Investment Thesis

Spotify Technology S.A. (NYSE:SPOT) hit a “pause” on investors’ excitement with its Q3 outlook, rendering them speechless. Spotify, the company that usually sets life’s rhythm, seemed offbeat in its recent quarter.

Most notably, its revenue outlook left a lot to be desired. However, I remain bullish on its overall prospects, even though I recognize that next quarter, Spotify will need to impress investors with its Q4 revenue outlook, otherwise, investors will be eager to press skip on this stock.

Rapid Recall

In my prior bullish analysis back in June, I wrote:

For my part, I am bullish on the name and proactively point to the business’ underlying health and growing user base.

However, I find its unimpressive free cash flows a concern. Unless Spotify finds a way to dramatically improve its free cash flows, I will struggle to remain bullish on the name.

That being said, Spotify assures investors that it will be improving its profitability throughout 2023, which for now goes a long way to support its rapidly increasing share price.

With another quarter of earnings results on which to base my opinion, I stand by those comments today. There’s still a lot to be bullish about Spotify’s increasing user base.

Furthermore, I believe that as Spotify increases its user market share, it will be well-positioned to increase prices on its users, following the playbook it has successfully employed in Sweden, its founding country.

So, let’s discuss the positive and negative aspects facing this investment thesis.

Revenue Growth Rates Slow Down

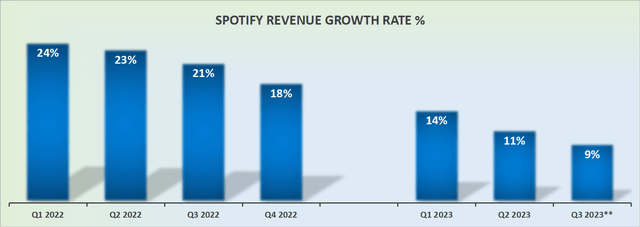

SPOT revenue growth rates, in EUR

Note, that Spotify’s revenues are reported in EUR. Therefore, the graphic above expresses the original currency.

Spotify’s revenue outlook for Q3 2023 leaves a lot to be desired. Many investors, myself included would have assumed that since Spotify’s comparables with the prior year were starting to ease up, Spotify could perhaps see a path towards stable and growing mid-teen revenue growth rates.

However, the quarterly performance ahead categorically does not inspire hope that this is the case. That being said, before readers throw in the towel on Spotify, I point readers towards the following consideration.

Follow the User Growth Rates

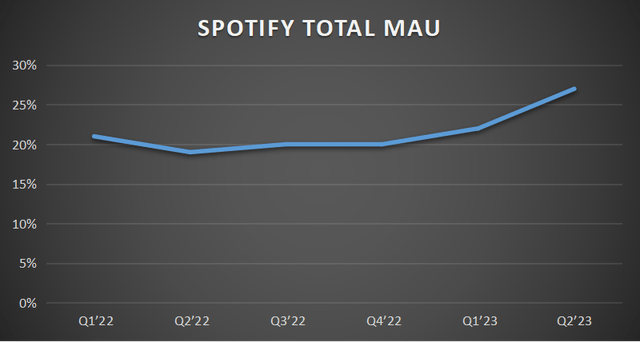

SPOT user growth, author’s work

Followers of my work will have seen me articulate on numerous occasions, to follow the customer adoption curve. I’ve often stated that I believe the customer, or user, adoption rate is more insightful over the long term regarding the value of a product or service than its quarterly revenue growth rates.

What makes me say so? Having a lot of users on your platform demonstrates that users find value in the platform. In a world where people’s attention spans last less time than a TikTok video, the mere fact that users are not churning out, and are in fact still increasing in numbers, provides Spotify with optionality.

Here’s a quote from Spotify’s Q2 earnings call echoing this assertion,

[On how Spotify wishes to grow revenues] One is obviously to grow the number of consumers. That’s our preferred way of doing that and keep the value of the price super high because that creates optionality. When user growth slows down, take Sweden as a great example where we’re already at a massive part of the population there, then price increases becomes an even more important tool in the toolbox.

This is a simple equation, the more users, the more Spotify can increase prices, and the better its free cash flow can end up.

Free Cash Flow Profile Must Improve

Spotify still has a lot of opportunities to improve its free cash flows and drive its share price higher.

SPOT Q2 2023

But as it stands right now, not only are its revenue growth rates not looking enticing, but the company’s underlying profitability doesn’t exude a particularly strong bullish case.

Indeed, recall, the bear case facing Spotify has always been that this business is doomed to be a razor-thin business. And it’s never going to operate as a particularly profitable business.

Consequently, investors will continue to be unwilling to pay a premium for its stock.

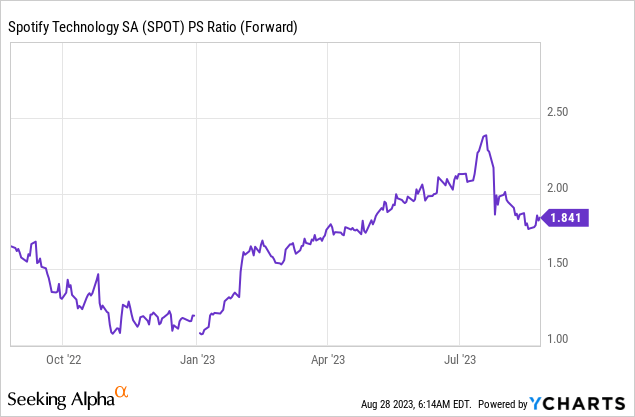

To further complicate matters, the biggest driver of its share price performance during 2023 has been its multiple expanding and increasing more than 50% since the lows of January.

In summary, I remain hopeful that Spotify can start to improve its profitability profile as it makes progress on monetizing its user base. But investors will only be willing to support close to 2x forward sales for so long. After a while, investors will once again return to a ”show-me” modus of operandi when it comes to Spotify.

The Bottom Line

Spotify’s results were a mixed bag. The Q3 outlook has left me a bit puzzled, especially in terms of revenue growth, which hasn’t quite hit the right note. Despite this, my overall optimism hasn’t wavered entirely.

I do acknowledge that Spotify Technology S.A. will need to strike the right chord with its Q4 revenue outlook to maintain investor enthusiasm. In the past, I’ve expressed concerns about their free cash flows, and while they promise profitability in 2023, the uncertainty lingers. However, Spotify’s growing user base and potential for price increases keep me cautiously hopeful. It’s a mixed tune, but I’m not ready to hit “skip” just yet.

Read the full article here