I came across the Global X SuperDividend REIT ETF (NASDAQ:SRET) while looking at high yielding funds. Although the SRET ETF pays an 8.7% distribution yield, I fear its narrow focus on high yielding global REITS may lead to poor overall performance for the fund, as a high dividend yield basically means poor stock performance.

The SRET ETF’s narrow focus may lead to a portfolio of poor performers with fundamental reasons driving their stock prices lower (and dividend yields higher).

Fund Overview

The Global X SuperDividend REIT ETF gives investors access to the 30 highest yielding REITs in the world. The SRET ETF tracks the Solactive Global SuperDividend REIT Index (“Index”), an index which measures the performance of high yielding global REITs. To qualify for the index, REITs must be listed on a regulated stock exchange with shares that are freely tradeable for foreign investors without restrictions. Also, the REITs must have minimum capitalization of $100 million and trade at least $5 million per day.

Out of the initial universe of eligible securities, the top 60 companies ranked by dividend yield are advanced to the volatility filter. Out of the top 60 dividend yielding companies, the 30 companies with the lowest trailing 90 day volatility are chosen for the index and are equal-weighted.

Index components are rebalanced and reconstituted annually at the end of January and reviewed quarterly. If a company’s dividend is cut, the company will be dropped from the index and ETF and be replaced by the next eligible company within the selection pool currently not in the index.

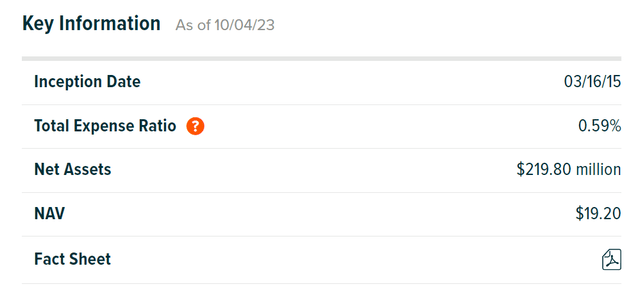

The SRET ETF has $220 million in assets and charges a 0.59% expense ratio (Figure 1).

Figure 1 – SRET overview (globalxetfs.com)

REITs As A Hedge Against Inflation

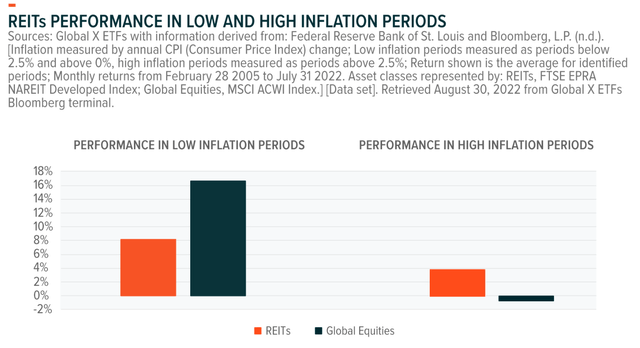

According to research from Global X, historically, when inflation is high, REITs may be a good inflation hedge due to the structure of rental contracts, which may be short-term (i.e. hotel room rates can be adjusted quickly) or have built-in inflation clauses. In addition, the replacement cost of property can rise due to inflation in the cost of materials and labour, resulting in properties rising in value during high inflation periods (Figure 2).

Figure 2 – REITs historically outperform during high inflation (globalxetfs.com)

Portfolio Holdings

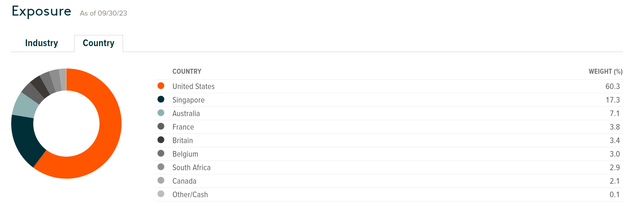

While the SRET ETF is billed as a ‘global’ fund, more than 60% of its holdings are from the U.S., with Singapore being a distant second at 17.3%. Australia contributes 7.1% to the portfolio and France has a 3.8% weight (Figure 3).

Figure 3 – SRET geographical allocation (globalxetfs.com)

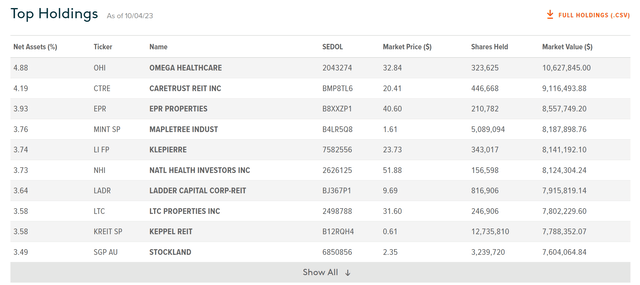

Figure 4 shows the top 10 holdings of the SRET ETF, which comprise 39.2% of the index.

Figure 4 – SRET top10 holdings (globalxetfs.com)

Distribution & Yield

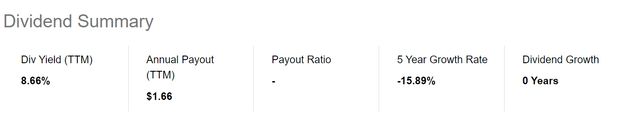

Since the SRET ETF selects the highest yielding REITs globally, it is able to pay a high monthly distribution with a trailing 8.7% yield (Figure 5).

Figure 5 – SRET pays a trailing 8.7% yield (Seeking Alpha)

Returns

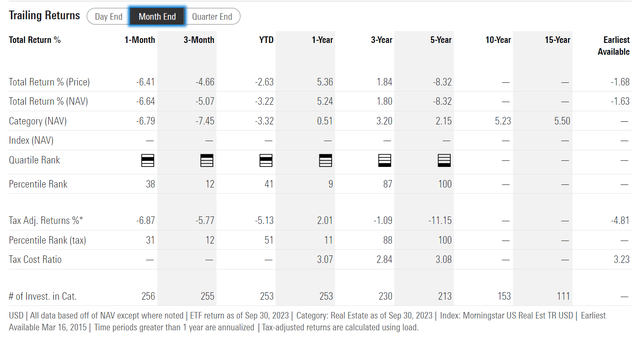

However, investors are cautioned against solely looking at SRET’s yield. Instead, investors should also consider the fund’s total returns. Despite paying a near 10% distribution yield, the SRET has only delivered modest total returns, with a 3 and 5 year average annual return of 1.8% and -8.3% respectively to September 30, 2023 (Figure 6).

Figure 6 – SRET historical returns (morningstar.com)

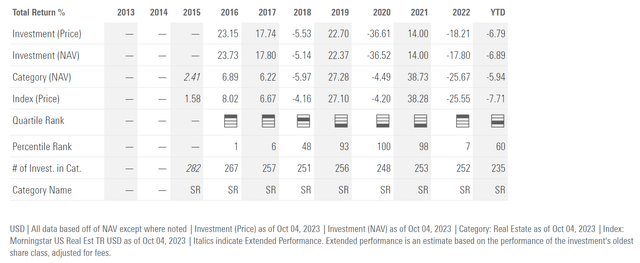

Studying SRET’s returns on an annual basis, we can see that the SRET has a very volatile returns history, ranging from -36.5% in 2020 to +23.7% in 2016 (Figure 7). So far in 2023, the SRET ETF has declined 6.9% to October 4th, 2023.

Figure 7 – SRET annual returns are very volatile (morningstar.com)

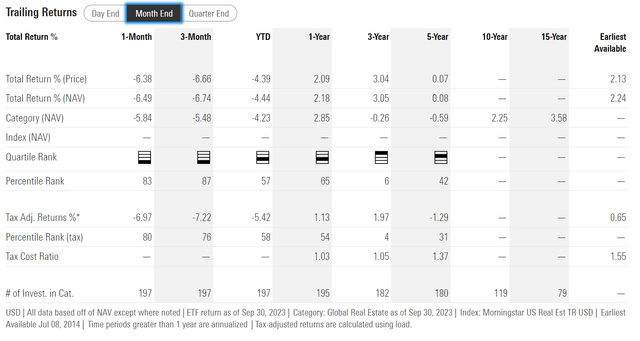

Furthermore, to gauge SRET’s performance, we should compare it against a passive global REIT index, for example, the iShares Global REIT ETF (REET). Figure 8 shows the historical performance of the REET ETF.

Figure 8 – REET historical returns (morningstar.com)

Comparing Figure 6 and Figure 8, we can see that the SRET has significantly underperformed the REET ETF, with a 5 year average annual return of -8.3% compared to 0.1% for REET.

Focus On Dividend Yield May Limit Universe To Poor Performers

I believe the biggest issue with the SRET ETF is its narrow focus on the dividend yield factor. Similar to my criticism of the Hoya Capital High Dividend Yield ETF (RIET), the SRET does not appear to consider the sustainability of the REITs’ dividends or other fundamental performance drivers until after the high yielding REITs have cut their dividends.

By continuously selecting the highest yielding REITs (lowest stock price relative to dividend) from its universe, the SRET may be self-selecting a basket of poorly performing stocks that end up delivering weak total returns over the long run.

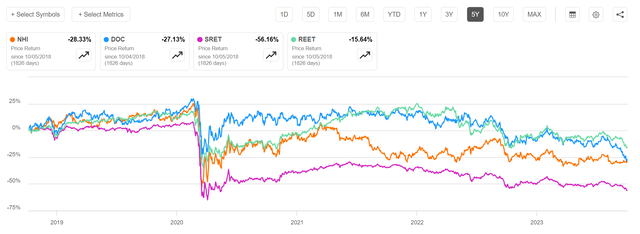

For example, the SRET ETF holds positions in many health care REITs like National Health Investors (NHI) and Physicians Realty Trust (DOC). Healthcare REITs have suffered fundamental issues like labor shortages and a reduction of government support post the COVID-pandemic. This has led to missed rent payments and lease renegotiations, driving their stock prices lower and dividend yields higher (Figure 9).

Figure 9 – SRET may be self-selecting fundamentally challenged companies with low stock prices (Seeking Alpha)

Conclusion

While the SRET ETF pays an attractive 8.7% distribution yield, I worry that the fund’s strategy of focusing only on the highest yielding REITs may cause negative security selection bias, i.e. it only selects poorly performing stocks with fundamental reasons driving high dividend yields (and low stock prices). The SRET ETF has significantly underperformed a passive index of global REITs. The SRET ETF is a pass for me.

Read the full article here