond with a 7 year duration which is priced at 96 bps over treasuries.

While intermediate treasury duration is attractive, bond spreads are not, and we are going to look into that in the next section.

What type of duration should you buy in today’s market?

We think risk free rates have peaked, but the timing for them to come down is unclear at the moment. Most investment banks are pricing for one or two cuts this year, mostly geared towards September and December. Duration simply means a certain tenor in the yield curve, and by buying duration you are locking in a certain yield to maturity.

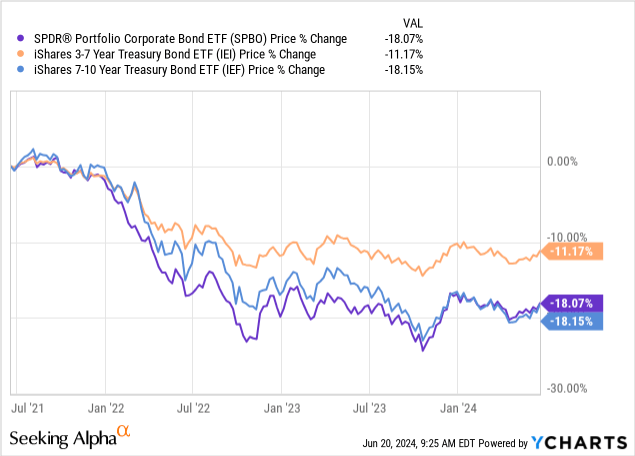

We like intermediate treasuries duration here (i.e., locking in treasuries yields) but we strongly feel that investment grade corporate bond spreads are too tight. Some critics argue that spreads are only a small component of the yield offered by SPBO, but we are going to have a look at what a widening in spreads would actually do to the fund. To finish the thought process here, intermediate treasury duration can be obtained via funds such as the iShares 3-7 Year Treasury Bond ETF (IEI) or the iShares 7-10 Year Treasury Bond ETF (IEF) which contain solely treasury securities and have their return profiles driven by risk free rates only:

SPBO is very well correlated with IEF given they have almost identical duration profiles. The graph above is a price change graph, not a total return, thus will not contain the differential in dividend yields. However, we can see SPBO having larger drawdowns during severe risk-off environments due to its credit spread component.

What happens to SPBO when credit spreads move wider

While the fund discloses its interest rate sensitivity (duration), it does not present the calculations for its credit spread sensitivity. Fortunately, the two are very similar for bullet corporate bonds, so we are going to assume a 7-year credit spread sensitivity here as well. This translates into a -7% loss for every 100 bps in widening credit spreads. So if spreads were to move up by 100 bps the fund would be down -7%, whereas a move by 200 bps would see a -14% loss for the name.

Let us have a closer look at how investment grade bond spreads have performed in the past years, and derive an average and upper range for spreads.

IG spreads are now at the bottom of their historic range

Courtesy of the data provided by the Fed, we are able to graph IG spreads:

IG Spreads (The Fed)

Kindly note the level on the ICE BofA US Corporate Index OAS is roughly equivalent to the one presented by SPBO. If we have a look at the above graph we will notice we are at the bottom of the range on a 10-year lookback. The average spread is roughly 133 bps, with the top of the range at 200 bps.

In a risk-off scenario, we can expect at least 50 bps of widening from current levels, which will translate into a -3.5% loss on the fund. Some market participants are arguing though that the next widening in credit spreads will be mitigated by risk free rates going down. The thought process is that a weak economy will widen spreads, but at the same time lower risk free rates since the Fed will be forced to cut more aggressively.

The only scenario where this negative correlation does not hold up is an inflationary one. If inflation continues to surprise on the upside and the Fed is forced to hold rates higher for longer or even talk about a hike, we will get a market scenario where spreads are widening and risk free rates are moving higher. That would be the worst scenario for SPBO from a drawdown perspective.

When to buy SPBO

We do not have a crystal ball, but we do believe in mean reversion. We are of the opinion that SPBO is to be bought on the back of a credit dislocation that would see spreads move much higher. Even if risk free rates end up being slightly lower in such a scenario (negative spread/risk free rate correlation) we would rather buy a corporate bond fund on the back of an increased probability of default rather than high absolute all-in yields. With spreads at the bottom of their historic range presently, we are a ‘Hold’ for the name.

Conclusion

SPBO is a fixed income exchange traded fund. The vehicle has a 7-year duration and contains a diversified portfolio of investment grade corporate bonds. The fund is best thought of as layering credit risk on top of IEF, with the two ETFs having very similar duration profiles. With corporate spreads at historic lows, we are of the opinion today’s environment does not present a good entry point into SPBO. We would rather buy duration via IEF and wait for a credit dislocation and IG spreads above 133 bps in order to trigger a buy level for SPBO.

Read the full article here